Welcome to The Interchange! If you received this in your inbox, thank you for signing up and your vote of confidence. If you’re reading this as a post on our site, sign up here so you can receive it directly in the future. Every week, I’ll take a look at the hottest fintech news of the previous week. This will include everything from funding rounds to trends to an analysis of a particular space to hot takes on a particular company or phenomenon. There’s a lot of fintech news out there and it’s our job to stay on top of it — and make sense of it — so you can stay in the know.

Hello! I am excited to report the introduction of two new additions to this newsletter. First, the amazing Christine Hall will be co-writing with me moving forward. Christine and I have actually known each other for 19 years, having used to work together at the Houston Business Journal. She’s been covering fintech for the past few years and I am thrilled she will be working on The Interchange with me moving forward. Second, if you read to the end, you’ll see a logo created just for the Interchange by TC’s incredible graphic designer, Bryce Durbin. I’m ridiculously excited about it. — Mary Ann

Thanks so much to Mary Ann for that greeting! I’m excited to be working with her in covering the wide world of fintech and look forward to contributing to what I biasedly consider the go-to newsletter for this industry. — Christine

Now on to the news.

Celebrating female-led ventures

I, as many of you I’m sure, continue to be disappointed in the lack of LP (limited partner) dollars flowing toward female-led venture capital firms. So you can imagine my excitement when I got an email about a new venture firm, called Vesey Ventures, that was founded by three female former managing directors of Amex Ventures who had recently closed a $78 million debut fund.

Vesey’s self-described mission is to back companies “transforming financial services” at the seed to Series B stages. It plans to invest $1.5 million to $3 million as initial checks, and larger amounts for follow-ons. Based in the United States and Israel, the fund has so far backed five startups, including Coast, Cyrus, Grain, Equi and Proper.

The trio would not say whether Amex is an LP in its new fund but implied there were no hard feelings when they all decided to leave (at the exact same time in late 2021, mind you). Personally, besides the fact that this means more money out there for fintech startups, I do love that Dana Eli-Lorch, Lindsay Fitzgerald and Julia Huang worked together for about a decade and got along so well as colleagues and friends that they decided, “Hey, let’s do this on our own.”

Clearly, their track record impressed enough LPs — including seven “prominent” unnamed financial institutions — that they were able to close the fund in a very challenging macroenvironment. During their time at Amex, they worked on investments in companies such as Plaid, Stripe, Melio and Trulioo. They also worked a lot on helping fintechs build partnerships with incumbent financial institutions — experience they plan to use to offer portfolio companies bespoke “Strategy Sheets” alongside term sheets.

Vesey defines fintech in its broadest sense — meaning that it invests outside of traditional categories of financial services such as consumer and B2B. It also looks at vertical software, embedded fintech, the future of commerce and the infrastructure layer — such as cybersecurity, risk and compliance.

It made my week to have the opportunity to cover this news, not going to lie. Here’s to more money flowing to female investors, and founders, too!!

Speaking of which, I also covered the $15 million raise for Kindred, a home-swapping network. While that company is more proptech than fintech, I am mentioning it because it was also founded by women who previously worked together — in this case, at Opendoor — and saw an opportunity to branch out on their own. — Mary Ann

Fintech funding in Q1

This week, we took a look at global fintech funding for the first quarter of 2023 and found some notable tidbits.

First things first, funding for the quarter totaled $15 billion, which is up 55% from the fourth quarter, but clearly showing a market correction due to the staggering amounts fintech companies raised in both 2021 and 2022.

And, it’s important to note that of that $15 billion, $6.5 billion was Stripe’s raise. Without that deal, CB Insights said funding would have amounted to $8.5 billion, or a 12% drop in funding from the fourth quarter of 2022.

