China is becoming a superpower in the tech industry. According to Straits Times, China is the only place in the world where it takes less than six years for a startup to become a unicorn — it takes seven years in the U.S., eight years in the U.K. and 11 years in Germany. Despite geopolitical tensions and recent amendments in CFIUS, it is hard to ignore China.

When I joined Runa Capital almost a year ago, my task was to help our portfolio companies enter the Chinese market, find the right partners and raise funding from Chinese investors. And almost on every call with our startups, colleagues from Runa or other global VCs, I heard: Is it a good idea to raise from a Chinese VC? Is it OK to co-invest with Chinese investors? I was surprised to learn that there is little research answering such questions, as there is a lack of adequate information in English about Chinese investments.

Access to the Chinese market seems to be an obvious reason to invite Chinese funds aboard, but only about 20% of Western startups with Chinese capital have operations in China.

So as a Mandarin-speaking specialist, I decided to fill this gap by conducting a study based on Chinese VC database ITjuzi (the Chinese version of Crunchbase) with the help of our powerful data science resources developed by Danil Okhlopkov.

Below, I will try to answer the following questions using statistics and a case-based approach:

- How much do Chinese funds invest abroad?

- What is the current trend?

- Can Chinese investors bring any value to Western startups?

- Who are the most active Chinese investors abroad?

- In which areas can Chinese funds bring the most value?

- What value can Chinese investors bring?

- When is it better to invite a Chinese investor?

