Maria Lepskaya

Market trends are the best indicators we have to judge the maturity of the quantum industry. While they don’t perfectly reflect technological progress, they showcase investors’ willingness to write checks for the industry.

In the next three to five years, quantum computers manufacturers are expected to generate revenue of $5 billion to $10 billion, according to Boston Consulting Group. McKinsey expects the chemical and pharma industries to be the first potential users of quantum computing, enabling the accurate simulation of larger numbers of atoms and molecules, which is not possible today using classical supercomputers.

Although many VCs seem to be new to quantum technologies, some investors foresaw this movement several years ago and are now making their first quantum exits.

Take IonQ, a U.S.-based manufacturer of ion-trapped quantum computers, for instance. The company was founded in 2015, and it went public in 2021 through a SPAC at a $2 billion valuation. Berkeley-based Rigetti will also go public through a SPAC this year, raising $458 million at a $1.5 billion valuation. The company is developing a superconducting quantum computer, which already could scale up to 80 qubits.

IonQ and Rigetti’s IPOs set the valuation benchmarks for the whole industry, which impact the valuations of all quantum deals. More importantly, these IPOs show venture capitalists could make money from the quantum industry without significant commercialization of the technology.

Today, a quantum processor is a complicated device requiring a lab environment. This makes cloud access to quantum processors preferable, which was not possible during the emergence of classical computers. As a result, quantum hardware manufacturers develop their own cloud-based operating systems. Right now, it is hard to imagine someone would build a large quantum OS company as Microsoft did in the 1980s.

“Although technology maturity will still take many years, the future winners in the quantum computing market will be determined in the next two years. We are expecting a first consolidation phase led by the 10 leading full-stack quantum hardware players,” said Benno Broer, CEO at Qu&Co. This is a path the quantum industry may follow, collecting pieces of the stack via acquisitions.

VCs are not the only ones to bet on the quantum industry. National quantum programs worldwide have invested more than $9 billion in the ecosystem over the last 15 years. The Chinese national project, “Quantum Control,” has already spent about $1 billion in this period, and is now increasing funding. The European “Quantum Flagship” initiative spent €500 million during the last 20 years and will spend over €1 billion over the next 10 years. France stands out among European countries with a €1.8 billion budget for its “Plan Quantique.”

North America is not far behind: Canada has already spent $1 billion for its national program, and the U.S. will spend more than $1.2 billion in the next five years.

Governments worldwide undoubtedly understand the importance of quantum technologies, and the amount of funding is proof of that. Unfortunately, state funding closes the doors for some VCs who want to invest in sensitive sectors.

“Sufficient investment to enable quantum startups is currently probably the main bottleneck to establishing a strong European quantum ecosystem. Efficient, innovative ways to leverage private investment in synergy with government grants will be key to success in translating leading European expertise into leading industrial capacity. We have a window of opportunity we cannot afford to miss in the next few years,” said Tommaso Calarco, director at the Institute of Quantum Control.

