Market headwinds continue to dog startups chasing venture backing. That’s the top-level finding of a new PitchBook report that looked at VC trends toward the end of 2022, specifically Q4, including investments made at the seed, late-stage and nearing-the-exit levels.

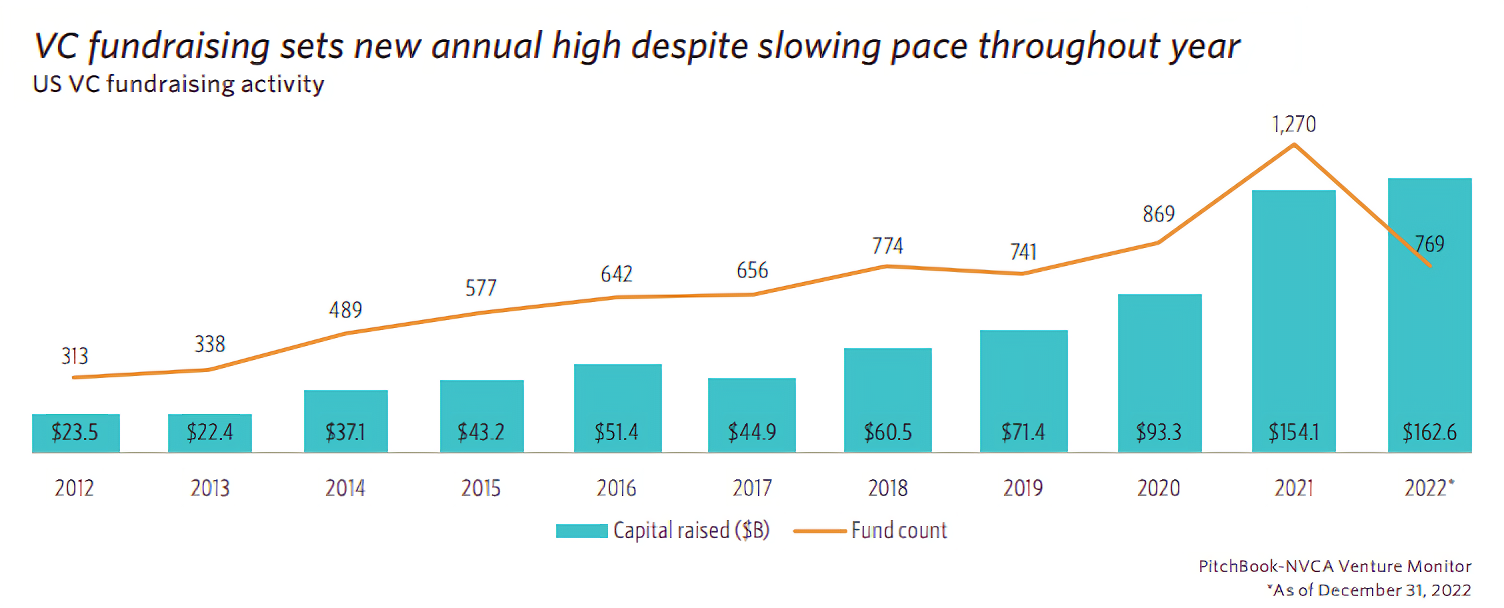

First, the good news: “On an annual basis, angel- and seed-stage deal activity remained relatively resilient in 2022, with $21.0 billion invested across an estimated 7,261 deals,” the report said. Last year set an annual record for capital raised, in fact, with $162.6 billion closed across 769 funds — the second consecutive year to exceed $150 billion.

