Dana Stalder

We were bullish on fintech when we launched the Matrix Fintech Index in 2017, but even we underestimated the magnitude of the growth to come. Fintech tailwinds, strengthened by the COVID-19 pandemic in 2020, only accelerated in 2021. And despite public markets’ rocky start in early January, we’re confident that 2022 will be another banner year for the sector.

In this year’s edition of the Matrix Fintech Index, we’ll look at the performance of public fintech versus the broader market in 2021 and reflect on the private fintech market’s red-hot year. Then, we’ll turn our attention to the year ahead and offer some predictions for fintech in 2022.

Fintech continued to outperform the market by 3x

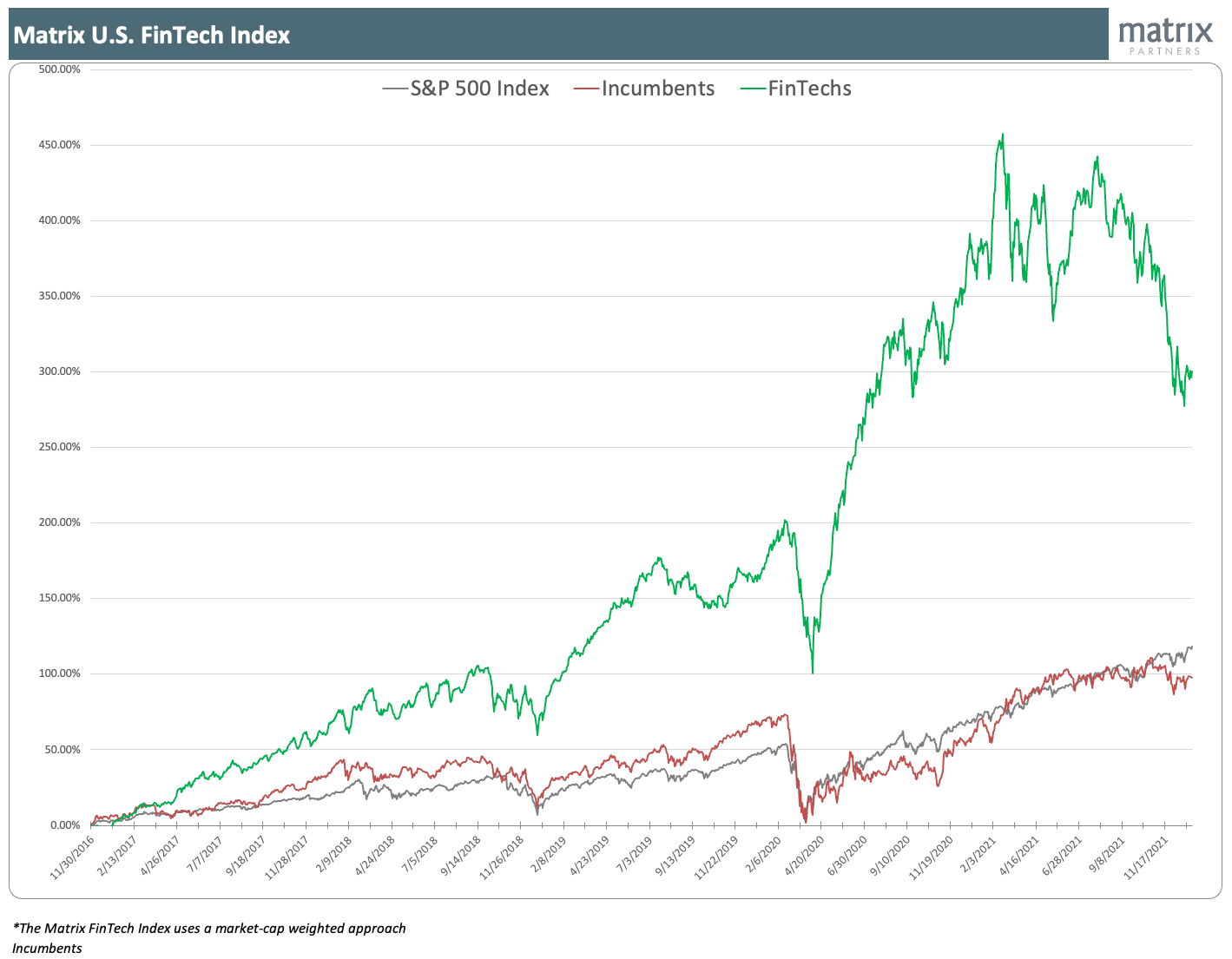

The Matrix Fintech Index has significantly outperformed major public stock indexes as well as a basket of legacy financial service providers for the fifth year in a row. As a reminder, the Matrix Fintech Index is a market-cap weighted index that tracks a portfolio of 25 leading public fintech companies.

Despite a roughly 30% draw-down in the last months of 2021, the Matrix Fintech Index continued to beat the broader market as well as incumbent financial service companies. Fintech’s consistent outperformance signals that the changes brought about by COVID-19 – including shifts toward e-commerce, online payments and digital interactions over physical ones – are here to stay.

A great year of public debuts

Last year was outstanding for fintech IPOs, with notable debuts occurring across several categories. Consumer companies such as Coinbase ($86 billion) and Robinhood ($32 billion), infrastructure players such as dLocal ($6 billion) and Marqeta ($15 billion), and insurtech providers such as Lemonade ($1.6 billion) all entered the public market.

