The venture capital scene in Africa has consistently grown, with an influx of capital from local and international investors reaching unprecedented heights in recent years. To understand how much growth has occurred, African startups raised a meagre $400 million in 2015 compared to the $2 billion that came into the continent in 2019, according to Africa-focused fund Partech Africa.

However, that figure isn’t the only yardstick. With other outlets like media publications WeeTracker and Disrupt Africa disclosing different results for the African venture capital market, we compared and contrasted their results last year. The result of that investigation detailed differences in methodology, as well as similarities.

In comparison to Partech’s $2 billion figure for 2019, WeeTracker estimated that African startups raised $1.3 billion while Disrupt Africa, $496 million for the same year.

It was expected that these figures would increase in 2020. But with the pandemic bringing in utter confusion and panic, companies downsized as investors re-strategized, and due diligence slowed during the first few months of the year. Also, new predictions came into light in May with AfricArena pegging expected deals to close between $1.2 billion and $1.8 billion by the end of the year.

Investments did pick up, and from July, VC funding on the continent had a bullish run until December. Although 2020 didn’t witness the series of mammoth deals in 2019 and didn’t reach the $2 billion mark, it proved to be a good year for acquisitions. Sendwave’s $500 million purchase by WorldRemit; Network International buying DPO Group for $288 million; and Stripe’s larger than $200 million acquisition of Paystack were high-profile examples.

Stripe acquires Nigeria’s Paystack for $200M+ to expand into the African continent

To better understand how VCs invested in Africa during 2020, we’ll look into data from Partech Africa, Briter Bridges and Disrupt Africa.

Behind the numbers

In 2019, Partech Africa reported that a total of $2 billion went into African startups. For 2020, the number dropped to $1.43 billion. Briter Bridges pegged total 2020 VC for African startups at $1.31 billion (for disclosed and undisclosed amounts), up from $1.27 billion in 2019. Disrupt Africa noted an increase in its figures moving from $496 million in 2019 to $700 million in 2020.

Just as last year, contrasting methodologies from the type of deals reviewed, to the definition of an African startup, contributed to the numbers’ disparity.

Cyril Collon, general partner at Partech, says the firm’s numbers are based on equity deals greater than $200,000. Also, it defines African startups “as companies with their primary market, in terms of operations or revenues, in Africa not based on HQ or incorporation,” he said. “When these companies evolve to go global, we still count them as African companies.”

Briter Bridges has a similar methodology. According to Dario Giuliani, the firm’s director, the research organisation avoided using geography to define an African startup due to factors contributing to business identities like taxation, customers, IP and management team.

For Disrupt Africa, the startups featured in its report are seven years or less in operation, still scaling and have a potential to achieve profitability. It excluded “companies that are spin-offs of corporates or any other large entity, or that have developed past the point of being a startup, by our definition of one.”

The continued dominance of fintech and the Big Four

Despite the drop in total funding, Partech says African startups closed more total deals in 2020 than previous years. According to the firm, 347 startups completed 359 deals in 2020 compared to 250 deals in 2019. This can be attributed to an increase in seed rounds (up 88% from 2019) and bridge rounds due to shortage of cash amidst a pandemic-induced lockdown.

A common theme in the three reports shows fintech, health tech and clean tech in the top five sectors. But, as expected, fintech retained the lion’s share of African VC funding.

According to Partech, fintech represented 25% of total African funding raised last year, with agritech, logistics & mobility, off-grid tech and health tech sectors following behind.

Briter Bridges reported that fintech companies accounted for 31% of the total VC funding over the same time period. Clean tech came second; health tech, third; agritech and data analytics, fourth and fifth, respectively.

Fintech startups raised 24.9% of the total African VC funding counted by Disrupt Africa. E-commerce, health tech, logistics and energy startups followed, respectively.

2020 also showed the Big Four countries’ preponderance in terms of investment destination, at least in two out of the three reports.

