It’s no surprise that the venture capital market was incredibly active in the United States during the first quarter of 2021, but precisely how strong has only recently become clear. This morning, we’re digging into the data.

According to a report from PitchBook, venture capitalists unleashed a wave of capital in the first three months of the year. So much, in fact, that funding in the United States nearly doubled compared to the same quarter of 2020.

We’ll dig into specific numbers and trends regarding aggregate venture capital results in a moment, but what stood out the most while digesting the Q1 dataset was how strong VC results appeared across different states; a solo late-stage boom the quarter was not.

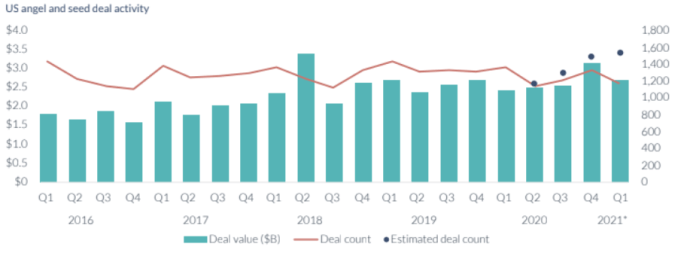

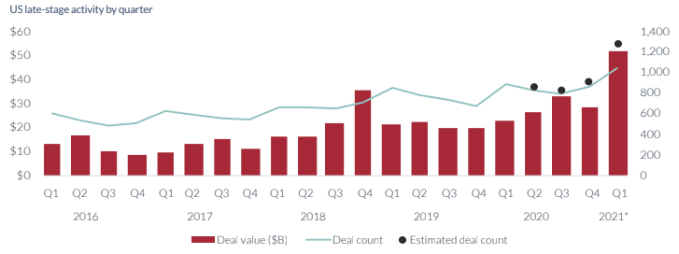

Seed deal volume appeared strong and early-stage venture capital activity could reach new highs in 2021, but late-stage venture capital activity in the United States is already setting records in both deal count and invested dollars.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

We’ll parse the headline numbers and then dive into seed and super late-stage data with the help of Sarah Kunst of Cleo Capital, Jenny Lefcourt of Freestyle Capital, Iris Choi of Floodgate and Laela Sturdy of CapitalG.

With their help, we’ll contextualize the numbers and weave anecdotal observations into what the charts and graphs tell us. Especially in the case of seed data, which is famously laggy, added context is crucial. Let’s go!

A Q1 overview

According to PitchBook’s report, some 3,987 venture capital rounds were closed in the United States during Q1 2021. Those deals were worth $69 billion, a figure up nearly 93% from 2020’s first-quarter results.

In broad strokes, the United States had a crushing venture capital start to the new year, pandemic be damned. That is especially true when we consider 2020’s full-year figures. Last year, venture capitalists deployed some $166 billion into U.S.-based startups across 12,546 rounds. In contrast, if the first quarter’s pace was maintained during the rest of 2021, the United States would see around 16,000 rounds worth around $280 billion.

Of course, we cannot see the future, so those projections are merely shared to underscore how active the first quarter proved to be; we’ll have to wait for at least another quarter’s data to confidently predict full-year records for 2021.

Powering the rapid start to the venture capital year was a holistic boom: Seed deal volume is forecasted to have set a multiyear high, perhaps matching the historically strong Q2 2018 period. Early-stage venture capital during Q1 2021 was also robust, with $14.5 billion deployed across 1,170 rounds. Both numbers set a pace for fresh records in 2021.

Then there was late-stage dealmaking, which soared in the first quarter. In 2020, late-stage venture capital deals were worth $111.4 billion raised from 3,504 rounds. In the first quarter of 2021, some $51.9 billion was invested into late-stage startups across 1,291 deals.

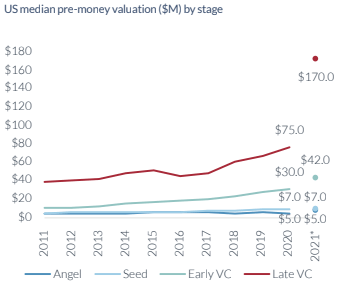

Valuations and round sizes continued to rise across the board. If there was a better time to raise a big whack of venture capital as a U.S.-based startup, we cannot recall it. And the data seems to scream that the good times are now as good, or gooder, than ever.

A closer look at seed

Seed data is famously hard to get right. It’s the least transparent of all the venture capital categories, and with recent expansion in use of fundraising mechanisms like SAFEs and their ilk, it’s not getting easier.

Still, PitchBook data indicates that in the first quarter, “despite [a] drop in the share of total investment, angel/seed and early-stage investment remained robust,” and by its own estimates, “over 1,500 of these deals occurred during Q1, the highest quarterly total we have tracked in our dataset.”

We were curious about how that compared to international totals, so we perused the recent Crunchbase News global venture capital report. Per Crunchbase, global seed volume was roughly flat between Q4 2020 ($4.2 billion) and Q1 2021 ($4.1 billion), though the first quarter of this year topped Q1 2020’s volume of $3.9 billion.

But as Crunchbase data evangelist Gené Teare pointed out in a recent post, data related to seed deals is subject to lots of temporal lag: “Often, we find as much as 40% of deals are added in the year after a quarter closes, and as much as 50% to 60% two years out,” she explained.

