You can’t raise more than $370 million on a good idea alone. But you can raise a seed round worth a few million from Aileen Lee with that and a few other critical ingredients.

Guild Education CEO Rachel Carlson did just that. Aileen Lee, founder and managing partner of Cowboy Ventures, led a $2 million seed round in 2015 before Guild Education even had a real product.

Carlson and her co-founder, Brittany Stich, had been running educational classes on their own while in school at Stanford and saw a massive, scalable opportunity.

If the market size is big enough, it’s really important to put it at the beginning of the deck. Aileen Lee

For those who aren’t familiar with Guild Education, it’s an education and upskilling platform that started by focusing on the 99%. Carlson and Stich realized that the vast majority of upskilling platforms focused on the top third of the labor triangle in the U.S., such as helping a developer get a better developer job or helping an executive be a better executive.

Starting out in a strip mall

Stich and Carlson rented out space in a strip mall and developed a boot camp model with classes focused on how to find a job or how to better communicate your experience on your resume.

“I was nervous to be a non-product founder and I was not particularly technical,” said Carlson. “In hindsight, it’s so fun to look back through our deck because we had an idea about the problem to be solved and a lot of ideas about distribution. We were pretty unsure about what the product was going to be, but we were sure we would find our way to the right product if we stayed obsessive about the problem.”

After networking with some of the players in San Francisco, Carlson found herself at a meeting with Lee. According to both parties, it was an awesome first encounter, with vulnerability on both sides of the table. However, the second meeting didn’t go like the first.

“[We felt like we had to] show up and be a founding team,” said Carlson. “We tried to fake it a little bit. We had this great intellectual first meeting, and at the next one, I felt like I had to show up and show her that I made a business. I was a little less authentic.”

But they got on the phone after that second meeting and were honest with one another, saying that it didn’t go well and that they’d both like to try again. Carlson and Lee both said it was the vulnerability of setting things right that is so emblematic of their relationship and, at the same time, so rare in Silicon Valley.

To Lee, what stood out most was actually watching the week-to-week progress and innovation of the founders, rather than having a fully fleshed-out, polished business and product.

“They were like, ‘Let’s do a boot camp, let’s post on Craigslist, let’s find a strip mall space and rent it and then let’s tell people it’s free,'” said Lee. “They were testing in real time, every week, while they were going to grad school. Seeing what they were able to figure out, at that velocity, with almost no resources, was super impressive.”

The deck

Carlson said that a huge part of fundraising was educating Silicon Valley about people that they don’t think about much, who live in the middle of the country.

“They don’t go to Stanford and they don’t buy their shoes at Allbirds,” she said.

She said anyone working on 99% problems has to learn how to educate investors. She told the story of meeting an investor who exclaimed that community colleges are great — his wife takes art classes there.

The deck Guild Education used in its early rounds spent plenty of time personifying the person Guild was built to serve.

Guild Series A Pitch Deck by Jordan Crook on Scribd

“People often jumped to someone they knew who was low-wage, like a nanny, or they’d jump to the first young person they knew who was often born on third base,” said Carlson. “We set up ‘John’ in our slide deck and explained that there are 40 million people like John, and that the investor is the edge case. John is the norm case. We would sit on this slide for a long time.”

Carlson explained that some investors immediately get curious about this and show some humility, looking to learn more. Others would bring up their son who works at IBM and is looking to get a master’s in computer science or the equivalent.

That was an important litmus test for Carlson in her investor-dating journey.

“It’s my job to educate, but it’s also my job to watch how they learn the information I provide to them,” said Carlson. “When they don’t engage in that topic with empathy and humility, it’s a pretty quick pass for us, too.”

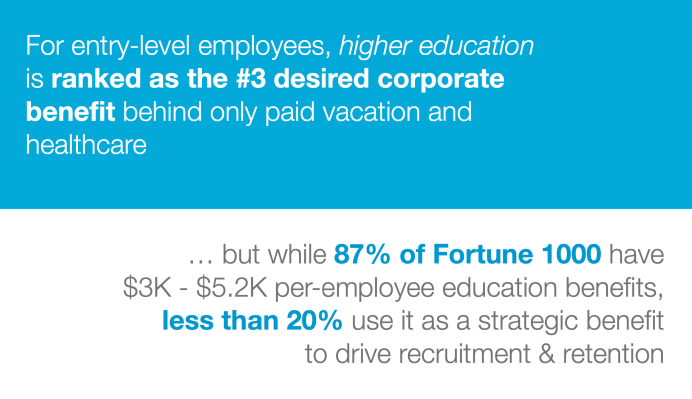

The TAM slide was also critical in educating the investor on just how big of a problem this was and how many people in the U.S. could make use of Guild Education.

“If the market size is big enough, it’s really important to put it at the beginning of the deck,” said Lee. “A lot of investors are screening for opportunity size. If it’s a really big, multibillion-dollar market, tell me in the beginning, because then I’ll be leaning forward in my seat.”

When Lee understood the scale and depth of the problem, and then learned of Carlson and Stich’s experience working in the community college space, she realized that all the ingredients were coming together.

Another shiny spot in the early deck was the ideas the founders had around distribution. But Carlson warns other founders to not do too much too quickly.

“We just made our first hire to expand into the fourth of these buckets,” she said, gesturing to the distribution slide. “This slide said, ‘Look! We’re doing everything.'” But what we learned very quickly was to do one thing really well for five years, and then pick your head up.”

In this episode of TechCrunch Live, Carlson and Lee also talked through how Guild landed its first major B2B customer after almost a year of conversations and testing. Spoiler: They first made contact over LinkedIn.

You can check out the whole episode, including the TechCrunch Live pitch-off, in the video below.