Fintech has been a key startup story in recent quarters, with leading players in the genre raising titanic rounds at eye-popping valuations. Consider companies like Robinhood, and its epic capital run this year on the back of huge revenue growth, or Chime, which also raised huge sums while riding a tailwind provided by the savings and investing boom.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

As you can imagine, all those megadeals have added up. According to data collated by CB Insights on the fintech space in the third quarter, 60% of all capital raised by financial technology startups came from just 25 rounds worth $100 million or more. Adding to the trend of venture getting bigger — and later as unicorns age without graduating to the public markets — the same report noted that fintech investment from $100 million rounds grew 24% compared to Q2, while investment in the space from smaller deals fell 16% over the same timeframe.

Overall fintech deal volume dipped 24% compared to Q3 2019, totaling 451 global deals. But dollars invested into fintech startups edged up once again to $10.631 billion, the largest result thus far in 2020 and the second-best single-quarter tally since mid-2018.

Overall fintech deal volume dipped 24% compared to Q3 2019, totaling 451 global deals. But dollars invested into fintech startups edged up once again to $10.631 billion, the largest result thus far in 2020 and the second-best single-quarter tally since mid-2018.

Oddly, it was the bottom, as well as the top of the market that did best. As we’ve seen, late-stage money flowed. But, notably, the number of the smaller venture rounds, those marked seed or angel, grew by 20% compared to Q2 2020.

Perhaps the next crop of unicorns is being founded?

Inside the CB Insights data are a few trends worth digging into, including what’s going on with venture investment into payments-focused startups, how the IPO market may be impacting insurtech investment, and how both wealth management startups like Robinhood and banking startups like Chime are faring as cohorts.

The data is fascinating, so let’s get into the state of fintech investing today.

Big trends, bigger dollars

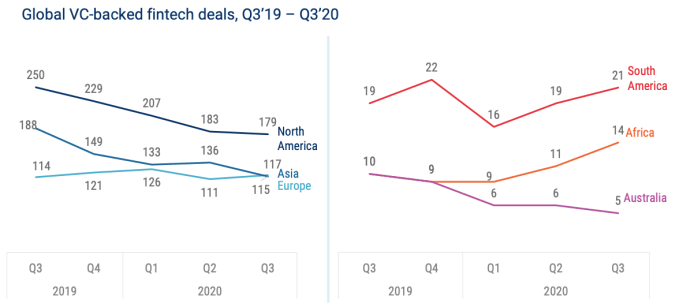

We’re focused on four megatrends today, but I wanted to point out that African fintech startups saw what appears to be their all-time record in deal count at 14. That was up from 11 in Q2 2020 and nine in Q1. I’m working to pay more attention to the African tech scene and those numbers stood out.

As fintech deal count falls in the largest VC markets — North America, Europe, Asia — it is rising in Africa and Latin America, something to keep an eye on.

Now, into our four megatrends.

Payments

Payments startups like Stripe and Finix get their share of headlines, but they make up only a fraction of the total volume of venture capital investment that their sector absorbs.

Per CB Insights, venture investment into payments startups ticked higher in Q3 2020, rising to $3.959 billion from $2.379 billion in Q2 2020 and $2.927 billion in Q3 2019.

Aside from an anomalous final quarter in 2019, investment into payments-focused startups has been on a steady incline for some time. Why? PayPal earnings offer a partial explanation. As we reported yesterday after the consumer payments giant reported its Q3 performance:

In numerical terms, PayPal processed $247 billion, up 38% from the year-ago quarter, and 4 billion payments, up 30% across the same time frame. For startups that want to facilitate consumer or business payment volume, that’s good news; their market is growing quickly.

Venmo usage also accelerated and the company beat profit and revenue expectations.

E-commerce and rising consumer digitization are pushing payments usage forward, so to see more venture capital going into the space is wildly unsurprising. But the the payments space is also incredibly weighted toward front-runners, with 65% of capital invested in the niche during Q3 going to rounds that were $100 million or greater.

