On Tuesday, I covered Arkive’s $9.7 million funding round, a startup that is trying to answer the question: “What if the Smithsonian was owned and curated by the internet?”

The company’s founder and CEO Tom McLeod was gracious enough to let me take a closer look at the pitch deck he used to raise their seed round for our pitch deck teardown series here on TechCrunch+. Let’s get to it!

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Arkive’s deck is a hard-hitting, to-the-point deck that crams a lot of details into just 12 slides:

- Cover slide

- Mission slide

- Problem slide

- Solution slide

- Business model slide

- Value proposition slide

- Roadmap slide

- Market context slide

- Market size slide

- Milestones and What’s Next slide

- Team slide

- Closing slide

The deck has a small number of redactions; the team reports it removed the following information:

- Amount of money needed and valuation.

- Specific timeline of product features.

Three things to love

Right off the bat, this slide deck shouts both “good storytelling” and “experienced entrepreneur.” The former because the narrative flows effortlessly and clearly from one slide to the next. Very few of the slides are, as many founders choose to do for clarity, labeled as “product” or “roadmap.” Both the content and design make sure you know exactly which part of the story you’re looking at.

Here’s a few things I think Arkive did particularly well:

Planting the seed of a dream

[Slide 2] Barreling hard out of the gates. Image Credits: Arkive (opens in a new window)

So what’s left? You sell the dream — and my goodness, did Arkive knock that particular ball out of the park.

Love or loathe the idea, “What if the Smithsonian was owned and curated by the internet?” is a hell of a conversation starter. It also serves a more subtle purpose — for some subset of potential investors, this slide will make them nope the hell out of the deal right away.

Make it easier for investors to paint your dream in numbers — it makes it far easier to give an enthusiastic “yes!” to backing your company.

That can be an advantage, as it’s nearly impossible to convince people who’ve made up their minds about crypto, blockchain, museum curation or fractal ownership to get excited about Arkive. The corollary is that investors who are excited about this space are invited to elevate their excitement with a very simple slide.

The slide hints at the market, it suggests the solution Arkive is building, and it communicates the company’s goals and missions. It’s simple, effective and demonstrates a clarity of vision that I rarely see in founders in this context.

There’s one lesson you can take away from this: If you’re struggling to come up with a vision that’s as clear as this, ask yourself if you fully understand your market, the problem you are solving and the solutions you are proposing.

