How it feels to be the elephant in the room.

Hey Founders,

You can let out a breath. It's 2021 and we made it. While many hope this year will mark a return to normalcy, it's anyone's guess when normalcy will come and what it look will look like. As founders formulate their annual forecasts, this unknown is beginning to feel like the proverbial elephant in the room.

But 2020 was a mixed bag for healthcare ventures. It rapidly accelerated the adoption of some healthtech subsets, while stymied clinical progress and enterprise traction for others. So here we'll summarize healthtech investing trends from this last year and highlight lessons learned from enterprise healthcare leaders. Let's dive in.

You can apply for our next Customer and Investor Sprints through Feb 15th, 2021.

2020 Review - Healthtech Investing Trends

|

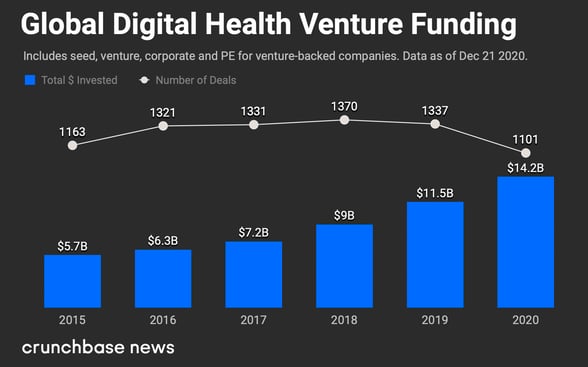

Sector | The first half of 2020 signaled a record year for healthtech investing and we saw that trend persist through year end. "Investors in the space poured record investment dollars into digital health startups in 2020: $14.2 billion globally and $9.2 billion domestically", according to Crunchbase.

|

|

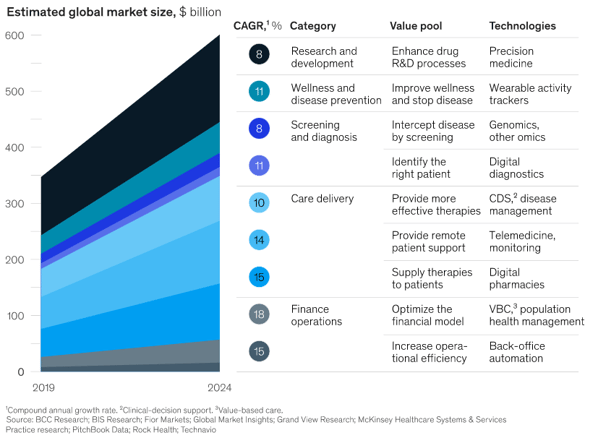

Subsets | A rising tide lifts all boats. According to McKinsey's report, "all digital health value pools are expected to grow by at least 8 percent annually through 2024." They noted the two biggest drivers of cost savings were value props tied to increased operational efficiency and remote patient support.

|

|

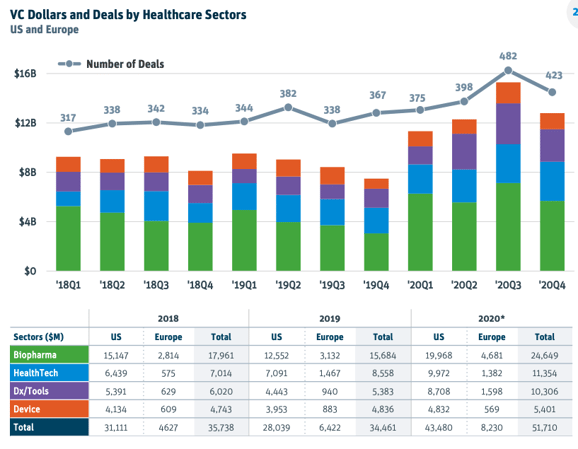

Perspective | While biopharma still commands the most venture dollars, this year-end Silicon Valley Bank report shows how quarterly investment dollars compare to other sectors. In 2018, total healthtech funding was roughly 39% of biopharma funding. That proportion grew to about 55% in 2019 and ended last year at 46%. Funding for diagnostics/tools had a big year of growth and followed close behind healthtech this year, with medical device funding coming last.

|

2020 Review - Enterprise Healthcare Perspectives

| "The financial impact of Covid-19 has increased our focus on cost optimization, leading us to conduct a deep review of operations, including contract renegotiation/cancellation, application portfolio rationalization, contractors, etc. IT will concentrate on these areas as high priority to continue supporting Covid-19 efforts." |

Kristin Myers, CIO, Mount Sinai Health System | MedCityNews

|

| "The silver lining of the pandemic is that the 'risk benefit' equation of healthcare delivery and biomedical research has shifted significantly, and it has allowed innovation to flourish over the past 12 months. Many of these innovations, such as telehealth and mRNA vaccines to name a few, will be saving lives for centuries – long after COVID is simply a word in history books describing a few unfortunate years." |

Daniel Durand, CIO, LifeBridge Health | Beckers

|

Office Hours with Dreamit Healthtech

.png?upscale=true&width=1172&upscale=true&name=Office%20Hours%20Banner%202%20(1).png)

Want VC advice? Check out Dreamit Healthtech Office Hours!

Our team is available to discuss healthtech strategy, key issues for your startup, or hear your pitch live. If you're a healthtech founder, office hours are a great way to get in front of us. Click above or book here.

Latest #DreamitDoses

We've compiled and organized every Dreamit Dose on our website. You'll find the three most recent Doses from our team below on pitching VC associates and the best way to answer two common investor questions.

|

5 Things VC Associates Wish Founders Knew Before Their Call - The venture capital screening call is an important step to get right in due diligence. In this Dreamit Dose, Alana and I offer five things we wish founders knew after screening over 1,000 startups in the last year. |

|

.jpg?upscale=true&width=572&upscale=true&name=maxresdefault%20(1).jpg)

|

How To Answer: “How Much Are You Raising?” - In this Dreamit Dose, Adam Dakin, Managing Director of Dreamit Healthtech, gives you his insight on how to answer ‘How much are you raising?’ It’s an important question that almost invariably comes up during post-pitch Q&A.

|

|

.jpg?upscale=true&width=576&upscale=true&name=maxresdefault%20(2).jpg)

|

How To Answer: “What's Your Valuation?” - This question is a common component of investor Q/A. Seasoned founders have a particular way of framing their answer to investors. In this Dreamit Dose, Adam reveals the right approach on how to answer the valuation question when pitching VCs. |

Dreamit Portfolio Company Updates 👏👏👏

- RxLive joined Dreamit Healthtech

- CareAlign made Technical.ly's RealLIST Startups 2021

- Vitls joined KidsX Accelerator's 2021 class

- Voiceitt collaborates with Amazon Alexa

- NeuroFlow raised $20M in Series B funding

- Redox partnered with Withings

Follow Dreamit

👋🏼 Subscribe to the Dreamit Newsletter