Chinese investors are interested in Western startups

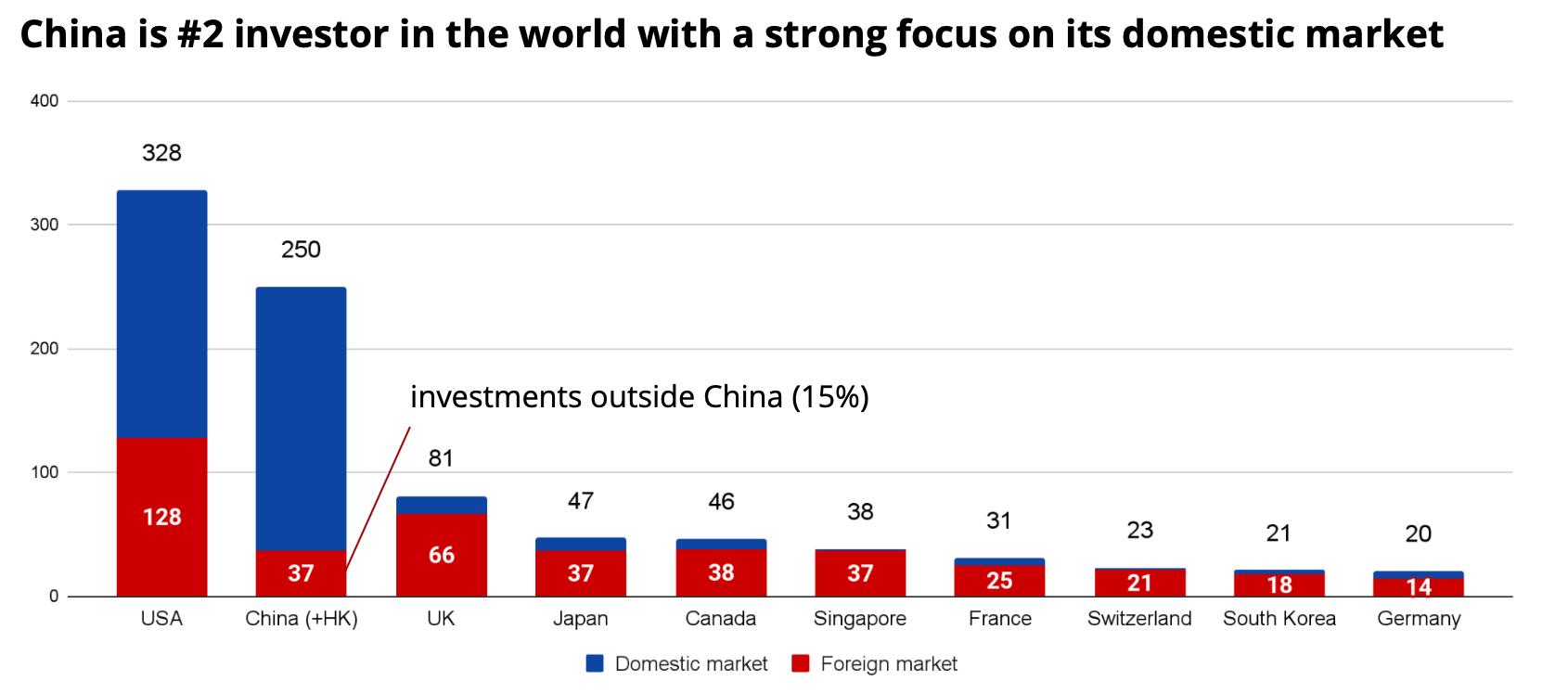

After studying data from ITjuzi, we estimated that Chinese funds invested around $250 billion in 2020 (three times higher than the figure reported in Crunchbase). This figure puts Chinese VC investments only 30% lower than investments by U.S. funds, but three times that of U.K. funds and 12.5 times more than German funds.

Fig. 1 — Comparison of investment from different countries in 2020, $bn. Source: Crunchbase, ITjuzi. Image Credits: Denis Kalinin

