Amit Anand

Southeast Asian tech companies are drawing the attention of investors around the world. In 2020, startups in the region raised over $8.2 billion, about four times more than they did in 2015. This trend continued in 2021, with regional M&A hitting a record high of $124.8 billion in the first half of 2021, up 83% from a year earlier.

This begs the question: Who exactly is investing in Southeast Asia?

Let’s explore the three key types of investors pouring money into and driving the growth of Southeast Asia’s tech ecosystem.

Big tech

Southeast Asia has become an attractive market for U.S. and Chinese tech firms. Internet penetration here stands at 70%, higher than the global average, and digital adoption in the region remains nascent — it wasn’t until the pandemic that adoption of digital services such as e-wallets and online shopping took off.

China’s tech giants Tencent and Alibaba were among the first to support early e-commerce growth in Southeast Asia with investments in Sea Limited and Lazada, and have since expanded their footprint into other internet verticals. Alibaba has backed Akulaku, M-Pay (eMonkey), DANA, Wave Money and Mynt (GCash), while Tencent has invested in Voyager Innovations (PayMaya), SHAREit, iflix, Ookbee and Sanook.

U.S. tech firms have also recently entered the scene. In June 2020, Gojek closed a $3 billion Series F round from Google, Facebook, Tencent and Visa. Google, together with Singapore’s Temasek Holdings, invested some $350 million in Tokopedia in October. Meanwhile, Microsoft invested an undisclosed amount in Grab in 2018 and has invested $100 million in Indonesian e-commerce firm Bukalapak.

Venture capitalists

In Q1 2021, Southeast Asian startups raised $6 billion, according to DealStreetAsia, positioning 2021 as another record year for VC investment in the region.

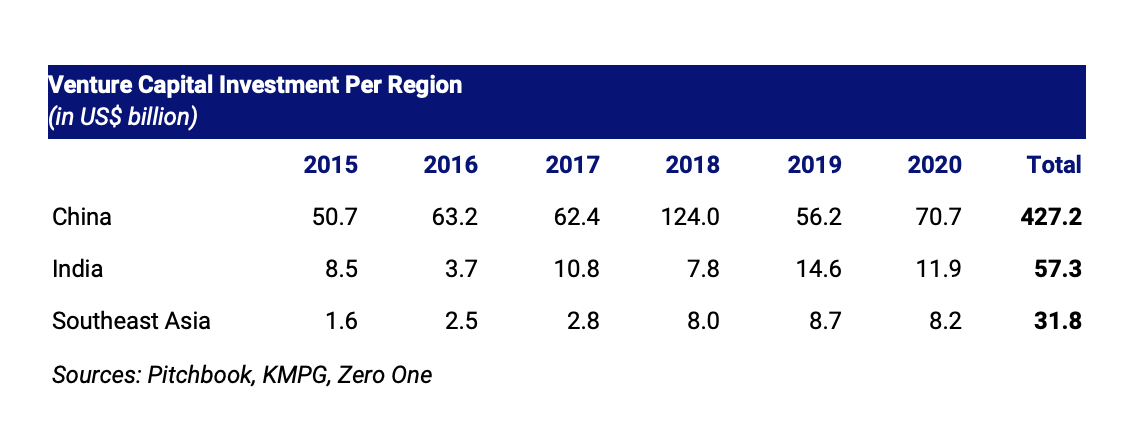

The region is also rising in prominence as a destination for investment capital relative to the rest of Asia. Regional VC investment grew 5.2 times to $8.2 billion in 2020 from $1.6 billion in 2015, as we can see in the table below.