Given that we’re relying on PitchBook’s estimates — grounded in known data as they are — and Crunchbase’s admission that seed data is simply hard to get right in the short term, we asked investors for their perceptions of the venture category’s Q1 in the United States. Their reports were bullish.

“Other than the slowdown that we had seen during Q2 of 2020, COVID hasn’t really affected the pace of deals getting done; I don’t think it’s necessarily faster or slower than Q4, [it] just continues to be busy,” Floodgate partner (and “Equity” podcast regular) Iris Choi told us.

Jenny Lefcourt, an early-stage investor at Freestyle, said she even noticed an acceleration compared to last year. “The pace of seed deals in Q1 2021 was so much faster than any quarter I have ever witnessed in 20-plus years (as a founder and then as a VC). Q4 2020 felt fast at the time but in comparison to Q1 2021, now seems slow.” In addition, the “size of rounds was significantly higher, as were the valuations,” she noted.

Lefcourt suggested two factors contributing to a fast-paced seed investing scene; many VCs have more time available because they are not traveling, and there are many interesting startups on their radar.

Another investor confirmed that the latter point is also true at the pre-seed stage: “The deal flow has been stronger than ever,” reported Sarah Kunst, managing partner at Cleo Capital, which invests $500,000-$1 million into pre-seed startups.

Sarah Kunst will outline how to get ready to fundraise at Early Stage

Choi also mentioned Y Combinator W21’s recent large-sized batch as proof that lots of great companies are getting started — TechCrunch has to agree on the point, having recently been forced to discuss our favorites from the cohort in not just one but two posts.

Does the apparent hot pre-seed and seed market change how investors get to conviction and cut checks? Yes and no, we were told.

On one hand, it wouldn’t make sense to skip steps when investing so early. On the other, there’s no time to lose, Lefcourt recalled.

“Competition for deals this quarter was fierce,” Lefcourt said. “If I was interested in a company [or] team, I would move to meet with them as quickly as possible and then if I liked [them], would clear [my] calendar to do due diligence with speed so that I wouldn’t lose opportunity due to timing.”

The largest rounds accelerate

If seed is hot and early-stage investing is even hotter, late-stage deal-making in the United States during the first quarter was molten.

As discussed above, full-quarter totals for the period are on track to smash previous records this year. Here’s a chart to help make that plain:

-

Image Credits: PitchBook. Shared with permission.

Powering that spike in the chart’s most recent bar was an explosion in the largest late-stage rounds, investments worth $100 million or more. Call them what you will — mega-rounds, super-giant investments, mega-deals, whatever — what matters is that 167 were recorded in the United States during Q1 2021.

For context, that’s about half the number that 2020 saw in total: 336. And the money side of the volume question was no slouch. Rounds worth $100 million or more in the United States during the first quarter were worth $41.7 billion. The category was worth $76.6 billion in all of 2020, a record.

The Exchange was curious about whether the pace of late-stage deal-making merely appeared to be accelerating and the increased number of rounds was due to more players, or if deals were actually getting done more quickly. Laela Sturdy of CapitalG told TechCrunch that “it doesn’t just appear it — these rounds really are accelerating.”

She added that “high-growth companies used to raise every 12 [to] 18 months, but now we’re seeing more growth-stage companies raise multiple times within a given year.” We’ve seen this sort of thing with startups like AgentSync. Sturdy went on to say that “a lot more fundraising is taking place reactively, spurred on by investors who are preempting traditional fundraising cycles by giving term sheets to companies before they had originally intended to fundraise.”

Please, take our money!

So, sure, seed investing is active and early-stage investors are putting money to work. But the last stage of venture-style investing went even more wild in the first quarter, at least here in the United States.

Why? We have a few guesses.

A liquidity rush

It’s banal to note that venture capitalists, crossover funds, private equity and public-market players like Fidelity have been active in raising and deploying capital in recent quarters. Everyone knows that.

But what did change in the last few quarters has been a rise in the pace at which venture-backed startups have gone public; even discounting the recent SPAC boom, the pace of super-late-stage liquidity has been impressive. So why not put a zillion dollars to work in a late-stage investment if the company in question could turn around, list and make you a mint in mere months?

Roblox and others showed that this was possible. And while the IPO market has cooled somewhat in the last few weeks, it seems unlikely that the unlocked liquidity fountain will slow to the point that the last money into the biggest startups dries up.

At what price?

To close, a note on valuations. It’s not enough for us to note that lots of capital was deployed in the first quarter. Inside that data has been a boom in the price at which private investors are buying startup shares. Here’s a chart from the PitchBook report that makes the story plain:

-

Image Credits: PitchBook. Shared with permission.

We could dig into per-stage numbers, but that single image should give you an idea of how expensive startup shares are at the moment; investors are paying more than before to get the same shareholding in startups, especially in the later stages, even if at the earliest stages, known priced rounds could be stalling. But as SAFEs and other non-priced rounds become the norm among the youngest startups, we’re more interested in the early-stage and later data. And that all points up.

There’s more to say. We asked investors about their deal-making pace and how they have had to adapt. What their notes boiled down to was that they had to find a way to move faster to avoid missing deals. Mix that speed with the prices and dollar amounts we’ve seen today, and we can at least say that the venture capital market is rather risk-on at the moment.

And it doesn’t feel like Q2 2021 is too different. Thus far.

Comment