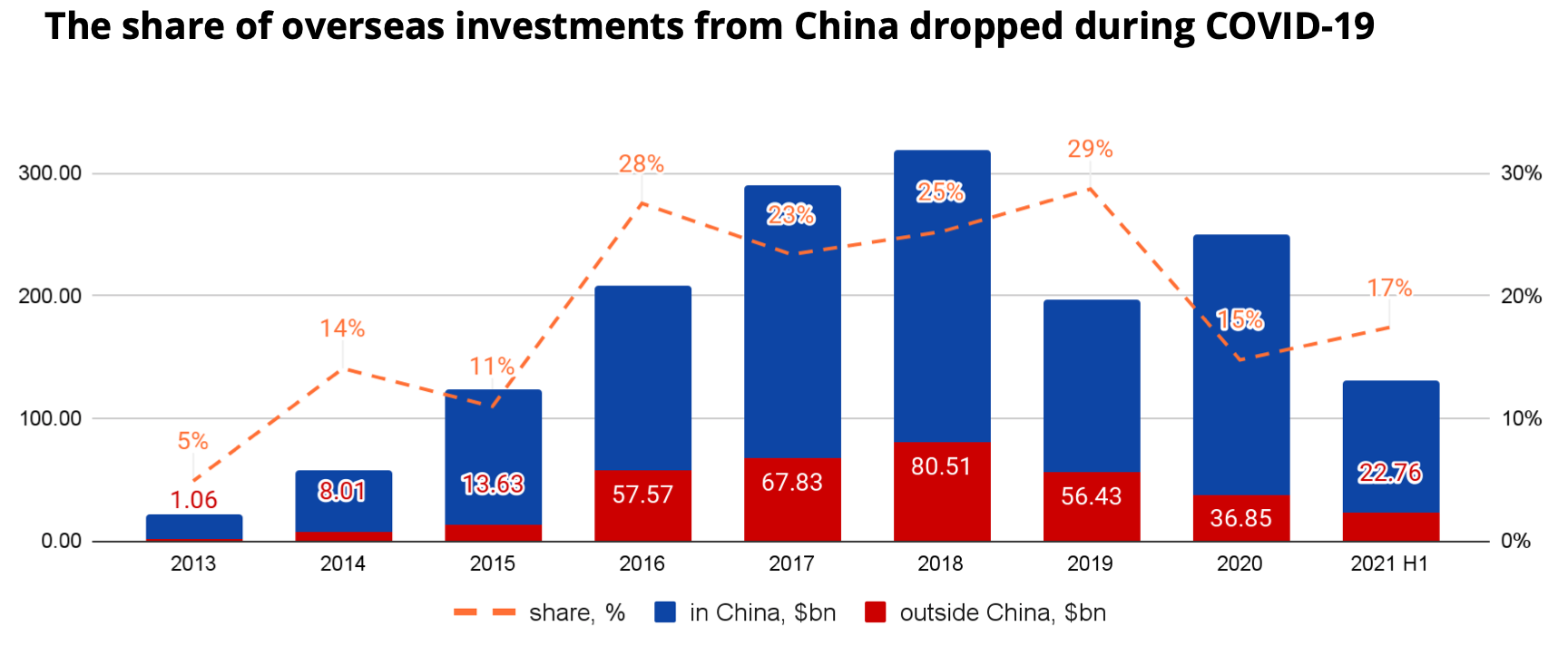

However, only 15% of investments in 2020 and 17% of investments in the first half of 2021 were in companies outside China, significantly lower than in 2019. This appears to be because during COVID, China’s economy recovered much faster than other countries’, so many Chinese investors preferred to redirect their capital flows to the domestic market.

On the other hand, there is great potential for overseas investments to rebound as soon as the borders reopen and the global economy starts to recover.

Fig. 2 — Dynamics of Chinese investments. $bn. Source: Crunchbase, ITjuzi. Image Credits: Denis Kalinin

