On Earth Day, April 22, SOSV published the SOSV Climate Tech 100, a list of the best startups that we’ve supported from their earliest stages to address climate change. There are always valuable insights embedded in a list like the 100. A TechCrunch story captured the investment perspective, and an SOSV post went deeper into the companies’ category breakdown and founder profiles.

But what can founders learn from the list about climate tech investors? In other words, who invested in the Climate Tech 100? We dug into the “who’s who” of the list, which had more than 500 investors, and here’s what we found.

An active but fragmented landscape

If you think 500 investors in 100 companies is a lot of investors, you’re right. There are clearly a lot of investors interested in climate tech, and most are generalists just testing the waters. For the Climate Tech 100, about 10% of investors put their money in more than one startup and only seven (less than 2%) wrote a check to four or more. These included Blue Horizon, CPT Capital, EF, Fifty Years, Hemisphere Ventures and Horizons Ventures.

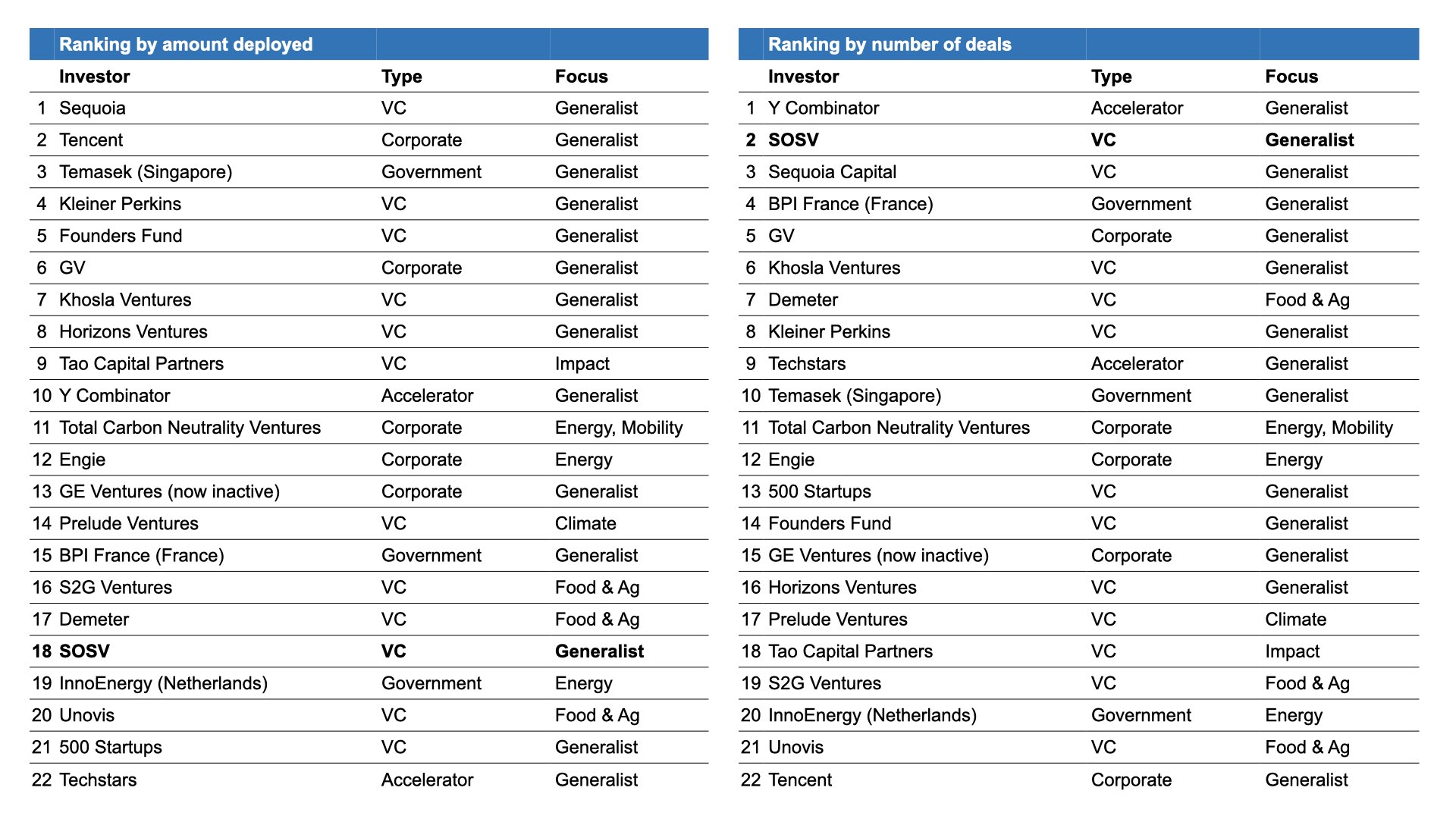

That pattern tracks well with data from PwC, which found that 2,700 unique investors had backed 1,200 startups in its State of Climate Tech 2020 report covering the 2013-2019 period. The report found that only 10 firms out of 2,700 made four or more climate tech deals per year, on average, over the 2013-2019 period. The most active firms are listed in the table below.

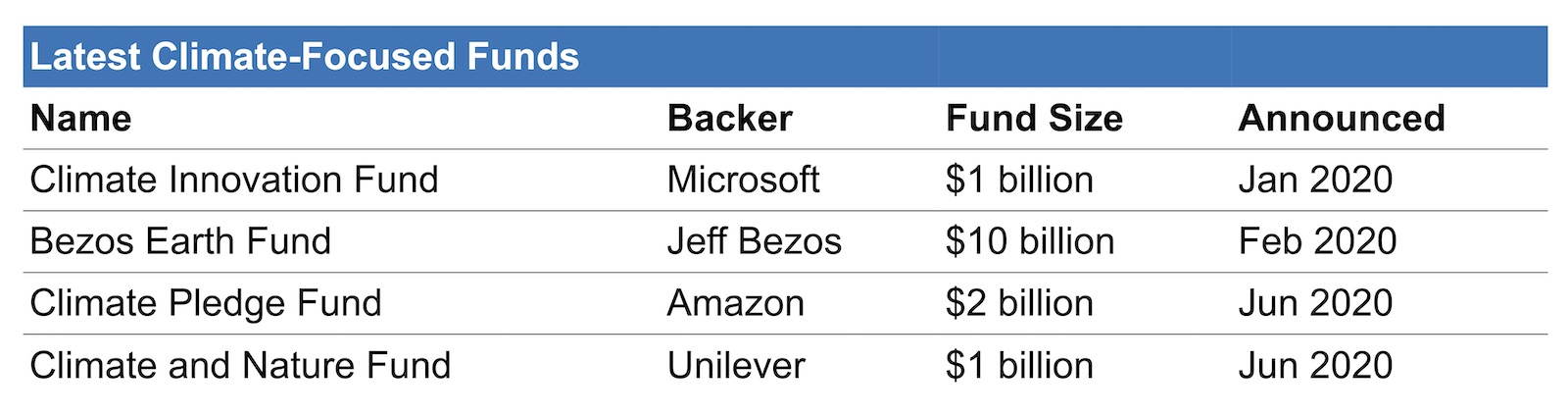

There is reason to believe that the fragmentation will diminish with the launch of more funds focused on climate tech. Four funds worth more than a billion dollars each have launched since 2020 that fit the description (see chart below).

