We lied when we said that The Exchange was done covering 2021 venture capital performance. Yesterday, we dug into preliminary Q3 data for the Chinese startup market. This morning, we’re looking back at just what startups in New York City managed in the first half of the year.

Some startups, at least. We paged through a report from New York City-based Work-Bench, a venture capital group focused on enterprise technology. The firm ran the numbers on Q1 and Q2 venture performance in their target market. What emerged from the data is a startup market busy accelerating its ability to raise capital, mint unicorns and, increasingly, generate outsized exits.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Gone are the days when the New York startup ecosystem, perennially in Silicon Valley’s shadow, was more hype than substance. (In recent news, Work-Bench recently raised a new $100 million fund.)

There’s a lot to chat through, so we got Work-Bench partner Jonathan Lehr — one half of a founding pair that includes Jessica Lin — to answer our questions. Let’s explore just how large the New York City venture capital market has grown, where the funds are flowing in enterprise-startup terms, and discuss the pace at which the city is minting new unicorns — can it find enough exits for so many $1 billion startups?

That final question is one that we have about essentially every startup hub in the world. Perhaps New York City will provide a blueprint for how to think about an ever-larger unicorn stable that seems to have a wider entrance than exit.

That final question is one that we have about essentially every startup hub in the world. Perhaps New York City will provide a blueprint for how to think about an ever-larger unicorn stable that seems to have a wider entrance than exit.

A venture bonanza

At a state level, New York had a huge start to 2021. As with many startup ecosystems, there was far more venture capital activity in the state during the first half of 2021 than in the same period of 2020.

CB Insights data paints a clear picture: In the first half of 2020, New York-based startups raised $7.6 billion across 667 rounds. In the first half of 2021, however, those numbers swelled to $22.4 billion from 847 deals.

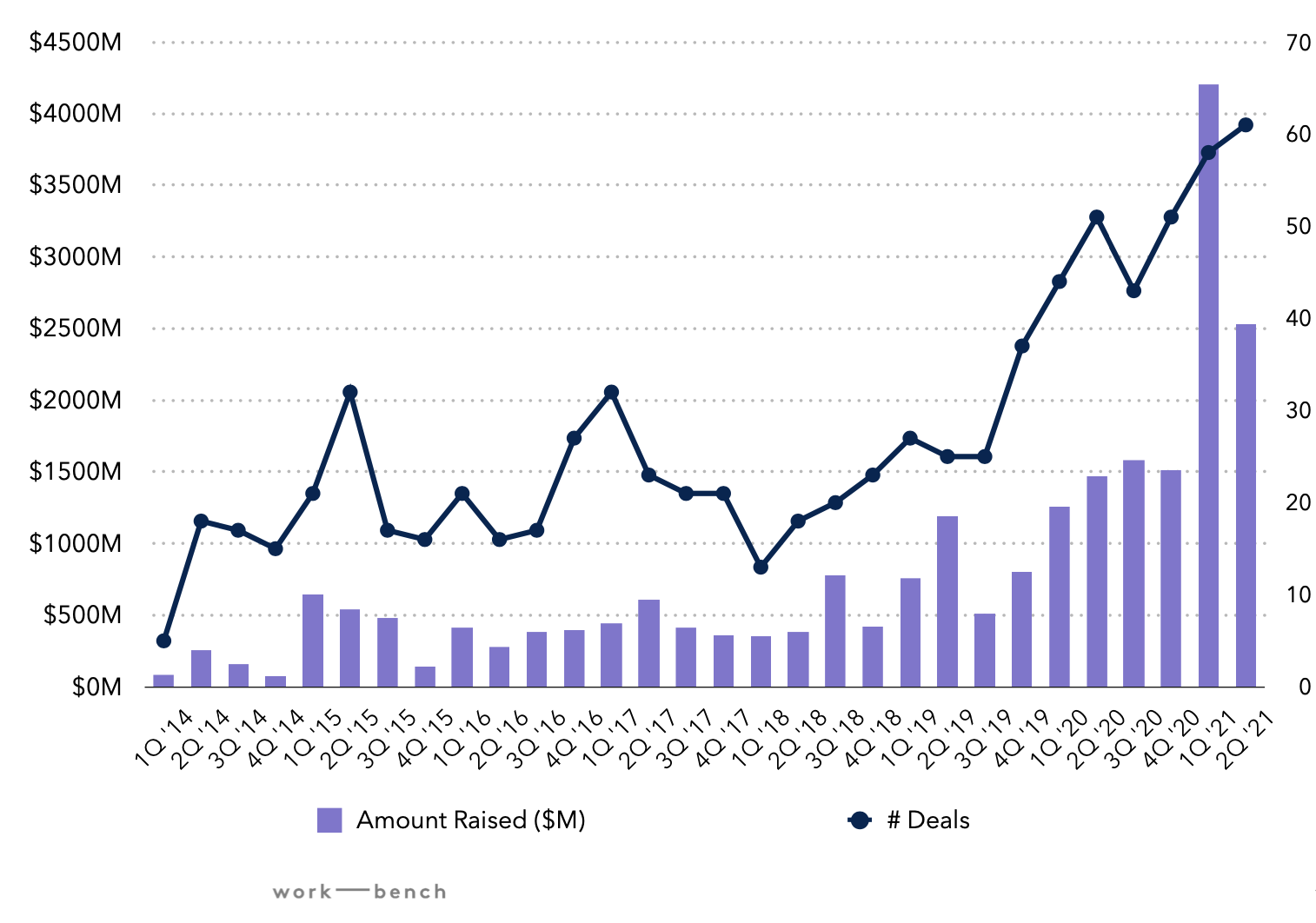

Enterprise venture funding saw similar gains. Per the Work-Bench report, enterprise startups in New York City raised $6.7 billion in the first and second quarters of this year, up 146% from the first half of 2020, when $2.7 billion was raised. Even more notable, Work-Bench reports that venture funding of enterprise startups in its city was up 12x in H1 2021 compared to a full-year 2014 tally.

