Tiger Global believes India is likely to produce the highest equity returns globally in the future, its partner Scott Shleifer said on an investor call Tuesday, projecting high confidence in the key overseas nation even as he admitted that the world’s second largest internet market has delivered below average returns for the investor giant historically and the local startup ecosystem is grappling with governance and unit economics challenges.

“We think it will be the best place to invest,” said Shleifer of India at his rare appearance. “We were able to purchase 16 or 17% of Flipkart for $8 million in 2010,” he said of the investment in the e-commerce giant, which is currently valued at over $37 billion. “We were able to purchase 10% of [business-to-business commerce startup] InfraMarket for $8 million. We purchased a third of [investing app] Upstox for $50 million.” Both the firms raised capital in their most recent rounds at over $2.5 billion valuation.

Tiger Global is one of the most prolific investors in India and is a backer of over a third of all unicorn startups in the country. The New York-headquartered firm, which counts India among its top three markets globally, has deployed over $6.5 billion in the South Asian market since inception, TechCrunch reported last year. In Flipkart alone, Tiger Global has invested over $1 billion.

India has attracted over $75 billion in investment from tech giants such as Google, Meta, Walmart, Microsoft and Amazon and investors including Sequoia, Tiger Global, Accel and Lightspeed over the past decade. But the country’s burgeoning startup ecosystem has seen very few exits and many consumer internet startups that listed in the past two years are trading significantly below their listing prices.

The absence of exit liquidity has been one of the biggest criticisms or concerns about India among some investors. Shleifer, who was an analyst at Blackstone before joining Tiger Global, acknowledged that returns on India have not been anything to write home about so far.

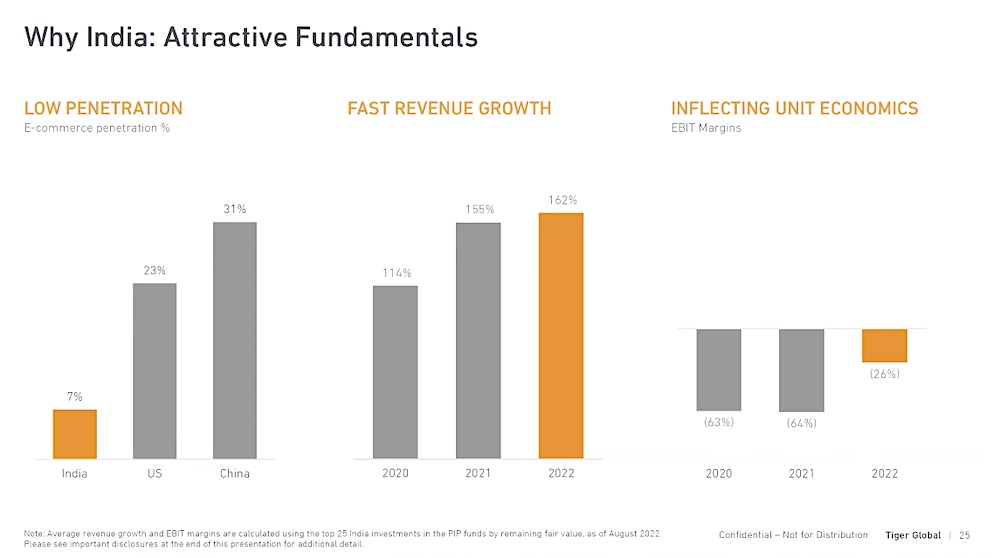

“Returns on capital in India have sucked historically. If you look at the market-leading internet companies, whether it is Google, Facebook, Alibaba or Tencent, revenue for them got bigger than cost more than a decade ago. You had a great legacy of last 17-18 years of materially profitable internet companies. So returns on equity in the internet got really high and the returns for investors have been really high. But that did not happen in India,” he said on the call, which was also attended by Alpha Wave Global co-founder and partner Navroz Udwadia and saw participation from about 200 entrepreneurs, investors and bankers.

