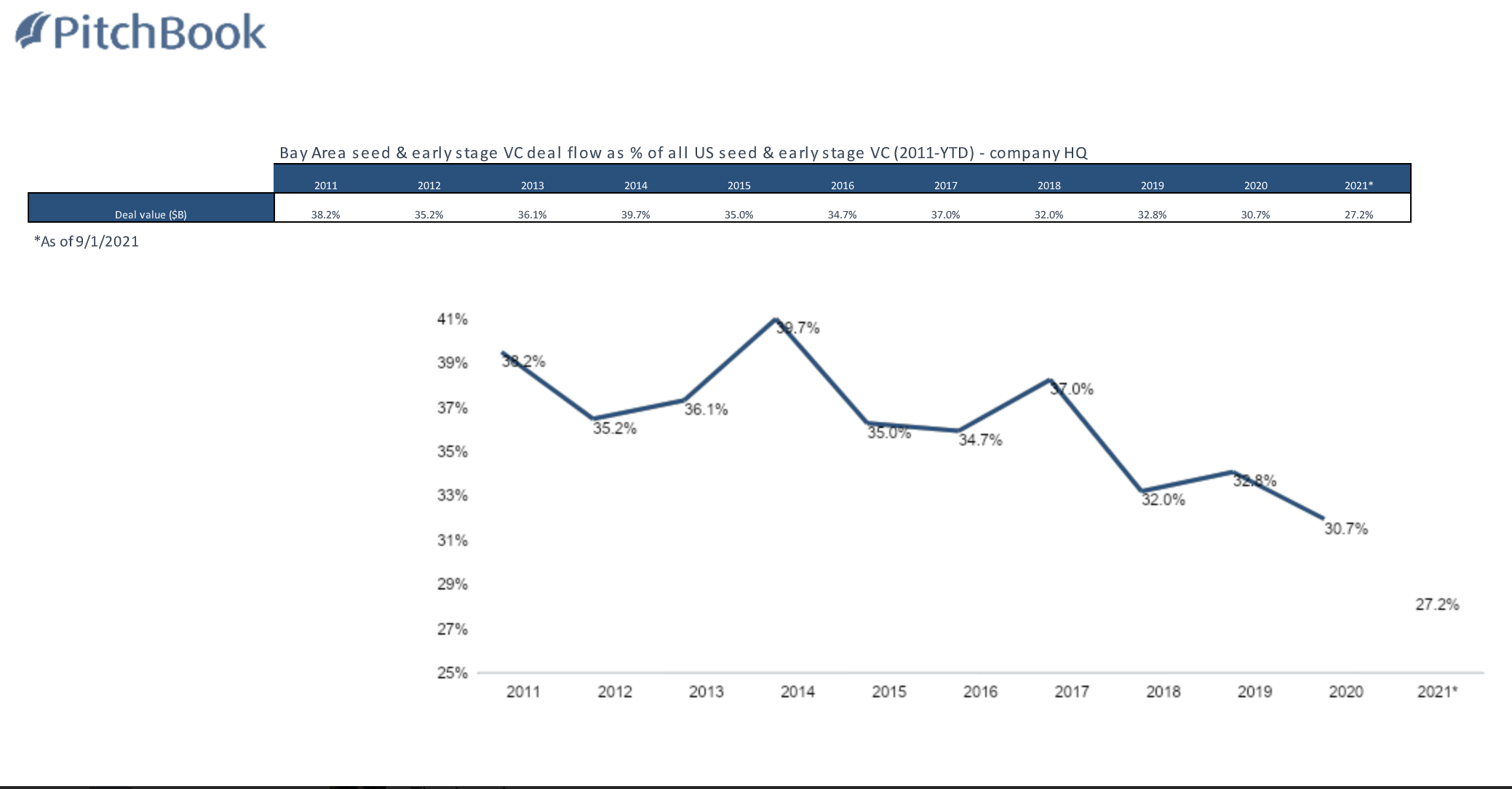

In 2014, more than 40% of U.S. seed- and early-stage venture dollars went to Bay Area startups.

But that was a long time ago.