It’s also encouraging to see that capital deployed in climate tech grew at five times the venture capital overall growth rate over the 2013-2019 period.

Even so, climate tech still only represented 6% of total venture capital deployed in 2019, so there is plenty of room to grow.

The investor who’s who in SOSV’s Climate Tech 100

VCs

Most of the venture firms that invested in the Climate Tech 100 were generalists like Khosla Ventures, True Ventures and Horizons Ventures (a Hong Kong-based early investor and serial backer of four of the Climate Tech 100), or deep tech funds such as DCVC, Future Ventures, France’s Elaia and Australia’s Main Sequence Ventures.

It’s important for founders to note that VCs routinely write checks for very early-stage companies, often coming in at the same stage as angels.

More recently, venture firms that specialize in one or more climate tech categories have started to appear in Climate Tech 100 syndicates. Today, they represent about 30% of the VCs in our data set. AgFunder, for example, is focused on food and agriculture; Braemar Energy Ventures looks at energy startups; Prelude Ventures invests in carbon reduction; and Unovis funds companies that reduce the need for animal products. Fifty Years and Future Positive take a broader approach to social good investments.

For founders, this new class of mission-focused investors is important to watch.

Corporate VCs

Various corporate VCs (CVCs) are keen on climate tech, both to honor the commitments to net-zero carbon emissions (over 100 firms joined the Climate Pledge), and to keep track of innovations in their sector.