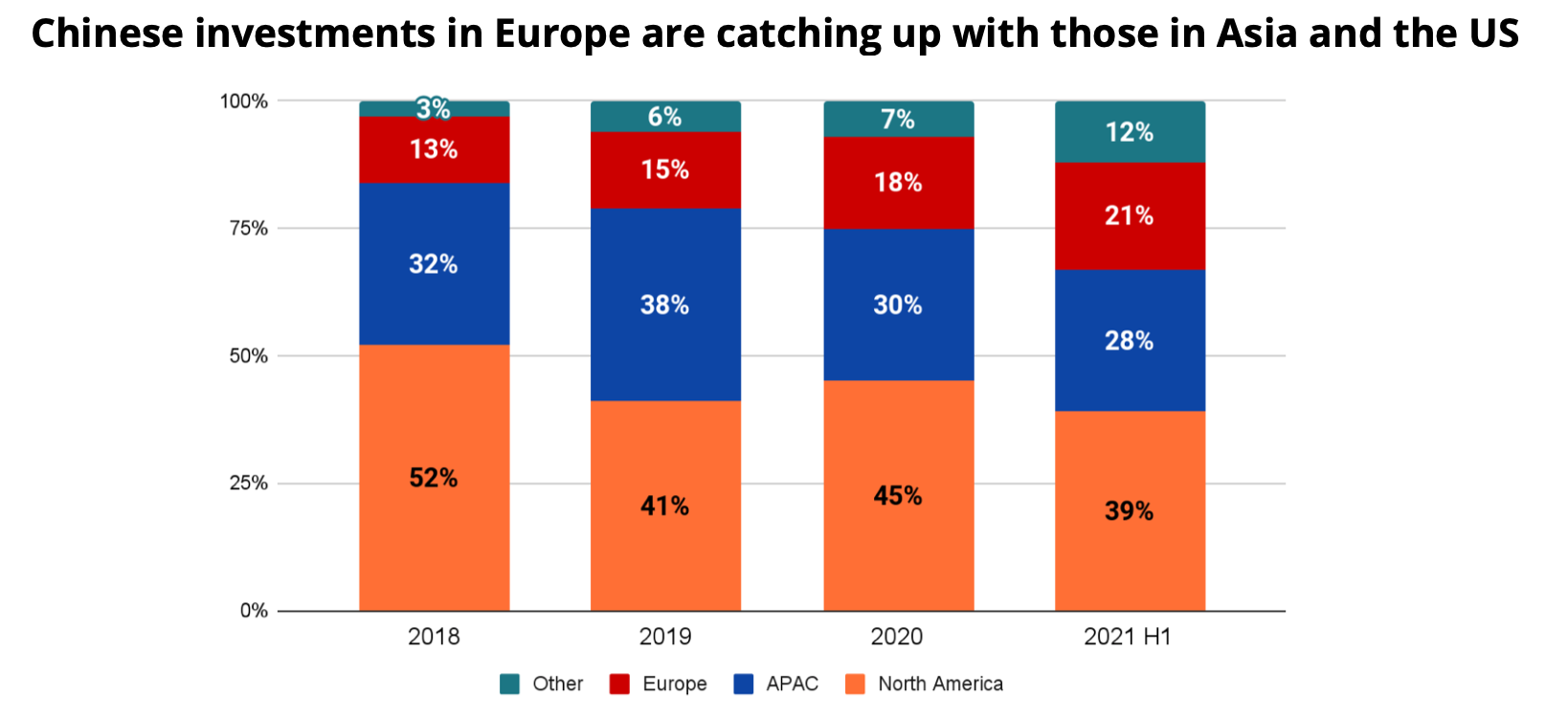

We can also see that Chinese investors are eyeing European startups favorably, which is related to U.S.-China geopolitical tensions as well as the fact that the European VC market is becoming mature.

Fig. 3 — Chinese overseas investments by destination and number of deals. Source: ITjuzi. Image Credits: Denis Kalinin

Who are the most active Chinese cross-border investors?