So, it’s even more unequal than fintech more broadly. For younger startups, a cash disadvantage could matter.

Robinhood raises $200M more at $11.2B valuation as its revenue scales

Insurtech

On the back of Lemonade’s blockbuster IPO and Root’s runup to its own public debut, you’d be uncontroversial for thinking that insurtech investment surged in Q3 2020. And you’d be right, with capital flowing into startups in the space soaring to a local maxima of $2.558 billion.

That’s up from $1.684 billion in Q2 2020 and $1.957 billion in Q3 2019, for reference.

But as with payments, there’s a royalty in the sector, with just five rounds comprising just under 50% of all capital raised in the genre during the third quarter. Bright’s $500 million round, Next Insurance’s $250 million deal, Waterdrop’s $230 million investment, Hippo’s $150 million check and the $130 million that PolicyBazaar raised stood tall during the three-month period.

So, there’s plenty of late-stage capital in the space, even while deal volume was roughly flat in the third quarter at 105 rounds, up from 99 in Q2 2020 and down from 127 in Q3 2019.

Given how concentrated the insurtech space is in terms of its biggest unicorns consuming most of the capital, it’s fair to wonder what might happen to the startup genre’s venture totals once a few more IPOs happen; megarounds could dip, drastically undercutting the space’s VC investment totals.

In the third quarter, however, private investors were content to make an outsized bet on just a few companies in the insurtech space, a wager that the recent run of liquidity amongst insurance technology startups will continue.

Wealth management

Startups focused on wealth management had a good aggregate quarter, raising $1.491 billion, beating a Q2 2020 tally of $1.355 billion and about equalling the money that the space raised from Q3 2019 through Q1 2020.

But as with insurtech, a lot of that capital went to just a few companies. CB Insights highlighted three megarounds in its report worth a total $875 million. Those three rounds were worth around 59% of all capital raised in the quarter by our math.

Hell, Robinhood’s own totals were worth about 31% of the group’s aggregate. So, the later and larger venture capital story that we keep seeing was the state of affairs amongst wealth management startup fundraising in the third quarter.

But there was good news as well: Round count skyrocketed in the third quarter, exploding from a multiquarter low of 38 in Q2 2020 to 62. Perhaps there are some new, smaller wealth management startups out there raising early capital to take on the late-stage incumbents of this particular startup niche.

Banking

And finally, banking fintech startups. Ye olde neobanking, in other words. The startup varietal had a good quarter — unsurprisingly, I feel obliged to add — with capital flowing in rising yet again to $2.427 billion, up a few hundred million in Q2 2020, though down from a huge Q3 2019 result.

Banking startups had their best quarter in four in dollar terms, though the second-worst in terms of deal count. Notably banking deal count did rebound somewhat in Q3 2020 to 58 from a local minima of 55 rounds set in Q2 2020.

That lots of capital was available was good news; it’s very expensive to build neobanks. As we reported when Monzo saw its revenue explode from around £9.2 million in the year ending February 2019 to £35.7 million in the next, its losses also widened sharply:

On the other side of the coin, we can see why neobanks are outside-investment hungry. While Monzo managed epic growth from the year ending February 2019 to the year ending February 2020, its losses swelled sharply to over £113 million over the same time period. But Monzo raised over £100 million in 2018, over £100 million in 2019, and has put together £80 million so far this year. This is the sort of expense it is being funded to generate, provided that its growth keeps looking impressive.

To see more capital flow into the sector globally is therefore not surprising.

Not that all neobanks are torching cash. The American entrant Chime raised a $485 million Series F that valued it at $14.5 billion, announcing at the time that it is generating “true EBITDA” at the same time. That’s impressive!

Regardless, the slow ramp in capital raised by neobanks since Q4 2019 should be encouraging for startups working in the space, as it implies quite a lot of regular interest from investors. Now we just want to see some goddamn IPOs.

Chime, if you could be so kind?

Fintech’s savings and investing boom isn’t just a domestic affair

Comment