It was that, now it is this

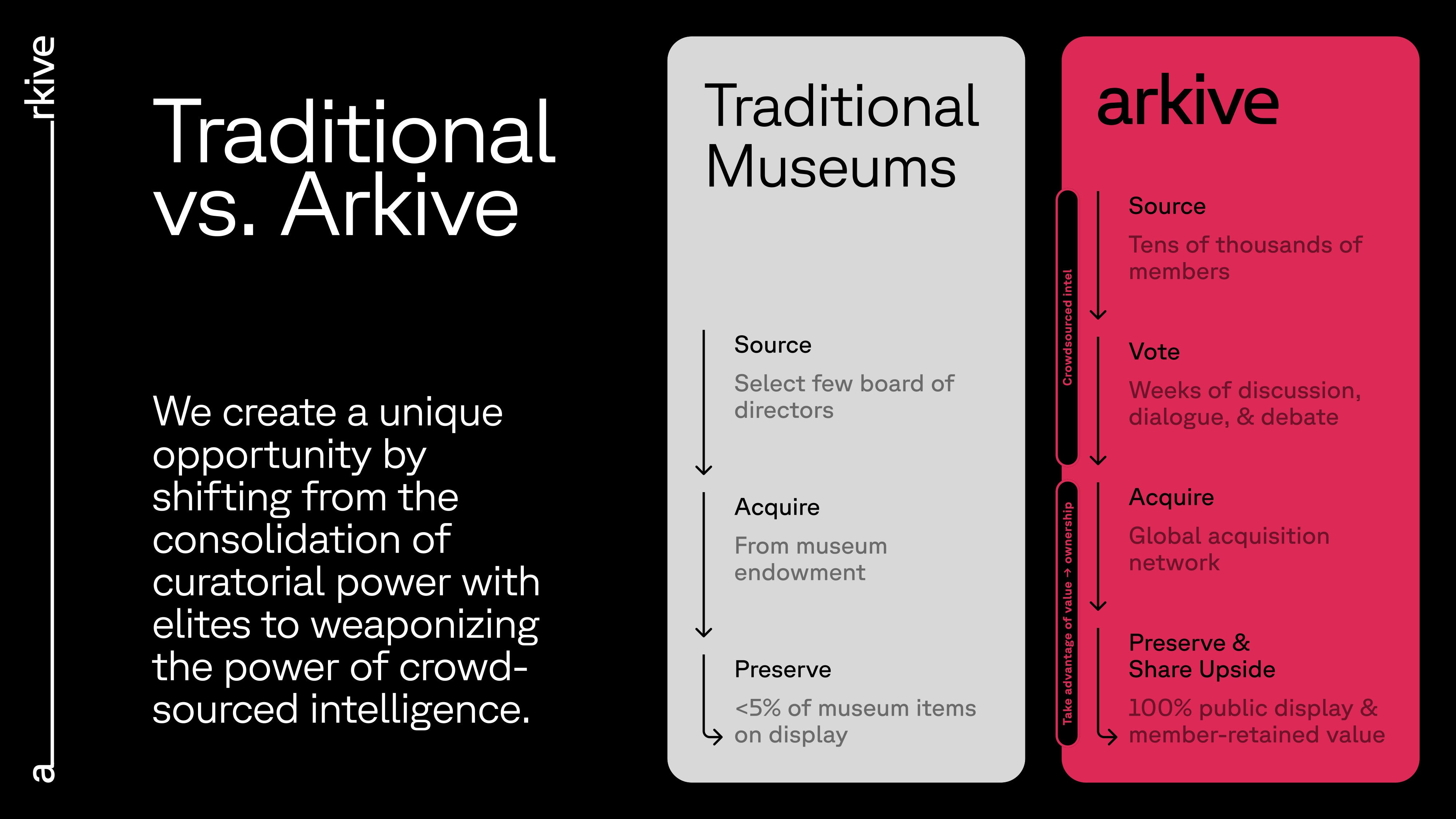

[Slide 4] “We create a unique opportunity by shifting from the consolidation of curatorial power with elites to weaponizing the power of crowd-sourced intelligence.” Image Credits: Arkive.

Few founders pause for long enough to consider that investors are pretty similar in their motivations. Yes, they’re trying to create an outsized return for their LPs, but to many VCs, that’s the “what” and maybe the “how,” but not the “why.”

I love this slide because it plants a bold stake in the ground, striking a stark contrast between the old (traditional musea) and the new (Arkive). It uses the buzzwords of crowd-sourcing, equality and speaking democratic truth to a traditionally elitist group of curators.

For investors who care about diversity, inclusion and social justice, the message is spot on — will this be the first time there will be true representation in art and artifact curation? And on the other end, for investors who couldn’t wring out a singular copulation about making the world a better place, the slide does something else: It highlights a market that is staggeringly low on innovation and may turn out to be ripe for financial disruption.

I wish the slide had fewer words in it (perhaps Arkive could have made a deck with fewer words for presentation purposes), but that tiny niggle aside, I think it is very close to being perfect. It draws out the contrasts and sets out the playing field effectively while leaving enough space to have fruitful and interesting discussions about Arkive’s visions for the future.

