I am told that the angel groups of the Northeast have one of the best systems for syndicating deals in the country. There are many parts to making that happen. I have the privilege of running the nomination, application, and selection processes.

The process is efficient and fair and might be helpful to other angel groups, or to other groups who see a lot of applications from people seeking money (accelerators, foundations, government agencies, etc). And… no coders or high-tech talent required, we do it all with free/cheap tools we can easily modify to meet our needs!

None of what I am sharing would be possible without the contributions of the staff of the Angel Capital Association (ACA) and the participation of so many angel investors.

Process Overview

- Set the timetable

- The ACA selects a date for the regional event.

- 7 days before the event we announce which teams are presenting.

- 14 days before the event applications from entrepreneurs are due.

- Call for nominations

- Keep a canonical list – If you don’t have a canonical list, you are going to miss people. The Angel Capital Association maintains a Google Groups mailing list containing the leaders of all angel groups in the region and anyone who has served as a deal lead for a previously-nominated deal.

- People forget, so remind them – We send out “call for nominations” emails (and reminders) to the mailing list and personalized versions to each member of that mailing list 1 day before the deadline, 7 days, 14 days, 21 days, and 30 days. To keep it from being annoying we use features of MixMax so that anyone that writes me back doesn’t get follow-on reminders.

- Make it easy – Most angel investors do this as a hobby, so you need to make it easy for them. We, therefore, pack all the info they really need into the “call for nominations” email. Furthermore, the only things they have to do are:

- Forward that same email to the CEO of the company they want to nominate.

- Email the CEO a short endorsement blurb.

- Put the work in the hands of the people motivated to get it done – You’ll note in the prior step almost all the work is done by the startup CEOs. They are very motivated to get things done, done right, and on time. Even the email is very short so the deal leads can read it quickly and pass it on. Then the entrepreneurs click the link embedded in the email to get a full page of detailed instructions.

- Here is what one of our “call for nomination” emails looks like

-

Subject: Paul, nominate deals by 3/15 for next ACA NE Syndication Meeting

Request:

- Nominate deals by 3/15 @ 11:59pm for the upcoming ACA NE Syndication Summit by

- Forwarding this link (http://goo.gl/d4wgm) to deal CEOs.

- Sending the CEO a < 5000 character summary of your investment thesis (CEOs include it when they fill in the application form).

- Help select presenters by reviewing the best companies in the region. Sign up via this form to join the selection committee.

Background:

- Nomination Requirements:

- Your group will champion the deal and serve as the central coordinator for follow-on due diligence efforts.

- Deals in due diligence or in term-sheet negotiation are certainly welcome. That said, preference will be shown to deals that at least have a term sheet from the champion angel group.

- Deal leads are strongly encouraged to serve on the Selection Committee so we can learn more about the company you are nominating. Time commitment is about 2 hours to read deals and 45 minutes for a con call. Please note that we have a simple and effective ranking system that removes conflict-of-interest issues while allowing us access to the personal knowledge of the deal leads. Sign up to help select presenters via this form.

If there are any questions, do not hesitate to contact me.

- Nominate deals by 3/15 @ 11:59pm for the upcoming ACA NE Syndication Summit by

-

- Provide clear instructions for entrepreneurs – This is obvious, but most of us goof it up anyway. We certainly did for years and are always striving to be clearer and more respectful of the entrepreneurs’ time. The “call for nominations” email features a link for the CEOs to click where they find all of their instructions.

- Collect applications – We collect applications via a google form. We configure the setting so that applicants get a receipt and have permission to edit their entry after submission. This turns out to be a gigantic time-saver, stress reducer and increases quality. Otherwise, you have panicking CEOs and/or deal leads calling and emailing you at all hours!

- Create packet – We have our google form dump its data into a google sheet (see a sample with dummy data here). Then by applying filters, some spiffy conditional formatting, and hiding some columns, we can have it display only applications that are for the current period.

- Send packet – This packet is sent to the mailing list so that the startups have maximum exposure to the investor community and to set the stage for voting.

- Selection – This is done in two rounds.

- Round 1

- Ask everyone – You want to leverage the wisdom of crowds by getting lots of smart people to independently assess the startups. So we ask all members of the mailing list, as well as all angels who nominated a deal this time around, to cast votes. The requirements are that they review all applicants and vote on all of them.

- Collect the votes – Angels are not asked to rate companies by how much they “like” the company. Instead, we ask them to predict how successful the company will be at raising money thanks to the event. The difference is subtle, but it is important. See the 1st round voting form (w/ dummy data). Angels have a set deadline to cast their votes.

