Acquiring new customers isn’t easy. It not only requires sales efforts but there’s also a monetary cost involved. This monetary cost could be as low as $1 for a $500 offering or as high as $1500 for the same product.

Hence, it’s really important to calculate how much it will cost to get a new customer on-board to keep the business profitable for the long run.

But what is customer acquisition cost? What all does it constitute? How do you calculate it?

Here’s a guide answering all such questions.

What Is Customer Acquisition Cost (CAC)?

Customer acquisition cost (CAC) is the total cost a business incurs to earn a new paying customer over a specific time period.

This cost includes marketing and sales costs and salaries paid to the employees to get the customer on board.

CAC and the lifetime value of the customer are considered to be the defining factors in whether a business has a viable business and revenue model or not.

The lifetime value (CLV) tells how much a customer brings in over his lifetime. This metric, when compared with the cost of acquiring that customer (CAC), results in the profit that the business earns throughout the customer’s lifetime.

Importance Of CAC

The cost of acquiring a customer is an important metric for both: the business and the investor who invests in that business.

- From the business’s perspective, this metric conveys the business model’s viability and what should be improved to earn more profits. A high CAC and low CLV means the current acquisition process needs improvement and a low CAC implies that the business is spending money efficiently and shall see higher profits.

- From the investor’s perspective, this metric is essential to calculate how much investment the business requires to stay afloat. Moreover, it also conveys the viability of this investment for the investor as it helps to calculate the ROI.

For example, investing $1 million in a startup to help it market itself and reach out to customers is only justified if the startup is viable enough to earn more than the invested amount – the lifetime value should be more than the cost of acquisition.

Even though CAC is a niche agnostic KPI, it is more often used by businesses operating on a SAAS and subscription-based model. Customers of such businesses stay for long, paying in a recurring manner, making their LTV more than their CAC.

How To Calculate CAC

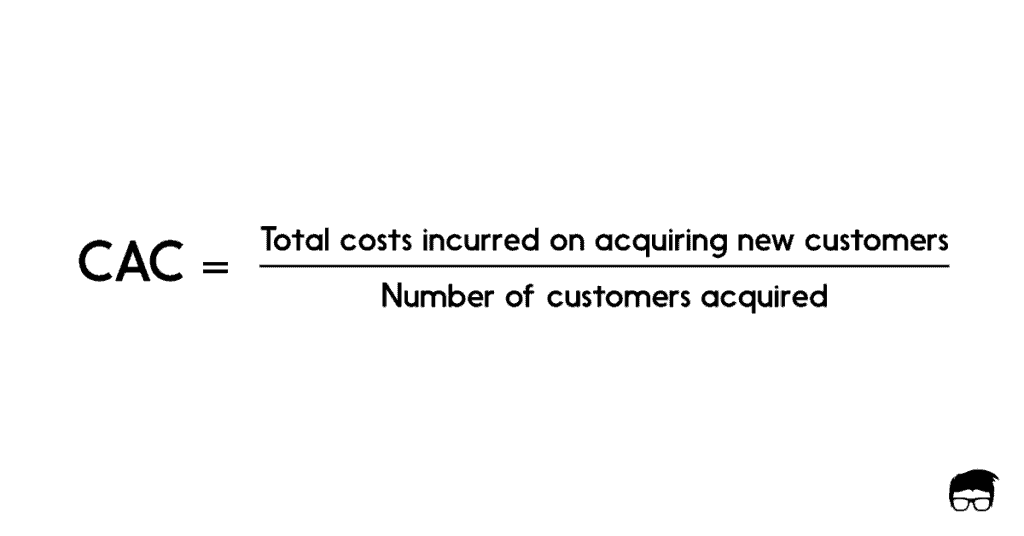

Generally, CAC is calculated by dividing all the costs spent on acquiring new customers by the number of customers acquired in a specific time period.

CAC = Total costs incurred on acquiring new customers in a specific period / number of customers acquired in a specific period