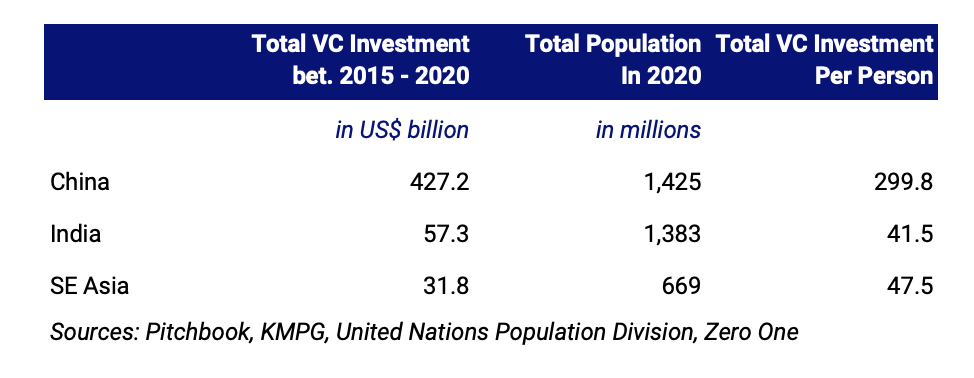

Southeast Asia also has many opportunities for VC investment relative to its market size. From 2015 to 2020, China saw VC investment of nearly $300 per person; for Southeast Asia — despite a recent investment boom — this metric sits at just $47.50 per person, or just a sixth of that in China. This implies a substantial opportunity for investments to develop the region’s digital economy.

The region’s rising population and growth prospects are higher due to China’s population growth challenges, alongside the latter’s higher digital economy market saturation and maturity.

Family offices

Southeast Asia has become a focus for family offices, many of which establish a local presence in Singapore. Over 229 family offices have been registered in Singapore since 2020, with total assets under management of an estimated $20 billion, according to the Monetary Authority of Singapore (MAS).

Microsoft co-founder Paul Allen’s family office, Vulcan Inc., opened its first international branch in Singapore in 2019, while the family office of Google co-founder Sergey Brin — operated via Bayshore Global Management — also established a center in Singapore in 2020. Bridgewater Associates founder Ray Dalio and Dyson founder James Dyson also opened family offices in Singapore recently.

East Asian billionaires have also joined the fray. Shu Ping, a founder of Haidilao, the world’s biggest Chinese hotpot restaurant chain, opened Sunrise Capital Management in Singapore in 2019. Meanwhile, the family office of Joseph Phua, managing partner of Turn Capital and co-founder of Taiwanese livestreaming app 17Live, acquired Taiwan-based blockchain firm Dapp Pocket and cryptocurrency exchange Coinomo in 2021.