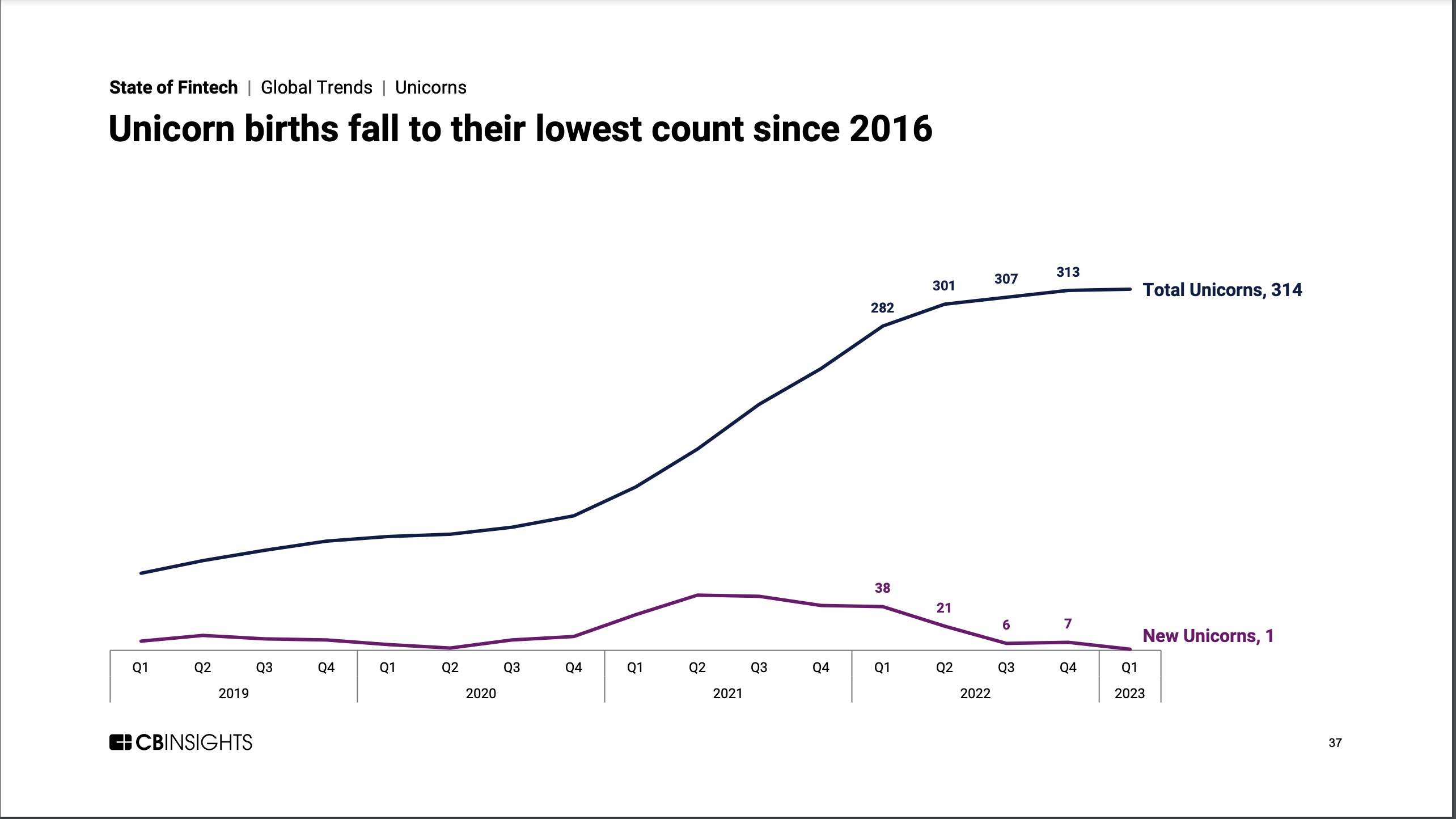

Meanwhile, 2022 was flush with fintech companies reaching unicorn status, with 72 unicorns minted that year, and 38 in the first quarter alone. That was likely aided by the plethora of available capital flowing into the sector, however; in the first quarter of 2023, just one fintech company was minted a unicorn: Egypt-based MNT-Halan, which in early February raised $260 million in equity financing at a $1 billion valuation. According to the CB Insights’ latest State of Fintech report, this is the first time that has happened since the end of 2016.

