It appears that the slowdown in tech debuts is not a complete freeze; despite concerning news regarding the IPO pipeline, some deals are chugging ahead. This morning, we’re adding Alkami Technology to a list that includes Coinbase’s impending direct listing and Robinhood’s expected IPO.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch, or get The Exchange newsletter every Saturday.

We are playing catch-up, so let’s learn about Alkami and its software, dig into its backers and final private valuation, and pick apart its numbers before checking out its impending IPO valuation. After all, if Kaltura and others are going to hit the brakes, we must turn our attention to companies that are still putting the hammer down.

We are playing catch-up, so let’s learn about Alkami and its software, dig into its backers and final private valuation, and pick apart its numbers before checking out its impending IPO valuation. After all, if Kaltura and others are going to hit the brakes, we must turn our attention to companies that are still putting the hammer down.

Frankly, we should have known about Alkami’s IPO sooner. One of a rising number of large tech companies based in nontraditional areas, the bank-focused software company is based in Texas, despite having roots in Oklahoma. The company raised $385.2 million during its life, per Crunchbase data. That sum includes a September 2020 round worth $140 million that valued the company at $1.44 billion on a post-money basis, PitchBook reports.

So, into the latest SEC filing from the software unicorn we go!

Alkami Technology

Alkami Technology is a software company that delivers its product to banks via the cloud, so it’s not a legacy player scraping together an IPO during boom times. Instead, it is the sort of company that we understand; it’s built on top of AWS and charges for its services on a recurring basis.

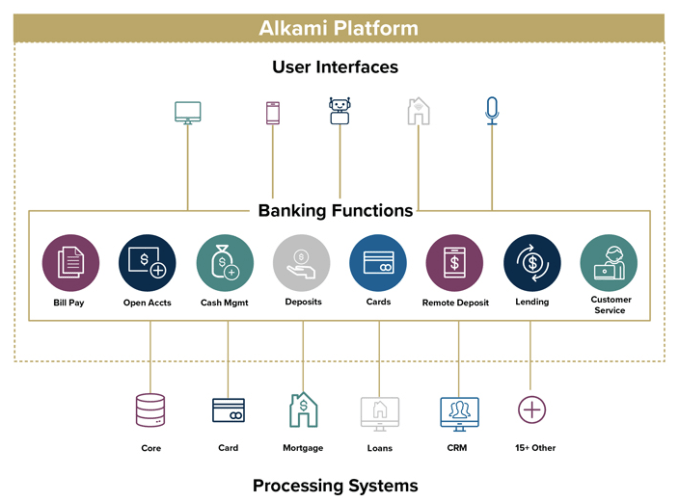

The company’s core market is all banks smaller than the largest, it appears, or what Alkami calls “community, regional and super-regional financial institutions.” Its service is a software layer that plugs into existing financial systems while also providing a number of user interface options.

In short, it takes a bank from its internal systems all the way to the end-user experience. Here’s how Alkami explained it in its S-1/A filing:

Image Credits: Alkami S-1

Simple enough!

Is it a good business? Yes and no. Yes, in that the company is growing, has moderately attractive gross margins, and some strong SaaS metrics. And no, in that the company’s fully loaded losses continue to rise.

A month ago, the company’s deficits would not have been a concern. But with sentiment shifting regarding tech debuts, we should pay them more heed.

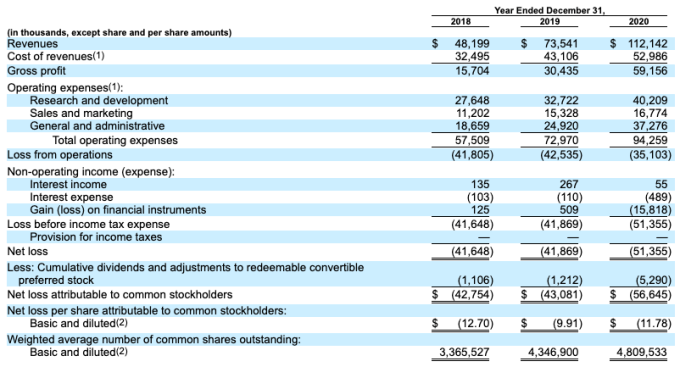

Here’s Alkami’s income statement:

Image Credits: Alkami S-1

The company’s revenue growth worked out to 52.5% in 2020. That’s a solid figure for a company operating at scale, and one that will surely attract some investors’ eyes. Additionally, Alkami’s operating losses fell a reasonable amount last year, indicating that it has some operating leverage to lean on.

Alkami also reported a “net dollar revenue [NDR] retention rate of 117% as of December 31, 2020 and 114% as of December 31, 2019,” though its definition of NDR is slightly confusing, so I don’t want to index too heavily on that figure.

Regardless, there’s more good news to be found in Alkami’s IPO filing. Its Q4 2020 growth rate was a bit higher than its 2020 average, implying that the company’s top-line expansion is not waning. And in the final quarter of 2020, the company had gross margins of 57.8%, up from 47.8% in Q4 2019. That’s the right direction, even if the absolute figure from the December period lags traditional SaaS comps.

For the bullish, Alkami’s adjusted EBITDA deficit was the smallest on record in its most recently reported quarter, namely the final three-month period of 2020. The company’s operating cash burn, however, was essentially unchanged at around $38 million last year.

So where does Alkami expect to price when it does debut? Between $22 and $25 per share.

The company is selling 6 million shares in its flotation, or 6.9 million if its underwriters exercise their option to buy more. After its debut, Alkami will have 83,135,445 shares of stock outstanding, or 84,035,445 if its underwriters exercise their option.

Using the higher share count, Alkami’s simple IPO valuation ranges from $1.85 billion to $2.1 billion. Renaissance Capital, an IPO tracking firm, estimates that the company’s fully diluted IPO valuation comes to $2.2 billion.

Employing the $2.2 billion number, Alkami is worth around 20x its 2020 revenues. Using its Q4 2020 revenue result to set a run rate, the company is worth around 16.5x its recent top line. Those numbers are not shocking, but they are not cheap either. To be frank, they are stronger multiples than I might have guessed we’d see when kicking off our work this morning.

So, good news for the IPO market? Provided that Alkami can get out at those prices, yes. After a few very weird weeks, the U.S. IPO market could use the shot in the arm. More when Alkami either announces a new price interval or picks a final per-share value for its debut.

The Exchange is taking a short break from Wednesday, April 7, to Friday, April 9.