Jeremy Abelson

More posts from Jeremy Abelson

We are in very interesting times today. It’s rare to see so many tectonic shifts happening in real time: High interest rates, declining equity values, SVB and other banks failing with a continued contagion risk and a recession looming.

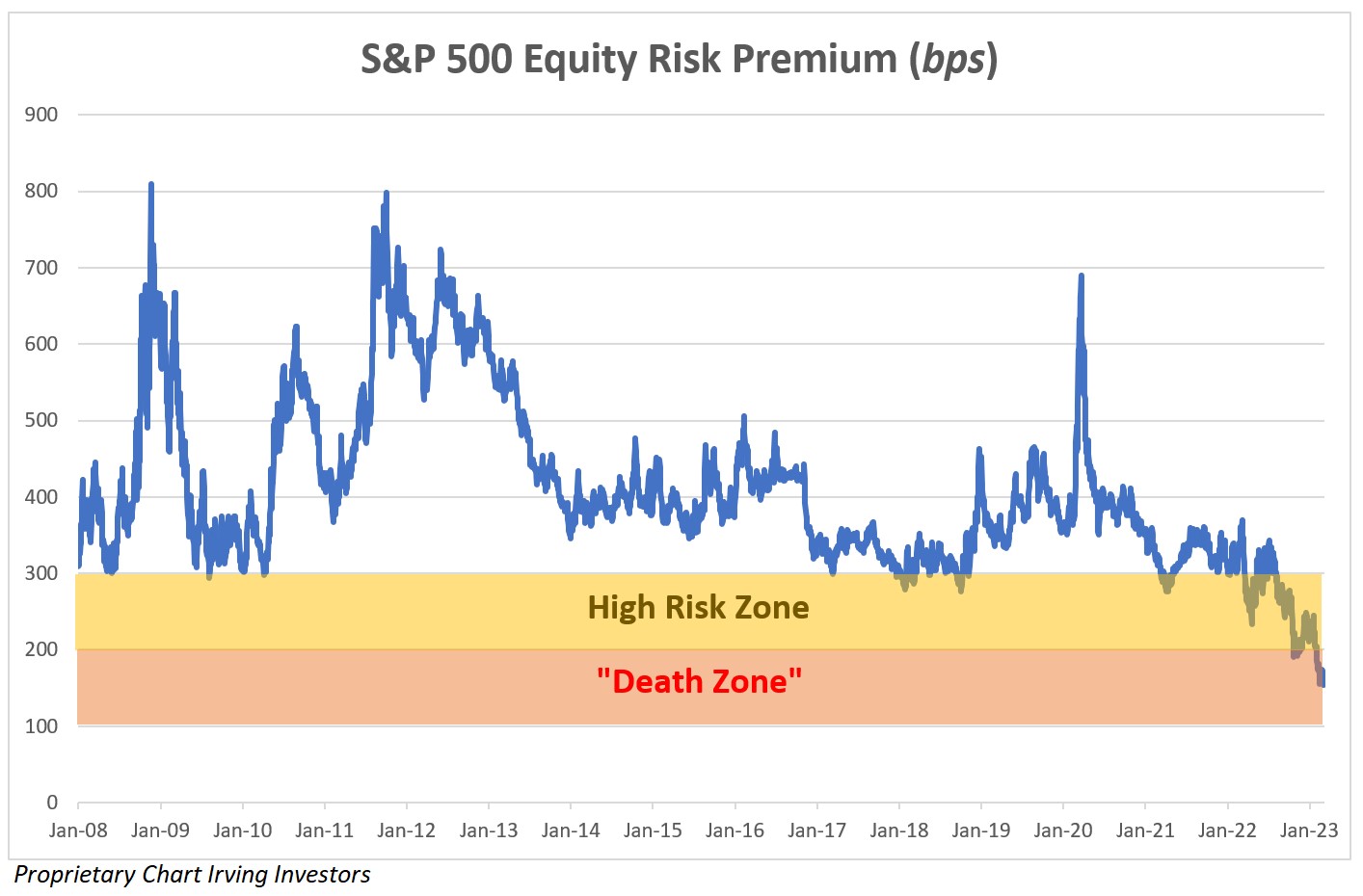

There has been an aggressive shift in assumed equity returns compared to fixed income returns. The data tells a clear and extreme story.

Simply put, equity risk premiums (ERPs) have broken down well below the ranges that were established since 2008. The ERP calculates the projected S&P returns versus the returns of 10-year treasury bills (data from Morgan Stanley).

The below chart is important to the startup audience because it speaks to why fundraising is extremely challenging right now and why valuations are coming down so dramatically. Opportunity cost is powerful indeed.

For the venture world specifically, this dynamic is compounded by the venture debt markets cooling, which in turn makes equity the most viable option for most.

The factors at play

Venture capital activity has declined

Deployment of VC capital continues to slow down. SVB measured the inflow and outflow of deposits by a metric called total client funds (TCF), which has been negative since the first quarter of 2022 (five straight quarters now).

This trend is continuing in 2023: VC capital deployment declined another 60%, and deal count has dropped about 25% from a year earlier.

Declining venture activity combined with dropping ERPs is a clear signal that there needs to be a material correction in private tech company valuations. However, anecdotally, we have seen that private company valuation expectations have remained lofty relative to obvious public comparables.

Venture debt activity is declining

Venture debt, which helps fill the gaps for companies that want equity alternatives, grew in popularity last year: Over $32 billion of venture debt was issued in 2022, about four times the amount in 2012 ($8 billion).

This practice lets companies avoid an updated valuation mark because they get to delay an equity raise. The rationale goes something like: “Take from Peter at a later date to pay back Paul plus interest (and warrants).”

