It’s Halloween. And, if you’re contract management software company Icertis, it’s payday. After raising $115 million in 2019, Icertis today secured $150 million — $75 million in convertible debt and a $75 million revolving credit facility — in a combined tranche from Silicon Valley Bank that brings the company’s total capital raised to $520 million.

By going the debt route, Icertis avoids having to answer the tricky question of valuation in an especially challenging economic environment. (Icertis was valued at $2.8 billion as of March 2021 and reportedly as high as $5 billion earlier this year, but valuations in tech are on a steep downswing.) Convertible debt allows Icertis to pay its loan obligation with equity or stocks, while the credit facility lets it borrow and repay on an ongoing basis.

CEO Samir Bodas was rather vague about the plans for the new cash, but told TechCrunch in an interview that it would involve “accelerating the application of transformational technologies like artificial intelligence, natural language processing, machine learning and blockchain to deliver material, unique and consequential value to customers.” That’s all rather ambitious (and, truth be told, a little buzzwordy), but Bodas asserted that Icertis is well-positioned to fend off rival startups in the cutthroat contract management space.

“Industry analysts like Gartner and Forrester refer to our category as contract lifecycle management (CLM), but Icertis differentiates from traditional CLM vendors,” Bodas said. “We not only deliver efficiencies in contract creation and negotiation, but we use AI and natural language processing to structure contract information into on-demand data and connect that data to operational systems … to automate processes, maximize contract value and ensure compliance.”

Founded in 2009 by Bodas (a veteran of Microsoft and Aztecsoft) and Monish Darda (previously an executive at BladeLogic), Icertis provides cloud-hosted tools for managing procurement, sales and corporate contracts — including tools that can read and analyze contracts to deliver risk management reports and automatic obligation tracking. The platform systemizes contracts and the associated documentation, extracting data like contact information and clauses to figure out contractual commitments and monitor them to ensure compliance.

Ingested contracts can be used to model commercial relationships in Icertis, letting users identify contracts missing clauses necessary to complying with regulations like GDPR. Bodas claims the AI systems powering this and other features of the Icertis platform are among the most capable of their kind, able to process over 7,000 different types of contracts across 11 verticals.