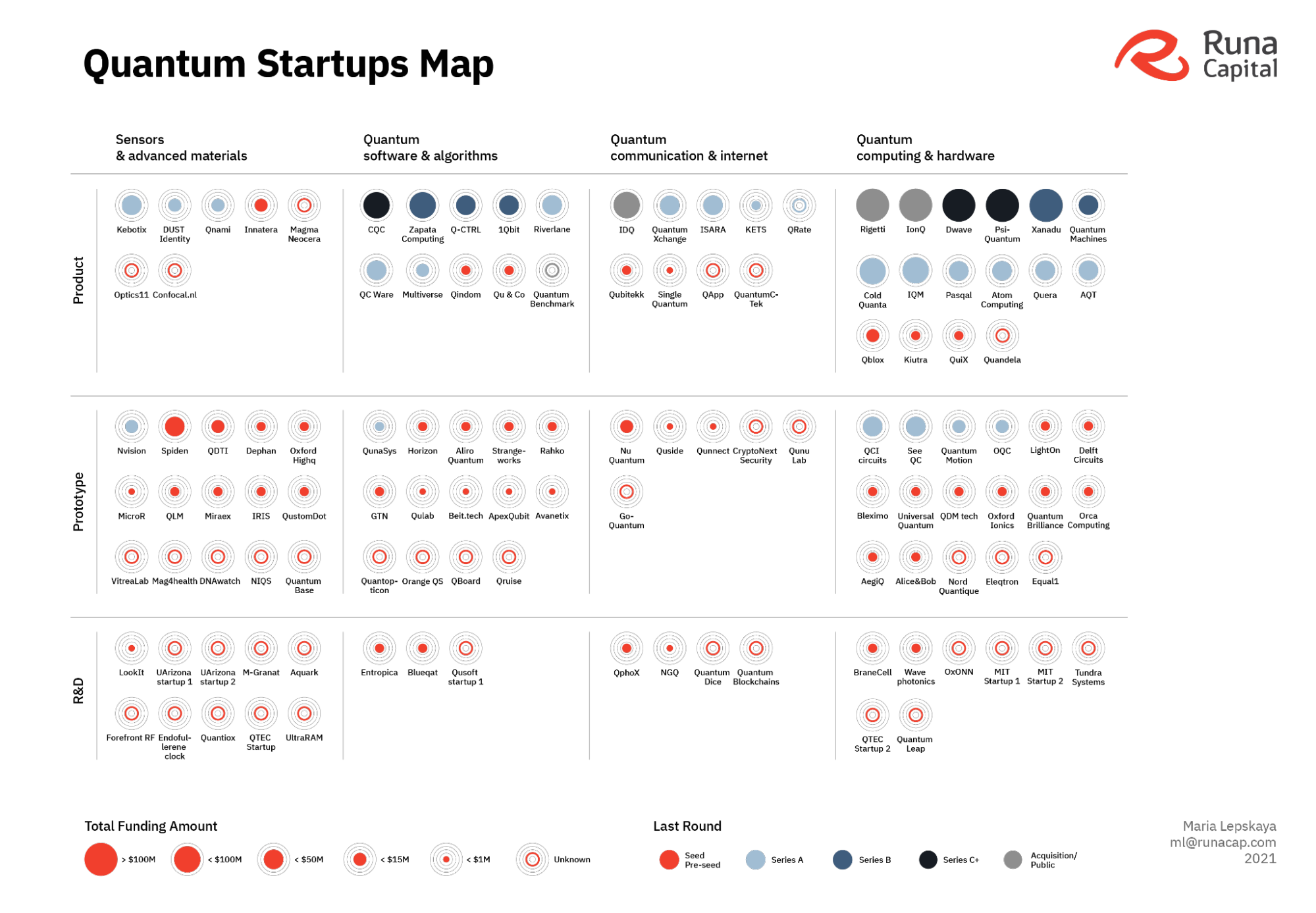

After the early success of quantum communication, our team decided to study the quantum landscape in more detail. At the time, it was not apparent if the quantum market even existed. We created a map of the quantum startups ecosystem that is divided into 12 quadrants, each corresponding to particular quantum technology and a stage of startups.

We define three stages, including R&D, prototype and product. The R&D stage is the earliest stage where scientists build the first operational prototype. There is already something functional at the prototype stage, but it usually functions only in lab environments. Finally, there is at least one fully operational product or service at the product stage that the company can sell to a customer.

In terms of technology, all startups are divided into four categories: sensors and advanced materials, quantum software and algorithms, quantum communication and internet, and quantum computing and hardware.

The map features 120 startups, of which 31% are in the product stage, 47% in the prototype stage and 22% in the R&D stage. Surprisingly, there are not so many startups in the R&D stage out there. Due to affordable grant funding and the nature of the industry — which originated in university laboratories and R&D centers — often, these spinoffs are in stealth mode for a long time in labs and are in no hurry to emerge.

Considering that about 400 laboratories are dealing with quantum technologies worldwide, and a maximum of two startups can spin off from each laboratory, we can estimate how many quantum startups we can see in the future. We anticipate this figure to remain stable in the coming years because the number of labs and the number of scientific groups can’t simply grow out of nowhere. The situation may change, though, if a hardware breakthrough drives a new wave of quantum software startups.

