We’re facing a pretty big climate change challenge, and I’ve long been skeptical about whether venture capital can be as big a part of the solution as it seems to think it is.

This is why I was so excited when Harri wrote about fintech startup Enduring Planet. It’s playing a really clever card: trying to make rapid financing available to climate entrepreneurs in a win4 situation — where investors, the startups, society and the environment all win.

A coherent story, with enough detail to understand what’s going on, without dropping into a rabbit hole. Put simply, I wish every deck did it this well.

Today, I’m delighted to present the deck the company used to raise its financing. As you might expect, it is a little bit inside baseball — this is a deck for a startup that helps other startups raise money from other VCs — but as you might also expect, Enduring Planet really knows what it is doing.

The deck is pretty extraordinary, and it’s fun to get under the skin of how the founders are thinking about its round. The company did an exemplary job on several slides that a lot of startups get wrong, and it even included some of the appendix slides, which helps deepen the story and context of the fundraise even further.

I’m psyched to share this with you — LFG!

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Enduring Planet’s slide deck does have some light redactions, but the main deck is more or less intact. The company removed the revenue numbers (but kept the graph) on Slide 16. It removed a deep dive into its underwriting criteria and removed company names from its pipeline slide. It also deleted a number of appendix slides (sensitive info about its underwriting, structures, etc.).

The main deck is an 18-slide deck, and the company included five of its appendix slides. That represents the first time I’ve been able to include appendix slides as part of a pitch deck teardown. I’m excited to dive in on the ins and outs of what appendix slides are for!

- Cover slide

- Team slide

- “Some investments to date” — Traction slide

- “Trend” — “Why now?” slide

- “Expanding investment by corporates and VCs” — Market evolution slide

- “Governments are turbocharging private sector action” — Global market opportunity slide