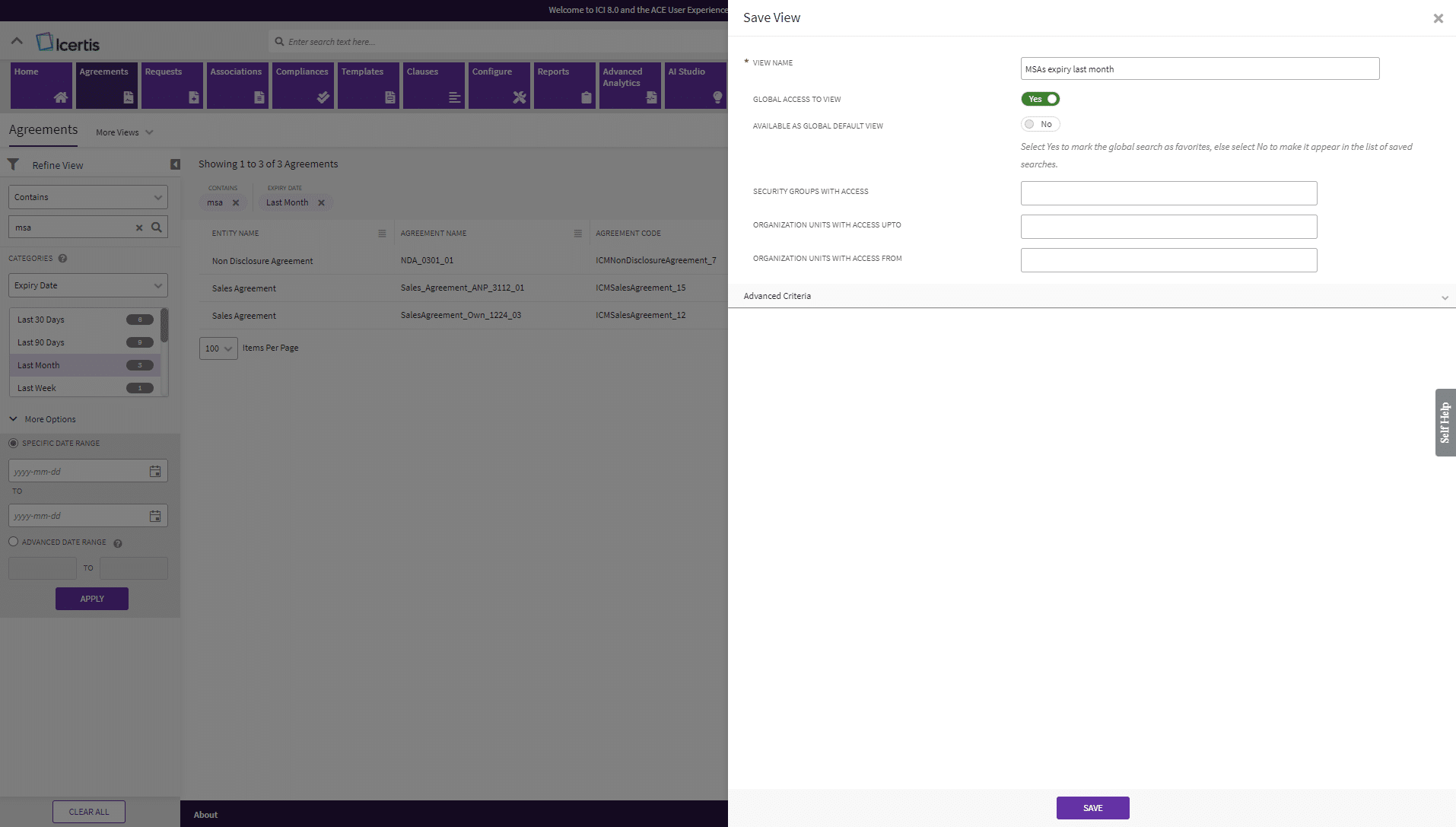

Icertis’ contract management software, which runs in the cloud. Image Credits: Icertis

“We are forging and leading a new category of technology — contract intelligence — which uses AI to automate processes and deliver insights with structured, connected contract data to digitally memorialize the purpose of every commercial relationship and ensure the intent of those agreements is fully realized,” Bodas said.

That’s a bold statement. But it’s true Bellevue, Washington-based Icertis is already one of the larger and more successful contract management software vendors to emerge in recent years. Bodas says that the company exited 2021 with an annual recurring revenue north of $100 million and recently surpassed $200 million in recurring revenue. He declined to disclose the size of Icertis’ customer base, but he noted that current clients include Microsoft, Boeing, Google, Johnson & Johnson, Sanofi, Mercedes-Benz and Qantas and unnamed public sector agencies.

This year, Icertis announced a partnership with SAP to make Icertis the CLM solution of choice for SAP customers. (Alongside SoftBank, SAP holds a minority stake in Icertis.) Bodas says it’ll create a contract management “ecosystem” for SAP clients through integrations with SAP solutions like Ariba, Fieldglass, S/4HANA and SuccessFactors.

“In this economic downturn, we believe contracts, which govern every dollar in and out of the enterprise, will emerge as the go-to asset because they are an untapped source of invaluable business value to reduce costs, manage risk, ensure compliance and drive revenue,” Bodas said. “We are bullish that contract intelligence will emerge from this downturn as the fifth system of record in the enterprise, and that Icertis is positioned to lead it for the long term.”

Investors see promise in contract management legal technology for procurement, sales, finance, legal and HR like Icertis’ — perhaps because of the enormous addressable market. The contract management lifecycle market is expected to grow from $1.5 billion in 2019 to $2.9 billion by 2024, according to Markets and Markets.

The early adoption metrics certainly have been promising, with one recent Bloomberg Law survey showing that more than half of in-house lawyers were using contract management programs in 2020. Bodas says that Icertis’ platform alone has handled more than 10 million contracts worth over $1 trillion in more than 40 languages and over 90 countries.

“Contracts are an invaluable source of original data — documenting and governing the entitlements and obligations between a company and its suppliers, customers and employees. In other words, contracts provide a single source of truth for commercial relationships,” Bodas said. He gave an example: “Recently, customers have been turning to Icertis to help them navigate inflation as best they can. Do their contracts have clauses that enable them to adjust prices in the event of inflation, how often can they raise prices, and by how much? We deliver these insights instantly, so every entitlement within a company’s contracts can be realized for maximum value.”

Among Icertis’ competitors are ContractPodAI and SirionLabs, which raised $55 million in July and $85 million in May, respectively, for their automation-fueled contract management software. Another formidable rival is LinkSquares, which landed $100 million in April to grow its platform that combines legal analysis with contract lifecycle capabilities.

For what it’s worth, Icertis dwarfs them in size, with more than 2,000 employees spread across its offices in New Jersey, Chicago and elsewhere.