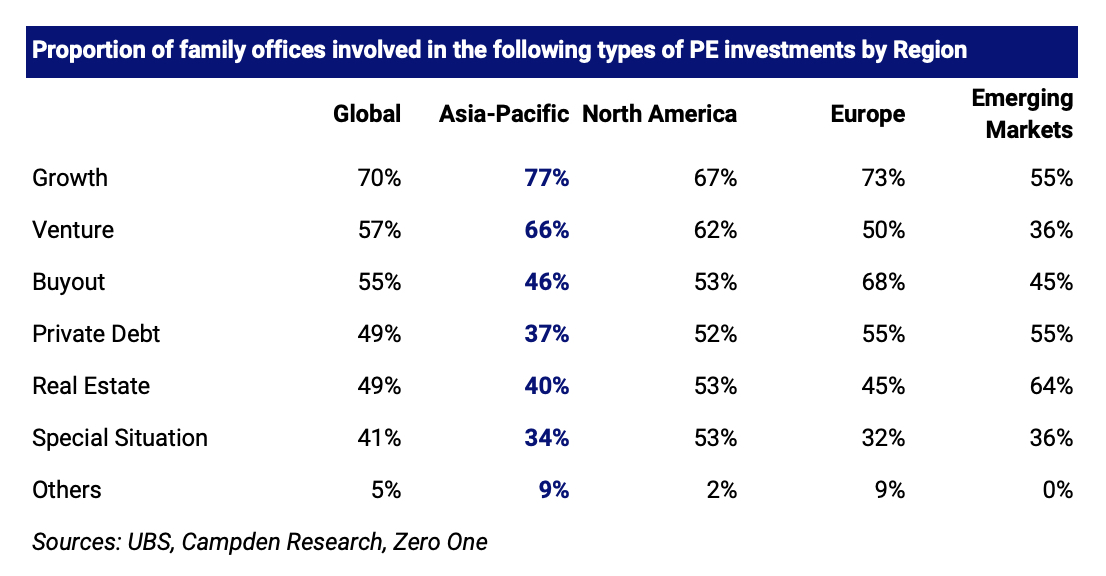

Family offices based in Asia-Pacific are increasingly allocating private equity capital to venture and growth-stage investments. A whopping 77% of family offices in APAC are actively involved in growth-stage investments, while 66% are making venture-stage investments, according to UBS. This compares to the global average of 70% and 57%, respectively.

What’s next for Southeast Asia tech?

Southeast Asia is poised to increase its prominence in the global tech ecosystem thanks to its favorable geopolitical climate and proven exit potential.

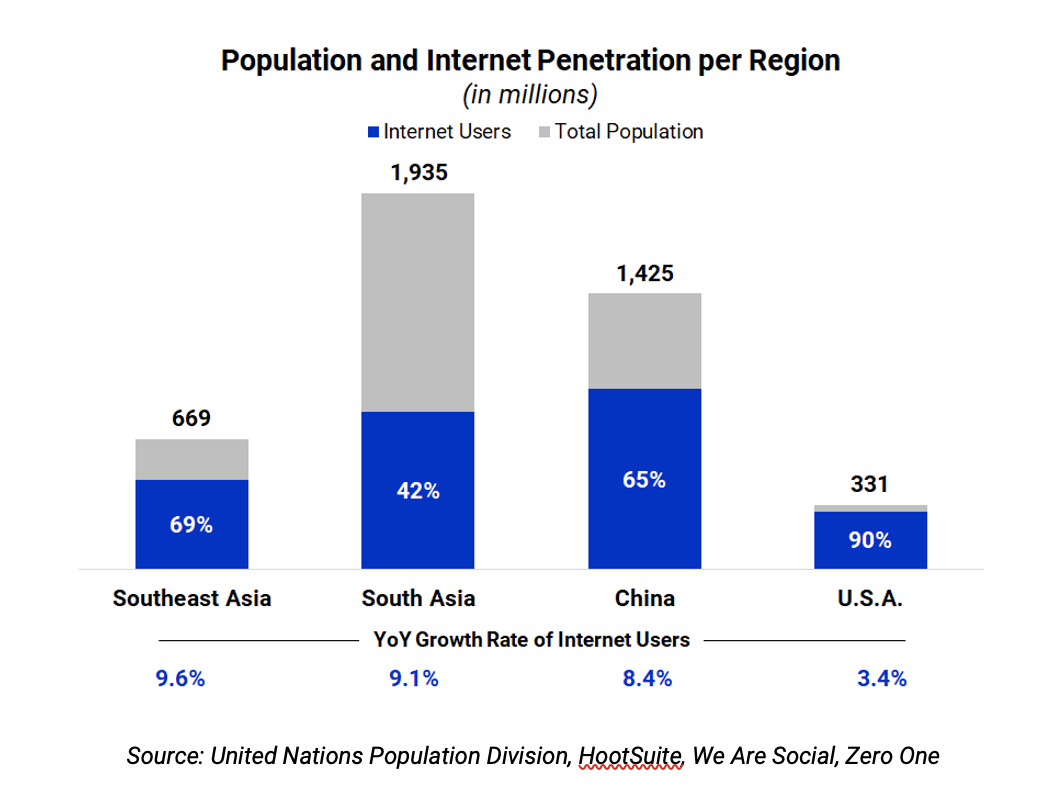

With an average age of 27, Southeast Asia is also home to a young and tech-savvy population. Research below shows the YoY growth of the region’s internet users is estimated to have surpassed South Asia, China and the U.S.

