Andre Maciel

Latin American venture capital and growth investments through 2018 had averaged less than $2 billion per year. With quality growth companies starved for capital, the few investors active in the region were making a killing. For instance, having invested in its Latin American franchise throughout different cycles, General Atlantic has an IRRs (internal rate of return) exceeding 50% from those vintages.

As a banker covering technology, I thought there was an opportunity to invest in the region and decided to quit my job at J.P. Morgan and give it a shot. When I called my former boss Nicolas Aguzin to thank him for his support, he said he’d introduce me to Marcelo Claure at SoftBank. By March 2019, we had launched SoftBank in Latin America with an initial commitment of $2 billion, which was worth more than the entire industry at the time.

Great companies like Nubank, Inter, Gympass, Quinto Andar and several others were in their early innings at the time, but the market dislocation did not last long. Latin America became the fastest-growing VC region globally, and the market expanded to $16 billion in 2021. In 2020, I founded a new growth fund to fill the funding gap in the region, giving me the opportunity to see how startups from recent vintages fared in a scenario of bonanza.

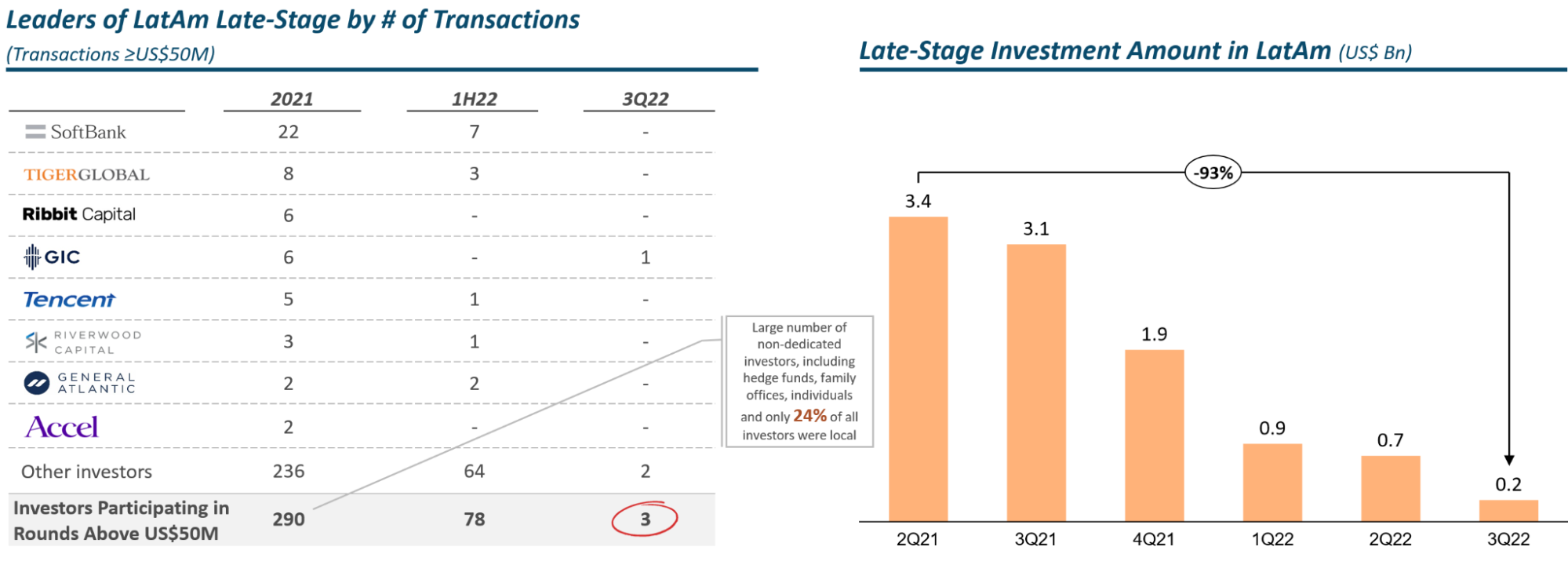

Fast-forward to today, late-stage funding in Latin America has been heavily impacted — volumes declined 93% in the third quarter of 2022 from a year earlier. Our assumption is that, going forward, the region will suffer more than other markets for its lack of available local growth capital.

