DoorDash filed to go public today, publishing numbers that showed rapid growth, enhanced profitability and an improving cash flow record which helped explain how the company had grown to a $16 billion valuation while private. The unicorn’s impending liquidity event will enrich a host of venture capital firms that bet on its eventual maturity.

Instead of posting this entry of The Exchange on Monday, we’ve put it out today for your Friday and weekend reading. Enjoy! — Alex and Walter.

But notable in DoorDash’s impressive results is the impact of COVID-19, accelerating secular trends already in place, and boosting the unicorn’s growth. Before we get into pricing this IPO and guessing what the company might be worth, let’s strive to understand what portion of its 2020 business gains could stem from the pandemic — and might not persist into the future.

We’re not being pessimistic; we merely want to better understand the company. And DoorDash agrees with our general thrust, writing in its S-1 filing that “58% of all adults and 70% of millennials say that they are more likely to have restaurant food delivered than they were two years ago,” adding that it believes “the COVID-19 pandemic has further accelerated these trends.”

Even more, elsewhere in its filings DoorDash states plainly that COVD-19 led it to experience “a significant increase in revenue, Total Orders, and Marketplace [gross order volume] due to increased consumer demand for delivery, more merchants using our platform to facilitate both delivery and take-out, and improved efficiency of our local logistics platform.” The company then went on to warn investors that the “circumstances that have accelerated the growth of our business stemming from the effects of the COVID-19 pandemic may not continue in the future, and we expect the growth rates in revenue, Total Orders, and Marketplace [gross order volume] to decline in future periods.”

We’re not idly speculating.

Let’s observe how DoorDash’s growth accelerated from 2019 through 2020 and then peek at how the company’s economics improved during the same period, giving the company a shot at adjusted profitability for the full year, a nearly unheard of result in the on-demand market.

Growth

DoorDash generates revenue when a customer orders food via its service, splitting the total bill of food costs, taxes, fees and tips, distributing them to itself, the merchant creating the goods and the delivery person.

In an “illustrative” example that DoorDash notes its 2019 “approximate average per-order information,” the split works out as follows:

- Bill: $32.90

- Merchant: $20.10, or 61%

- DoorDash: $4.90, or 15%

- Delivery person: $7.90, or 24%

Given that the company is giving us old data and DoorDash’s performance has been stellar this year in terms of generating more gross profit, I wonder what has happened amidst 2020’s upheaval. But, the old numbers do for what we need, which is to understand the link between gross order volume (GOV) and DoorDash revenue. When the former goes up, the latter goes up.

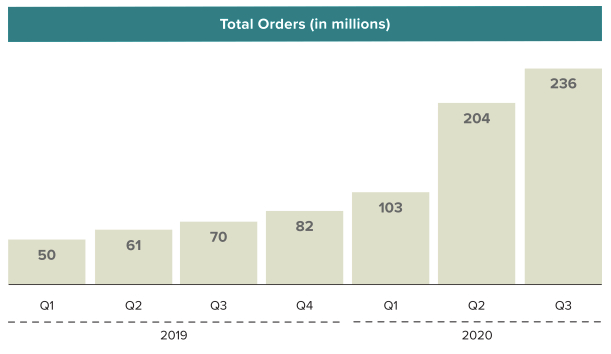

So, as orders rise:

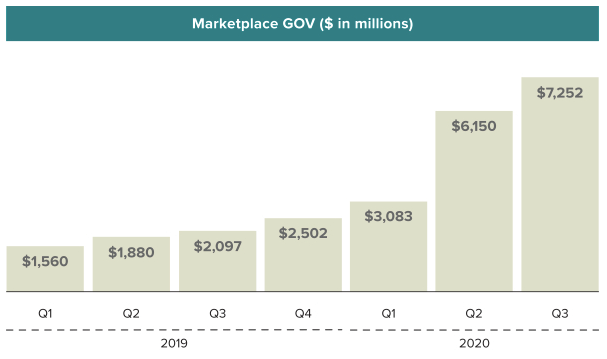

And, GOV rises along with them:

DoorDash revenue rises as well, as we saw during our dig into the company’s high-level results.

I’ve included those charts not to insult your intelligence, as I am sure you have already surmised that rising GOV is good for DoorDash’s revenue growth. Instead, I’ve shared them both so that you can see the dramatic changes COVID-19 brought to DoorDash in terms of rising orders (the top chart) and the value of those orders (the second).

DoorDash order volume effectively doubled in size from Q1 to Q2, and then smashed through that result in Q3, growing orders by a little under 11% and GOV by 18% respectively. We can infer rising order size as well, given those changes.