In recent years, Bay Area startups have accounted for a smaller percentage of U.S. VC investment, according to “Beyond Silicon Valley,” a new report co-produced by venture firm Revolution and PitchBook. So far in 2021, only about 27% of U.S. VC dollars have gone to Bay Area startups. It’s been more than 10 years since that percentage fell below 30%, the study said, despite the fact that the country is on track to see record amounts of venture funding overall this year. We dug into the report and talked to Revolution CEO and Chairman Steve Case about the findings.

Case is the founder of the Revolution trio of funds (including the Rise of the Rest Seed Fund), which focus exclusively on investing outside of Silicon Valley. Since launching the platform in 2014, Case and his teams have invested in 194 companies across 89 cities.

Not only is 2021 a record year for dollars raised, it’s panning out to be a record year for Bay Area- and NYC-based VCs who are investing in startups outside their regions. As recently as 2017, more than 50% of early-stage Bay Area dollars were received by Bay Area startups. Today, that percentage is 37%, according to the Revolution/PitchBook report.

In each of the past two years, at least $11 billion of Bay Area capital has been invested outside the three major ecosystems. A decade ago, that figure was under $3 billion.

“When we look at the industries of the future, and the companies of the future, they’re going to be dispersed around the country and around the world and if all you’re doing is investing in your own backyard, you’re going to miss out on all the opportunities to invest in some of the iconic companies of the future,” Case told TechCrunch.

This has already been a record year for Bay Area- and NYC-based VCs investing outside the Bay Area/NYC/Boston, with $24.1 billion deployed so far — about $13 billion of that from Bay Area investors and $10.7 billion from New York-based VCs, compared to a total of $4 billion invested outside those regions in 2011.

So, where is all the money going?