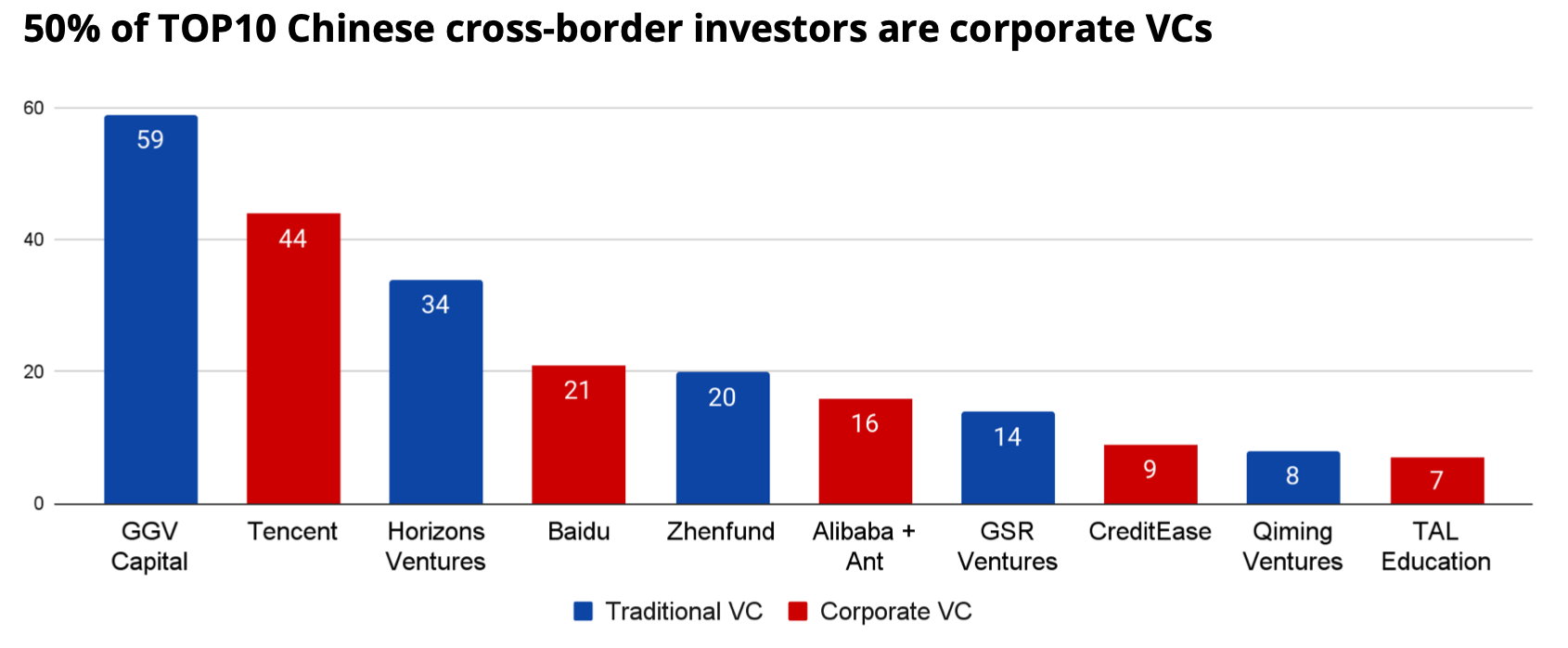

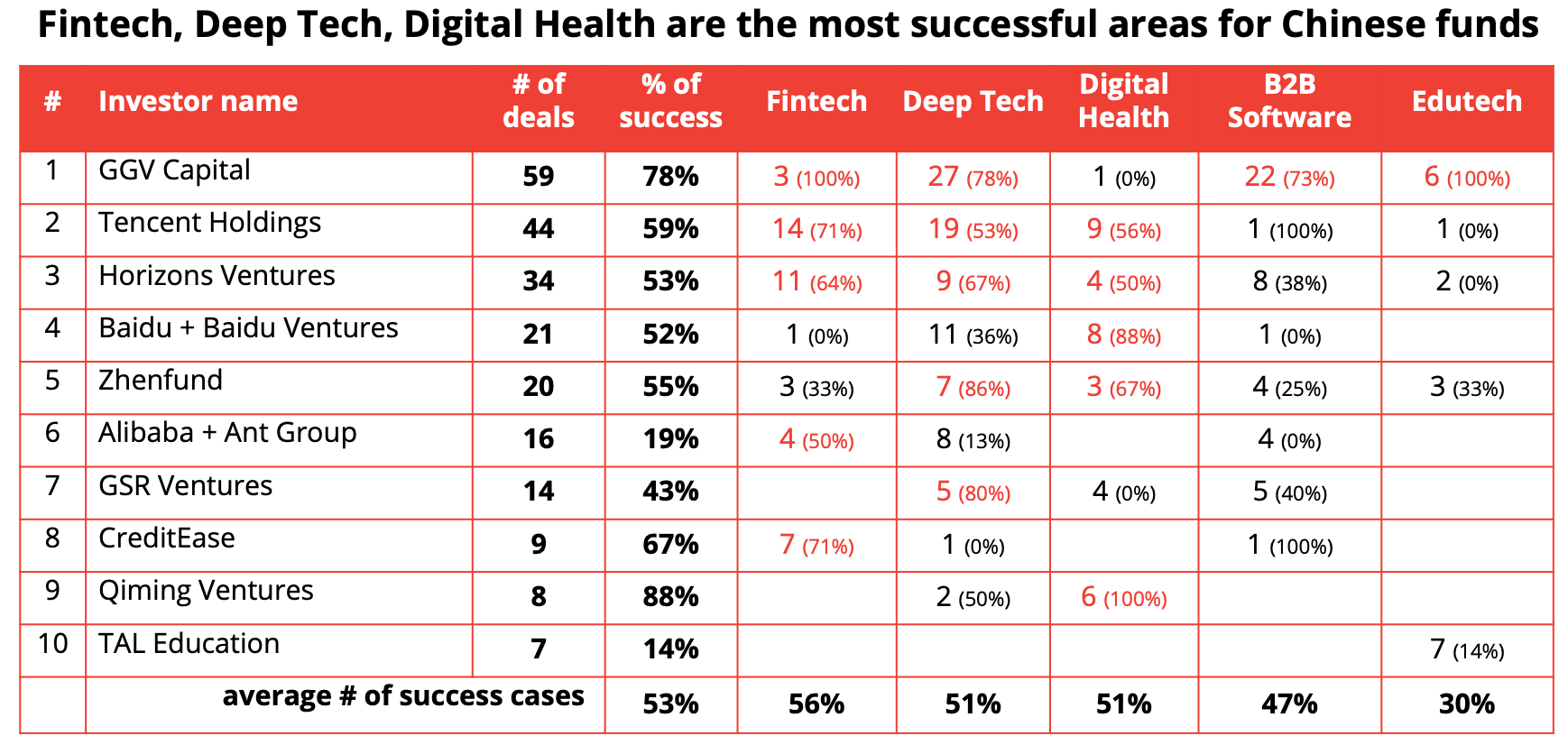

I analyzed Chinese funds with the largest number of investments in the U.S. and EU in the five sectors that Runa Capital is most familiar with: B2B SaaS, deep tech, fintech, digital health and edtech. The most active Chinese funds are shown in Fig. 4.

Fig. 4 — The top 10 most active Chinese VCs investing outside China, by number of deals (2012-2021). Source: ITjuzi. Image Credits: Denis Kalinin

About half of the most active investors from China are corporate VCs, which is very different from what we can observe in other countries. However, not all Chinese corporate funds position themselves as strategic investors. For example, Tencent and CreditEase admit that they act more as financial investors and take minor stakes up to 10% (we do not consider Tencent’s gaming M&As here).

Moreover, these VCs all have international backgrounds. For example, GGV Capital’s founder Jixun Foo graduated in Singapore and worked at Hewlett Packard Enterprise. Duane Kuang, founder of Qiming Ventures, was previously the director of Intel Capital China, and Martin Lau from Tencent worked at Goldman Sachs. Most funds have globally distributed teams in Palo Alto, London, Paris and other global tech centers.

Active cross-border investors from China also appear to have large volume of assets under management, usually way more than $1 billion (Zhenfund is an exception with only $600 million in AUM, since it is an angel fund). This is because small Chinese VCs are usually satisfied with investing domestically, since the market is so big, while big players like Tencent or Qiming Ventures are eager to diversify their assets globally.

Can Chinese investors bring value to Western startups?

Value can be measured in different ways, but I believe that the growth of valuation or liquidity events (IPO or acquisition) are the major criteria for startups.

I have calculated how many startups (below they will be called “success cases”) managed to increase their valuation, get acquired or announced an IPO after receiving money from Chinese funds. The results are shown in Fig. 5.

Fig. 5 — Share of successful deals for the top 10 most active Chinese investors in the U.S./EU. Source: ITjuzi. Image Credits: Denis Kalinin

For the top 10 most active Chinese overseas investors, the share of success cases averages at 53% across the five sectors. You can find the complete dataset here. For comparison, I analyzed 750 startups outside the U.S. that raised from the top five VC firms: Sequoia Capital, Bessemer Ventures, Insight Partners, Index Ventures and Accel using the same methodology. The share of success cases turned out to be ~55%.

