A Gen Z VC speaks up: Why Gen Z VCs are trash

TechCrunch

AUGUST 29, 2022

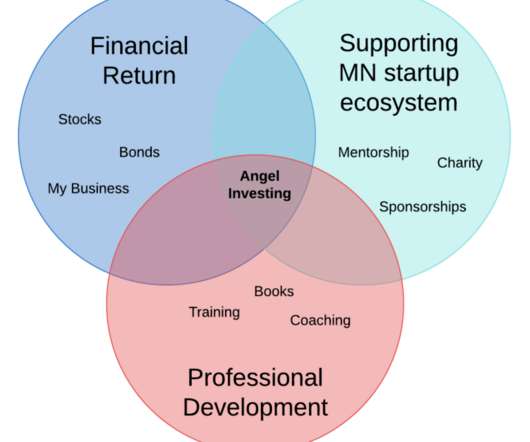

Andrew Chan is a senior associate at Builders VC , investing in early-stage companies that are transforming pen and paper industries. In the last couple of years, a large group of “Gen Z VCs” have come to the forefront of what one might consider “hip” venture capital investing. Andrew Chan. Contributor.

Let's personalize your content