Let’s talk business model

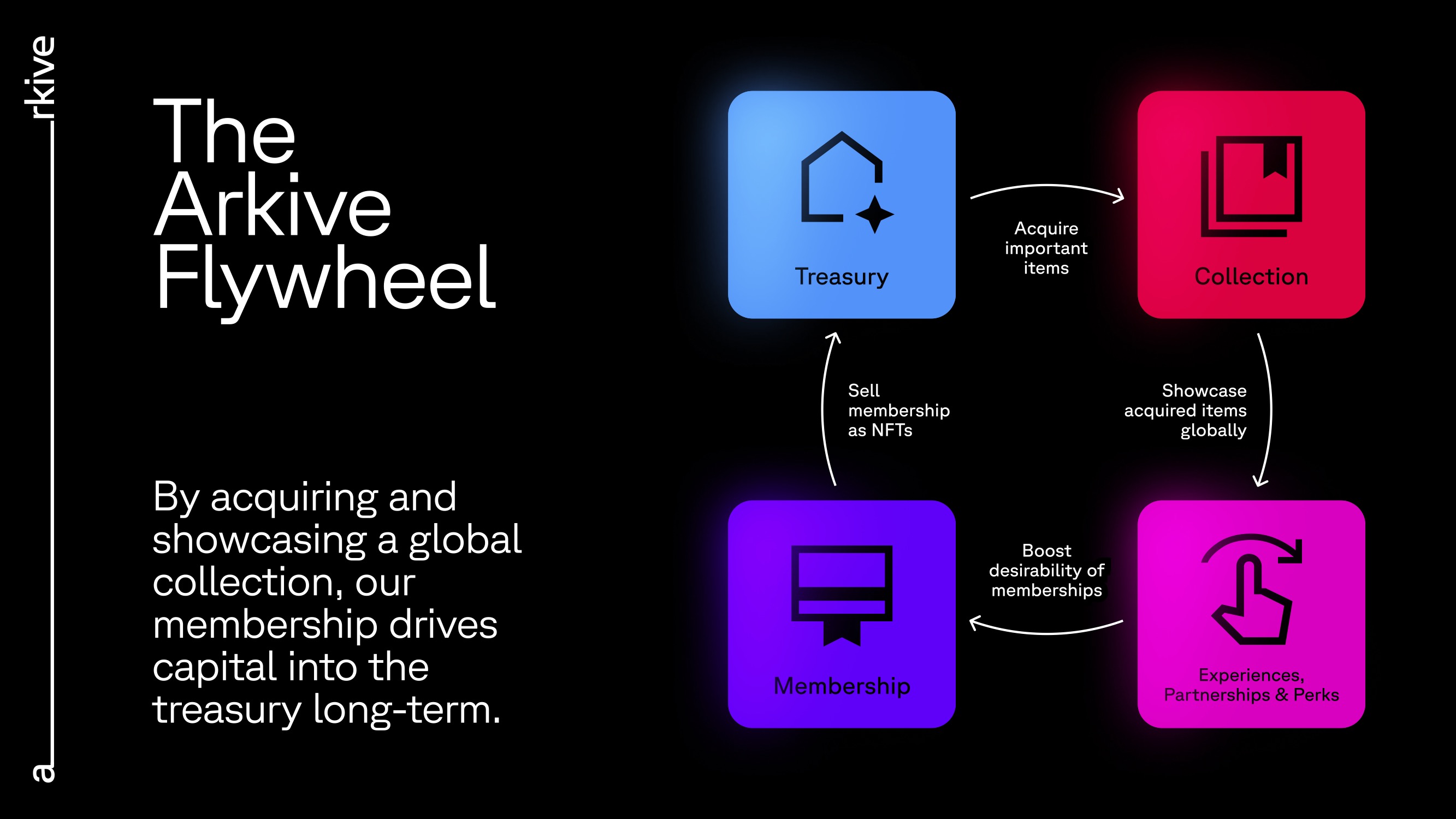

[Slide 5] Business model, meet acquisition model. Image Credits: Arkive

This slide outlines two important parts of that business model. For one, it outlines the user acquisition path and explains how the company is planning to take care of part of its marketing. It also explains the “How will this thing make money?” question without going into too much irrelevant detail.

This slide, in particular, helped me realize that the founding team is particularly experienced. Instead of only looking at one part of the puzzle in isolation, they have instead identified and articulated how all of the pieces come together while focusing on the user acquisition aspect of the business model.

