Airbnb filed to go public yesterday, offering the world a look into its financial performance over the past several years. The company’s S-1 detailed an expanding travel giant with billions in annual revenue that was severely disrupted by the COVID-19 pandemic.

But past our overview of Airbnb’s core financial results and our look into which investors will make the most from its public debut, there are still questions that need answering.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

We need to better understand how far Airbnb’s bookings fell during the end of Q1 and the start of Q2, when travel first collapsed. And, how far those numbers have come back since. We also want to understand what sort of booking activity is driving those gains — is Airbnb really benefiting from a surge of long-term, local stays?

Then, to close, how profitable was Airbnb when times were good, and what sort of cash stockpile does the company have to get back to its former scale?

Then, to close, how profitable was Airbnb when times were good, and what sort of cash stockpile does the company have to get back to its former scale?

These five questions should help us better understand how Airbnb managed to survive some tough months and still file to go public before 2020 ran out. Let’s get to work!

We’ll take each question individually, to make our homework today as simple as possible.

How far did Airbnb’s bookings fall during Q1 and Q2?

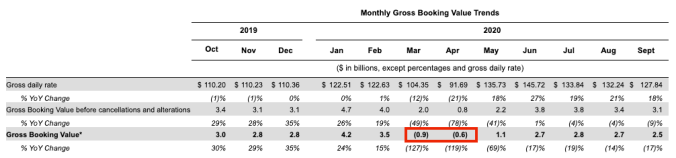

Let’s start by looking at Airbnb’s gross bookings on a quarterly basis. The company defines gross bookings as “net of cancellations and alterations,” so these numbers are not artificially inflated.

Here’s the chart:

Image Credits: Airbnb

Where does the decline begin? Q1, as we’ll see when we dig into monthly data, but the above chart does a good job painting just how bad things got for Airbnb in growth terms as Q1 closed and Q2 kicked off.

As you can see, Airbnb’s second quarter gross bookings were its lowest in recent history; Q2 2020 put up the smallest bookings result since at least the first quarter of 2017. For a company that had done $10 billion in gross bookings in a single quarter just over a year before, the declines were catastrophic.

But the results are actually worse than that chart shows; Airbnb actually saw gross bookings go negative for a few months.

How is that possible? Recall that the gross bookings figure discounts cancellations and alterations. So, if Airbnb had a big wave of cancellations, its gross bookings number could fall so sharply it goes negative, even if the company were still seeing some new bookings.

That’s what happened in March and April. Observe:

Image Credits: Airbnb

So how far did Airbnb’s gross bookings fall? They fell to -$900 million in March. More simply, Airbnb saw its expected rental volume fall by nearly $1 billion in a single month. And then in April it fell by another $600 million as more cancellations piled up.

That’s why Airbnb cut staff and took on expensive capital; its business had gone from accreting to bleeding in no time at all.

How far have Airbnb’s bookings come back since?

Flipping the coin from bad news to good, how far has Airbnb clawed its way back?

There are two ways to think about this. First, in quarterly terms, Airbnb has come back from just $3.2 billion in gross (which means net) bookings in Q2 2020, to $8 billion in Q3 2020. That’s a staggering return to form, even if Airbnb’s Q3 gross bookings were still off 17.5% from its year-ago Q3 total.

But inside the quarterly figures are some less-than-stellar data points. Observing the table from our first question, we can see that Airbnb’s gross bookings roared back into positive territory in May, giving the company a +$1.1 billion result. Then June saw the company’s gross bookings shoot to $2.7 billion, a figure that must have felt like a return to form.

But then Airbnb only saw modest gross bookings growth in July, which became negative gross bookings growth in August, falling even more in September. That’s the wrong direction!

Yes, Airbnb’s gross bookings in Q3 2020 returned to 80% of the company’s peak of $10 billion set in Q1 2019. But, inside the big number is more weakness than you’d probably like to see as COVID resurges around the world.

Did local, long-term stays save Airbnb?

Pretty much.

The general view about Airbnb I heard from folks in the pre-S-1 days was that users were renting houses and cabins near where they lived to get out of their own home for a bit, and that those longer-term, more local stays were buoying Airbnb’s revenue numbers.

Data mostly backs this up.

