The venture capital boom of 2021 was not built from merely traditional VC money. A host of other capital sources played a role in the global trend, from new methods of disbursing angel and seed capital to crossover funds pouring into late-stage startups. And amid all the noise, record-setting totals, and rapid-fire dealmaking, corporate venture investors were busy, investing gobs of parent-company cash into far-smaller concerns.

Corporate venture capital, or CVC for short, is the method by which wealthy businesses build their own investing arm. Traditionally, these efforts blend strategic goals (M&A, early access to technology, partnerships) and financial ones (returns). The exact mix varies by company and CVC effort, but it’s rare to find a corporate venture concern that has none of one or the other. This makes their investing an interesting blend of traditional venture and corporate opportunism.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

CVCs were busy last year. New data from CB Insights makes it clear that 2021 was a colossal period for CVCs, an all-time record by some metrics and a near-record year by others.

CVCs are in the news lately as well, thanks to MongoDB – a NoSQL company that went public in 2017 – putting together its own fund, an event that the technology world took note of. MongoDB joins recently public companies like Coinbase in employing corporate investor work before reaching mega-cap status. The trend goes further: We’ve even seen private companies launch their own CVCs, evidence at once of the lengthening period in which high-growth tech startups stay private and the sheer amount of capital available to pre-IPO companies.

Today, we’re exploring the data behind 2021’s CVC investing boom with commentary from Serge Tanjga, SVP Finance at MongoDB. Tomorrow, we’ll dive into the hows and whys of CVC in the current venture climate with commentary from a number of corporate investing players — and even one public company that is choosing to not build its own investing arm. Sounds good? Let’s get into the data.

Today, we’re exploring the data behind 2021’s CVC investing boom with commentary from Serge Tanjga, SVP Finance at MongoDB. Tomorrow, we’ll dive into the hows and whys of CVC in the current venture climate with commentary from a number of corporate investing players — and even one public company that is choosing to not build its own investing arm. Sounds good? Let’s get into the data.

How quickly is corporate venture capital investment accelerating?

There are two ways to track the growth of corporate venture capital: The pace at which new CVC concerns are set up, and the rate at which the larger CVC segment invests.

We’ll take them in order. It’s clear that more CVCs are being compiled in the current market than nearly ever before. Indeed, CB Insights data indicates that some 221 new CVCs were created in 2021, a huge 53% increase on 2020 data. However, the 2021 result was actually fractionally lower than the 259 built in 2018. That said, 2021 was the second-hottest year for which we have data when it came to new CVCs reaching the market.

Tanjga, discussing the CVC market from a technology perspective, said that more mature tech companies “tend to set up CVC arms because they have excess capital to deploy, or because being in the VC space will help with their brand positioning,” while younger technology companies “tend to start CVC efforts to attract startups to build on their product, to fund their existing customers or supercharge go-to-market partnerships.” So when we discuss just how many CVCs are being built, keep in mind that they are not a monolith when it comes to goals.

We can’t tease out a perfect split of CVC focus from the pace at which new funds were put to market last year. But if we presume that the new crop of corporate venture players is similar to those that came before it, it is safe to infer that a good number of returns-first and strategy-first CVCs were launched in 2021. For startups, that means that their set of capital funding options is not only broader than ever, but also that the corporate portion of the market is deeper than ever.

Why do we care?

To put an example to the data, recall that corporate spending startup Airbase recently raised from Amex Ventures, a corporate credit giant. So we’re seeing CVC money flow not merely into startups per se, but also the most competitive of startup sectors; corporate spend in the United States is an all-out scrap between Brex, Airbase, Ramp, Divvy, TripActions and other players, for reference. CVCs are playing in the most competitive of venture waters, in other words.

With the larger venture market afire and CVC creation rebounding from pandemic lows, did the pace at which rounds that corporate investors put capital into the market accelerate? Oh yes, yes it did.

How much capital is flowing, and where?