The chart below shows that of the 290 investors focused on late-stage rounds in 2021, only three were active in the third quarter of 2022. Moreover, just 24% of those investors in 2021 were local, the majority of which were non-dedicated growth capital and included a high number of individuals, hedge funds and family offices.

Early-stage funding has remained relatively active so far this year, and many good companies are raising early rounds, expecting to come to market in 2023. But over 200 late-stage Latin American companies are holding back as much as they can before trying to raise additional capital. Foreign capital will only cover a portion of these funding needs.

I started my career in private equity in 2002, but my first job at J.P. Morgan was simple: writing portfolio reviews and helping unwind a large portfolio of internet companies that had had their share of glory, but were mostly failures by then. What I’ve learned from those days about how some companies thrived while most have failed is part of what we share with our portfolio companies today.

Here are a few takeaways:

Milk every dollar, save every penny

Below are a couple examples how companies did all they could to stay afloat, and eventually, thrive:

In 2001, MercadoLibre employed a freemium strategy to gain market share in the highly competitive Latin American online auction market. Users could sell their products on the platform at no cost, which of course boosted GMV growth. By 2003, that was gone and the company quickly introduced fees across its markets.

Another of my favorite Latin American technology companies, Universo Online, went public in 2005 after a botched attempt in 2000. Their prospectus said one of their main strategies included a “continued effort to reduce costs.” Universo Online monetized everything it could: paid subscriptions, mailboxes, VoiP, premium content, antivirus, paid links and more. Some of these were doomed revenue lines from the outset, but it did not matter. It allowed the operation to survive and to become a core pillar of the Uol strategy.

Growth is the output

In any region with extremely low productivity and slow economic growth, disruption will create long-term value.