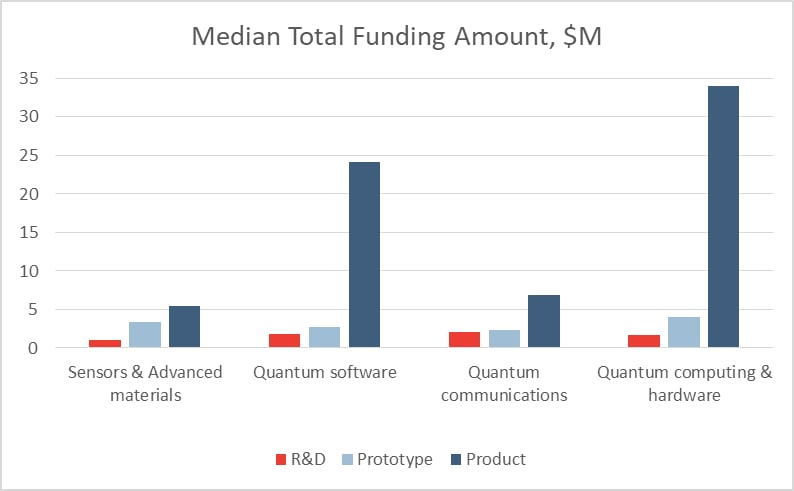

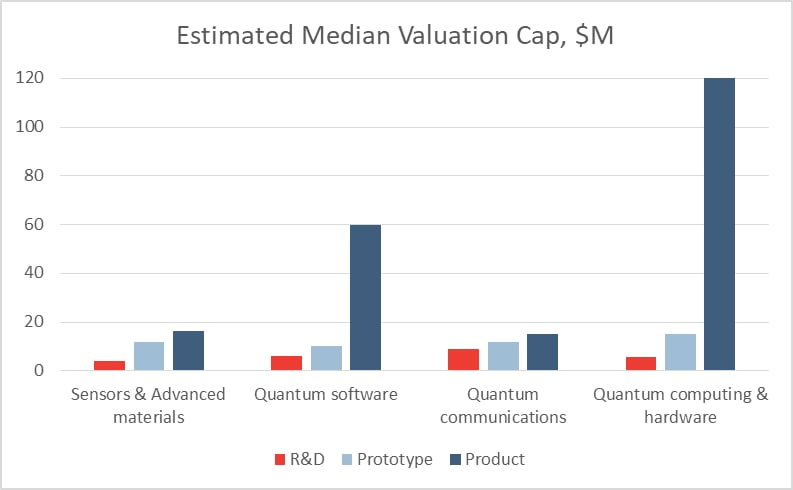

Quantum hardware startups that have products typically raise the largest rounds relative to other categories. One example is photonics startup PsiQuantum, which has raised $650 million to date — fun fact, it features a grandson of Erwin Schrödinger among its founders.

Quantum software startups come second in terms of funding. Interestingly, both hardware and software startups in this space see a pretty big jump in funding when they go from the prototype to the product stage. This trend reflects investors’ expectations of market maturity. However, quantum sensors and communications startups only see a small bump, perhaps because investors aren’t convinced about the viability of these markets yet.

Distributions of total funding and valuations are similar. Again, the first place is taken by hardware startups. Among them, photonics players received the most capital, as, on average, their valuations are two times higher. But if you look at it from another angle, the corresponding difference in funding is also very significant. Yes, these companies raise more money at higher valuations, but this simply reflects their greater needs for capital rather than extraordinary investor excitement.

VCs are not really in favor of the quantum sensors and communications space. Communications is perhaps the most state-funded category. And when it comes to cybersecurity, governments strive to keep such resources under greater control. Sensors, on the other hand, do not have this problem. Although there are already practical sensor applications, this market is still not vibrant enough for VCs.

Quantum software that has no hardware to run on yet attracts much more capital. “I am thrilled to see that quantum software startups are figuring so prominently in total funding and valuation cap. With appropriate software, I foresee that we can use quantum computers to take the role of a ‘programmable molecule,’ allowing simulations to be performed with speeds and accuracies out of reach of conventional computers. Such simulations will be invaluable in the fields of material and chemical design, accelerating the development of, for example, more efficient batteries, catalysts and solar panels.” said Harry Buhrman, founding director of QuSoft.

The quantum VC club

According to Crunchbase, there are about 300 active quantum startups worldwide that have emerged from stealth mode.

