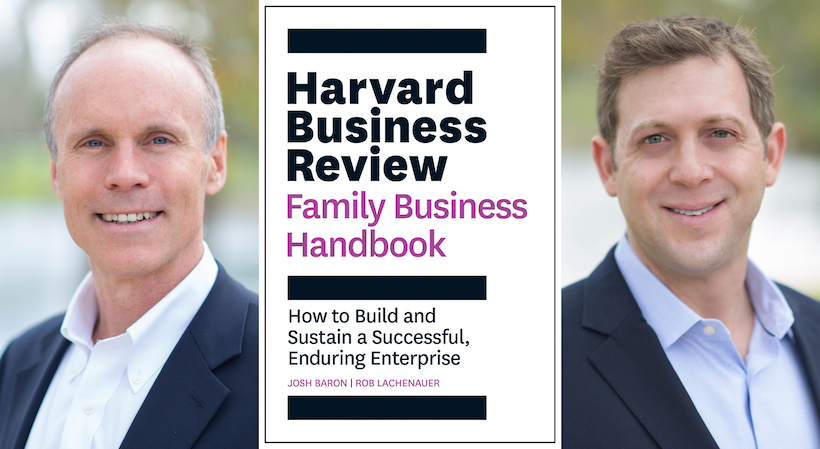

The following is excerpted from “The Harvard Business Review Family Business Handbook: How to Build and Sustain a Successful, Enduring Enterprise” by Josh Baron and Rob Lachenauer (Harvard Business Review Press, 2021).

It may seem counterintuitive to those who are neck deep in building their business, but if you want to build an enduring legacy to pass to the next generation, it’s never too early to start your continuity planning.

Even with good intentions, many owners find it difficult to plan their own eventual transition from the business that has become part of their identity. But delaying or poorly planning your transition can wreak havoc on the business (and the family) in the long run.

A BCG study of more than two hundred Indian family businesses found a “28-percentage-point differential in market capitalization growth between companies that had planned transitions and those that had not.” The study concludes, “An enormous amount of value is destroyed by unplanned transitions, with potentially catastrophic consequences for the business.”

StartupNation exclusive discounts and savings on Dell products and accessories: Learn more here

While there is no correct way to make the transition from one generation to the next, we have seen five main approaches that are likely to fail. If you identify with one—or more—of these scenarios, you are likely to be headed off the continuity cliff.

A problem patriarch or matriarch

This type of leader can’t let go. Patriarchs or matriarchs rule all aspects of their family business with an iron fist. Their hardball behavior, which led to their business success, is applied to the next generation, which finds it impossible to thrive under an iron-fisted senior leader. Because of this person’s oppressive behavior, the members of the next generation are incapable of leading the business or are so hurt by their previous experiences that they have no interest in continuing the business. Often, after the domineering leader leaves, they sell the business.

The one-size-fits-all fallacy

Governance, roles, and processes that worked brilliantly in one generation can be a disaster in the next. Even with good intentions, the senior generation can set the younger generation up for failure by maintaining rigid leadership roles without allowing the younger group to consider approaching leadership differently. Each generation brings different interests and skills to leadership—and the business itself may need different leadership skills. It’s a mistake to assume that what worked for one generation will be right for the next generation, too.

Ruling from the grave

Owners can set the rules by which the next generation will work and own the business together, often through formal vehicles like wills or trusts or through handed-down cultural expectations. The goal is often to protect what you have created and to help the next generation avoid mistakes. However, these formal approaches often backfire. Ruling from the grave removes the autonomy of the next generation to chart its course and to respond to changing circumstances. Trusts are very difficult to undo, and even cultural expectations are hard to shift.

Related: 12 Keys to Family Business Success

The chosen one

Many families have a cultural tradition that even when ownership is shared, the eldest male is put in charge of the family business. Sometimes, this person is given a greater ownership stake in the company (or all of it), and sometimes the power comes from being tapped on the shoulder by the previous generation. This tradition can help avoid battles over succession, since everyone knows their role at a young age. But more often than not, we have found that designating a successor at birth causes more problems than benefits. Even if it’s not spoken aloud, everyone will recognize that the chosen successor may not be the best candidate for the job—that this person simply has the luck of being born first. This approach also places great pressure on the “chosen one.” Meanwhile, the rest of the family often feels disengaged and resentful.

Sign Up: Receive the StartupNation newsletter!

All for none, none for all

When the current owners disagree on priorities, the individuals often want to compete with each other rather than collaborate. One way this competition happens is succession by attrition. For example, a “last one standing” provision in a shareholder agreement states that if, say, a company has three shareholders and one dies, then the two remaining shareholders must buy the shares from the surviving spouse at a discounted price. If a second shareholder dies, then, again the remaining shareholder is the buyer. The last person standing now probably owns all of the business, but because the business is likely to be heavily indebted, the last person will probably need to sell, too.

Maintaining family ownership over the years is a complicated endeavor. It requires making decisions that will reverberate for years to come and that are based on imperfect information about the future (e.g., which of the next generation will be the most qualified to lead the business?). These decisions are steeped in meaning, connecting to issues of fairness (do I treat my children equally?) and identity (what do I do after I have exited from my life’s work?).

To make a good transition, you need a continuity plan that maps out the path from the current generation of ownership to the next. Though the current owners will make the final calls, the process requires cross-generational collaboration skills. Everyone needs to understand how this transition will work. Family empires are consolidated or squandered in the transfer of power to younger generations.

We can’t state this strongly enough: a planned transition is far better for both the business and the family in the long run.

“The Harvard Business Review Family Business Handbook” is available now and can be purchased via StartupNation.com.