Alumni Ventures launches Women’s Fund 1

American Entrepreneurship

MARCH 27, 2024

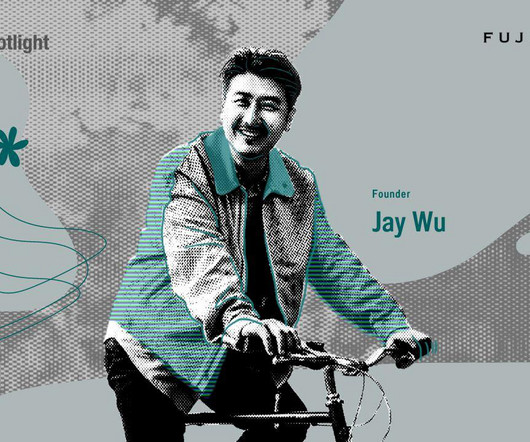

Women-founded startups show measurable positive results compared to those of men Alumni Ventures (AV), the most active venture firm in the U.S. billion from 10,000 individual investors since its founding in 2014, the firm has funded to date over 350 companies founded or led by women of its 1300+ current portfolio companies.

Let's personalize your content