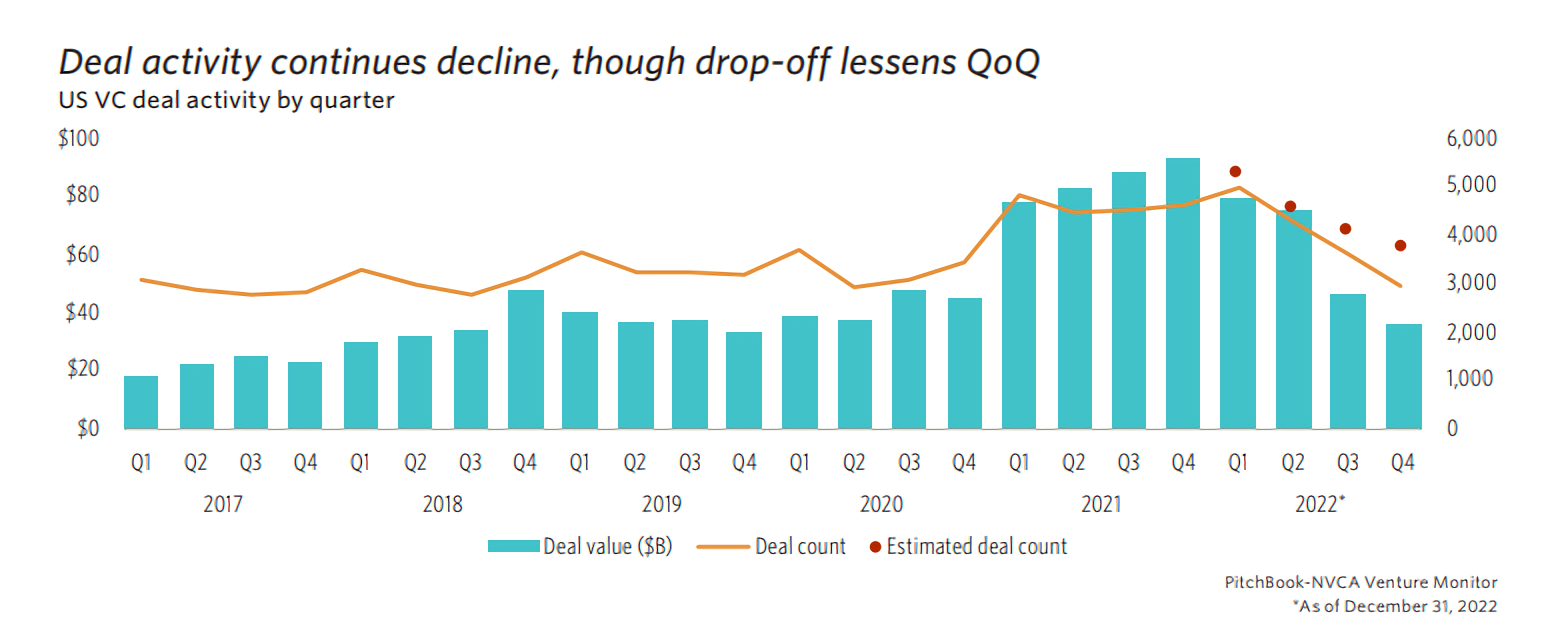

But the year was ultimately mixed. Q4 2022 marked the fourth consecutive quarter of declining deal counts while exit activity for the entire year fell to $71.4 billion — the first time the figure dipped below $100 billion since 2016. Acquisition volume also took a nosedive, with Q4 posting only $763 million in total acquisition deal value — the lowest quarterly value in more than a decade.

“Public exits of VC-backed companies have slowed to almost nonexistent levels, with just 14 public listings occurring in Q4, demonstrating how drastically institutional-investor appetite has been affected by rising interest rates and volatile macroeconomic factors,” the authors of the PitchBook report wrote.

Why the instability? PitchBook blames a variety of factors, including nontraditional investors slowing their capital deployment to VC amid less attractive risk/return profiles. According to the report, relative to 2021, the upside potential for VC-backed startups fell precipitously in 2022, which turned many investors away from the space.

Many of these nontraditional investors flocked to other asset classes as interest rates marched upward, spurred by the Fed’s continued battle against inflation. Investments like the 10-year Treasury yield, which finished at 3.5% as of December 2022, have simply become more attractive than “illiquid,” riskier asset classes like VC, PitchBook noted.

Just $24.1 billion in deal value involved nontraditional investors in Q4 2022, a three-year low, PitchBook found.

“Not only are we seeing lower deal value, but we are also seeing fewer nontraditional participants within the venture ecosystem,” the authors wrote. “The four consecutive quarters of declining deal counts could foreshadow a continued slide in 2023.”

So what does all this mean for 2023? Well, it depends on how the economy shapes up.

This year, like 2022, could see an increase in capital raised by what PitchBook calls “emerging managers,” or VC fund managers outside of the traditional Bay Area and New York ecosystems. On a less positive note, because seed-stage deal sizes and pre-money valuations were propped up in 2022 by microfunds (funds with less than $50 million in capital commitments) as well as nontraditional and crossover investors— many of which are pulling back — PitchBook fears that early-stage startups will start to feel pressure.

PitchBook gives a more detailed preview in its recently released 2023 U.S. Venture Capital Outlook. The firm predicts Series C and D rounds will see the most down rounds (e.g., rounds at reduced valuations) this year as these companies are currently the most starved for capital. At the same time, seed-stage startup valuations and deal sizes will continue their ascent, PitchBook anticipates, reaching new annual highs despite the slowdown in total deal value and count.

“As [later-stage] companies grapple with the new reality of higher interest rates and stricter deal terms, they will not be able to raise at their previous paces, high cash burn rates, or valuation levels,” the 2023 U.S. Venture Capital Outlook report reads. “[On the other hand,] seed-stage startups are more insulated from public market volatility than their early- and late-stage counterparts because they are at the most nascent stages of the VC lifecycle.”

PitchBook also predicts that “SPAC IPOs and mergers” will continue to decline while liquidations increase in 2023, and that venture deal value will fall below $50 billion in the U.S. as VC “mega-round” activity (rounds with deal sizes of $100 million or more) — which often has outsize participation from nontraditional investors — hits a three-year low.

On the SPAC front, the report notes that the U.S. Inflation Reduction Act, signed into law last year, implemented a tax on the repurchase of stock by a publicly traded company, which might incentivize SPACs to close up shop. (Recall that SPACs are publicly traded companies created for the purpose of acquiring or merging with an existing company, usually a startup.)

In another incentive, the market wasn’t kind to SPACs last year, with PitchBook’s DeSPAC Index showing a -64.5% year-to-date return for public companies that went the SPAC route, compared with -17.3% and -29.6% respective returns for the S&P 500 and Nasdaq.

About 139 SPACs liquidated in the months leading up to 2023, according to investment research portal SPAC Research.

From now to 2024, according to PitchBook, VC fundraising will land between $120 billion and $130 billion. The estimate factors in the appetite of long-term partners who provide the funding for VC firms, who are on pace to receive less in payouts on their investments in 2022 than in any year going back to at least 2006, per data from Hamilton Lane.

“If nontraditional investors reduce their investment in VC markets, mega-round activity will fall. … This void of funding for venture growth sets 2023 up to be very challenging for companies needing capital,” the authors wrote. “Not only could they remain unable to access the public market through IPO, but without the necessary supply of capital, which will generally be needed to fund large deals, it is more likely that companies that find themselves at the venture growth stage will experience down rounds or even failure.”

Comment