- Skyrocketing Startup + SMB Expansion” — Market trend slide

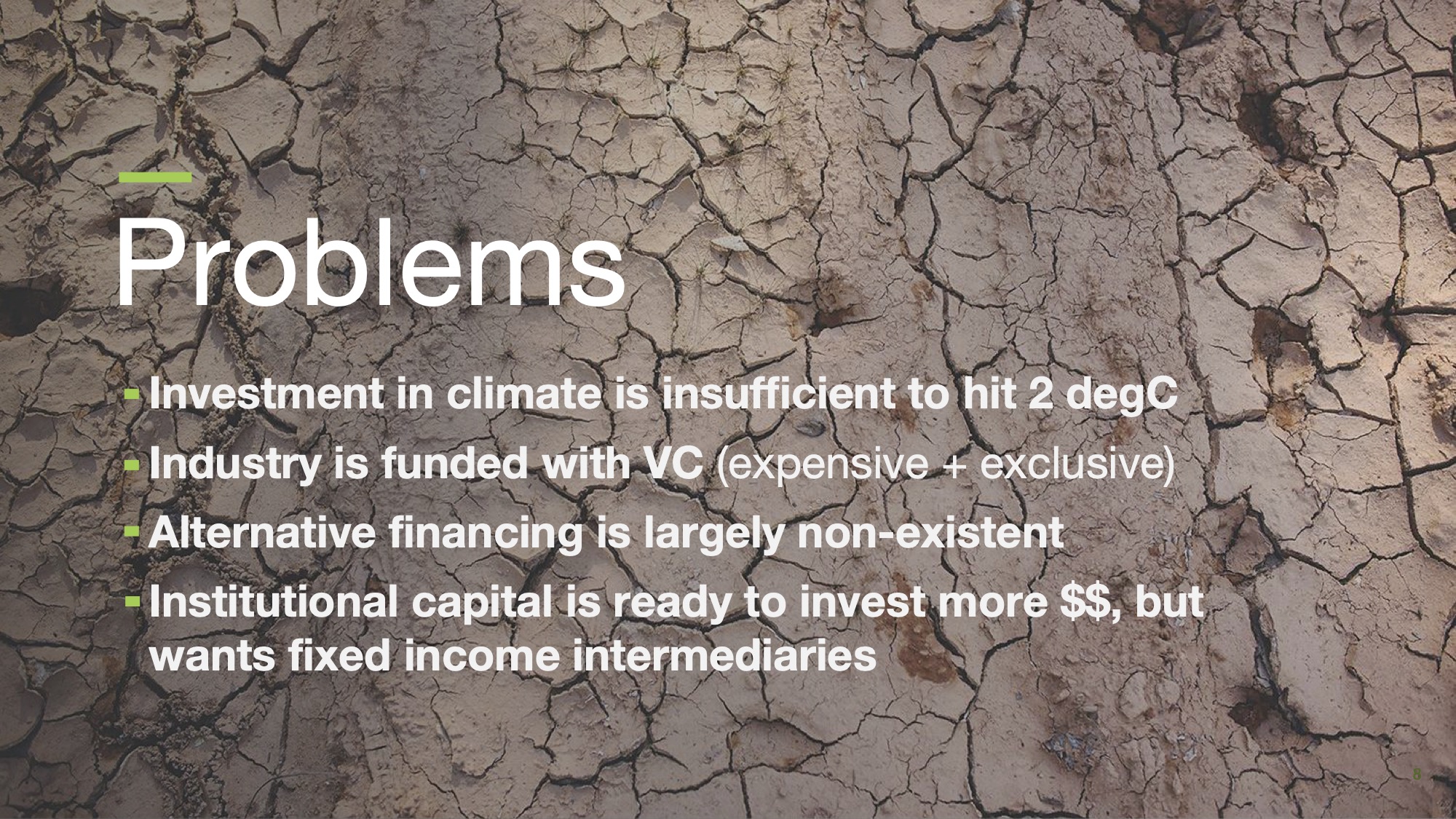

- Problem slide

- Solution slide

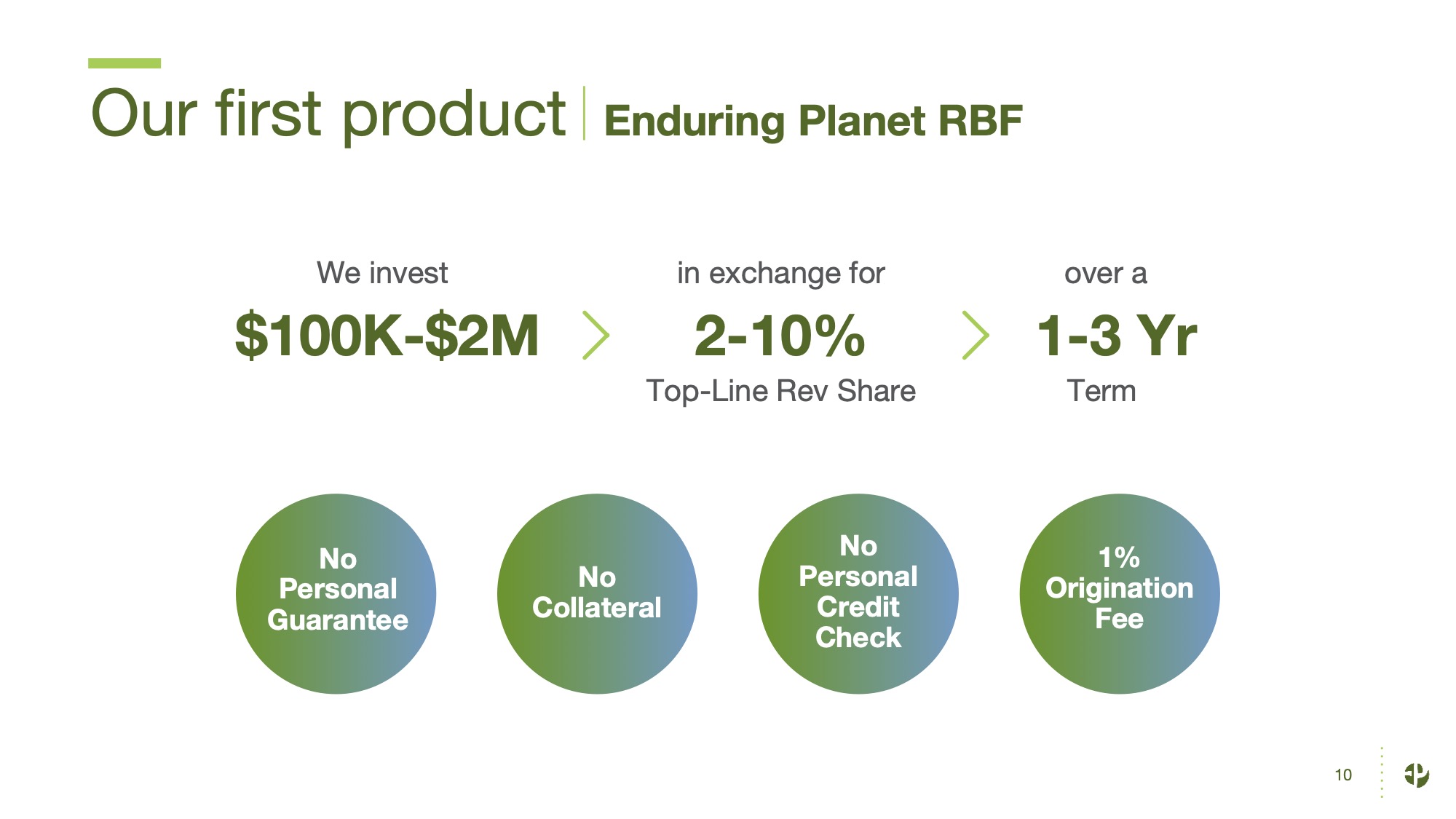

- Product slide

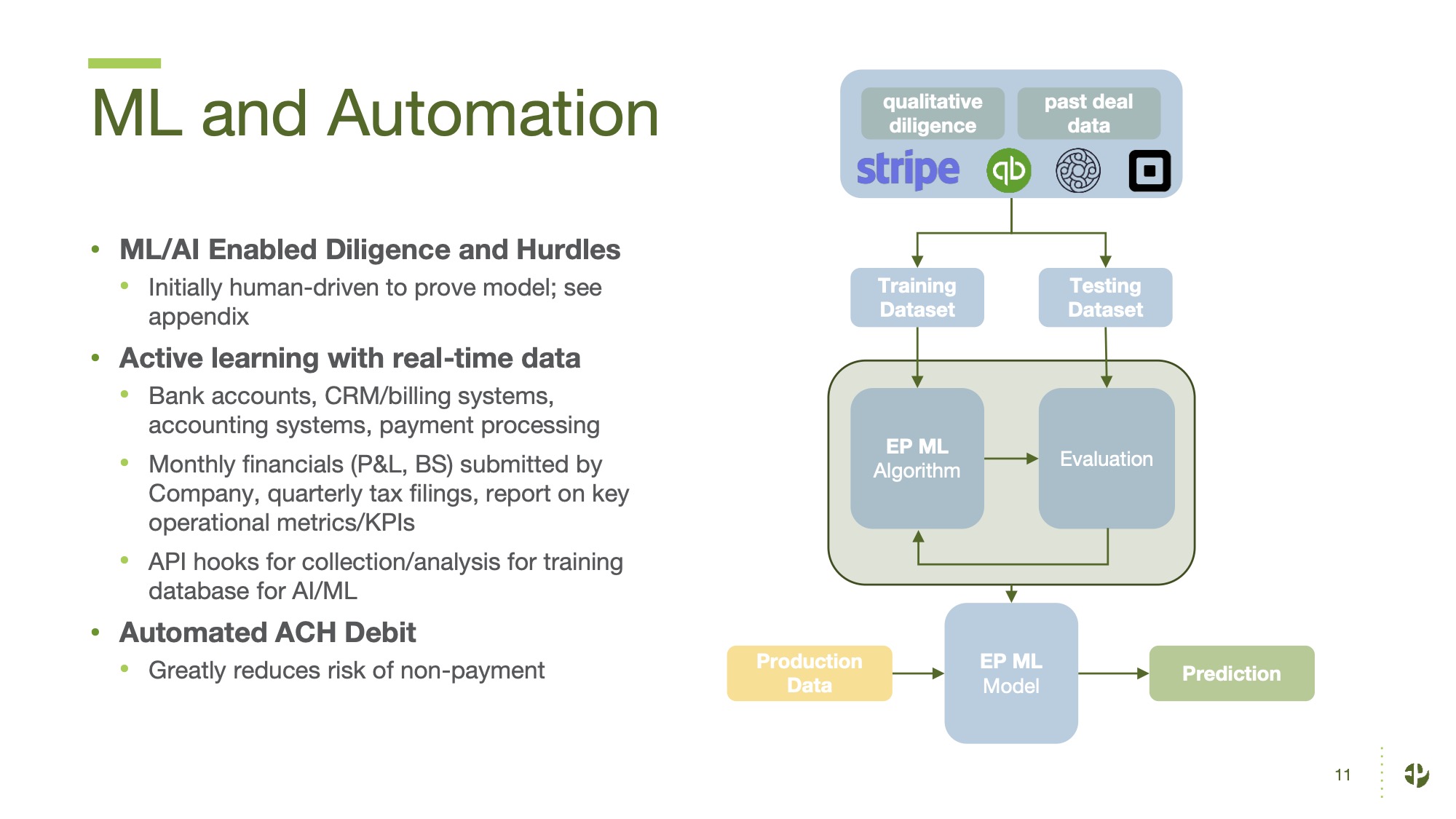

- “ML and Automation” — Product detail slide

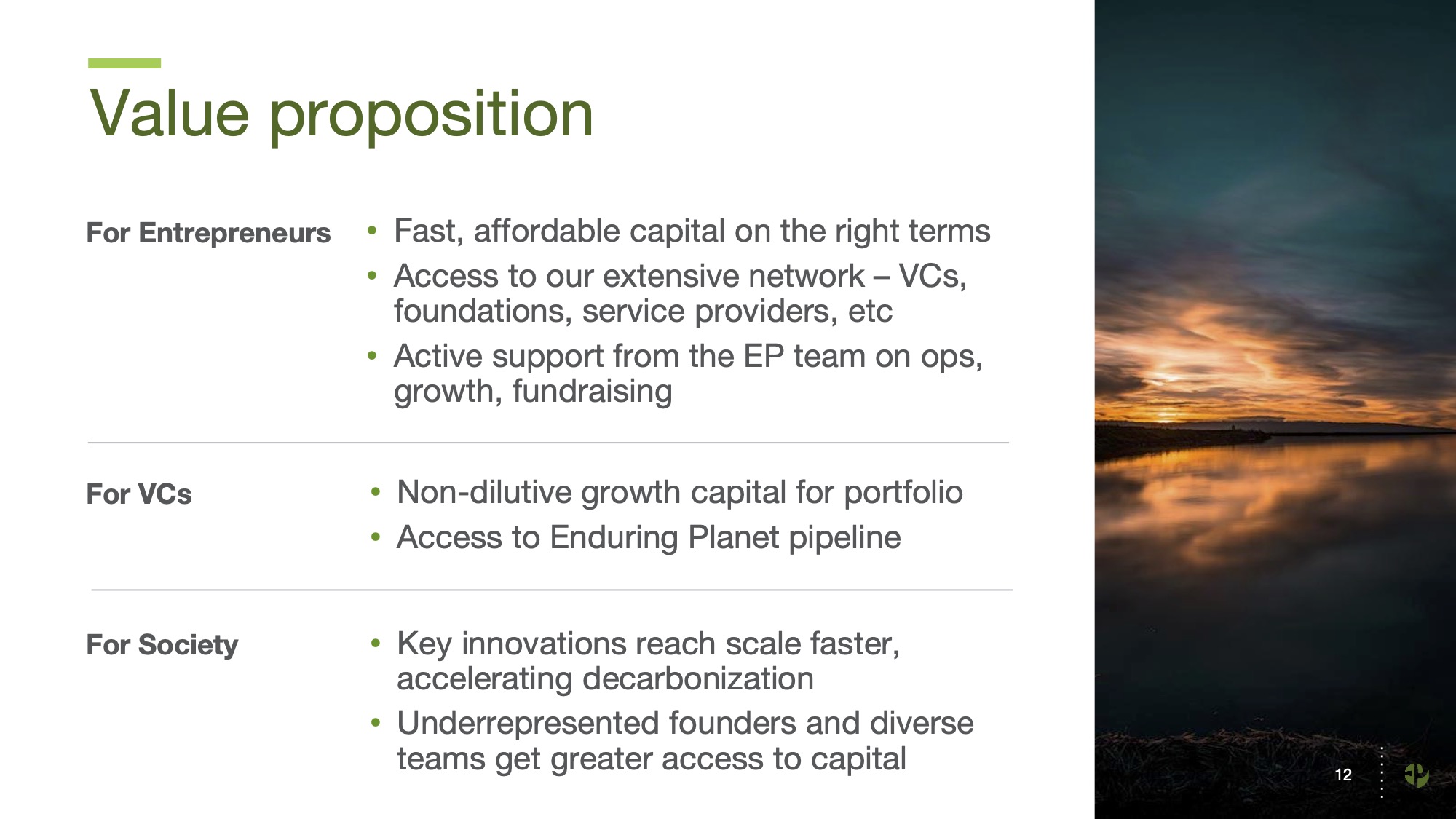

- Value proposition slide

- Key investment criteria slide

- Pipeline slide

- Solution road map slide

- Financial projections slide (redacted)

- Team and board slide

- “Fundraising target” — Ask slide

- Appendices cover slide

- Appendix — Detailed problem slide

- Appendix — Sample VC partners slide

- Appendix — Key investment criteria: Sectors detail slide

- Appendix — Key investment criteria: Equity and inclusion detail slide

- Appendix — Risk management slide

Three things to love

There are some very serious issues with this deck, but I’ll get to those toward the end of this article. There’s also some absolutely excellent storytelling at play here, though — so let’s start there!

The deck pulls no punches

[Slide 8] The company’s problem slide is bold. Image Credits: Enduring Planet (opens in a new window)

