The coronavirus pandemic disproportionately reduced venture capital funding for female founders last year, despite a greater boom in fundraising thanks to megafunds and the advent of Zoom investing. The result was an uneven landscape in which capital flowed more toward men than was normal historically.

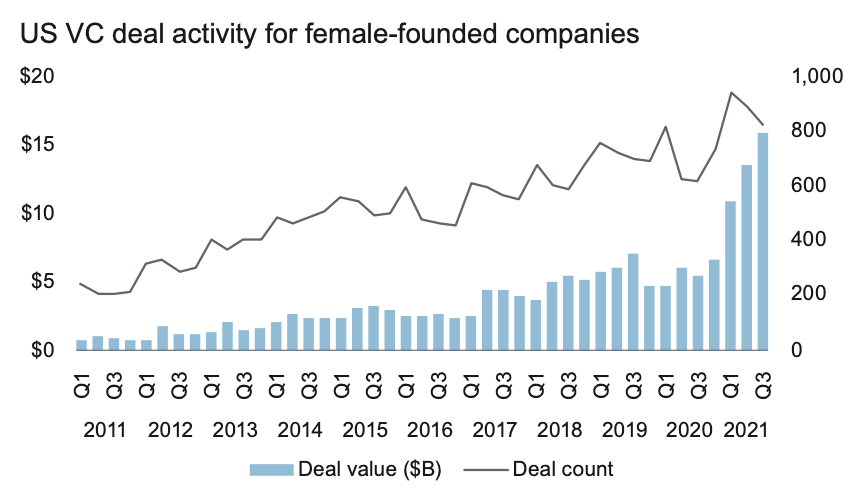

But the gender gap in startup fundraising is closing slightly, new PitchBook data shows. Female-founded companies raised $40.4 billion across 2,661 deals through the first three quarters of 2021, almost doubling 2019’s total of $23.7 billion and over 10 times 2011’s total of $3.6 billion.

There’s still significant work to be done, as we remain far from even, far from fair and far from seeing enough change to stop tracking this data set. Companies started by women still raise less and receive lower valuations from investors.

While the rising tide of venture hasn’t lifted all boats, we’ll use this data to explore early inklings of a comeback for the historically overlooked group, from funding to exits to decision-makers.

Rising investment in female-founded startups

Venture capital totals are surging around the world, bouncing back sharply from a short period of COVID-induced conservatism that caused some startups to struggle to raise capital at the start of the pandemic. PitchBook, which analyzed investment activity in U.S.-based startups with at least one female founder, shows that female founders are breaking records in this environment.

If you didn’t expect to see improved numbers for female-founded startups this year, you weren’t overly pessimistic: In 2020, despite rising venture capital totals in general, U.S.-based startups founded by women actually saw their deal count fall by 2% and total dollars invested in their enterprises fall by 3%.

As the venture capital pie got larger, female-founded startups raised fewer dollars from fewer rounds, a sharp decline compared to previous years. PitchBook said that in 2019, female founders landed 150 to 200 deals per quarter, worth between $700 million and $950 million. In Q3 2020, the cohort only landed 136 rounds, worth just $434 million. That was in an upmarket.

In better news, thus far in 2021, the backsliding has more than stopped. Indeed, it has shot the other direction.

The headline number of $40.04 billion for U.S.-headquartered, female-founded startups actually doesn’t pay enough respect to the accelerating pace at which female founders have raised capital. Observe the following chart from the PitchBook-NVCA report:

The data is clear that female-founded startups just had their best quarter on record in terms of total deal value, despite a modest dip in deal volume from recent all-time highs. This chart is more than bullish, just as its 2020 data points are gobsmackingly bad.

Note that venture capital data lags reality and smaller deals are often missed, as the investments in question are done quietly with limited legal disclosure. So we can expect a few more rounds to filter into the PitchBook data set over time. That may paint an even more bullish picture of domestic female-founded startup fundraising than what we can see today.

Zooming in, the PitchBook report shows that deal volume is growing for female-founded companies in health tech, fintech and tech more broadly. For example, if female founders of health tech firms continue to raise at the same clip, 2021 could be the first year that the cohort lands 600 deals. More broadly in tech, deal volume is set to increase by 30% this year.

Zooming out, the rising dollar value of U.S.-located, female-founded startups’ fundraising tally is built atop massive deals like Maven’s $110 million Series D and Modern Health’s $51 million Series C.