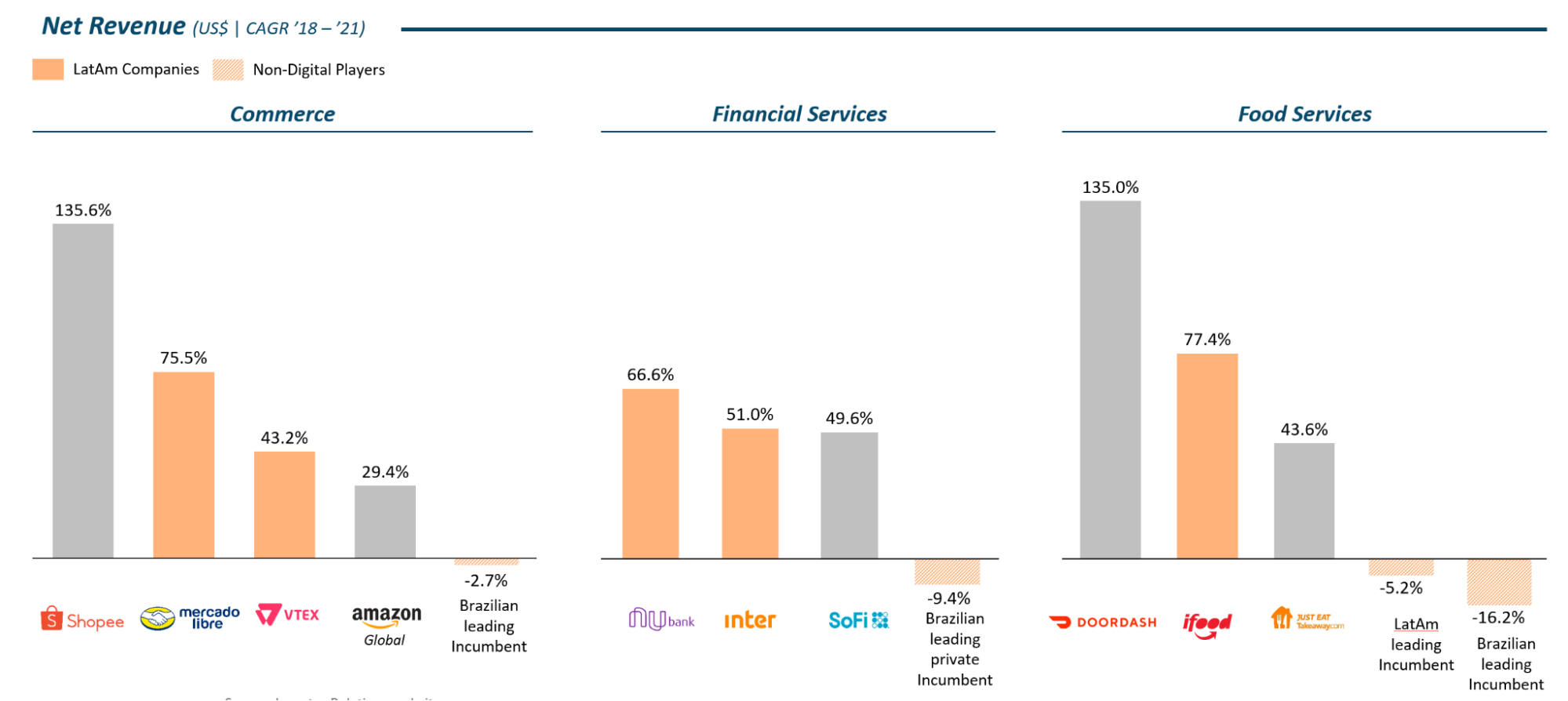

The chart below compares growth rates of some disruptors compared to incumbents.

Why risk a winning model by building on the wrong foundations? Established players will find new, winning models difficult to replicate, and you will win regardless in the long run.

We tell our companies that 30% is a better growth rate than 50% if growing faster entails too much waste and low revenue recurrence.

Are you sure you have a business model?

Our take is that many companies that have received late-stage rounds do not have a business model. Certain categories such as ultra-fast delivery, BNPL and consumer insurtech have a difficult time in markets that have the potential to scale significantly higher.

Are they suitable for Latin America? Mexican social commerce startup Neta couldn’t find product-market fit and decided to return whatever was left of its capital to its investors. Although that is a hard decision, it would have been a lot harder if it chose to do so after burning even more capital and hiring more people.

Other companies successfully pivoted their business model, sometimes more than once. I led the SoftBank investment in Gympass and I was impressed with its CEO Cesar Carvalho’s tenacity. The company started off as a B2C gym platform but quickly switched to B2B, creating value for gyms and companies that wanted to invest in their employees’ well-being. In mid-2020, when most gyms faced a possible collapse, Gympass helped digitize an entire industry.

When expanding to the U.S., Incognia changed from offering geolocation-based advertising services to a location-based security. This happened when the pandemic hit and authenticating users across several channels became essential for businesses.

Are you the right person for the job?

Founders are great leaders, but they are often not the best CEOs.

In a founder-friendly VC environment, where lax governance allows founders significant leeway, it generally falls to the founder to make that decision.

Having the self-awareness to focus on areas where a founder may excel, such as product and motivation, and letting a professional CEO take the reins can net everyone a lot of money by effectively protecting the value of their equity.

Clean up every funding dollar available

Latin American companies are competing for a very small pool of capital. There is the wrong perception that local early-stage and continuity funds are well capitalized because they raised record amounts in 2020 and 2021.

We don’t believe this is the case, as most funds are already 20%-40% allocated, and their priority will be to protect their portfolios.

Latin American startups are competing with their industry peers, as well as every other Series A+ company, for the same pool of supply.

Address local issues

By solving local issues, startups will build pricing power, which should allow them to thrive. For example:

Universo Online, a web portal and online service provider that competed with AOL in Latin America, leveraged its traditional media and online marketing expertise, particularly its Portuguese-language content, to maintain its relevance.

Recently, Intuit announced the end of QuickBooks in Brazil, which faced strong competition from local players such as Contabilizei, Conta Azul and other ERP platforms.

Take advantage of this crisis

Focus on vertical acquisitions instead of product expansion. Take advantage of the massive pool of talent in the market because of the layoffs and rope them in to improve products and operations. Strive for high margins and low burn rates, and be there for your clients.

Latin America has changed in the last few years, but most of the positive developments that we’ve seen come about are here to stay. The $35 billion invested by VCs over the past three years has created a new industry with millions of software developers and IT professionals.

The next MercadoLibre, Banco Inter and Nubank are being created right now — this is just natural selection.

Disclaimer: Volpe Capital is an investor in UOL Edtech, a Universo Online company.

Comment