This quarter, strong earnings results from public cloud companies were overshadowed by a seemingly endless IPO cycle. Another moment we somewhat missed over the last few weeks was the stock market pushing the value of public cloud companies to all-time highs.

These events are connected. And they bode well for startups working on SaaS and API-delivered software, which are keeping the climate for cloud venture investment warm and valuations stretched by historical norms.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

The earnings results that have made Wall Street content include a growing number of cloud companies that are seeing revenue growth accelerate from Q2 2020 to Q3 2020, according to a recent analysis by Redpoint’s Jamin Ball.

Astute readers will recall that The Exchange chatted with Ball after the Q2 earnings cycle, a conversation that included puzzling over how to square a nearly uniform deceleration in revenue growth from Q1 to Q2 in the software sector, which, at the very same time, was supposedly undergoing a boom in demand thanks to the pandemic and a suddenly remote workforce.

One hypothesis Ball offered was that deals signed in Q2 by SaaS companies would not show up much until Q3 if they were signed in the back-half of the quarter. Regardless of the reason, Q3 featured a far-stronger crop of cloud results that imply a strengthening sector.

For us startup watchers on the hunt for a hint of what is going on in opaque private markets, this is a useful data point. If you’ve been slightly befuddled as to why the venture capital space has seen deals accelerate with time-to-conviction falling from weeks to minutes — and pre-emption the new normal — this is part of the why.

For us startup watchers on the hunt for a hint of what is going on in opaque private markets, this is a useful data point. If you’ve been slightly befuddled as to why the venture capital space has seen deals accelerate with time-to-conviction falling from weeks to minutes — and pre-emption the new normal — this is part of the why.

As the future has been pulled forward when it comes to digitizing the American and global economies, it’s a good time to be a software company. This was visible in SaaS company Smartsheet’s earnings this quarter. The Exchange chatted with CEO Mark Mader about his company’s recent earnings results that beat expectations and led to the company’s shares rising. Analyst upgrades have followed.

This morning, let’s examine the data regarding how many cloud companies are seeing revenue growth accelerate, dig into Smartsheet’s results to see what we can learn (hint: SMBs matter), and then apply all our findings to the startup market itself so that we can go into the weekend as informed as possible.

Public acceleration

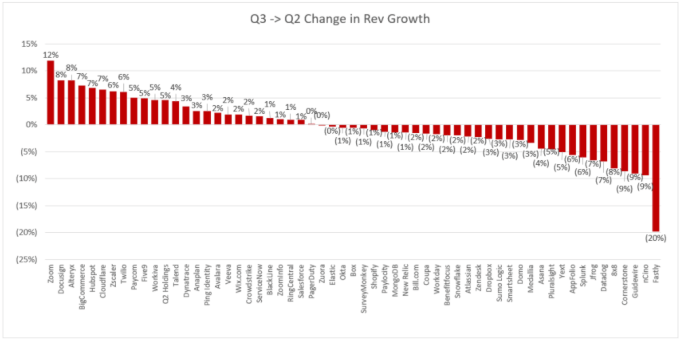

At the risk of being cheeky, I’ve embedded Ball’s chart concerning Q3 revenue acceleration from cloud companies below. (If you are into similar data sets, he’s worth following on Twitter.) Here’s the data:

Image: Jamin Ball

This chart shows Q2’s cloud year-over-year growth rates subtracted from Q3’s own; a result greater than one shows that a company’s year-over-year growth accelerated from the second quarter to the third. The higher the number of cloud companies that wind up with a result of 1% or greater in the above chart, the faster the cloud market as a whole is accelerating.

In Q2 2020, just seven companies met the test. It was more than 25 in Q3.

Smartsheet is an interesting company to discuss in this context. The company’s growth actually shrank slightly from Q2 to Q3, so you might not think it fits our line of inquiry; if the company isn’t accelerating, why do we care about it?

Because even though it failed to grow more quickly in Q3 — it decelerated from 41% growth to 38% growth — it bested expectations, and analysts have since upgraded its stock. Deceleration and such a good reception? Let’s figure out what’s happened.

Smartsheet’s recent quarter came in ahead of expectations in terms of both growth (revenue) and profitability (earnings per share). And the company detailed a number of performance metrics that were growth-friendly, including annual contract value (ACV) rising 42% compared to the year-ago period, a 73% year-over-year gain in customers with ACV of greater than $50,000, and an 83% gain in customers with an ACV of greater than $100,000 over the same time period.

Toss in dollar-based net retention of 125%, and Morgan Stanley was content to say that the company “could be spring-loaded for strong growth in 2021.” Worth about $62 per share before its earnings report this week, Smartsheet is now worth more than $69 per share today after giving back some of its post-results gains.

How did Smartsheet manage to woo Wall Street and create the market impression that it has strong growth to look forward to? According to Mader, Smartsheet has a better idea of how to sell during COVID-19 than it did before, citing a need to approach the market in a different manner than it once did.

And the company’s results included what its CFO described as “strength” in medium-and-large companies, along with “stabilization” in the SMB sector, implying reasonable-or-better buying intention from the entire size gamut of business.

Mader clarified during our interview that SMBs are still under pressure in today’s economy, but added that small companies still have to make investment decisions, albeit with often reduced budgets; needed software can get into the spending mix.

Even more, the CEO said amongst the most-impacted industries from COVID, growth came in around 15%. In the best industries, that rose to 75%. If you can see past the pandemic, there could be more growth to unlock.

Investors seem to think so. And that optimism about Smartsheet and its even-faster-growing peers has helped push their collective valuations to new all-time highs, as measured by the Bessemer Cloud Index.

Now, let’s talk startups.

Private acceleration

It would be simple to say that the public cloud results are dragging software startups forward in terms of venture interest. That would help explain the faster deal cadence that we’ve seen in recent months and the valuation complaints that we’ve seen from investors on Twitter and other social platforms.

But I think it would be simplistic to stop there. Or at least incomplete. I also suspect that we’re actually seeing startup growth accelerate as well. And to be a bit silly and make a prediction based on my gut, I expect that we’re seeing startup growth accelerate in roughly similar proportions to what we’ve seen amongst public cloud companies in Q2 to Q3.

Provided that Ball’s COVID software timeline applies to all cloud companies and not merely public players, we can have some confidence in our optimistic take.

Which clarifies. Now the frenetic pace of deal making makes sense. Now the influx of news this deep into December is less odd. Things are hot everywhere in software-land, and a boiling pot cooks all vegetables.1

Closing, it’s nearly time to report on Q4 startup growth, after our fun-if-incomplete look at Q3 expansion. Please prepare your numbers. I need them.

- I tried.