The company outlines the problem succinctly and hints at its own solution in the last point — that institutional capital wants to deploy more money but doesn’t have an efficient mechanism for doing so. It’s one of the cleanest, simplest problem slides I’ve seen in a while; it outlines both an enormous problem and hints at the scale of the opportunity.

Solution and product slide working in tandem

[Slide 10] Product slide. Image Credits: Enduring Planet (opens in a new window)

Especially in the earliest-stage companies, you have a hypothesis that your product is a good solution to the problem, but you don’t know for sure. By divorcing the solution your company believes in from the product your company builds, you’re setting yourself up for success. You can always pivot exactly how you provide a solution — what you’re showing is an in-depth understanding of your market. Besides, you’re setting the scene for a story that includes more than one product to solve the full set of problems in the industry. That’s exactly what Enduring Planet is doing here.

On its solution slide (Slide 9), the company states that its solution is a “Climate-exclusive lending platform providing entrepreneur-friendly capital using the latest automation technology.” It sounds like a mission, but pay close attention: It is more tactical than a mission and works really well as the company’s solution statement.

From Slide 9, it moves into its product, and even explicitly states that this is its first product. There’s no whisper here: It loudly shouts that it has more ideas to serve as part of its platform.

If you’re in the process of fundraising, take an extra close look at slides 8 through 10 in this slide deck; Enduring Planet does a great job at presenting the problem/solution/product in a coherent story, with enough detail to understand what’s going on here, without dropping into a rabbit hole. Put simply, I wish every deck did it this well.

A win/win value prop

As I suggested in the intro paragraph, Enduring Planet does a particularly good job at painting a world where everyone wins.

[Slide 12] Value proposition slide. Image Credits: Enduring Planet (opens in a new window)

Pay extra close attention to the “For VCs” part of this — as a would-be investor, I would. In two short bullet points, Enduring Planet is able to make two different points. “Non-dilutive growth capital for portfolio companies” is a powerful sentence; it means that Enduring Planet is promising VCs that its companies can go further without giving up more equity. Given that VCs typically are optimized to care about their ownership stake (and, by extension, are allergic to unnecessary dilution), that’s a powerful promise.

The second point is related but substantially different: By offering non-dilutive financing, Enduring Planet is likely to see a lot of deal flow and financial data for climate tech companies. That’s an information goldmine for VCs who are interested in investing in this space. When a company is ready to raise equity financing, some ways down the road after getting financing from Enduring Planet, the latter is in a fantastic position to be able to have a much deeper view into what startups are worth investing in and which are less attractive.

Bonus: Appendices

Image Credits: Enduring Planet (opens in a new window)

I quickly wanted to note the appendices that Enduring Planet used in its pitch deck; it’s worth taking a closer look at them in the full pitch deck below, but I love Slide 20, where the company expands on its claim that “Capital for climate entrepreneurs is either high cost or inaccessible.” It does that with a full matrix showing how equity, grants, commercial debt, venture debt and revenue-based financing are all poor ways to grow a startup in this space. It’s supremely elegantly done and efficiently positions Enduring Planet as a great financing option. An additional win — and something I wish was acknowledged more often — is that the company points out that “these challenges are greater for underrepresented founders across the climate-tech ecosystem.”