The effect is simple but powerful. Just with the slide, I can deduce what I would have said to pitch it, but I’ve interviewed McLeod, the company’s co-founder, so I know he is a good presenter and can speak about his vision with great passion. Each of the four boxes on this slide is a slightly ajar door inviting you to have a conversation.

In the rest of this teardown, we’ll take a look at three things Arkive could have improved or done differently, along with its full pitch deck!

Three things that could be improved

Nearly $10 million doesn’t lie — the deck worked. But, in the poorly butchered and fantastically misquoted words of Lin-Manuel Miranda, I’m never met with perfection so great that it didn’t accept a little nudge in the right direction.

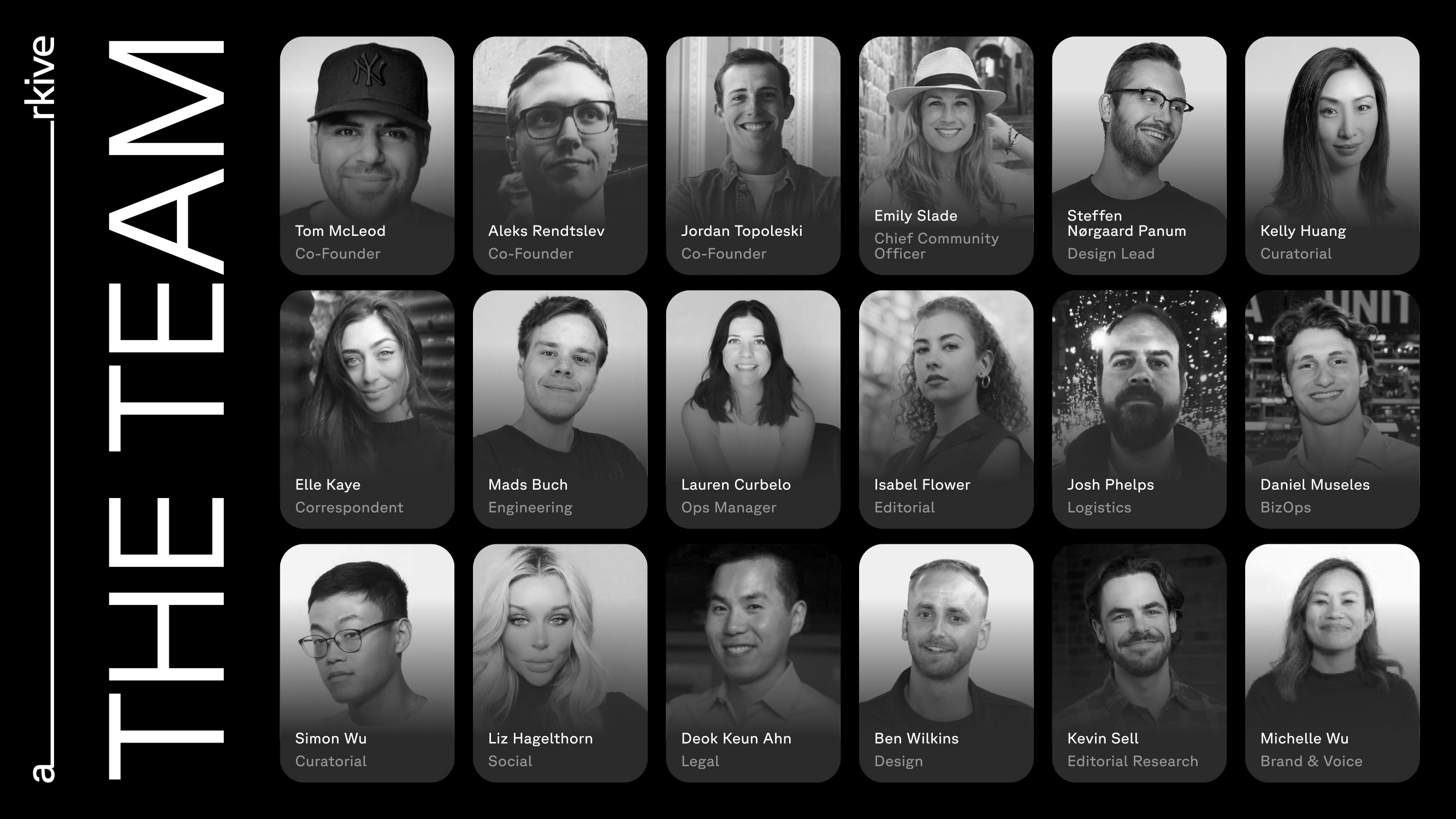

That team slide tho

[Slide 11] Team. Image Credits: Arkive

Team: 18

See? You don’t need to take up a full slide to do that. I imagine the founders have a good narrative to go over this page of the presentation deck, but on its own, it’s pretty awful.

On the PDF, the names aren’t clickable links with LinkedIn profiles, so there’s no easy way to go deeper. Usually, having a slide with the team toward the end of the deck implies that the team isn’t very good or isn’t a good fit for starting this company.

The thing is, I spent an hour talking to McLeod, and he’s got more blockchain experience than most and has built companies on the technology for a fair few years. I also know he hired some extraordinarily smart people.

I get that sometimes companies want to downplay things or prepare themselves for a mic-drop moment. This slide is neither, and it’s useless to the point of silliness. In a 12-slide deck, you don’t have the space to throw away your shot (hey, that’s catchy! Someone should write a song about that), so either make the slide count or get rid of it.

What is “this?”

[Slide 8] By doing what now? Image Credits: Arkive (opens in a new window)

On slide 8, Arkive falls into the trap of getting that slightly wrong. The slide starts with “By doing this … ” but it’s unclear what the “this” is. Slide 7 is a phased product roadmap of sorts, but it’s not clear whether “this” refers to a particular phase, the building of the company in the first place or something else altogether.