CVCs represented only about 10% of the total VC group. Specialist CVCs like Ingredion, Whole Foods Market or Tyson Ventures — unsurprisingly, focused on food — accounted for 40% of the CVC group. That said, CVCs account for only about 12% of VC investments in the Climate 100, which is probably explained by the fact that the average company is only four years old.

Although CVCs may not be rich targets for early-stage founders, it’s important to note that corporates can be helpful off the cap table by providing contracts for research, pilots, co-operation and distribution, as well as access to infrastructure such as fermentation tanks.

Angel Investors

Angels generally support companies from formation to Series A. We counted over 150 unique angel investors across the Top 100, and over 70% of the startups that have successfully raised capital had at least one angel investor on their cap table. Angel investors can be great to help startups get off the ground with initial capital and advice.

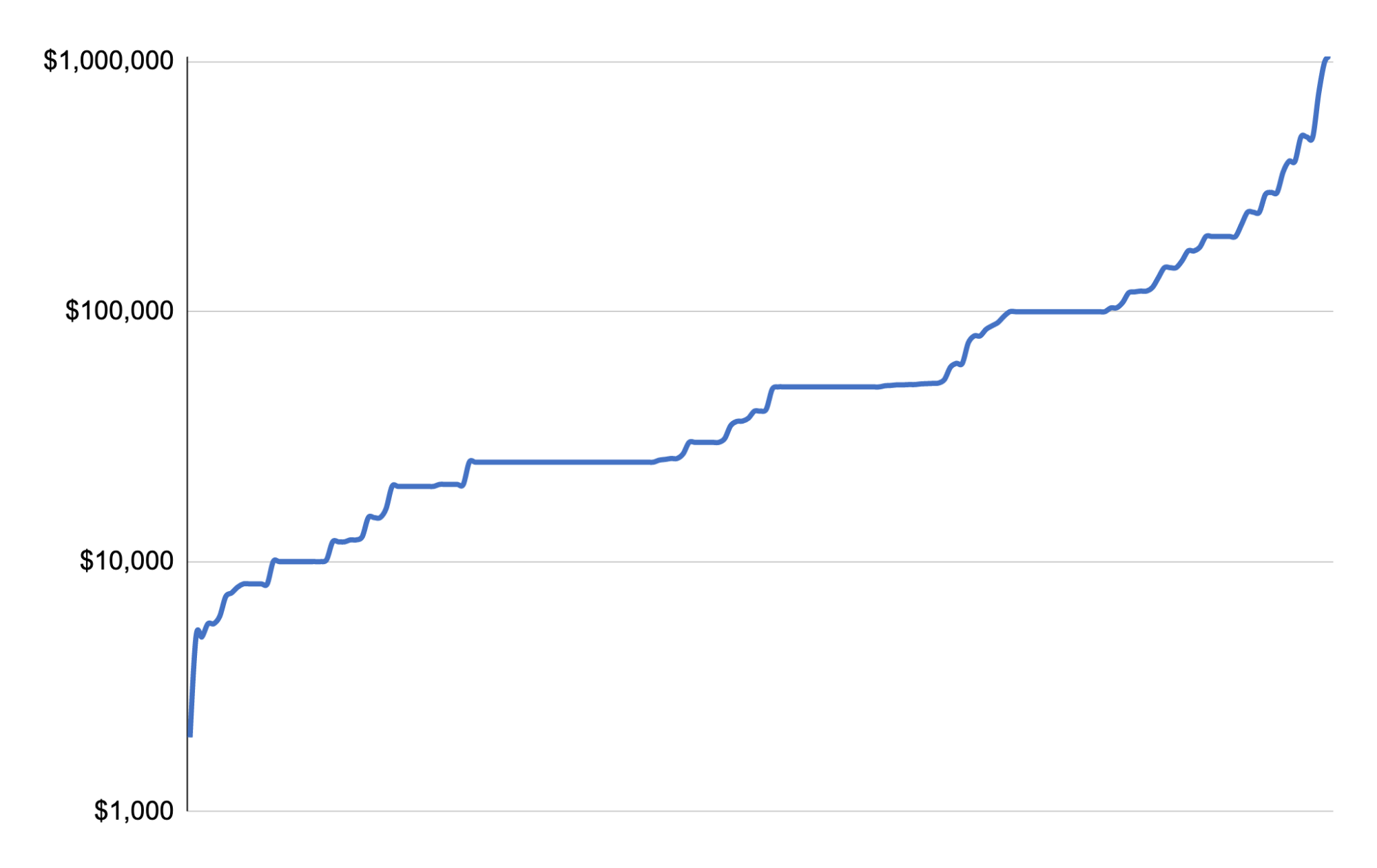

The majority of angels wrote checks in the $25,000 to $100,000 range, but some doubled down to go as big as $200,000 or more. On rare occasions, angels enabled startups to close seed rounds without a VC altogether. The following chart shows the distribution of individual angel checks, with amounts in logarithmic scale, from $1,000 to over $1 million.