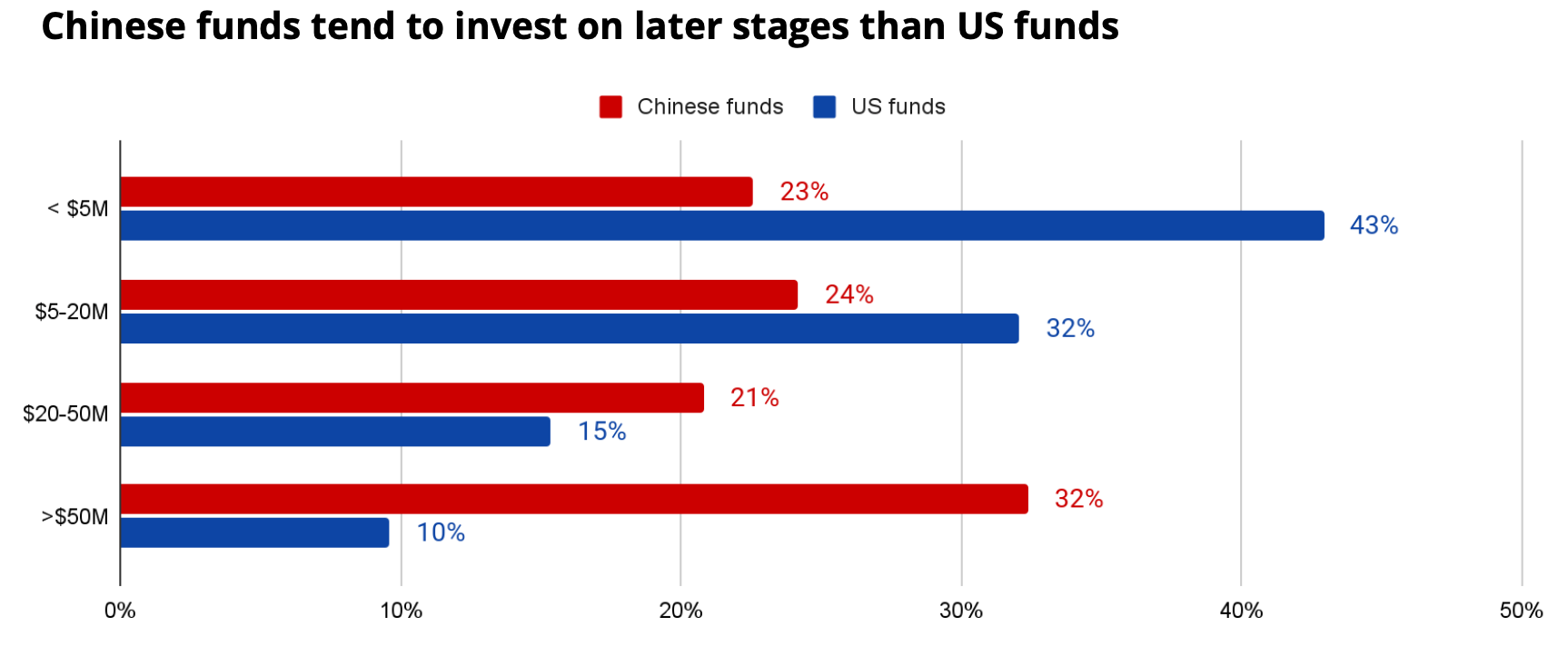

This tells us that the percentage of successful overseas investments for Chinese funds is approximately the same as for U.S. funds. The difference is U.S. funds tend to invest at earlier stages than Chinese funds (as we see later in Fig. 6).

Which industries are Chinese investors more likely to bring value to?

If you’re a global startup eyeing Chinese venture capital, it can be useful to consider industries where the synergy is more likely to happen.

Fintech

Fintech in China is traditionally one of the strongest sectors. Big players like Tencent, Ant Group and CreditEase have developed strong fintech solutions in the domestic market and now are sharing their expertise with their investment portfolio across the globe. There are also some traditional VCs who specialize in certain fintech subsectors, like Horizons Ventures, which has expertise in insurtech and challenger banks.

Success cases:

- N26, a German neobank, raised money from Horizons Ventures in a round that valued it at $195 million in 2016, then from Tencent at a $1 billion valuation in 2018, and now it’s valued at $3.5 billion.

- Hippo, a U.S. insurtech startup, closed a Series A round from Horizons Ventures and GGV Capital at a valuation of $70 million in 2016, and it is currently valued at $3.2 billion after going public via a SPAC combination.

- Wefox, a German insurtech startup, raised from Horizons Ventures at a valuation of $135 million in 2016, then from CreditEase at a $600 million valuation in 2019. It is currently valued at $3 billion.

