They say pressure makes diamonds. I’d say that’s also true for recessions creating amazing startups. Airbnb, Uber and Groupon are great examples of companies that emerged during the recession in 2008.

How does one build, scale and navigate the headwinds of a recession, especially as consumer behavior changes dramatically? That’s without even going into the complexities of 2022, such as the degradation of ad targeting (due to Apple’s App Tracking Transparency program) and post-pandemic behavioral shifts.

But there is a path we can follow to strategize and execute during a recession — my Triple R model: Re-forecast, re-prioritize and refine.

Re-forecast your models

If new channels and major experiments were in the picture, it’s probably best to shelve those for when the markets recover.

It’s no secret that average revenue per user (ARPU) is dropping at companies across the board. A prime example is the stock-trading platform, Robinhood, which reported an ARPU decline of 62% — that’s $53 compared to a high of $137 during the first quarter of 2021.

That’s a massive decline. If Robinhood was once comfortable acquiring users at $137 to break even, it would now be acquiring users at nearly three times the revenue it brings in.

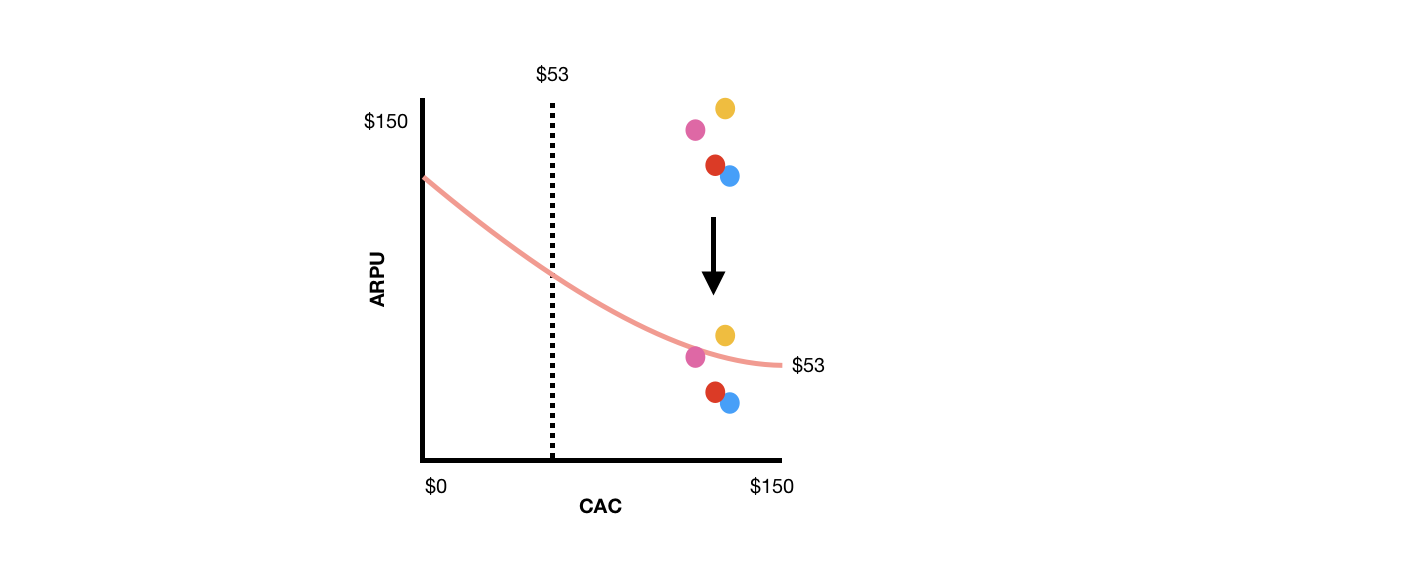

A simulation of Robinhood’s CAC/ARPU by channel. Image Credits: Jonathan Martinez

In the chart above, ARPU drops from $137 to $53. More specifically, the colored bubbles represent channels and their CAC/ARPU relationships. Robinhood was acquiring users in the $130 CAC range and expecting ARPU of $137. The shift in these channels depicts how CAC remains constant while ARPU drops.

This type of acquisition is not sustainable and demonstrates what many startups face during recessions due to lower consumer demand. As a result, leveraging COVID-era data to inform ARPU is no longer of any use to many businesses.