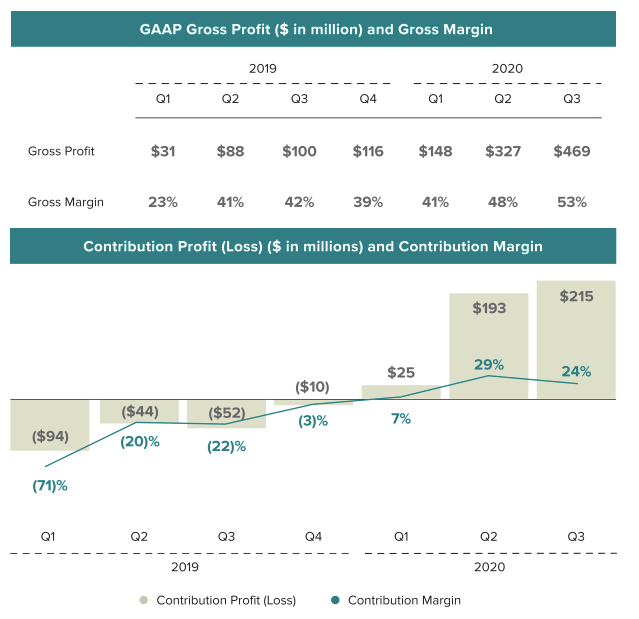

Critically for DoorDash, its revenue quality (gross margin), ability to cover its own expenses (gross profit) and the unit economics of its delivery business (contribution margin) greatly improved during those two growth-infused quarters.

The following table makes the situation clear. First, observe the gross margin (revenue quality) improvements that begin in Q2 2020. Prior to the second quarter of this year, DoorDash gross margins hovered between 42% and 39% for a year. Then, its gross margin broke out from that range in Q2 and kept expanding in Q3. Those changes allowed DoorDash to more than double its gross profit (money available to cover its own costs) by the midpoint of the year, and then smash that result in Q3:

We can see similar results in the company’s improving contribution margin (unit economics), which managed to break into the black during Q1 2020, before more than quadrupling in the second quarter. Notably DoorDash’s contribution margin slipped in Q3, but its rising order volume meant that its aggregate contribution profit still rose.

The pandemic, then, and its changes to our lifestyle have been boons for DoorDash.

To be clear, noting that DoorDash accelerated with a tailwind is not a diss. It’s easy to simply fall over when a tailwind strengthens, to continue the analogy. Instead, DoorDash improved its business economics while expanding its top line, allowing it to move from a history of adjusted losses to adjusted profit, and reduce its net income deficits to negligible levels when compared to its top line scale and growth.

OK, but how did it do all that?

If you recall one of our first quotes, DoorDash said COVID-19 was at least partially responsible for “increased consumer demand for delivery, more merchants using our platform to facilitate both delivery and take-out, and improved efficiency of our local logistics platform,” which gives us two ideas:

- That the “improved efficiency of our local logistics platform” cited was material, allowing the company to avoiding commensurate spending gains to handle increased delivery volume, helping it clear more contribution margin per order.

- And that the rest of the company’s operations did not have to scale as quickly as its gross profit did, allowing DoorDash to curtail expenses as a percent of gross profit, bringing its GAAP profitability closer to breakeven.

COVID-derived boosts to operational efficiency, and company-wide operating leverage, in other words.

So, what happens when the pandemic lessens? A few things, probably:

- Some gains to its economics evaporate: The pandemic giveth, and the pandemic taketh away. DoorDash will retain some gains as it will not lose all COVID-19 driven scale — presuming that our behavior has been permanently changed at least somewhat, which you may want to argue against — but if COVID-19 allowed the company to find efficiencies, expecting it to keep all of them is optimistic.

- Revenue growth slows: This one is obvious, but we’ve not stated it in its worst case, which would be: Revenue growth turns negative. To buy into the DoorDash IPO, especially at its currently floated $25 billion price, you have to believe that the company’s revenue growth will slow modestly at most. Otherwise the price makes no sense. Bearish investors who might expect the company to post negative growth in Q3 2021 won’t pay any price for DoorDash shares, but in between the two camps is a mess of vaccine timings, shifts in consumer behavior and macroeconomic questions that could determine how many American families can afford delivery. All of which will impact DoorDash’s future growth rates.

It’s your call on how to balance the factors and decide whether or not to buy into the IPO, but this one is going to be big.

DoorDash is nailing the timing, posting an impressive growth story on the back of COVID-juiced economics to paint the picture of a company that has cracked delivery, and is going to laugh all the way as a courier delivers its money to the bank.

Comment