After years of working in marketing for a number of financial services companies, Solape Akinpelu came to a conclusion: There was an “alarmingly low adoption” by women for financial services in her home country of Nigeria and all of Africa as a whole.

“I could see women living the reality around me,” Akinpelu recalls. “These women could not make sound financial decisions. Some of these women that do not even know that they could do better with their money.”

She found that the problem is particularly acute for women living in rural areas, especially those working on farms.

So in August 2020, she teamed up with Yomi Ogunleye to found Lagos, Nigeria-based HerVest, a startup that describes itself as “an inclusive fintech company” serving underserved and excluded women in Africa through a gender lens. The company presented today at the Startup Battlefield.

Broadly speaking, HerVest aims to bridge the $42 billion gender finance gap for urban and last-mile women in the country with an emphasis on women in agriculture.

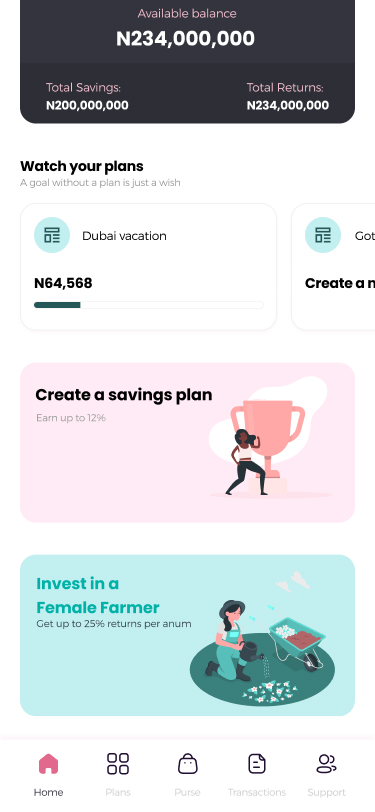

The startup, she said, provides familiar access to savings, fund transfers, impact investment, financial insights and tools to underserved women while offering blended finance to smallholder female farmers in underserved African communities. Put simply, it offers a way to invest in female farmers while seeing a return on that investment and gives the farmers the financial literacy, education and opportunities they might not have otherwise had access to.

“We want to address the gender gap in Africa by giving access to savings, impact investment and credit to women, regardless of who they are and where they live,” she said.

Today, just over one year after Akinpelu started the company, over 4,000 women are on the HerVest platform.

Earlier this year, HerVest raised a friends and family funding round of $100,000. The company plans to use the capital to add to its nine-person team, strengthen its digital infrastructure and accelerate marketing efforts. It started operations as a distributed company and still mostly operates as one.

Before becoming CEO at HerVest, Akinpelu’s last role was head of marketing for capital market conglomerate Mersitem, and prior to that, she worked in marketing for various financial brands.

The experiences gave her insight into the need to provide more access to financial services for women. The COVID-19 pandemic and resulting economic crisis, Akinpelu believes, have only emphasized the vulnerability of low-income women.

“This makes financial inclusion ever more critical as a means for women to recover from the global crisis and build resilience in the long term,” she told TechCrunch.

While starting with Nigeria, where Akinpelu says is home to over 57 million working women, HerVest has plans to roll out its platform into other West and East African countries in 2022.

https://www.youtube.com/watch?v=-lMhy2Ze-5A

“The problem we’re solving is an African finance gender gap, not just Nigerian,” Akinpelu said.

To get the word out, HerVest has relied on referrals and partnerships with cooperatives and social media. The company has a live app on iOS and Android and recently launched a desktop application.

According to its website, HerVest says that its cooperative members “can earn as high as 25% annualized returns while strengthening the financial capacity of female farmers” through access to capital, trainings and markets. What this means, Akinpelu said, is women with disposable income pool funds together as credit (impact investment) for smallholder women farmers as a cooperative.

“In addition, women also get to create automatic savings plans toward their personal goals. Picture an ‘inclusive neobank for women,” she told TechCrunch. “To assure our stakeholders, our funds are held in trust by a trustee firm, FBNQuest Trustees Limited. This is an added layer of accountability and transparency of our funds management.”

By investing in these women, HerVest aims to provide growth opportunities toward specific crops, grain banking, livestock and provision of digitized e-extension services to female small-scale farmers in rural areas.

Comment