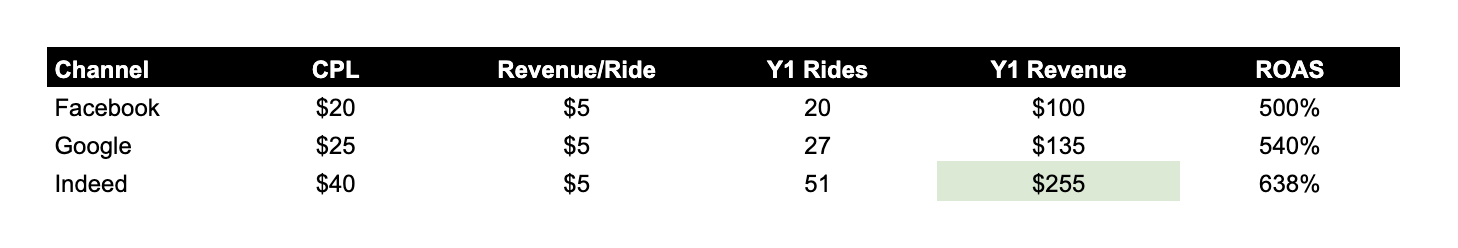

Instead of relying on longer historical data windows, it is now necessary to use smaller data time frames to project revenue. The table below illustrates how a startup can project revenue using a shorter window.

Projecting startup revenue with shorter revenue windows. Image Credits: Jonathan Martinez

By considering new monthly transactions and average revenue per transaction, you can compute the revenue for Y1. This paints a more accurate picture of how much your users are now worth.

Using solely 30 days of data is OK as an interim solution, and at any rate, it is much better than bleeding cash.

Re-prioritize growth initiatives

If new channels and major experiments were in the picture, it’s probably best to shelve those for when the markets recover. This is the time to double down on the following:

- Most efficient growth channels.

- Owned media (i.e., social, lifecycle, etc.).

- Channel optimizations.

After re-forecasting, you will most likely need to reallocate budgets and optimize channels that give you higher CAC than the newly forecasted ARPU. To supplement the decrease in paid acquisition, it can be advantageous to leverage owned media such as lifecycle marketing. Instead of heavy discounting (which decreases ARPU), think about messaging that aims to promote referral programs or new product enhancements.

During my time at Coinbase, markets began sinking amid the 2022 “crypto winter.” Consequently, the growth marketing team swiftly re-prioritized projects. Instead of focusing on expensive experiments, the team clamped down on lifecycle marketing to increase user engagement and reactivate churned users.

This showcases that you don’t always have to “acquire at all costs” if it doesn’t make sense, even if you’re a company worth billions.

Refine your growth efforts

There’s no better time to refine your growth marketing tech stack and overall growth efforts than during a slow period. This is particularly important for startups that are struggling with data degradation due to the iOS 14.5 privacy changes. For example, iOS 14 advertisers are at the mercy of modeled conversions on paid channels such as Facebook for ad-level reporting. This has created a massive blind spot in understanding how creative is performing.

So what can we do to improve a marketing tech stack? Listed below are a few key and timely pillars to focus on:

- Staying up to date on new measurement tools.

- Testing on channels where data is available.

- New measurement methodologies (i.e., incrementality).

Take the time to understand the tools being built to help combat data degradation, such as Facebook’s conversions API (CAPI). With CAPI integrated, advertisers can send data back to Facebook, server to server (S2S), rather than relying on web pixels. This creates a much stronger signal that is less likely to be affected by privacy restrictions.

If you don’t have accurate ad-level data, this is a great time to test creative, copy and other attributes for which data is available. For example, creative can be tested on owned channels, such as lifecycle or platforms like Android and web. The results from these tests will help supplement areas where you don’t have much data when it’s time to step on the pedal again.

There’s no perfect marketing tech stack, and even companies like Uber have gaps in their data. When I worked at Uber, we had to constantly build formula-rich models to account for data gaps or to improve our forecasting. When new incrementality tests would hit statistical significance, we would immediately leverage that data and add it to our attribution tables as scalars.

As you decelerate, you open opportunities for new measurement tests. If we pause Google Ads, how much do conversions decline? How about Snapchat Story ads or TikTok as a whole?

If incrementality is battle-tested before it’s time to scale back up, the allocation of budgets will be much more efficient.

Looking ahead

There’s no denying that 2022 is different. While all the doom and gloom sounds terrible, many startups have emerged stronger than ever from recessions because they’ve adapted to new conditions by re-forecasting, re-prioritizing and refining their growth efforts.

Therefore, it’s important to remember that this methodology is not something you can set and forget. Instead, the Triple R model should be reevaluated constantly.

If we traveled into the future by a few years, would you look back and say you made the necessary changes during a market downturn?