This is a great example of why you should consider having an appendix in the first place.

Putting a slide like this in the main deck would be a distraction; there’s 20 cells of detailed information, and if you care about this sort of thing, you could easily spend several hours picking it apart and rabbit-holing on the pros and cons of each funding option for various startups. Enduring Planet sidesteps that elegantly; if a VC wants to discuss this in more detail, they can quickly flick to the relevant slide and show that they’ve done the intellectual legwork to answer the question. And if it doesn’t come up as part of the pitch, great. The info is there for the investor to ingest after the call or in a later meeting, and you didn’t waste any time in the time-limited pitch. This is a great example of why you should consider having an appendix in the first place.

In the rest of this teardown, we’ll take a look at three things Enduring Planet could have improved or done differently, along with its full pitch deck!

Three things that could be improved

The Enduring Planet slide deck is rather extraordinary, but it isn’t a complete slam dunk. Here are a few things to consider.

Off to a lackluster start

[Slide 3] investments to date. Image Credits: Enduring Planet (opens in a new window)

I dread to think how many quick nos Enduring Planet got from associates who didn’t get to the good part before they’d made up their minds.

That wasn’t the point I was trying to make though — I’ve whined about early team slides in a bunch of pitch deck teardowns. I think that overall, the opening to this presentation is pretty weak. The cover slide doesn’t lift as strongly as it could. Slide 2 is a founder slide that doesn’t shout “wow!” at me.

Then we have Slide 3, shown above, which I find a little confusing. When the company says “investments to date,” then lists funds of funds and startup lending, I’m unclear as to whether this is money flowing in or out. In other words: Did Enduring Planet raise money from Lendable, Sunfunder, and … perhaps I should know better, but I don’t recognize that A-shaped logo, so I don’t even know who that is. (But it has $1 billion under management, and as a climate investor, I’d feel really awkward if I’d have to ask.)

Or did Enduring Planet deploy money into these organizations? Also, what are we trying to say here? Is this traction? Customer validation? I’m confused, and that’s not a great way to start a pitch.

Then there’s slides 4 to 7 which, as far as I can tell, make the same points: Climate investments are exploding, corporates are getting in on the fun, governments are spurring private sector growth, and startups and small and medium businesses are leading the charge. My gut sense is that the right investors for Enduring Planet will be intimately, painfully aware of all of these figures. My impression is that the company is wasting four slides teaching grandma to suck eggs.

The compound effect of this is that I made it to Slide 8 before anything interesting happened in this deck. That’s a pretty seriously underwhelming start — I almost didn’t feature Enduring Planet’s slide deck in this pitch deck teardown because of it. The only reason I kept reading was that I remembered Harri’s article from May. Remember that as a reporter, I have a lot less to lose than a potential investor; I dread to think how many quick nos Enduring Planet got from associate partners who didn’t get to the good part before they’d made up their minds as they were working their way through a stack of 200 pitch decks.

Er, I don’t know what this means

[Slide 11] This slide is a deep dive into, er … you know, I’m not entirely sure. Image Credits: Enduring Planet (opens in a new window)

It is a really easy-to-solve problem, too: The title of the slide could be something like “We use machine learning to reduce risk,” or “We use a lot of data to analyze the quality of a potential investment” or “We have a unique dataset that helps us make smarter investments.” I would also make explicit what the output is — what is the prediction? A risk score? A return on investment prediction? A climate impact calculation?

I’m sure the founders have a great voiceover for this slide that would illuminate it all, but unfortunately, I don’t have the luxury of that when I do these teardowns, so this slide is a bit of a head-scratcher.