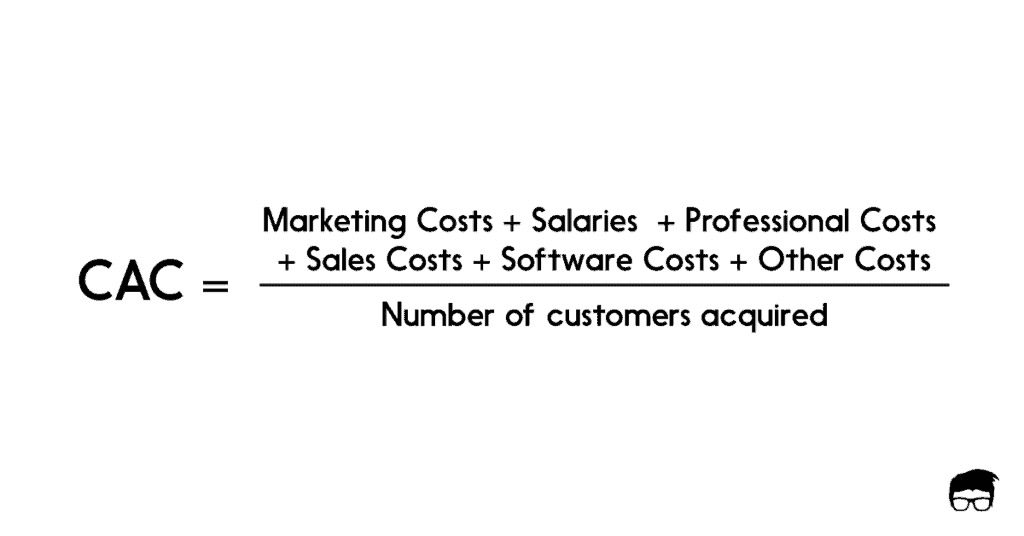

This cost includes all the sales and marketing costs, which is further divided into:

- Marketing Costs (M): The total marketing cost for acquiring customers. This cost includes advertising costs as well.

- Employee Salaries (E): The salaries associated with marketing and sales.

- Professional Costs (P): Costs incurred for professional services like designing, consultancy, etc.

- Sales Costs (S): Sales associated costs (eCommerce commission, brokers, etc.).

- Software and tools cost (ST): These include all the expenses incurred to buy, run, and operate the software used in the marketing and sales process.

- Other Costs (O): All the additional overheads associated with marketing and sales, like rents, equipment, etc. allocated to marketing and sales employees.

So, a better formula of CAC would be:

CAC = (M+E+P+S+ST+O) / CA

Example of Customer Acquisition Cost

Suppose an ecommerce store XYZ launched several marketing campaigns last year, and the costs include –

Marketing Campaign | Marketing Costs | Salaries | Sales Costs | Professional Costs | Acquisitions |

|---|---|---|---|---|---|

Marketing Campaign Q1 | $50,000 | $20,000 | $10,000 | 0 | 1,000 |

Marketing Campaign Q2 | $50,000 | $20,000 | $15,000 | 0 | 1,200 |

Marketing Campaign Q3 | $50,000 | $20,000 | $25,000 | $10,000 | 2,000 |

Marketing Campaign Q4 | $50,000 | $20,000 | $10,000 | $10,000 | 2,800 |

Total | $200,000 | $80,000 | $60,000 | $20,000 | 7,000 |

The CAC for XYZ for the year would be: ($200,000 + $80,000 + $60,000 + $ 20,000) / 7000 = $51.43

CAC And CPA

One important KPI that people often confuse customer acquisition cost (CAC) with is cost per acquisition (CPA).

CAC explicitly measures the cost per paying customer acquisition.

CPA could be anything other than a paying customer. It could be a lead, an activated user, a new free trial registration, etc.

These two terms are related because CPA is a lead indicator to CAC, but they are not the same.

For example, Spotify spends enormous amounts on getting new free users on board. These free users acquisition cost is referred to as cost per acquisition (CPA). Some of these users become paying user of the application, and such costs get translated to CAC.

So, in freemium and SAAS products like Spotify, Dropbox, SEMrush, etc. CAC also includes CPA (Cost to acquire free users + cost to develop free product + cost to support free product) as such costs come under marketing expenses as well.

CAC (Freemium) = cost to acquire free user + cost to develop free product + cost to support free product + cost to convert free user to paid user.

CAC And CLV

CAC is rarely calculated without CLV. It’s really important to compare the acquisition cost with the customer’s lifetime value to calculate the profits a business earns and check the viability of the business.

The ratio of CLV to CAC is important as it signifies the ROI:

- 1:1 – the business is at break-even (no profit, no loss). A 1:1 ratio means that the customer ends up paying exactly what the business paid to acquire them. Having such a ratio conveys that the business should do something to reduce the acquisition cost or to increase the LTV.

- Less Than 1:1 – this means that the business is paying more to acquire the customer than what the customer pays back. This signifies a faulty marketing and financial strategy that needs to be improved.

- 3:1 – it’s a good level ratio that signifies that the business earns more than what it spends on acquiring the customer.

- Higher than 3:1 – Usually, businesses having more than a 3:1 CLV to CAC ratio sustain for the long term.

Go On, Tell Us What You Think!

Did we miss something? Come on! Tell us what you think about our article on customer acquisition cost in the comments section.

A startup consultant, digital marketer, traveller, and philomath. Aashish has worked with over 20 startups and successfully helped them ideate, raise money, and succeed. When not working, he can be found hiking, camping, and stargazing.