Sure, Facebook is apparently rebranding as a metaverse company — because that will fix its trust deficit — but this morning we’re jumping right back into the IPO game instead of making rude jokes at the social giant’s expense.

This time our target is Backblaze, which you may not be familiar with. Frankly, given how limited my knowledge of the storage-focused software company was before reading its IPO filing, I was almost ready to stick it in The Exchange newsletter for the weekend.

But!

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

It turns out that there are a few twists to the company’s filing that make it really worth our time. So, we’re digging in.

Backblaze, based in San Mateo, California, has a very limited venture capital history. That’s because it has a track record of not losing money. Indeed, per Crunchbase data, it only raised a handful of millions during its private life. The company confirmed that in its filing, stating that:

Our operations have historically been efficient with limited outside investment. Prior to issuing $10.0 million of convertible notes (which we also refer to as a Simple Agreement for Future Equity agreement (SAFE)) in a private financing round in August 2021, we had raised less than $3.0 million in outside equity since our founding in 2007.

Did anyone else mostly forget that you can build IPO-ready software companies without utter truckloads of external cash? Here’s a reminder.

Naturally, we’re going to figure out just how the company managed to grow to its current size without losing nine figures worth of venture money. And we’ll want to look at its gross margins.

Naturally, we’re going to figure out just how the company managed to grow to its current size without losing nine figures worth of venture money. And we’ll want to look at its gross margins.

Why? Because by offering storage, our presumption is that Backblaze has somewhat lackluster gross margins. But we could be wrong. Finally, we’ll pick up a topic we touched on last weekend, namely specialty cloud infra providers and how they may stack up with the public cloud giants.

Let’s go!

How Backblaze grew to IPO scale without losing all of god’s money

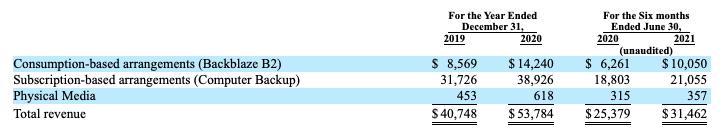

Backblaze has two main products, both of which sit atop its “storage cloud.” Or, as I like to think of it, a large bucket of online storage capacity. The company offers “B2 Cloud Storage,” a tool that includes API access for developers looking to back up information, mesh with third-party content delivery networks (CDNs) and the like. Its second product is called “Computer Backup.” It does what it says on the tin, for one computer or many.

For whom does Backblaze build? While the company claims that its “solutions are designed for individuals and businesses of all sizes and across all industries,” it does note a “particularly strong appeal to midmarket organizations,” or those with under 1,000 employees.

All of this matters because it frames our question: How did Backblaze grow to a greater than $60 million annual run rate (based on H1 2021 data; more on the matter shortly) without more venture dollars?

Here’s a hint:

When we were first reading the company’s S-1 filing, this statistic caught our eye and we laughed at it. What a silly non-GAAP metric! However, it turns out that online demand generation through native content is actually a huge lever for Backblaze, so, sure, the blog readers metric actually does matter.

Here’s the company on its sales motion:

Our content marketing engine — driven by our blog, which was visited by more than 3 million readers in 2020 alone — propels our highly efficient customer acquisition. We believe such a large, engaged audience and the trust we have developed organically with them over 14 years of sharing valuable, unique content, would be difficult for any competitor to replicate.

Ah. It turns out with a long history of writing, you can scale a software company inside of a segment outside the SMB market. Today we learned.

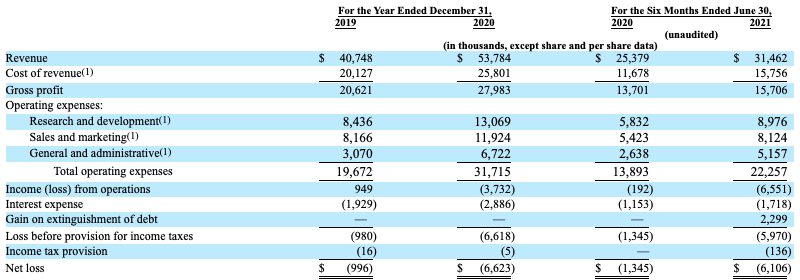

How do the company’s storage products and go-to-market motion join up to produce financial results? I am glad you asked. Here’s the data:

It’s a wall of numbers, but we can pick through it. First, the top line is revenue. Get a feel for how quickly the company added revenues in 2020 compared to 2019, and then in the first half of 2021 compared to the same period of last year.