That rationale can be crippling for unprofitable companies; the success of the debt instrument for both the borrower and lender is solely based on the company’s ability to raise equity in the future to pay down the debt.

In the wake of SVB’s collapse, venture-lending practices are being questioned. The venture debt market has been jolted in the short term and will change in several ways:

- The permanent removal of SVB will take a meaningful amount of capital out of the system, as it was not only one of the most active lenders, it also offered some of the most supportive terms. In 2022, SVB issued $6.7 billion of venture debt, or 21% of the total $32 billion issued.

- On its website, SVB stated it was the “first bank to create loan products for startups.” PitchBook goes on to note, “for the past four decades, SVB has issued loans to VC-backed startups with low interest rates and minimal to no covenants.”

- The current banking crisis will lead to tighter lending standards.

- The spike in future default headlines will limit investor interest in the space.

- Venture debt BDC’s (Owl Rock, Hercules) will be over-served with opportunities, as more companies will compete for much less capital.

Where to get the next dollar

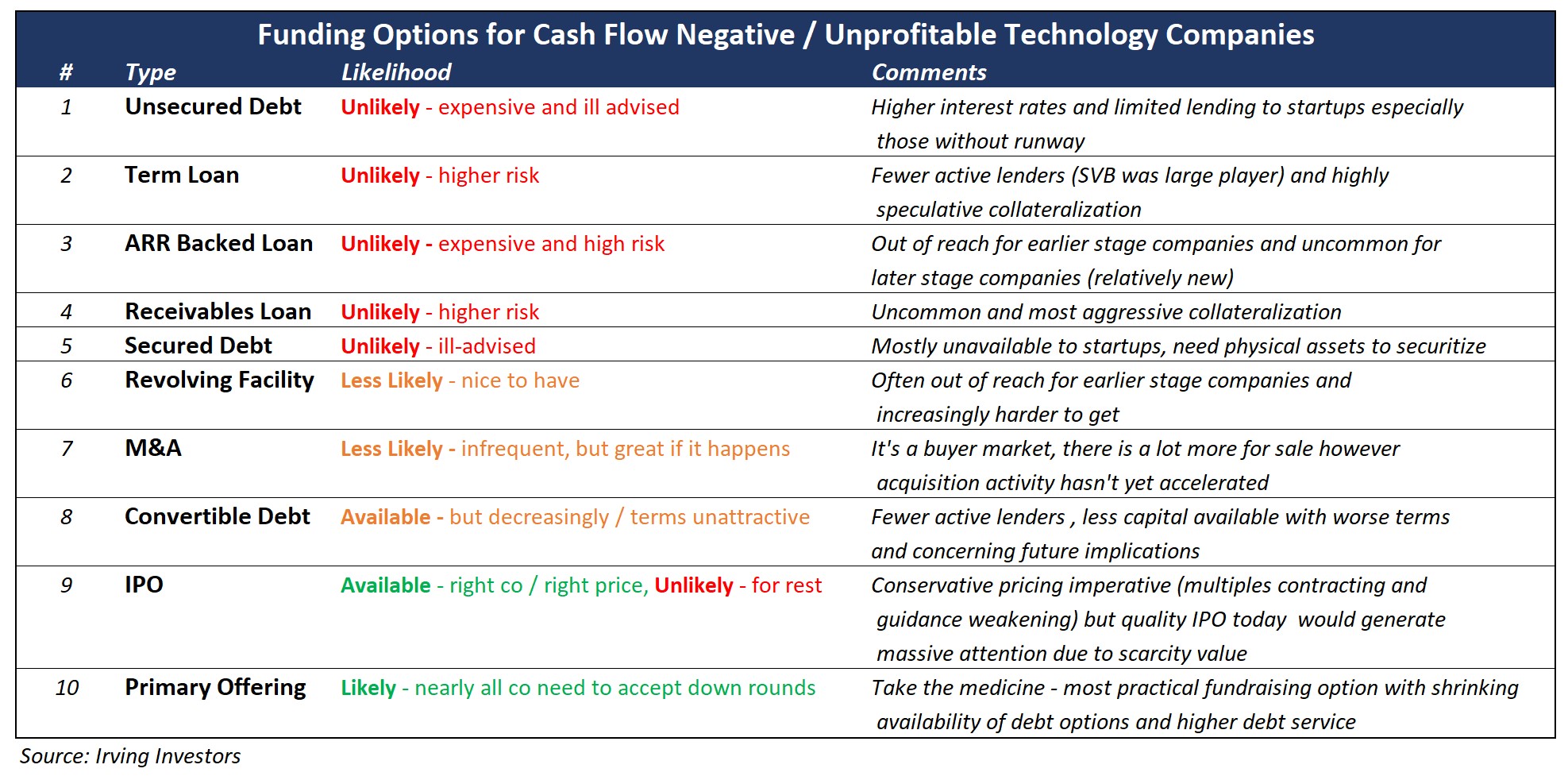

Capital markets are changing, which means financing options for companies are changing as well. The clear trend is that companies’ optionality is shrinking.

We explore the 10 most prominent capital raise/exit opportunities

With optionality around fundraising trending lower, more companies will look to pursue primary stock offerings. We will continue to see additional downrounds like with Stripe, Tonal and Dataiku.

Many venture-backed companies are in strong cash positions due to large raises in 2021 and/or aggressive cuts in spending, but most are dealing with both slowing fundamentals and aggressive multiple compression in their public comparable groups.

Waiting for a rebound in public market multiples in order to preserve previous valuations has not proven to be a good strategy, and now an increasingly larger group of companies are competing for a smaller pool of VC and crossover capital.

Comment