The last year taught us that the connection between the stock market and the economy is imprecise at best.

Despite some useful commentary underscoring the two are at least somewhat linked, it’s clear that many Americans can lose their jobs and financial security at the same time that stocks can keep on rising like the boom times will never end.

That’s the macro picture; 2021 is teaching us its microcorollary — smaller groups of stocks can keep rising regardless of what is going on with their fundamentals.

And in the micro-micro case, that Tesla’s value is unlimited, because [fill in your reasons here].

To avoid all useless Twitter whining, yes, Tesla’s ability to turn GAAP profits — albeit at times by selling regulatory credits — is a win, and joining the S&P 500 is great. Delivering 500,000 cars in 2020, a full 75% of GM’s third-quarter deliveries, is impressive as well.

I am certainly not arguing that Tesla is worthless, or that the group of companies like those that comprise the ARK Innovation ETF, are all overpriced. Instead, it seems that today’s market is willing to value stocks not on their past performance, current performance or analyst-expected future performance but on the rosiest future that investors have imagined for their favorite companies.

You can see elements of this logic at work if you ever talk about stocks on the internet. Don’t call Tesla a car company, for example — this despite automotive revenues making up nearly 87% of the company’s Q3 top line. Tesla is a battery company, its religious fans will tell you.

Tech and VC heavyweights join the Disrupt 2025 agenda

Netflix, ElevenLabs, Wayve, Sequoia Capital, Elad Gil — just a few of the heavy hitters joining the Disrupt 2025 agenda. They’re here to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch Disrupt, and a chance to learn from the top voices in tech — grab your ticket now and save up to $600+ before prices rise.

Tech and VC heavyweights join the Disrupt 2025 agenda

Netflix, ElevenLabs, Wayve, Sequoia Capital — just a few of the heavy hitters joining the Disrupt 2025 agenda. They’re here to deliver the insights that fuel startup growth and sharpen your edge. Don’t miss the 20th anniversary of TechCrunch Disrupt, and a chance to learn from the top voices in tech — grab your ticket now and save up to $675 before prices rise.

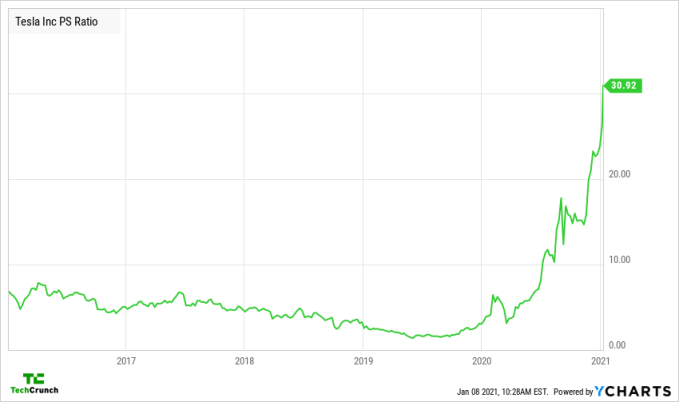

That’s why it’s fine to pay 31x sales for Tesla, while GM is worth 0.5348x sales today. Amazon, for comparison, is worth 4.6x sales. Tesla shares are valued like Twilio’s own in terms of their price-sales ratio, but the difference is that the car company had gross margins of 23.5% in Q3 2020, while the software company managed twice that. And Twilio is growing more quickly.

Today, Tesla is worth more than Facebook. But it’s hardly the only stock, or stock collection, that is enjoying such devotion. You can’t really overprice a software stock some software bulls will tell you, because waves hands the market for software companies is effectively infinite! Enterprise IT spend is only 10% or 15% or 12% or whatever-percent converted to the cloud! Buy! Now! More!

During a melt up, when the price of everything is going up at once, it’s hard to be a bear. And I’m not one. I buy index funds of a few stripes every month. But I am a little irked that I am paying enthusiast prices for my retirement savings.

Tesla stretches profit streak to four quarters, gains 6% in after-hours trading

The only reason you can really square Tesla’s valuation today — around $822 billion per Google Finance — with its historical or near-future anticipated performance, is if you expect the company to multiply in size (quickly), maintain its market position and drive huge margins from nascent product lines. And then some.

Yet every day Tesla shares rise another grip of points, seemingly like there’s precisely zero gravity in the public markets.

Pride cometh before the fall, as does a melt up, I think.

Somewhat comically there’s little on the horizon that could bring a change to the current market narrative. Interest rates are going to stay at zero for years. Capital will still want yield. So cryptocurrencies, public equities and venture capital funds are going to stay stuffed.

Amazing stat via @TheOneDave “$TSLA shares are higher for the 11th day in a row. If the gain holds up, the stock would have its longest winning streak since going public in 2010. Its climbed as much as 35% during the streak, which began 2 days after it entered the SPX last month”

— Hilary (@queenofchartz) January 8, 2021

Things are going to stay silly.

But that doesn’t mean that valuing Tesla — a great company I’d reckon, at a different per-share price — higher every day makes sense, even if we can understand why money is being silly lately.

I mean what the hell is this?

2020 was a weird year in the markets. 2021 is not looking any different.