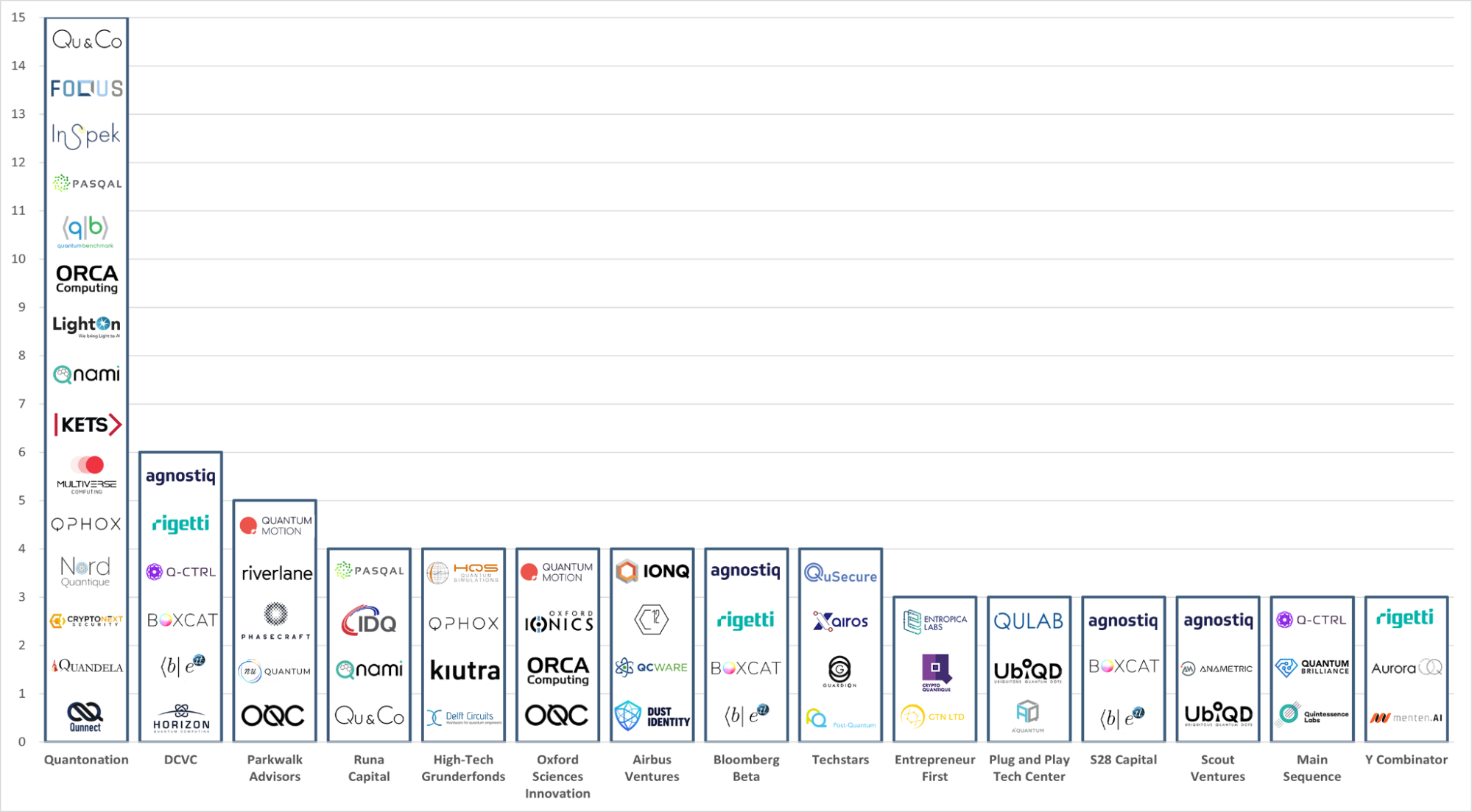

There is just a handful of investors betting on quantum startups around the world. According to Crunchbase, only 15 VCs, including venture capital funds and accelerators, have invested in at least three quantum startups. Together with entrepreneurship and university programs (Creative Destruction Lab and Innovate UK), incubators (European Innovation Council and AGORANOV), micro VCs (Acequia Capital), investment banks (Bpifrance), government offices (In-Q-Tel, National Science Foundation and SGInnovate) and agencies (EASME), this number increases to 30.

The undisputed leader by the number of investments is Paris-based Quantonation, which has backed 15 quantum startups to date.

Another noticeable fund is U.S.-based DCVC, which has six quantum investments. The firm seems to be more focused on quantum software (BEIT, Q-CTRL, BoxCat, Agnostiq and Horizon Quantum Computing), but it has also backed superconducting quantum computer company Rigetti, which is soon to go public. Parkwalk Advisors comes third on this list with five U.K. quantum startups in its portfolio: Quantum Motion Technologies, Oxford Quantum Circuits, Riverlane, Phasecraft and Nu Quantum. Runa Capital invested in four quantum startups, which places us in fourth place together with HTGF, Oxford Sciences Innovation, Airbus Ventures, Bloomberg Beta and Techstars.

Top accelerators also do not hesitate to invest in quantum technology. Techstars, Plug and Play, Y Combinator and Entrepreneur First have access to early-stage ventures, which allows them to catch startups before others notice them. This is especially beneficial in the quantum industry, with dozens of startups staying in stealth.

Despite all the buzz, quantum investments are still not mainstream. There were about 90 quantum investments in 2021. The amount of funding is also small compared to other venture-backed industries: $1.4 billion in 2021 and $700 million in 2020.

Investing in quantum computing is a long-term game that demands patience, expertise and commitment. The situation is unlikely to change soon – generalist VCs certainly could participate in the growth rounds, but it’s likely that the early-stage quantum venture remains the specialist VC’s domain.

Comment