Though MNT-Halan was the only company to earn a horn, the first quarter was ripe with “megarounds,” the term for deals valued at $100 million or more. There were 16 deals like this, totaling $9.2 billion, an increase of 179% over the fourth quarter of 2022 and accounting for 61% of total funding in the first quarter, CB Insights reported. After Stripe’s $6.5 billion deal came Rippling, which raised $500 million in mid-March as Silicon Valley Bank was melting down. Notably, deal count was down, dropping 24% quarter over quarter. — Christine

Apple pushes further into fintech

Does every tech company want to become a fintech? As reported by Romain Dillet: “Apple Card customers in the U.S. can now open a savings account and earn interest through an Apple savings account. To learn the specifics about Apple’s new offering, click here. When the company originally announced the new financial product back in October, Apple said that it couldn’t share what interest rate would be paid out on these accounts because rates are fluctuating so much these days. As of today, Apple is going to offer an APY of 4.15%.” You can read more details on the move here.

Meanwhile, Moody’s Investors Service issued a new report summarizing its view that consumers’ ability to realize higher yields on their cash through the tech giant’s new savings account (which is being offered in partnership with Goldman Sachs) — if well integrated into the Apple ecosystem — “is credit negative for incumbent banks and cash alternatives such as money market funds.”

As we know, the new savings account deepens Apple’s offering of financial services products, which already includes a digital wallet, credit card and its buy now, pay later credit offering, Apple Pay Later. As Moody’s points out, “the expansion aligns with a common technology firm strategy to increase the scope, utility and appeal of their digital platforms.”

“If Apple promotes the savings product aggressively, it could attract a significant amount of savings to the Apple ecosystem and away from traditional banks. Through the partnership, Goldman Sachs could benefit from increased deposit funding through the broad reach of Apple’s digital ecosystem,” said Stephen Tu, a vice president with Moody’s Investors Service, in a written statement.

Moody’s further added: “While there are already many higher-yielding cash alternatives available for most consumers, Apple’s higher-than-average rate of interest on the account combined with its simple and easy to use ecosystem could incentivize consumers to shift funds to the Apple platform from incumbent financial institutions.” — Mary Ann

(Disclosure: My husband works for Apple, but not in any capacity related to this project.)

Other weekly news

Lili claims super app status with new accounting platform

Greenwood — a digital banking platform for Black and Latino individuals and businesses — goes live for all, cancels waitlist (TechCrunch covered the company’s 2021 $40 million raise here.)

UK-based Finastra partners with Plaid to give users access to fintech apps

Airbase adds guided procurement to spend management platform

Online real estate firm Opendoor cuts 22% of workforce (TechCrunch covered the company’s previous round of layoffs, which affected 18% of its staff at that time, last November.)

Bain Capital Ventures’ Matt Harris published a piece on how banks should be working with startups: Lessons from Ancient Rome: How banks can learn to love startups

Fundings and M&A

Seen on TechCrunch

Autotech Ventures’ new $230M mobility fund adds fintech, circular economy to its investment strategy

Accounting automation startup Trullion lands $15M investment

And elsewhere

Wealthtech-proptech-fintech crossover Plotify raises $12.5 million in equity financing

Actor Ryan Reynolds Buys Position in Canadian Payments Tech Company Nuvei

Insurtech Capitola raises $15.6M Series A from Munich Re

Clerkie raises $33M Series A funding from top investors to address the broken debt system

French expense management firm Mooncard bags €37M Series C funding

YELO Funding, a college financing startup, announces $1.2 million in pre-seed funding

TiiCKER, a shareholder loyalty and engagement platform, raises $5M in seed round

Residential technology company Habi receives $100M credit facility from Victory Park Capital

Waste management payments startup CurbWaste raises $4M

Now, here’s that logo I promised! Isn’t it pretty?!

That’s it for this week. It felt a little slow but hey, sometimes, that’s okay :) Hope you all are having fantastic and fun-filled weekends! See you next time. xoxoxo, Mary Ann and Christine

Comment