In a nutshell, the figures detail the rise of New York’s key startup market in the last decade.

Let’s put those numbers into context. It’s fine to say that New York City is growing compared to its prior totals, but let’s do more. The African startup market has seen rising venture capital totals in recent years. However, despite those gains, the continent only raised a little over $1 billion in the first half of 2021. Just New York City enterprise startups outraised all of Africa in venture terms, doing more than the continent’s half-year venture tally every single month so far this year.

It’s a lot of money.

This is what the chart looks like, with Q2 2021 for NYC enterprise startups only being bested by the first quarter of the same year:

Before we get into how startups in the New York City scene managed to raise as much as they did, it’s worth noting that UiPath raised a $750 million round in the first quarter. Because the company moved its headquarters to NYC, the round counted in the data set. UiPath has since gone public and is worth $33 billion today, slightly under the price at which it raised its mammoth Q1 round.

All told, there were 22 venture rounds for New York City enterprise startups worth $100 million or more in H1 2021. How did they raise so much?

What is driving the boom?

There are undoubtedly tailwinds for VC across the world, especially in the U.S. But beyond that, Lehr says, “H1 2021 was arguably the culmination of years of ecosystem building for NYC enterprise tech. … There’s been years of companies getting seed funding and many of them maturing to Series A, B, C and beyond.” In other words, past efforts are now bearing fruit.

But according to Lehr, it isn’t just about the current moment: New York enterprise tech has now earned a stamp of “this is here to stay.” Some milestones definitely helped, such as MongoDB’s IPO in 2017 and Datadog’s in 2019; 2021 will keep adding to that perception. Among attention-grabbing factors, Lehr highlighted this year’s four multibillion-dollar IPOs and two multibillion-dollar acquisitions.

“There’s true heft across all stages of the maturity stack from seed to growth to exit, and that last piece, in particular, is notable because NYC used to get a lot of crap for not having enough meaningful exits,” Lehr said.

Unicorn births, exits

True heft or not, the number of $1 billion exits that NYC has managed so far this year contrasts with a different data point. Recall that there were six exits worth roughly $1 billion or more in the first half of 2021 from NYC enterprise startups. In contrast, there were 18 new unicorns minted in the same startup cohort, according to Work-Bench. (For reference, recall that all of China saw just three new unicorns in H1 2021! The United States generated a total of 132 in the same period.)

That’s a pretty steep imbalance. We asked Lehr about new unicorn creation versus unicorn exits, and he said that “we’re just under a decade of NYC enterprise tech really being a thing,” and that given the relative youth of the local market, “seeing this breadth of exit activity to start the year is a signal of continued strength for the ecosystem.”

It’s worth noting that unicorn births have outpaced unicorn exits globally for years. This is not a New York City issue; New York City’s 3x unicorn birth:exit rate is merely a symptom of a larger issue among private companies and their backers.

Lehr sees a strong future spate of exits, however, implying that the unicorn trade deficit — press-ganging a separate economic concept for our purposes — could decline. According to the investors, “many companies on our unicorn list have either raised a mega-round this year and/or are growing ARR at a rapid clip, positioning them for an exit in the next 12-24 months.”

From Work-Bench’s perspective, the exit market for New York City startups could be gearing up for a huge wave of exits in the next year or two. (As a side note, if you are an NYC enterprise unicorn with impressive ARR growth, we’d love to hear about it!)

Before we dig into sectors, which New York City enterprise companies exited for $1 billion or more in 2021 thus far? DigitalOcean went public, as did UiPath. StackOverflow sold for nearly $2 billion. And both Zeta and Sprinklr went public later in the second quarter.

Hot sectors

Work-Bench’s report also includes a section dedicated to its Next Guard tracker, which focuses on New York City enterprise tech companies that have either raised more than $100 million or are valued at more than $500 million. There are no fewer than 33 this year, and highlighting them is obviously interesting because many of these are tomorrow’s IPO candidates.

However, what’s perhaps even more interesting at this stage is to look at the most represented categories.

In 2021, this mix is more varied than in 2020, when the risk/security category accounted for 38.5% of all the companies in the group. This year, that percentage is down to 24.2% — which still makes it the leading category, but only slightly ahead of sales/marketing (21%), closely followed by collaboration/productivity startups (18.2%). The remainder is split between data/AI/ML (15.2%), HR/future of work (15.2%) and cloud-native/dev tools (6.1%).

According to Lehr, this goes to show “how robust the enterprise tech ecosystem is in NYC given that you have so many varied enterprise categories being built here.”

So what?

Our coverage of the Q2 2021 venture capital market, and 2021 more broadly, has had a consistent flavor. Most startup markets are doing incredibly well when it comes to raising money, and global exits have proved stronger in recent quarters than in recent years.

To see a key piece of a particular startup hub do well in numerical terms is therefore not any more surprising than it was to see the United States, Europe and Africa post similarly impressive numbers compared to historical results.

But New York City’s enterprise footprint is now large enough that it must be considered a leading market for the startup varietal, making its results a bellwether to some degree. And if New York City is laying the groundwork for a huge wave of unicorn exits in the coming four to eight quarters, we should expect to see something similar in other enterprise markets around the world.

Yes, that means more IPOs. And if the numbers shake out, perhaps the chance that the global startup scene will exit a few more unicorns than it creates for a change. We can’t run a unicorn surplus forever; at some point, liquidity needs will outpace investor patience.

Comment