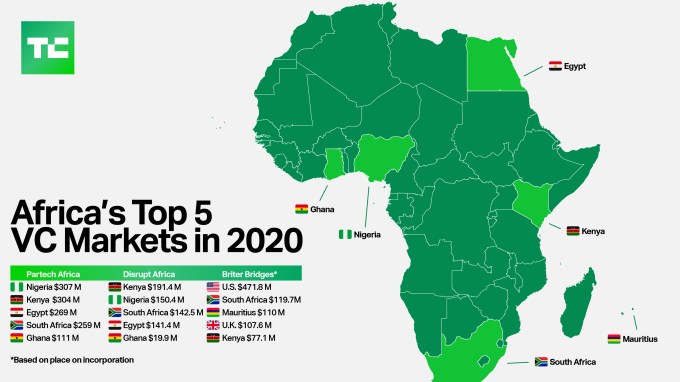

The countries remained unchanged on Partech’s top five as Nigeria remained the VC’s top destination with $307 million. At a close second was Kenya, accounting for $304 million of the total investments in the continent. Egypt came third, with its startups raising $269 million, while $259 million flowed into South African startups. Rounding up the top five was Ghana with $111 million, displacing Rwanda, which was fifth in Partech’s 2019 list.

The sequence remained unchanged from Disrupt Africa’s 2019 list as well. Funding raised by Kenyan startups reached $191.4 million; Nigeria followed with $150.4 million; South Africa, third at $142.5 million; Egypt came a close fourth with $141.4 million; while Ghanaian startups raised $19.9 million.

Briter Bridges took a different approach. Whereas Partech and Disrupt Africa highlighted funding activities per country of origin and operations, Briter Bridges chose to attribute funding to the startups’ place of incorporation or headquarters. This premise slightly altered the Big Four’s positions. Startups headquartered in the U.S. received $471.8 million of the total funding, according to Briter Bridges. Those in South Africa claimed $119.7 million. Mauritius-headquartered companies received $110 million while African startups headquartered in the U.K. and Kenya raised $107.6 million and $77.1 million respectively.

On why Briter Bridges went with this narrative, Giuliani said the company wants its data to be an impartial conversation starter, which can be used to investigate more complex dynamics such as the need for better policies, regulation or financial availability.

This speaks particularly to the absence of Nigeria as a primary location for incorporation. Due to unfriendly regulations, business and tax conditions, Nigerian startups are increasingly incorporating their startups abroad and other African countries like Seychelles and Mauritius. It’s a trend that may well continue as most foreign VCs prefer African startups to be incorporated in countries with business-friendly investment laws.

Regional and gender diversity check

With an increase in startup activity in Francophone Africa, one would’ve expected an uptick in VC funding in the region. Well, that’s not exactly the case. Senegal, the region’s top destination for VC funding, dropped from $16 million in 2019 to $8.8 million in 2020, according to Partech. The country was ninth on the list, while Ivory Coast, at tenth, raised a meagre sum of $6.5 million.

However, the good news is that 22 other countries received investments outside this Big Four this year, according to Partech data. Will we see this continue? And if yes, which countries will likely join the nine-figure club?

Tidjane Deme, a general partner of Partech Africa, believes Ghana might be next. He references how it previously used to be the Big 3 of Kenya, Nigeria and South Africa before Egypt became a dominant force, and says a similar event might happen with the West African country.

“We see a clear diversification happening as investors are going into more markets. Ghana, for instance, is already attracting above $100 million. Of course, we all wish it would happen faster, but we also recognize that this is a learning process for both investors entering new markets and for founders learning about this game.”

Ghana also emerged in Giuliani’s forecast. He adds the likes of Tunisia, Morocco and Rwanda as second-tier countries quickly entering global investors’ radar and building more sophisticated ecosystems.

Tom Jackson, co-founder of Disrupt Africa, doesn’t mention any names. But he thinks that while there are some positives from other markets, the Big Four dominance will continue.

“Funding will filter down to other markets more and more, and there are already positive signs in that regard. But the space is still relatively early-stage and those four big markets have a big head start and will remain far ahead for years to come,” he said.

Another diversity check that cannot be overlooked is that of gender. Despite all the talk of inclusion, Briter Bridges reported that 15% of the funded startups in 2020 had women as founders, co-founders or C-level executives. Partech, on the other hand, places this number at 14%. There’s still a lot of work to be done to increase this figure, and we might see more early-stage firms looking to plug that gap.

These investors want to back ‘ridiculously early’ female-led African startups

Comment