Celebrity angels

Celebrities are also active in climate tech. Natalie Portman and John Legend are investors in our Climate Tech 100 (in mycelium leather startup, MycoWorks), while Leonardo DiCaprio is on the advisory board of the animal-free dairy protein startup, Perfect Day.

Not every founder has access to celebrities, but you never know who you might bump into.

Many celebrities are outspoken about climate and put their money where their mouth is. Bono, for example, has made more than 20 investments through his $5 billion Rise Fund with TPG. Robert Downey Jr. has made seven investments via his Footprint Coalition, and Serena Williams has written checks to Impossible Foods, Pachama and Myro. Elon Musk, as usual, is taking his own path by underwriting the $100 million XPRIZE for Carbon Removal technologies.

Governments

About 10% of startups in our Climate Tech 100 won grants or loans from government entities. Often these funds target early stage R&D.

In the U.S., the National Science Foundation (NSF) and its Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs, dubbed “America’s seed fund,” actively support startups. The Biden administration has requested a $36 billion budget to fight climate change, and some of that may find its way to startups through these programs and others.

Other startup backers were regional, national or international organizations, such as the Departments of Defense, Energy or Agriculture, Space Florida, Bayern Kapital (Germany), the Austrian Research Promotion Agency, the Atlantic Canada Opportunities Agency, the New Brunswick Innovation Foundation (Canada) and the European Innovation Council.

Sovereign funds

Sovereign funds generally invest in assets such as stocks, real estate, bonds and VC funds (including Softbank’s $100 billion Vision Fund 1), but some sovereign wealth funds invest directly in startups. They generally come in at Series A or later. Because our Climate Tech 100 companies are so young, only a few have sovereign fund investors.

One of the most prominent in the Climate Tech 100 is Singapore’s Temasek (over $230 billion AUM as of 31 March, 2020), which has invested in the SOSV alternative protein companies Upside Foods (formerly known as Memphis Meats) and Perfect Day. BPI France offers grants and makes investments in many French startups, including SOSV’s Pili (biopigments), while EIT InnoEnergy, funded by the EU as a key part of the European Green Deal, has funded hundreds of startups, including VoltStorage (redox flow battery).

Family offices

Nearly 10% of the startups in the Climate 100 received investments ranging from $25,000 to $2 million from family offices and trusts. There were 30 family offices involved in that investment range, and four of the Climate 100 received funding from four or more of those backers, so there are likely network effects in play.

Unfortunately, family offices can be hard to find for those not in the know, because they do not have websites or announce their investments. To connect with them, founders need to develop their networks and ensure their startups are as visible as possible.

Foundations and nonprofits

Climate is a focus for many foundations and nonprofits. Large organizations like the Bill & Melinda Gates Foundation, Novo Holdings and the Grantham Foundation appear among the backers of the Climate Tech 100, alongside smaller, more specialized organizations like the CEDAS Foundation, the Straubel Foundation (environment), the Fink Family Foundation (waste and biodiversity), the Westly Foundation (at-risk children in California) and Endeavor (impact).

Many come in at the earlier stages, from angel to Series A, writing meaningful checks that are usually grants. The most visible foundations tend to be in high demand and difficult to reach, but worth the effort for nondilutive funding.

Writing the climate tech investment playbook

This analysis of investors in the Climate Tech 100 reveals the enormous breadth of investor types working in this fast emerging category. It’s important to keep in mind how broad the category itself is — climate tech touches everything from food and energy to construction and infrastructure. We should also consider the outlooks and mission of investors, from the sovereign funds investing in food security and hard tech funds looking for revolutionary technologies, to angels (celebrity or not) trying to invest in a better future for their children’s sake.

Founders should zoom in and out across that landscape to find investors who line up with their products and mission. Clearly, there has never been more money lined up for the climate sector, and investors are eager to make an impact on what’s likely to be the trillion-dollar opportunity of the century.

Former TechCrunch COO Ned Desmond is now senior operating partner at SOSV.

4 sustainable industries where founders and VCs can see green by going green

Comment