This is what your English teacher would give you a walloping for, screeching “unclear antecedent!” while angrily waving a three-foot ruler around. No? Just me? Still, the point stands.

I also don’t love the rest of the slide. The dark red boxes on black with red text makes it hard to read; there’s too much text; the text is too small; and the headline is too wordy.

Here’s an alternative solution that halves the number of words on the slide:

Headline: At the intersection of web3 and Alternative Assets

- Crypto: Market cap is up 270% since 2017.

- Projection: 1 billion web3 users by 2030.

- Space for growth: Market cap is only 2% of global wealth.

- Doubling: AUM in alternative assets to double by 2027.

- Interest: 84% of investors plan to buy alternative assets.

- 10%+ CAGR across the asset class.

The next step would be to design the slide better and strip bullet points you don’t need. But by halving the number of words, you can double the font size and make the whole thing a lot more readable.

Show me the numbers!

Image Credits: Frank Straub / EyeEm (opens in a new window) / Getty Images

The deck is a great storytelling device, but it’s missing some very obvious information. The team didn’t remove the information from the slide deck either, which means it wasn’t there in the first place.

I’m talking about the financial aspects, or the story-as-numbers slides that I typically recommend. A company like Arkive probably has a financial and growth model, and I’d love to see it referenced with some graphs or growth projections.

In addition, you’ll need to show an operating plan as part of your fundraising efforts, so it makes sense to show what you’re planning with numbers. In Arkive’s case, it might make sense to outline product milestones, how many historical artifacts have been acquired, and some numbers around how much these items will cost.

It also isn’t entirely clear what the company charges for “membership,” which makes it far harder to ascertain whether the business model makes sense.

Remember that investors aren’t your friends or cheerleaders; they might want to dream of changing the world, but they also need to show a return to their LPs. Make it easier for them to paint your dream in numbers — it makes it far easier to give an enthusiastic “yes!” to backing your company.

The full pitch deck

If you want your own pitch deck teardown featured on TechCrunch+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice.