Jeremy Abelson

More posts from Jeremy Abelson

Venture fundraising has continued at a robust pace, but much less cash is being deployed.

Let’s start with a few headlines:

- Bessemer in September raised about $3.85 billion for early-stage startups, the largest vehicle in the firm’s 50-year existence.

- Insight Partners in February raised over $20.0 billion, double its predecessor fund (closed in April 2020 at $9.5 billion).

- Lightspeed in July raised more than $7 billion across four funds for seed to Series B rounds.

- Battery Ventures in July raised over $3.8 billion with a broad mandate.

- Founders Fund in March raised over $5 billion across venture ($1.9 billion) and growth ($3.4 billion) funds.

- a16z in May raised about $4.5 billion in its fourth fund targeting blockchain, bringing its total funds raised for blockchain-related companies to more than $7.6 billion.

- a16z separately closed $9 billion in fresh capital in January, with $1.5 billion allocated to biotech investments.

- Tiger Global is rumored to be raising PIIP 16 in what could be around a $10 billion vehicle and its second-largest fund ever.

The public markets have seen an extreme valuation recalibration, and it’s effectively trickling down into the private markets. All the while, crossover funds and VCs have been watching from the sidelines — capital deployment is in somewhat of a “wait and see” mode.

The net/net: More dollars being raised with less deployed equals materially higher cash balances.

What the numbers tell us

Capital raising

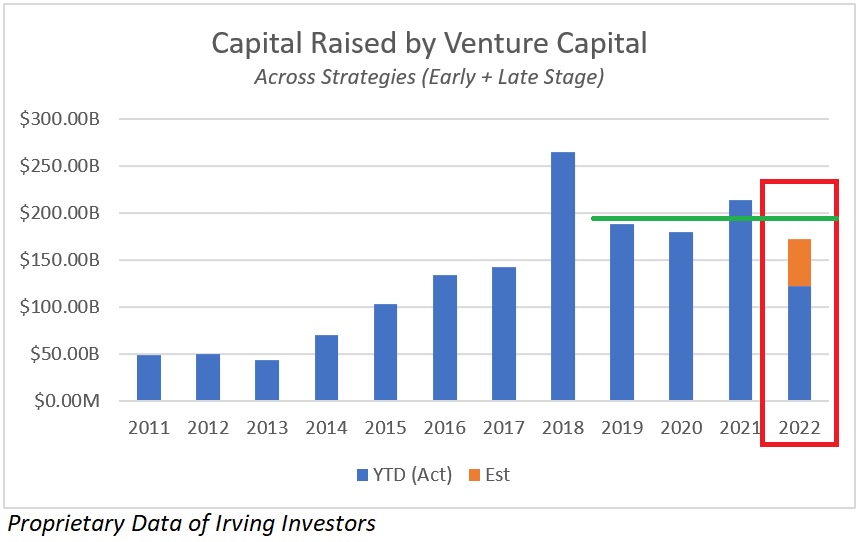

Venture capital fundraising has remained somewhat constant this year. VC firms have raised a total of $122 billion so far this year and are on pace to finish the year with $172 billion.

That’s 20% less than 2021 ($214 billion), a touch below 2020 ($180 billion) and about 11% less than the $194 billion average raised annually since 2019.

This strong level of fundraising is in stark contrast to the poor performance of high-growth names in the public markets. For instance, our high-growth SaaS bucket has suffered losses of about 60% to 80% or more.