There was also increased diversity in the way these companies went public, with some fintechs skipping the traditional IPO process altogether. More companies, such as Coinbase in the U.S. or Wise in the U.K., chose direct listings, while Robinhood earmarked $700 million in shares for its existing customers.

Others, including Hippo, Metromile and SoFi, chose to go public via SPAC. While SPACs’ track records have been mixed, even accounting for recent market volatility, the rise of IPO alternatives is a welcome change for the growing ranks of late-stage fintech unicorns.

A record year with 151 new unicorns

Private markets followed public markets in making 2021 a record-setting year. VC funding into private fintech companies crossed $134 billion in 2021, rising by 177% from a year earlier, according to Crunchbase.

Private investments, in turn, led to a record 151 new fintech unicorns, accounting for a third of all new unicorns created in 2021. As in the public markets, unicorns appeared across the fintech landscape, whether in e-commerce (Bolt, Recharge Payments, Extend), B2B (Deel, Papaya Global, Pipe, ChargeBee), crypto (Kraken, Blockfi, Anchorage Digital, TaxBit), infrastructure (Modern Treasury, Alloy), or investing (Public.com, M1 Finance, Stash).

Buy now, pay later went mainstream

In last year’s report, we called merchant-funded, point-of-sale financing, also known as buy now, pay later (BNPL), “one of the most important trends to gain traction in the last four years.” We predicted that BNPL would “cross the chasm to become a mainstream consumer choice, eventually displacing part of the role of credit card debt.”

Between Square’s $29 billion acquisition of Australian BNPL provider Afterpay (see our additional commentary here), U.S.-based BNPL Affirm’s $11.9 billion IPO, and a wave of other fundings and acquisitions, 2021 proved to be a huge year for the space.

Despite all that liquidity, we think it is still early days for BNPL. Major providers such as Klarna are still private, though several could go public in 2022. Plus, the BNPL model is seeing fertile ground in other verticals and geographies.

What’s ahead for fintech in 2022

Although the public markets saw some turbulence this January, we think fintech won’t slow down in the long term. Consumers want fewer (or no) overdraft fees, quicker, more convenient money transfers, and a wider scope of investment options. Fintech companies are continuing to deliver better financial services at lower costs to a broader range of people than ever before.

Here are some of the most promising areas for 2022:

$300+ billion in fintech liquidity

In last year’s report, we predicted that 2021 would see $100 billion in fintech liquidity. Thanks to a bevy of IPOs and acquisitions, total fintech liquidity easily surpassed $150 billion.

January 2022 opened with shaky markets and signs of multiple compression, but we believe this year will set another record with at least $300 billion in fintech liquidity.

What makes us so confident? Great businesses are started and thrive regardless of macro turmoil. However, the sweeping changes brought by widely accessible fintech infrastructure and changing consumer preferences provide a once-in-a-generation opportunity for startups to reinvent financial products the world over.

We still have amazing businesses ready to go public, be acquired or be funded. Here are the potential 2022 IPOs we’re most excited about:

- Stripe was valued at $95 billion during its March 2021 fundraise, making it one of the most valuable private companies, and the most valuable private fintech company. It has been on a growth and acquisition tear over the last year, launching new products such as Treasury and Tax while also doubling down on international expansion.

- Chime became a top-tier private company after raising $750 million at a $25 billion valuation in August 2021. The January 2022 SPAC listing of competitor Dave shows growing investor appetite for a new generation of consumer banks.

- Plaid got a second lease on life as an independent company after Visa was forced to drop its $5.3 billion acquisition last January. The firm quickly raised funds at a $13.4 billion valuation in April 2021 and has continued executing its strategy; it also recently entered the bank-funded payments space.

- Klarna is one of the few large BNPL providers that has not gone public or been acquired, so we expect it to go public in the near future. It was valued at $45.6 billion in a June 2021 funding round, making it Europe’s most valuable private company.

Vertical SaaS and fintech 2.0

Public companies such as Shopify, Bill.com and Toast showed the power of combining vertical software and natively integrated payments. We’re confident these companies will continue to shine, but we also believe a new generation is improving on their models and will even surpass them.

This next generation will be built by entrepreneurs who have deep knowledge of a given vertical and can take advantage of a much broader, more robust set of financial products from day one. Being able to monetize via a combination of SaaS and financial products expands a customer’s lifetime value and opens more avenues for customer acquisition.

We believe this trend will open up venture-scale opportunities in markets that were sub-venture-scale in a SaaS-only world, and will massively expand the TAM of companies that are already at venture scale. This will be a big year not only for these end providers — it will also prove decisive for infrastructure providers that make it easy to launch fintech products, such as banking, cards and credit.

BNPL expands to new sectors and geographies

While BNPL has entered the mainstream in the U.S. via consumer retail, there are many more geographies and sectors where the model can thrive. Whether it’s applying BNPL to other markets, such as Western Europe or LatAm, or applying it to sectors such as B2B payments, we think this model can go further in reshaping payments and the use of credit.

As smart entrepreneurs continue to build on the lessons learned by current BNPL giants – including the importance of point-of-sale placement and frequent touchpoints with the buyer – we think the BNPL model has plenty of room to grow.

Fintech continues to go global

Lastly, this year’s crop of fintech IPOs, acquisitions and fundraises has definitively shown that multibillion-dollar fintech companies can be built anywhere in the world. As economies move online, payments shift from cash to digital, and traditional financial institutions continue to under-deliver, we believe there will be massive opportunities to reinvent financial services far beyond the U.S.

Comment