- Normalize the data – Some people score generously. Some people score harshly. We adjust everyone’s scores so that each angel’s scores add up to 100 points.

- Adjust for conflicts of interest – We want people who are invested in one of the nominees to vote. But obviously, they are biased in favor of their nominees. To mitigate this we…

- Don’t let angels score companies they have a conflict of interest with (equating to an initial score of zero). As this would hurt their nominee, we then…

- Replace the 0 scores with the average score the other angels gave the company. In this way, an angel does not help or hurt their nominee.

- As each angel’s scores added up to 100 before, because of step 2 we’ve just increased their total contribution. So…

- We decrease the angel’s other scores proportionally to bring their total score back down to 100.

- You can see all the gory math here.

- Schedule the video conference for the 2nd round.

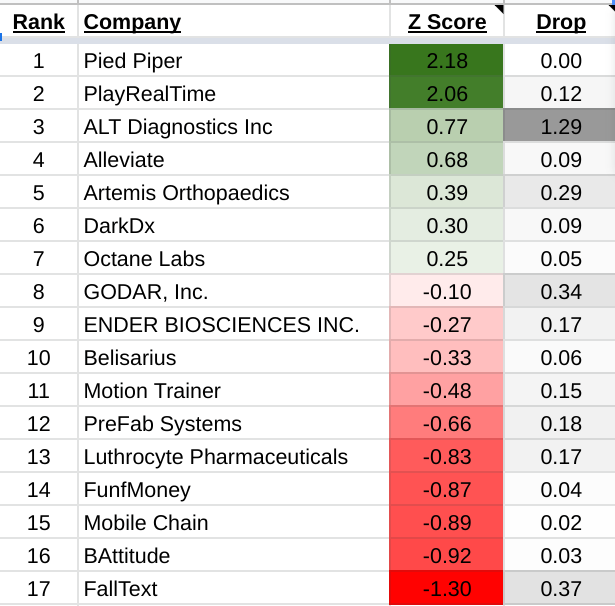

- Publish results of 1st round – The mailing list and everyone who signed up to be on the 2nd round video conference get an email that looks something like this…

-

Subject: ACA NE selection, 1st round voting results [confidential]

CONFIDENTIAL – DO NOT REDISTRIBUTE

Okay, legal stuff out of the way, happy day all! Here are the results of the first round of voting. We’ll use this to inform our conversation later today <date/time/link info>

* Z Score: # standard deviations above or below the mean score. AKA how much better or worse is this company than the average company in the packet. Note that scores have been adjusted for conflict of interest.

* Drop: # of standard deviations this company is below the next highest ranked company. AKA, how much “worse” is this company than the previous company.My initial recommendation is:

* Accept the top 7 ranked companies.

* We debate who the remaining 3 slots go to, accepting arguments from the next 5 highest-ranked teams. If there is a champion for any of the other companies, they will get a spot to advocate for the company.

* I shoot everyone a poll to cast a 2nd round vote for who should get the remaining slots.Details:

You can see the gory details on this google sheet. Most relevant tabs are: “Summary”, “Chart of Scores”, and “Chart of Dropoff in Score”

-

- 2nd round – Goal is to allocate 8-12 presentation slots

- Save Time – The purpose of the first round is to save time for the 2nd round. We’ve all been in deal selection meetings that go on forever and aren’t even all that effective. When you see a chart like the one above, it makes the argument faster. The top-rated companies just get in, no debate needed. The bottom companies don’t get in for much the same reason. You can then focus the time on giving away the final 1-3 slots to the much smaller set of companies in the middle.

- Debate – advocates for the companies in the middle get to speak for 1-2 minutes. Allow a few minutes for Q&A. Move on to the next company.

- Final Vote – Using this free tool I create a ranked-choice voting poll while everyone is debating. When the debate is over I publish the voting link to the chat in the video conf and give everyone 5 minutes to cast their votes. As it is ranked-choice voting, the final selections are ones that have majority support, which is awfully helpful. I present my screen and show people the poll results, I also email them to the participants so everyone has an audit trail of the voting.

- Round 1

- Wrap up

- Startups (and their nominating angels) that did not get in receive a polite note letting them know. They also get copies of the feedback provided in the 1st round voting form so we can help them learn from failed bid to present.

- Startups (and their nominating angels) that got spots receive an email with a link to a google doc with detailed instructions on everything they need to maximize their odds of success.

- The list of nominating companies is announced to the Google Group mailing list.