Capital deployment

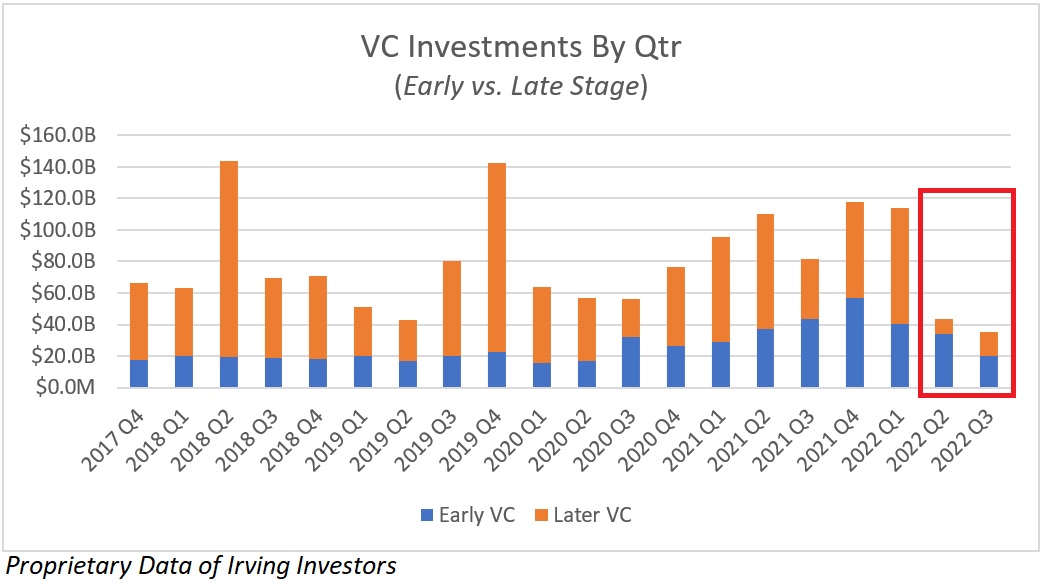

Total capital deployed by VCs in Q2 2022 and Q3 2022 has rapidly declined and now averages just $39 billion per quarter. This is on track to be the lowest reading since we can pull the data from 2017.

Currently, capital deployed in Q3 2022 (less than $40 billion) is on pace to be about 70% below Q4 2021 levels (about $118 billion).

This recent sharp decline in VC investments is consistent with commentary from “big check” writers such as SoftBank, which earlier this year noted it expects to pull back about 50% to 75% from investment levels seen in 2021.

Look to the unicorns

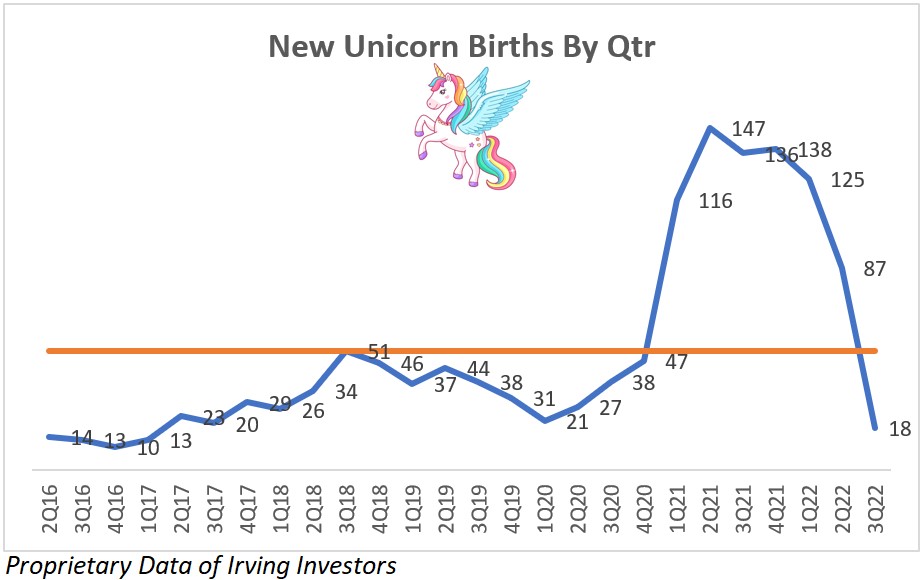

The pull-back in venture funding can also be seen in the staggering decline in the rate of new unicorns created every quarter. The theme was to be expected, but the degree shows the severity of how much funding has been reined in.

This chart shows what the notional dollars don’t: the selectivity dynamic at play here. We have both noticed and also implemented a significant concentration of focus on only top-tier companies this year. Dollars are flowing and will continue to flow, but it will be more capital to fewer companies. This chart shows how significant the impact of that will be.

Just 18 unicorns were created in Q3 2022, the lowest level in over five years (since Q2 2017).

Where is the cash going to go?