Next, look through each expense line item over time, noting how those rising costs shake out into net losses; deficits are going up as Backblaze scales sales and marketing, which feels somewhat antithetical to our above work. What’s going on? The company’s sales motion itself is maturing, likely allowing it to target larger customer accounts.

Here’s Backblaze:

We believe an increasingly important complement to our self-serve customer acquisition model is our targeted inside Sales team that is focused on a low-touch “sales-assisted” model that supports our larger customers if the need arises. This team focuses on inbound inquiries, outbound prospecting targeting specific use cases, and volume expansion of our self-serve customers.

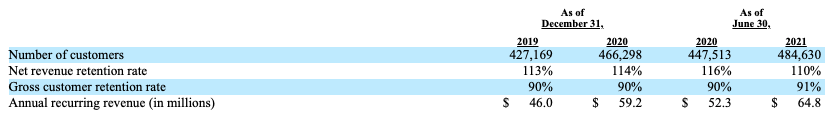

Makes sense! Larger customers may have better net retention metrics, a place where Backblaze has seen some recent slippage in its results:

From 116% in the first half of 2020 to 110% in the first half of 2021 is not a lethal drop, but it’s not wildly good either. Sure, Backblaze is swimming uphill somewhat thanks to its smaller-company market focus — observable in its gross retention metrics — but it’s still doing fine.

In better news, Backblaze has consistently raised its “annual average revenue per user” over time, from $92 in Q1 2019 to $133 in Q2 2021; the metric has risen linearly across the two data points. It’s still modest, but it’s going in the right direction.

All this adds up to a company that has posted positive operating cash flow in every period that we have on record (2019, 2020, H1 2020 and H1 2021), though its investing activities (where you can find “infrastructure deployments”) mean that the company has been modestly cash hungry here and there.

Now let’s talk revenue scale and quality.

Is the revenue any good?

Dealing with a company that is Backblaze’s size — which is to say, not very big for a company going public — we’re curious about its revenue quality. Because how good Backblaze’s revenue is will help us understand its IPO chances. Smaller revenue bases made up of very high-margin, recurring revenues may yet find public investor favor. Smaller revenue bases made of up low-margin, non-recurring revenues may not.

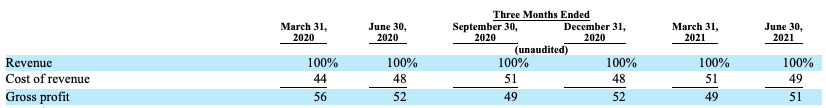

First up: gross profit metrics. From the S-1, here’s the data:

I hereby dub those gross margins (gross profit, in the above) precisely and exactly fine. That Backblaze’s gross profit as a percentage of revenue ticked up a little in Q2 2021 is good, but both numbers are with historical norms, so we are not exactly expecting much movement on this particular metric.

What about revenue recurrence? Here’s Backblaze:

While ARR is not a guarantee of future revenue, we consider over 98% of our revenue recurring for the periods presented.

Alrighty. Digging into that, from the bowels of the company’s S-1 filing, here’s the data:

So, mostly subscription with some on-demand pricing that deals with storage, implying that it is pretty steady in recurring terms (most companies don’t delete their data; this is a backup solution). I am content with labeling most of what Backblaze generates in top line as recurring.

The company’s margins are middling for SaaS but right in there for infra as a service. And the revenues they represent are recurring. Overall, it’s about as good a mix as we could have hoped for given what the company does. (You can draw comparisons to Twilio’s metrics here at your own risk.)

Valuing Backblaze is tricky. With just 24% growth between H1 2020 and H1 2021, it’s not taking flight like a rocket. But if investors reckon that rising sales and marketing spend, and a modest focus on larger accounts — visible, recall, by its rising focus on lightly sales-assisted customer acquisition over pure organic demand generation — will lead to revenue growth acceleration, you can make the pitch that Backblaze has plenty of growth ahead of it, and thus comely long-term cash flow possibilities.

I am not going to guess what Backblaze is worth because I would not like to be publicly wrong when I can avoid it.

Backblaze is evidence that there are cloud plays in the market that stand apart from what AWS and Azure offer while targeting business customers. You might think that Amazon and Microsoft had cornered that particular market. But it seems that AWS and its brethren are more focused on the enterprise than SMB and midmarket segments. Perhaps that means that there’s more space in the cloud infra market for other players than we anticipated.

Comment