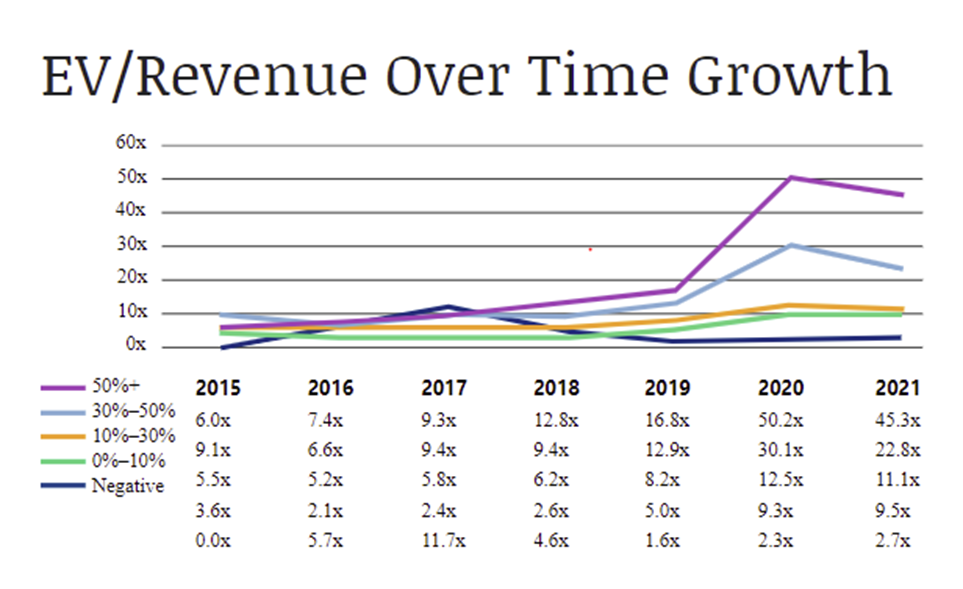

The flow of capital in SaaS is becoming increasingly bifurcated. There are the “haves” (public companies with revenue growth of over 30%) and the “have nots” (everyone else) of B2B software.

The chart below demonstrates just how drastically the “haves” separated themselves from the rest. With average EV/revenue multiple up +28.5x for companies that grew over 50% and +9.9x for companies that grew 30%-50% since 2019, compared to just +2.9x for those that grew by 10%-30%.

The real trick is identifying why certain companies are “haves” and how they remain that way. Put differently, what is it about companies like Zoom, Datadog, Monday.com and Asana that drive their outsized valuations? More importantly, are there strategies or tactics that management teams can employ to optimize for this type of outcome?

Growth in EV/revenue over time. Image Credits: OpenView Partners

Recent research shows that there are three key steps to becoming a “have”:

- Continued execution against large and growing market opportunities.

- Leveraging a business model that enables rapid growth (i.e., product-led growth).

- Strong unit economics that support high free cash flow margins over the long term.

Let’s dive into these steps and see what they look like in practice.

A large and growing market

The ability to create and ultimately dominate a large market is key to maximizing potential, but the path to domination needs to be believable. The very best “haves” demonstrate the rare ability to clearly communicate a roadmap for how they will win the market, and then execute that plan.

Salesforce’s S-1 identified a $7.1 billion market opportunity, and it clearly outlined how the company would come to dominate the CRM space. However, the driving force has been its emphasis on customers’ key needs. Through buying and building out its product suite, Salesforce has grown from the CRM-only days of old into a fully fledged system of record that handles everything from marketing (ExactTarget) to internal communication (Slack), to data visualization (Tableau), all integrated together (Mulesoft).

The company’s ability to identify its customers’ needs and execute on a go-to-market and product strategy to address them has enabled it to grow to a market cap that is now 30x its initial total addressable market. One takeaway from this tale should be the importance of having a clear vision to create a large market by identifying what customers’ current and future needs are, and then crafting a story for potential investors about how you’ll win it.

Using the potential of product-led growth

It can often make sense to pour resources into a sales and marketing engine to generate growth. Monday.com, for example, maintains its nearly triple-digit growth by efficiently spending on and marketing as it aims to dominate the “Work OS” market.

But, especially for earlier companies, there needs to be an efficient growth lever first. In today’s world, viral customer feedback loops driving an efficient GTM model are worth their weight in gold.

Zoom was widely used even pre-pandemic, but it wasn’t ubiquitous because it was spending billions of dollars on sales reps each year. Rather, Zoom went viral because it very effectively relied on making the experience so good for customers that they would share it with friends, family and colleagues.

Zoom’s business model centered around helping as many people as possible with a universal issue — making a remote meeting with a “face-to-face” feel as easy as possible. Its authentic drive to solve customers’ key pain points turbocharged its growth without a massive investment in sales and marketing. Once that investment came, though, it was much more efficient on a unit economic basis, benefiting from built-up customer goodwill, the brand, ease of use and more.

For the “haves,” product-market fit and customer validation came before their widespread success, which was followed by greater investment in sales and marketing.

Unit economics that support high FCF margins

An aspiring “have” should have a clear vision to create (and win) a massive market and a highly efficient unit economic model. Does that mean it’s worthy of a massive valuation?

Well, that depends on one thing: Cash flow. At the end of the day, everything is still a DCF, even if investors would rather sacrifice short-term cash flow for continued growth (bye-bye, Rule of 40). A discounted cash flow model will only work if there is positive cash flow eventually.

Take Monday.com, which is currently burning a ton of cash to grow each quarter. Despite aggressive burn, its unit economic strength and strong underlying value to the customer has led to cumulative ARR of over 2x its total burn, per its S1 filing. Monday.com’s valuation isn’t despite its cash burn today; rather, it’s a result of a unit economic model today that suggests the business will generate loads of cash in the long term (assuming it can establish a defensible competitive advantage along the way).

The lesson for aspiring “haves” is to target building a business with unit economics today without sacrificing short-term market share domination solely to be cash flow positive.

Becoming a “have” is hard work and requires thoughtful analysis of market dynamics, customer needs and more. When done correctly, it yields jaw dropping valuations in a rather predictable fashion.