There is a general feeling that what has worked in the past is not going to work in the future. We very adamantly disagree with that.

Our opinion: The solution is not a change in strategy; it is a revision of valuations consistent with the current market. Currently, there is too big of a delta between fair value and valuation expectations.

The net effect of this valuation mismatch is that investors have slowed capital deployment in traditional channels and are now looking elsewhere:

Alternative sectors

Traditional SaaS has become too expensive and secondarily saturated, so investors are looking at other sectors:

- Blockchain/web3/crypto.

- Tech investors going into life sciences/medtech.

- International (non-domestic) investments.

- Industrial tech.

- Agtech.

Structured financings

Traditional funds (Coatue, etc.) are raising structured product vehicles that are looking to take advantage of the current weakness in company/issuer positioning, and companies are entertaining it. Funds are effectively selling propositions such as, “If you need your last round valuation, then we need additional protection, assurances, guaranteed returns, etc.”

This can be seen in incremental ratchets, enhanced preferences, converts with minimum return thresholds and extended duration penalties, other debt instruments, etc.

In our opinion, this isn’t real investment or real support. This is conditional support. This can be a very dangerous trade-off between desired current valuation and future punitive dilution.

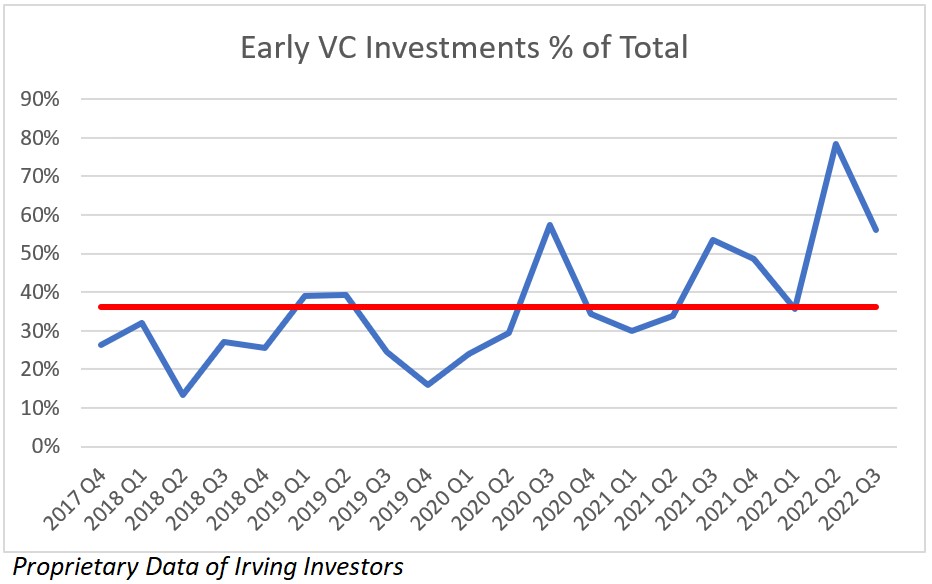

Investing earlier

Simply put, the earlier an investment is made in a company’s lifecycle, the lower the impact valuation has.

The early stages are about picking winners while the later stages are about investing in winners at good valuations. Investors can deploy in early-stage companies now without needing the valuation recalibration that they are waiting for and not finding in late-stage companies.

Additionally, going earlier simply delays the realization of returns. This is an easy way to shield a fund from near-term negative outcomes, and many funds are taking advantage of it.

We are in a buyer’s market and investors have the leverage. Companies have begun to adjust both their expectations and approach to attracting investors. Every company that is looking to become a public company is impacted by the public market sell-off, and no one’s valuation is immune. In our opinion, taking the valuation hit today is much better than taking it in the future. Short-term valuation “work arounds” can become much bigger long-term problems.

The solution is not a change in strategy for either side; it’s a revision of valuations consistent with the current market.

Good companies are still good companies regardless of market valuations. A down round is a pill that many companies have a challenge swallowing. As shown, there is a massive amount of VC capital raised and not yet deployed, as too many companies are hinged to their previous round valuations that could take multiple years to grow into. Until this occurs, more investor dollars will flow elsewhere.

Comment