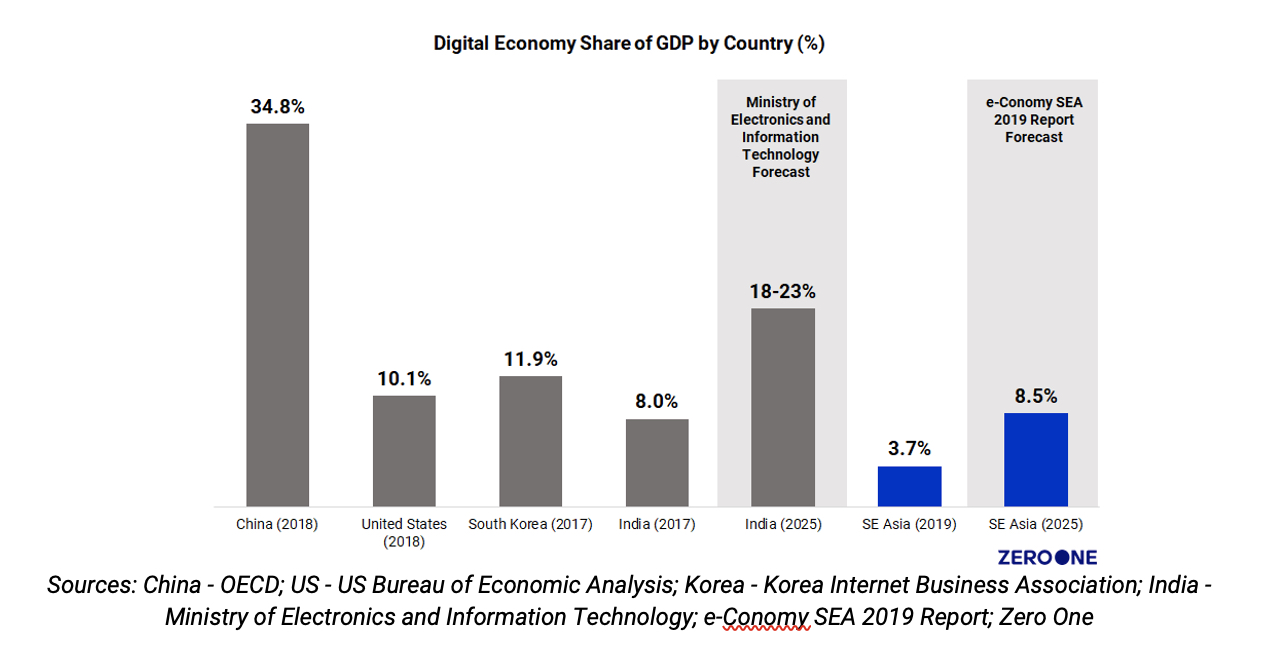

Southeast Asia is also at an earlier stage in terms of the development of its digital economy. Its digital economy only accounts for 3.7% of its total economy and is expected to more than double by 2025. But even at this level, this would still imply substantial room for further expansion when compared to the digital penetration in other markets.

The recent boom in M&A transactions and U.S. SPAC activity also bodes well for future investment flows even into early-stage companies. More investors will become comfortable investing in earlier-stage companies, paving well-trodden paths to realizing their investments via healthily valued acquisitions or IPOs.

Although China remains Asia’s most active venture capital ecosystem, its leadership position may be challenged in the long term by external factors, such as geopolitical tensions with the West, or domestic hurdles like its curb on foreign listings and crackdown on internet services.

Fortunately, governments across the rest of Asia are learning the right lessons from China and not following its policies in terms of regulations and governance. Instead, the environment in Southeast Asia is fertile for growth with favorable policies and incentives for tech companies or sandbox-type environments to experiment and test new technologies.

Comment