Until the past two or three years, India had about zero profitable internet startup even as banks and firms in other industries flourished. Flipkart, Ola, Freshworks and Paytm, all over a decade old, remain unprofitable. But Indian internet companies hitting $100 billion in revenue was an inflection point for the industry, he said.

“As a result, returns on capital for investors like us have been below average … way below. Our returns in India, our IRR, is something like 20% gross since inception. That compares to mid-30s in the U.S. on the private side, and low-50s in China. But that’s the past,” he said.

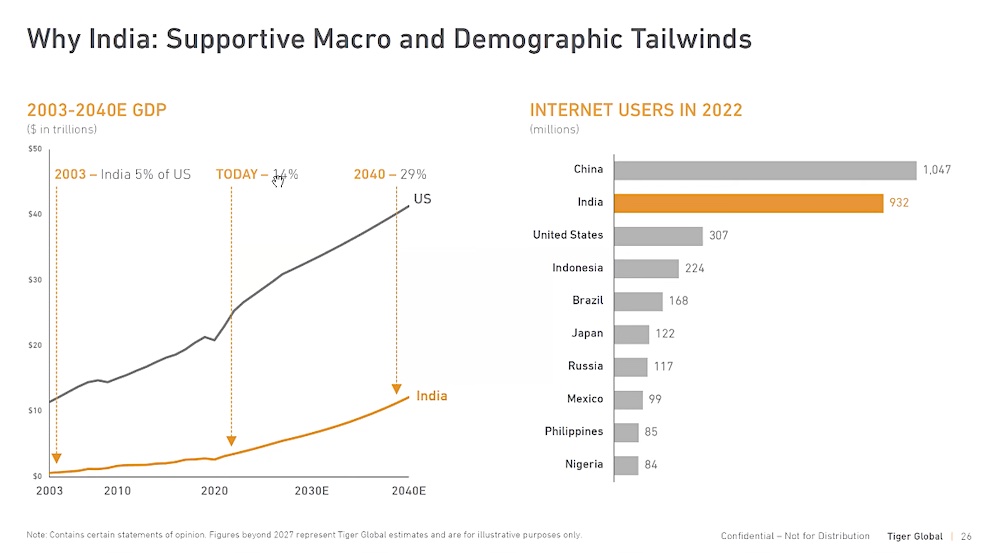

Shleifer, whose firm suffered one of the largest losses in venture history last year, offered a sympathetic take on India’s poor returns, asserting that the country could not have delivered a ton with its $3 trillion economy.

“We have seen incremental profit margins on market leaders be fabulous. So this big risk that you would have a great country that would gain share in GDP, but there wouldn’t just be excess profit pools that could have a sustainable competitive advantage, we think the odds of that has fallen off a cliff.”

He argued that the historical low returns in India allowed the country to enter the downturn in a better position than the U.S. “You did not have much excess capital in India as there were in few other places.”

Funding in Indian startups — as it the case elsewhere globally — has shrunk in the past one year as investors grow cautious of the broader market conditions. The last time Indian startups faced a steep decline in funding was around 2015 and 2016, when the country grappled with the aftermath of excess capital inflow in scores of internet startups.

“I think it was very helpful that the India internet went through a bubble in 2015. We helped contribute to it at Tiger Global, so we are not casting stones. The closest thing we have had to a proper bubble that burst was the Indian internet in 2015. The reason I bring that up is because I think that has been very helpful today and in the last couple of years. In 2022, our portfolio of investments in India performed far closer to budget from the beginning of the year compared to our companies in any other geography.”

“Founders weren’t called founders in India 15 years ago. They were called promoters. There was something different about the promoter culture. I don’t hear that word anymore. We have certainly seen improvements, as evidenced by even one of our own portfolio companies,” he said, referring to the meltdown at GoMechanic.

“It was reported that a bunch of numbers that they reported were fictitious. The truth is always going to come out.”

Comment