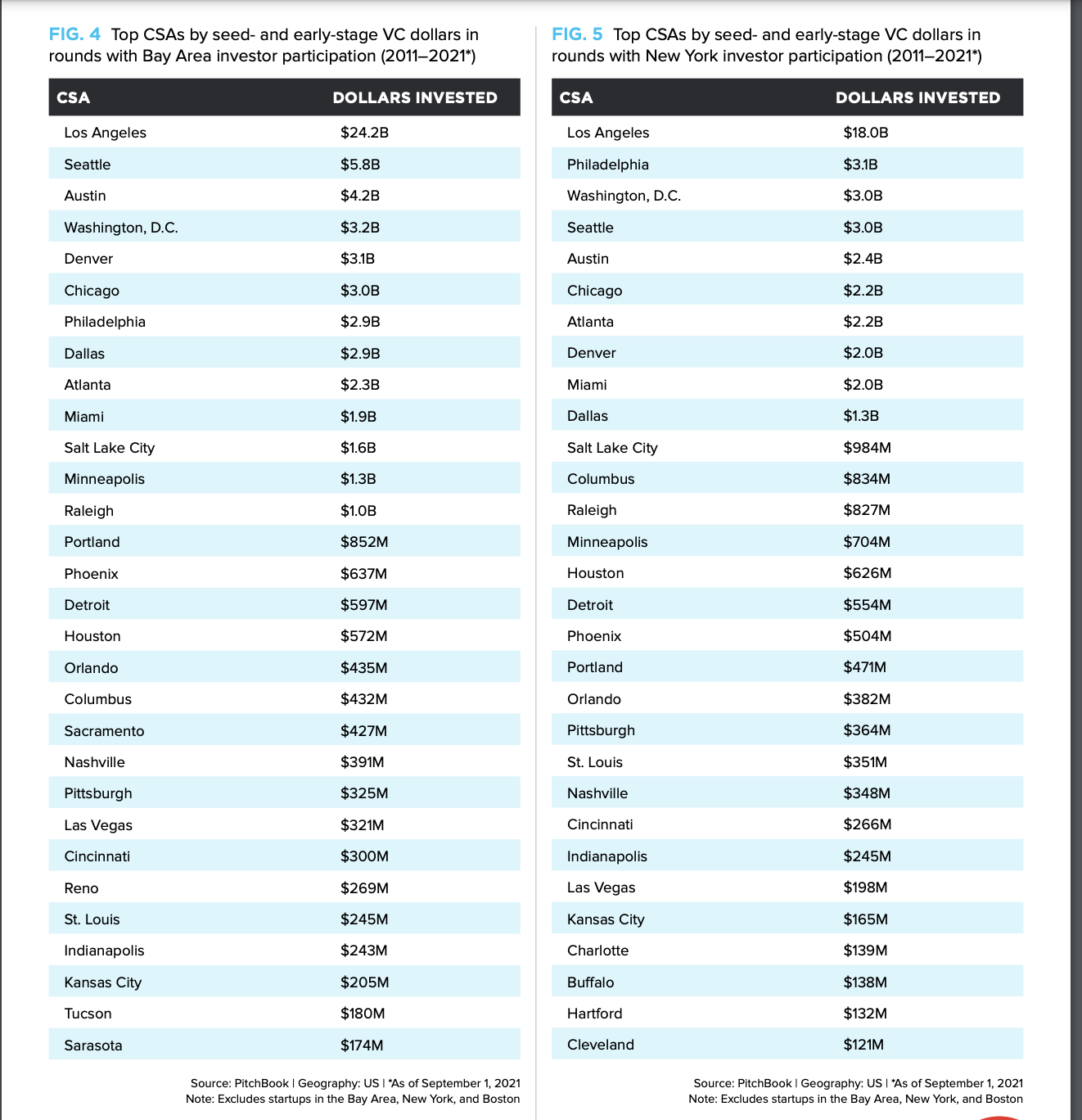

Much hyped Austin and Miami were both ranked in the top 10 cities to receive funding from Bay Area- and NYC-based investors between 2011 and 2021. But the city that topped them all is one that you might not have expected.

Los Angeles.

Startups in LA received a combined $42.2 billion of seed- and early-stage investment (defined as Series A or B) over that 10-year-period in rounds that included both Bay Area and New York City investor participation. See the chart below to see which other cities made the list.

Notably, West Coast investors tended to gravitate a bit more toward cities on their side of the continent, with Seattle taking the No. 2 slot and Denver the No. 5 position on that list. Likewise, East Coast investors leaned toward cities east of the Mississippi, with Philadelphia ranking second on that list.

