The venture capital market has skewed later and larger in recent quarters, something you might have felt in the rapid recent pace of new unicorn formation. December was a hot month for new unicorns, for example. So was January. February likely will be more of the same.

Powering those unicorn births are huge rounds led by large funds. In 2020, for example, there were at least 97 global fintech rounds worth $100 million or more. That number was up from 92 in 2019 and 66 in 2018. Each preceding year was a prior record.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

It’s possible to see how venture is trending toward bigger, later-stage rounds in other pieces of private market data. Venture capital in Europe during Q4 2020 set a record for dollars invested, some $14.3 billion, for example. But that money was spread against the continent’s lowest deal count since Q4 2019.

The result of that divergence has been rising deal sizes in Europe. A median Series B on the continent saw its value double from $10 million in 2016 to $20 million in 2020, for example.

The result of that divergence has been rising deal sizes in Europe. A median Series B on the continent saw its value double from $10 million in 2016 to $20 million in 2020, for example.

Adding to the pile of numbers, the U.S. startup industry raised around 90 rounds worth $100 million or more in Q3 2020 alone.

The data goes on and on. If you read essentially any recent TechCrunch piece concerning the state of venture capital, private rounds are getting bigger as unicorns propagate, and the pace at which the market manages to find exits for the largest startups lags their aggregate value creation.

2021 could be more than just more of the same; this year could set fresh records for private investment results.

Parsing data from Silicon Valley Bank’s most recent markets’ report, I’ve pulled a few trends that help illustrate where the startup and private capital markets are heading this year. And, for flavor, I’ve also collected some data from an Insight Partners’ dive into the impact that middle-aged startups have on job creation. That final set of data will illustrate how quickly the startup market has bounced back from COVID-19 lows to near-record numbers and what that rebound could mean for 2021.

It’s going to be one hell of a year. Let’s talk about why.

2020’s venture capital market

To understand how venture capital has grown its later-stage focus and penchant for huge rounds into unicorns, it’s worth understanding how rapidly the VC asset class has grown, for the larger that the industry is in aggregate, the more capital it has access to, allowing venture capitalists to invest in late-stage startups at new, higher prices.

Per the SVB report, here’s how much money venture capitalists have raised in recent years, globally. Update: I misread the chart in question, the data was the target value of raises. Happily, we got the correct data for what we wanted, which was what was actually, in fact, raised by VCs in the world during the last few years:

- 2016: $102 billion.

- 2017: $124 billion.

- 2018: $147 billion.

- 2019: $103 billion.

- 2020: $127 billion.

The rising total amount raised by venture capitalists helped expand fund sizes. Average VC fund sizes in Europe and the U.S. nearly doubled to $212 million and $205 million respectively last year, compared to 2019 averages of $116 million and $129 million. That’s nearly vertical growth.

In 2020, there were a record 15 billion-dollar funds raised in the U.S. 2021 is on pace to nearly match 2020’s results with just the funds that are raising billion-dollar capital pools at the moment, according to Silicon Valley Bank. We could easily see a fresh record in 10-figure funds this year.

More U.S. data underscores recent venture capital trends. Unicorn fundraising in the States amounted to 42% of total startup capital invested in the country last year. That was up from 31% in 2019 and 30% in 2018, according to the report.

Pre-money valuations in the States are also going up; the median time to fund a company in the U.S. from Series A to B, B to C, C to D, are all falling; and there’s a correlation between — surprise, surprise — the amount of money that VCs raise and pre-money startup valuations. (More on that matter soon.)

Summarizing, 2020 was a crazed year for venture capital investment. And the biggest companies did very well. But what about 2021?

2021’s venture capital market

We’re in for even more of the same this year. Why? Because the underlying conditions that have led to where we got us to 2020 have not changed. Money is still stupidly cheap, and internet access is still rolling more broadly around the world. And the changes that 2020 brought are generally expected to continue in 2021, including trends like an accelerated corporate digital transformation, a more mobile, global workforce and so forth.

2021 is going to be quite a lot like 2020, then, but without early-COVID shocks. That sounds like a recipe for new records. There’s other bits of data backing up this cheery perspective, like the powerful IPO market in Q3 and Q4 of 2020 that looks set to continue in 2021, keeping valuations hot and optimism high amongst private investors. And SPACs are bailing out some less-attractive startups, providing liquidity to VCs earlier than they might have anticipated. And at better prices. That could help those same investors raise more money, which they can then invest.

Expect more huge funds this year. More huge rounds. More unicorn births. And more IPOs.

It’s worth noting at this juncture that SVB agrees with our take. The bank expects VC fundraising to reach new records in 2021. And it anticipates that late-stage valuations will grow this year as well. So, we’re not alone in our read of the data, trends and lack of change in the underlying causes of each.

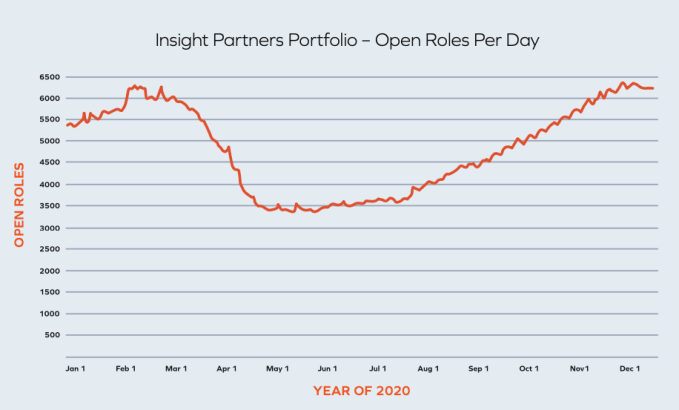

Let’s close with a chart that I found utterly fascinating. While skimming an Insight Partners’ report hyping “scaleups,” or startups with between $10 million and $1 billion in revenue, I ran across the following bit of information:

This, I think, is a good encapsulation of the 2020 venture capital market. From early highs to panicked declines, to an ensuing trough, and, finally, a steady incline.

This new year, then, started off on a high similar to where 2020 did when it comes to startup confidence and optimism, as expressed through their desire to up their burn — or, more politely, to boost headcount.

2021 is kicking off around where 2020 was, but with less impending catastrophe.

How far the chart’s red line can ascend this year will be a comp of sorts for the year’s startup and venture capital results. We’ll keep watching, but if you were hoping for things to slow down in VC-land this year, prepare to be disappointed.

Comment