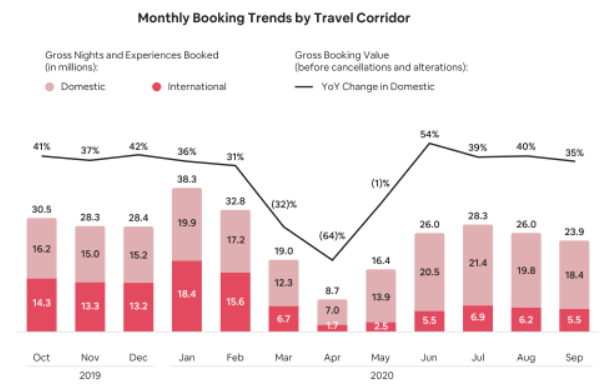

Let’s start by looking at trends in Airbnb’s domestic travel metrics, then look at changes in what I think of as hyperlocal stays, and finally changes in how long-term travelers rented spaces. The mix will make plain how Airbnb has molted during COVID-19 into a very different sort of hospitality company.

We’ll start with a look at domestic bookings, which Airbnb defines as “travel within the same country, when the guest’s origin country is the same as the destination country.” The company goes on to note that its business has “historically [been] weighted toward cross-border travel, which accounted for 49% of nights in 2019 relative to our estimate for the travel industry [of] 20%.”

But, after the pandemic hit, local travel started to grow, while international travel did not:

Image Credits: Airbnb

Starting in June, domestic travel started to grow on a year-over-year basis. It increased 21% in June, 17% in July, 16% in August and 14% in September. So while cross-border travel fell sharply (the red bits in the bar chart), more folks started to rent Airbnbs inside their home country.

At the same time, bookings that were more than 500 miles from “guest origin” have posted year-over-year declines since March. Bookings where user origin was between 50 and 500 miles started to rebound in June. Best of all, bookings where origin was under 50 miles started to come back in year-over-year terms in May, and of the three groups has seen the strongest results compared to 2019’s results.

In July, for example, bookings within 50 miles of origin were up 31% compared to the same month of 2019. Bookings 50 to 500 miles from user origin were up 21%. And bookings with origin more than 500 miles distant were down 52% over the same timeframe.

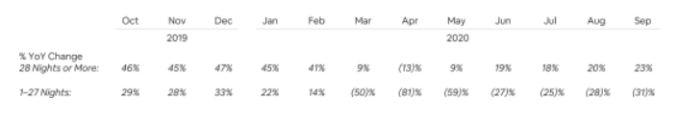

And users did stay longer than before. Here’s Airbnb’s dataset on stay length:

Image Credits: Airbnb

As you can see, starting in May, Airbnb returned to seeing growth in long-term (28 nights or more) stays. Short stays have yet to stop their bleeding. (Also note that even before the pandemic longer stays were already growing more quickly than short stays. That seems important.)

So, yes, strength in domestic, local, and longer stays did help Airbnb’s recovery. Just as we thought.

Has Airbnb ever really made money?

Nope.

Airbnb has made money in some quarters, using its GAAP net income as the measuring stick. But it has never turned in full-year net income. As it states in its risk factors:

We have incurred net losses in each year since inception, and we may not be able to achieve profitability.

We incurred net losses of $70 million, $16.9 million, $674.3 million and $696.9 million for the years ended December 31, 2017, 2018 and 2019 and the nine months ended September 30, 2020, respectively. As of December 31, 2019 and September 30, 2020, we had an accumulated deficit of $1.4 billion and $2.1 billion, respectively.

Airbnb came close in 2018, when its full-year net loss was just $16.9 million, and its adjusted EBITDA was +$170.6 million — that delta is why we never trust adjusted EBITDA, of course. But a net loss is not the same thing as net profit, so, Airbnb has never actually been profitable. Not really. Not in grown-up terms.

Is the company wealthy despite the pandemic?

But who cares about net losses when you are richer than Croesus? Hard to say, and Airbnb has it stacked to the rafters.

Here’s the company:

As of September 30, 2020, our principal sources of liquidity were cash and cash equivalents of $2.7 billion and marketable securities of $1.8 billion, which included $1.2 billion and $0.2 billion, respectively, held by foreign subsidiaries.

$4.5 billion is a lot of money.

Airbnb’s cash position is not entirely as good as it appears, as the company took on material debt during the downturn. The unicorn took on two loans, each worth $1 billion, at pretty high rates. In the case of the second loan, it gave out “warrants to purchase 7,934,794 shares of Class A common stock with an initial exercise price of $28.355 per share,” a steep discount to the company’s Series F share price of $52.50 that it set in a prior funding round.

Of that $2 billion in debt, the company retains $1.82 billion in net long-term debts, or $1.81 billion net of its current portion. Still, the debt is manageable by a company about to raise buckets of cash in its IPO that also has so very much cash. Airbnb is pretty damn rich and about to get richer.

Whew! And there’s still a lot more in this S-1 to talk about. What a week!