In the News: Coronavirus, industry reinvention & venture capital

OurCrowd

MAY 11, 2020

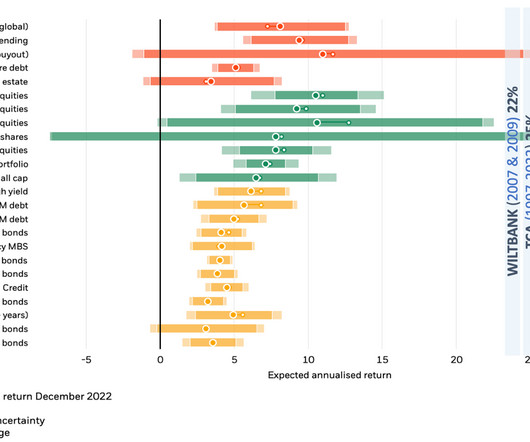

Historically, venture investing right after major market downturns – such as after the Internet bubble burst in 2000-2002, and after the financial crisis of 2007-2009 — has proved lucrative because you’re buying at a discount. That’s a very good entry point for new venture investors. Director of Operations for Rewire (Israel).

Let's personalize your content