Make it investor-focused

Compared to my other complaints, this one is minor, but it’s an easy trap to fall into, so let’s name it anyway:

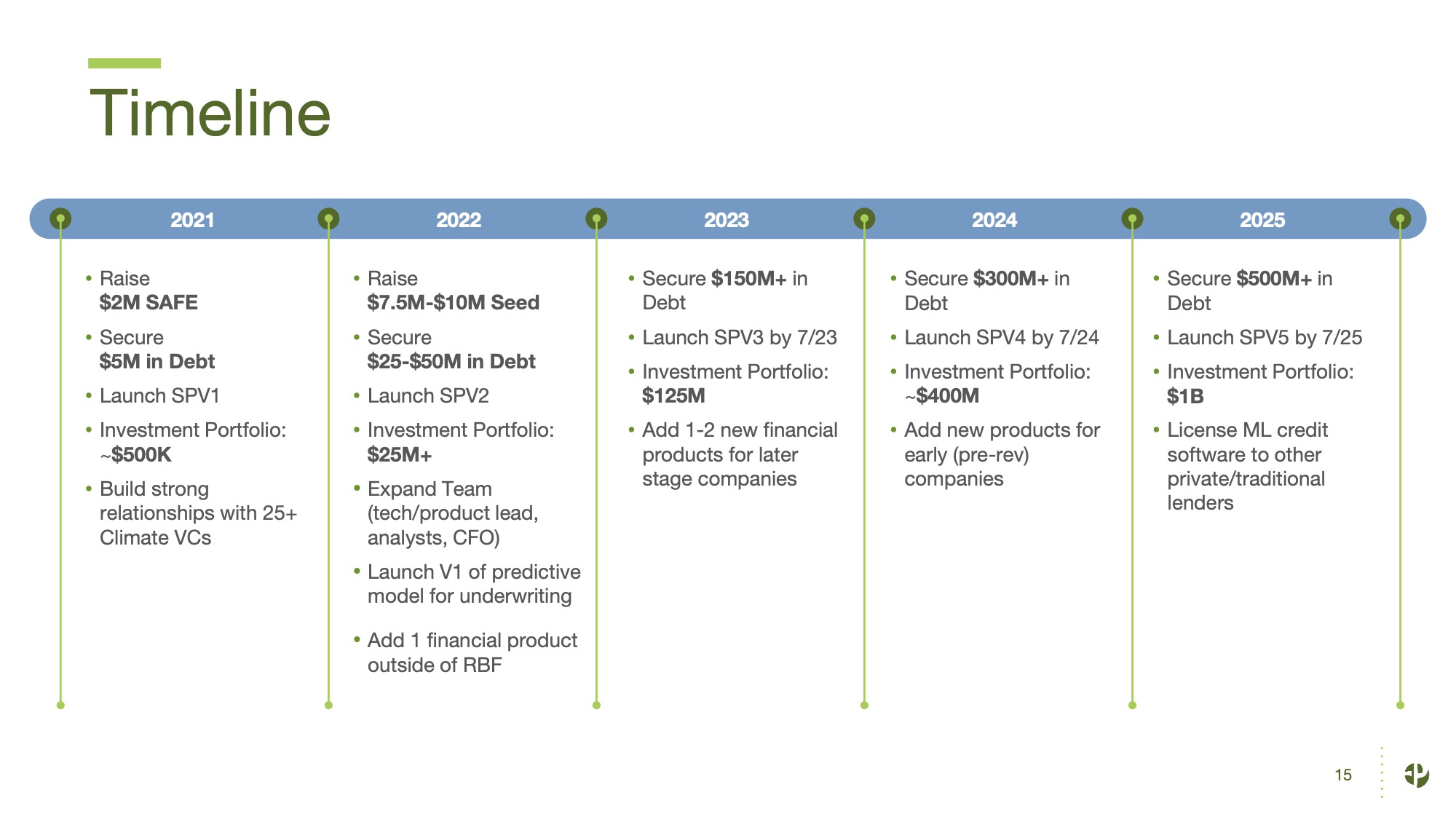

[Slide 15] A timeline of Enduring Planet’s history and near-future plans. Image Credits: Enduring Planet (opens in a new window)

Raising huge amounts of funding is impressive and exciting (and might be better represented as a bar graph), but what I really want to see is where the value is generated and what the forcing functions are for value generation for Enduring Planet. It’s possible that’s actually in the slide and that I’m just missing it, but I would have liked to see it spelled out more explicitly. I also suspect that there’s a more visual way of telling this part of the story so we don’t end up with a wall of text. One elegant way of doing that might be to spell it out as an operating plan covering the next 12-18 months, and then a more hand-wavy longer-term plan.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice.