How Will a Venture Capital Recovery Feel? Observations from 2008

Tomasz Tunguz

AUGUST 6, 2023

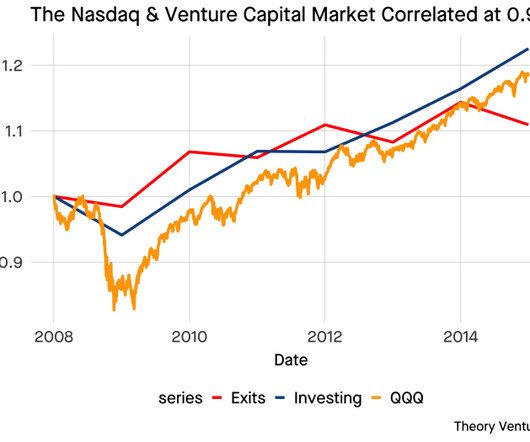

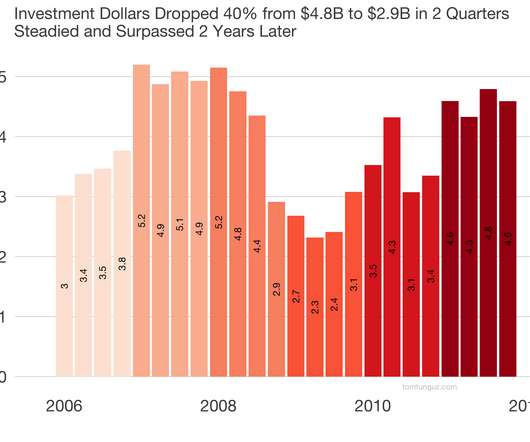

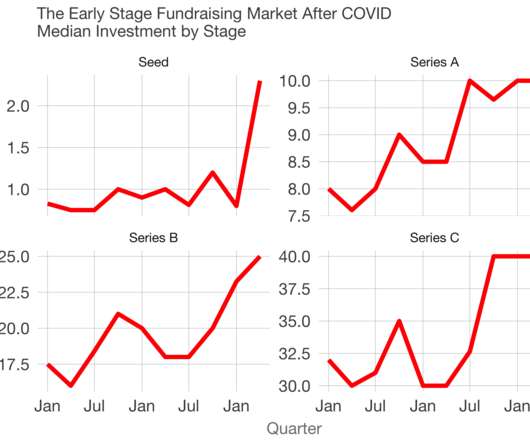

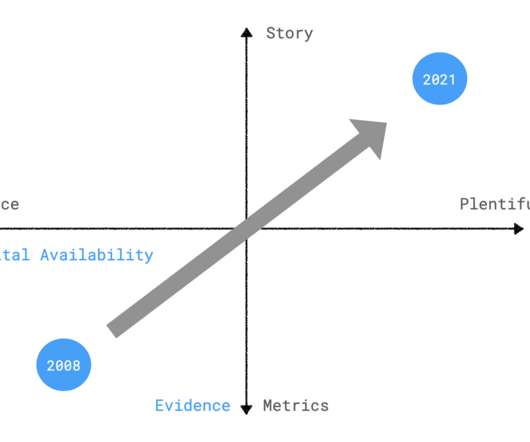

What will a venture capital turnaround feel like? In 2008, I had just become a venture capitalist. With 15 years’ perspective, I plotted the QQQ (Nasdaq) value against venture Investing activity & venture Exits activity (all log normalized). Will it be gradual or sudden? for QQQ/Investing & 0.93

Let's personalize your content