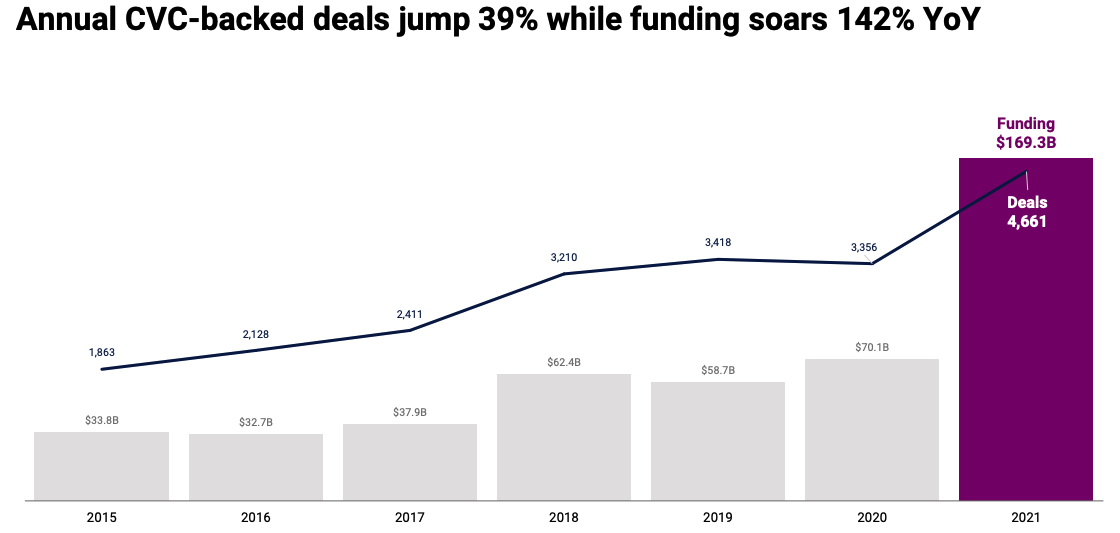

Moving on to the rate at which corporates invest, global CVC was on the rise in 2021 on two main counts: deal volume and dollar volume. The former rose by 39%, with 4,661 deals, compared with 3,356 in 2020. But it is funding that really soared, with a 142% year-on-year increase. And it’s not a rebound: $169.3 billion is a lot more than in 2020 ($70.1 billion), but also an absolute record compared to previous years.

What drove the investment increase? According to CB Insights, “a confluence of factors.” First, the rise in deal volume that we already mentioned. Second, a slight increase in late-stage deals, which represented 9% of all CVC deals. But the main factor is the “massive jump” in corporate venture arms’ participation in mega-rounds, or deals worth more than $100 million.

In 2021, there were 470 CVC-backed mega-rounds, a 163% increase from 179 in 2020, which was already a record. Considering the amounts involved, these giant transactions played a major role in dollar volume: “While accounting for only 10% of CVC deals, mega-rounds drove 62% of CVC-backed funding in 2021,” CB Insights wrote.

More than half of these mega-rounds happened in the U.S, which helps explain how the U.S. attracted twice as much CVC-backed funding in 2021 than in 2020 – up to $86.9 billion from $40.5 billion and a new record.

Silicon Valley was a huge driver of CVC growth in the U.S. The region saw a staggering $35 billion worth of CVC-backed funding in 2021, a number that is incredibly impressive when we consider that all U.S. corporate venture activity, as noted above, came to just over $40 billion in 2020.

The rise of CVC goes well beyond the U.S, though. CVC-backed funding also reached a record in Asia in 2021, increasing by 154% to reach $49.8 billion. In CB Insights’ methodology, the Asian region includes Israel, which contributed to the surge alongside China and India. These three countries saw CVC-backed funding more than double compared to 2020, thanks in large part to mega-rounds, the report noted.

Going by percentage, the increase in CVC-backed funding was even more pronounced in Europe – 170% – and in Latin America – a whopping 647%. The LatAm total still only makes for a comparatively modest $4.12 billion, but the growth remains significant. Similarly notable is the nearly 5x rise of CVC-backed funding in Germany. At $6.5 billion, it is no longer very far from the U.K. – the region’s leader in 2021 with $7.2 billion in dollar volume.

That’s where money is flowing geographically, but how about sectors? CB Insights highlights three of them: Fintech, which saw a 202% increase in CVC-backed capital, reached a $33.2 billion record; retail tech, where Asia-based companies attracted 46% of the sector’s $25.2 billion total CVC-backed funding; and digital health, which rose to $16.6 billion thanks to “the pandemic bump.”

The everything boom

In more traditional times, we might see one sector, one form of capital, or one geographic area prove a standout from its cohort. But in the current venture and startup boom, it seems that every sector, every form of capital and every geographic region is accelerating and setting new records.

This means that some of our reporting winds up having a similar tone. Don’t let that fool you to sleep; the data still matters even if all the charts are pointing in the same direction. And as we track current venture methods on their way up, just as we have with the startups they are busy backing, we’ll also track them on their way down when a correction comes.

Comment