As Roblox began to trade today, the company’s shares shot above its reference price of $45 per share. Currently, Roblox is trading at $71.10 per share, up just over 60% from the reference price that it announced last night. That effort finally set a directional value of sorts on Roblox’s shares before it floated on the public markets.

Roblox, a gaming company aimed at children and powered by an internal economy and third-party development activity, has had a tumultuous if exciting path to the public markets. The company initially intended to list in a traditional IPO, but after enthusiastic market conditions sent the value of some public-offering shares higher after they began to trade, Roblox hit pause.

The former startup then raised a Series H round of capital, a $520 million investment that boosted the value of Roblox from around $4 billion to $29.5 billion. TechCrunch jokes that, far from IPOs mispricing IPOs, that $4 billion price set in early 2020 was the real theft, given where the company was valued just a year later. Sure, the pandemic was good for Roblox, but seeing a 5x repricing in four quarters was hilarious.

Regardless. At $45 per share, Roblox’s direct listing reference price, the company was worth $29.1 billion, per Renaissance Capital, an IPO-focused group. Barron’s placed the number at $29.3 billion. No matter which is closer to the truth, they were both right next to the company’s final private price.

So, the Series H investors nailed the value of Roblox, or the company merely tied its reference price to that price. Either way, we had a pretty clear Series H → direct listing reference price handoff.

The company’s performance today makes that effort appear somewhat meaningless as both prices were wildly under what traders were willing to cough up during its first day of trading; naturally, we’ll keep tabs on its price as time continues, and one day is not a trend, but seeing Roblox trade so very far above its direct listing reference price and final private valuation appears to undercut the argument that this sort of debut can sort out pricing issues inherent in more traditional IPOs.

To understand the company’s early trading activity, however, we need to understand just how well Roblox performed in Q4 2020. When we last noodled on the company’s valuation, we only had data through the third quarter of last year. Now we have data through December 31, 2020. Let’s check how much Roblox grew in that final period, and if it helps explain how the company managed that epic Series H markup.

Gaming is popular, who knew

In broad strokes, Roblox revenue grew from $508.4 million in 2019 to $923.9 million in 2020. Those numbers work out to a roughly 82% gain in the year.

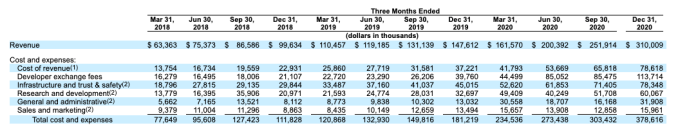

But if we dial into the company’s quarterly results, a far-steeper set of gains come into view. Here’s the chart, in case you want to read along:

If you observe carefully, you’ll note that from Q4 2019 to Q4 2020, Roblox grew 110%. And even more comically, Roblox managed to grow more than 50% from Q2 2020 to Q4 2020. In two quarters! That’s ridiculous for a company doing north of $200 million in revenue per quarter.

So, what can we make of Roblox’s final private and direct listing reference price valuations? At $310.0 million in Q4 revenue, the company was on a $1.24 billion run rate. Using the $29.5 million valuation, we can quickly compute a roughly 24x run-rate multiple for the company.

That’s two things: rich, and not. It’s a rich software valuation by historical norms, but it’s also not as high a number as it would be if Roblox was not a gaming company, and instead sold software on a recurring basis; the latter revenue varietal is worth more as it has proven more historically stable and predictable than gaming revenue.

But! We’re seeing a big conversation inside of the world of software about which is better, SaaS pricing or consumption pricing. Surely we could argue that Roblox is the latter? Right? And if so, does it really deserve what feels like a multiples discount?

Investors have thus far mocked the idea that Roblox should trade at a multiples discount, so we can infer that the final private investors in the company were too cautious in how they priced the company. And that its year-ago investors were flat-out legal bandits. (N.B. This is a compliment toward an investor.)

Doing some very rough and quick math, Roblox is worth around $47.4 billion. That’s a multiple of just over 38x its Q4 2020 annualized run rate. Holy damn; that is rather spicy. I have no real opinion if the number makes sense. I don’t know. But what we do know is that compared to other gaming stuff, Roblox is setting a new watermark for public worth, at least in revenue multiples terms.