But not all the numbers are good. For example, the report notes that median early-stage startup valuations rose 15% in the United States in 2020, but female-founded startups saw a mere 4% gain in median valuation. What’s worse, that “gap has sustained itself so far in 2021.” There’s still work to do.

Why the rising investment totals make sense

The fact that more women are raising money is inherently good from an equality perspective. But there’s also an investment story behind the results: Female-founded companies are putting up big exit tallies with results that are improving faster than the broader market.

Per the PitchBook-NVCA report, the exit value of female-founded startups based in the United States has reached $58.8 billion, up 144% from 2020. The larger domestic venture market’s exit totals have risen a more modest 102% over the same time frame.

Those impressive dollar results are undergirded by the number of exits recorded as well: 223 domestic female-founded startups have found an exit so far this year, 12% better than in all of 2020. Again, women did better than the overall market, which has put up just a 3% gain in the same metric over the same time frame.

“2021 is on pace to be the eleventh straight year that female-founded companies exited faster than the broader market,” PitchBook notes. Perhaps we should be more surprised that, given those metrics, women didn’t wind up getting an outsized portion of 2020’s venture capital gains, let alone an even share compared to prior norms. Instead, the fact that more women saw their ideas being underfunded in 2020 despite outperforming on exits is a head scratcher, unless you are familiar with the concept of sexism.

Some notable recent female-led exits from 2021 include Ro buying Modern Fertility, Mindbody buying ClassPass and Rent the Runway, which was the first U.S. company to ever go public with a female founder, COO and CFO, per All Raise.

Money recycles

There are many reasons why female founders routinely receive less venture capital than their male counterparts, ranging from sexism and structural bias to the pandemic causing cautious investors to revert to existing white and male networks. One clear catalyst for change, though, is having more diverse decision-makers on boards and cap tables. By stopping money from being handled by the same people, the next generation of investors will be able to break some of the gender gap in fundraising.

A major fund that was syndicating a round contacted me and asked if I’d intro them to @mcuban since we’ve worked together. I did, and Mark passed. I then offered for @Backstage_Cap to join the round. They ghosted. This is why wealth sits in the hands of the same people, recycled.

— Arlan 👊🏾 (@ArlanWasHere) November 2, 2021

JPMorgan and PitchBook published a report that looked deeper into gender diversity within startup board rooms. So far this year, nearly 22% of all new startup board appointments have identified as women, a statistic that has doubled in the span of three years, per the report.

The progress, as it often does, has an asterisk. The report also showed that every company in the S&P 500 had at least one female board director, and that 59% of all 2020 board appointments in the index were women, according to firm Spencer Stuart. In September, the SEC approved Nasdaq’s new rules that require most Nasdaq-listed companies to have, or explain why they do not have, at least two diversity directors. It also requires companies to publicly disclose certain diversity statistics about their boards on an annual basis.

It’s clear that as more companies head to the public markets, changes may be made in anticipation. The same report says that, as of August 2021, 59 startups that went public in the past year appointed their first female directors in the run-up to an IPO.

Meanwhile, change on the venture side has proved slow, thanks to myriad factors such as slow promotion rates and limited general-partner roles at the financial firms. Y Combinator, for example, made incremental progress in the number of female founders within its batch, despite growing the overall size of the cohort.

While fund managers are still mostly white and male, the rise of more diverse fund managers could significantly impact the clip of deals for minorities going forward. The female angel investor scene is thriving, with almost 1,000 active angels in the market, per PitchBook. Gen Z VC, led by Lerer Hippeau’s Meagan Loyst, has attracted over 11,000 aspiring VCs to its community.

Institutionally speaking (since that’s where most of the dollars are), there are some bright spots as well. Last year, Terri Burns became GV’s youngest partner and the first Black woman to hold the role. This year, Female Founders Fund closed its third fund with $57 million; Forerunner, led by Kirsten Green, closed a growth-stage fund; and Variant, with Li Jin joining as a general partner, closed a $110 million fund.

We often hear that tech innovation is a circle. But, as data shows, the concept of people recycling the same capital to the same founders with the same ideas is fading from our vernacular. As the broader venture market changes, it’s imperative that this year’s data is a benchmark to grow from instead of a blip in the process.

We’ll have a clearer view of 2021 when all the data trickles in after the conclusion of Q4, but it’s clear that female-founded startups are having a better year than they did in 2020. And that’s progress.

Comment