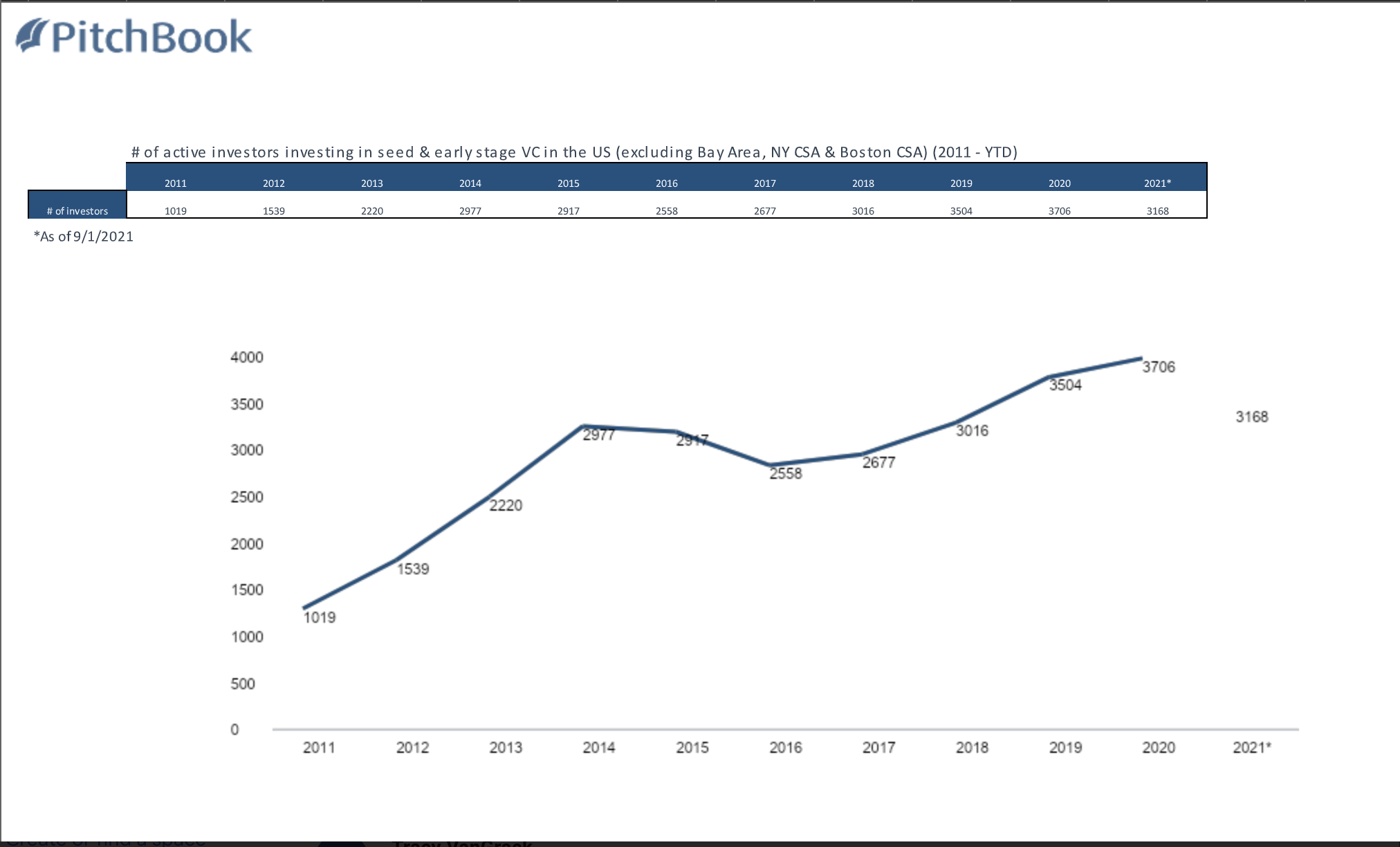

There are also more investors, period.

According to the report, there are more than 3,000 active investors located outside the Bay Area, New York and Boston, up from 1,000 in 2011. That new figure includes more than 1,400 new institutional VC firms that launched outside of those three regions, which are more likely to invest in local/regional startups.

“This is probably the most interesting data point in the report to me. The number of these firms has almost tripled over the last decade. That’s pretty significant,” Case told TechCrunch.

“Because in order to have successful companies, you have to start by seeding young companies — that’s how you get to the iconic breakout Fortune 500 companies. Similarly, you need to be seeding the venture capital in different parts of the country because they are likely to be backing companies in their region.”

In fact, 2021 is expected to be a record year for capital raised by VCs outside the three major tech hubs: $21.4 billion, compared to just more than $3 billion a decade ago.

Looking ahead, the report identified 12 cities with growing startup communities: Denver, Dallas, Minneapolis, Kansas City, Nashville, Philadelphia, Phoenix, Raleigh-Durham, Salt Lake City, St. Louis, Tampa Bay and Washington, D.C., Seattle, Austin, Chicago and Los Angeles were omitted because they have already experienced strong momentum and attention.

Each city has its own unique potential, Case said, and most give entrepreneurs one crucial thing: a lower cost of living and business expenses that give founders more runway. For example, the report found that Nashville is becoming “the VC epicenter of the South.” Historically, healthcare has been the biggest sector in the city, and locals have formed several family offices, angel networks and institutional funds to help grow the sector.

Meanwhile, the Research Triangle Park in North Carolina is increasingly attracting entrepreneurs drawn to the talent pool produced by the number of excellent universities in close proximity (UNC-Chapel Hill, Duke and NC State among them). The area has several legacy corporations, including IBM, Cisco, GlaxoSmithKline and Fidelity, but new entrants such as Google Cloud are also setting up shop — validating the region’s status as a tech hub.

“This momentum we’re seeing now? You ain’t seen nothing yet,” Case said. “Certainly this report reflects progress and that’s encouraging, but there’s still a lot of work to do to really level the playing field in terms of innovation, entrepreneurship, capital, talent, and really to help more and more entrepreneurs succeed in more and more cities.”

It should also be noted that Case’s strategy is working in the way of returns. Revolution has backed several of the roughly 100 unicorns based outside of NYC/Boston/Bay Area, including Detroit’s StockX, Austin-based ZenBusiness, STORD out of Atlanta and Chicago-based Tempus and Uptake. Recent exits from Revolution Growth include BigCommerce (Austin) and Sweetgreen (LA), and recent exits from the Rise of the Rest Seed Fund include Kentucky-based AppHarvest, Pear Deck out of Iowa City and Kansas City-based Backlot Cars.

Comment