Deep tech

The Communist Party of China has always seen cutting-edge technologies as a priority and encouraged a lot of companies, and hence investors, to dig deeper into sectors such as AI, machine learning, IoT, VR/AR and cybersecurity. This has resulted in Chinese venture funds — both strategic (like Tencent and Baidu) and financial (like GGV and Horizons) — developing strong expertise in deep tech, which they also leverage while investing outside China.

Success cases:

- tray.io, a U.S. cloud-based integration platform, closed a Series A round from GGV Capital at a $70 million valuation in 2018. It is currently valued at $600 million.

- Dynamic Yield, a U.S. customer interaction platform, raised money from Baidu at a $110 million valuation in 2016 and was acquired by McDonald’s for more than $300 million in 2019.

- Blue Vision Labs, a U.K. machine perception startup, closed an angel round from Horizons Ventures at a valuation of $12 million in 2016 and was acquired by Lyft two years later.

Digital health

Along with deep tech, medtech has also been on Chinese party leaders’ agenda. A few Chinese funds that have strong expertise in Medtech and invest pretty actively in the U.S. and Europe include Qiming Ventures, Ally Bridge Group, Zhenfund and Baidu.

Success cases:

- LetsGetChecked, a U.S. health testing app, closed a Series A round from Qiming Ventures at a $60 million valuation in 2018, and is now valued at over $1 billion.

- Subtle Medical, a U.S. AI-powered medical imaging startup, closed an angel round from Baidu at a $5 million valuation in 2017, then from Zhenfund at a valuation of $25 million in 2018. It is now valued at $60 million.

- Avail Medsystems, a U.S. telemedicine app, raised money from Baidu at a $60 million valuation in 2019 and now is valued at $500 million.

B2B SaaS

Unlike Western countries, where SaaS accounts for a pretty significant share of the VC market, in China, the SaaS market is still at a nascent stage, although it is growing fast. This means that there are very few Chinese VCs (like GGV, Tencent or Horizons) who have expertise in SaaS, and most of them have a global presence and international teams.

Success cases:

- Zendesk, a U.S. CRM platform, raised money from GGV Capital at a $300 million valuation in 2012 and in 2014 went public at a valuation of over $910 million.

- Slack, a U.S. enterprise software platform, raised capital from Horizons Ventures valued at $780 million in 2015, then from GGV Capital at a $3.7 billion valuation in 2016. In 2019, Slack went public with a $23 billion valuation.

- BlueKai, a U.S. data platform for marketing, closed a Series C round from GGV Capital at a $105 million valuation in 2010, and in 2014 was acquired by Oracle for over $400 million.

Edtech

Investing in the Western education industry still seems to be a challenge for Chinese companies, which can be explained by the differences in how China and Western countries approach education. On the other hand, GGV has had a few successes.

Success cases:

- Brightwheel, a U.S. preschool all-in-one platform, raised money from GGV Capital at a $50 million valuation in 2017, and now is valued at $600 million.

- Labster, a Danish virtual laboratory solution, closed a round from GGV Capital at a valuation of $45 million and now its valuation has reached $300 million.

It is worth mentioning that the founders of all the startups mentioned above are not Chinese, which also proves that Chinese funds do not invest only in companies with Chinese founders.

Why do Western startups take money from Chinese investors?

After multiple conversations with Chinese VCs and global startups who fundraised from China, I have identified three reasons for why startups look to China for VC funding:

- Money (large checks and high valuation).

- Expertise in certain business models (fintech, deep tech, etc.).

- Access to the Chinese market.

It is interesting to note that these reasons are sorted by priority. Access to the Chinese market seems to be an obvious reason to invite Chinese funds aboard, but only about 20% of Western startups with Chinese capital have operations in China. This can be explained by high barriers to entry to the Chinese market, as well as intense competition. And if a startup already has a strong presence in the U.S., geopolitical reasons can be a big factor, too.

Nevertheless, most companies who do have a presence in China sooner or later partner with a local strategic investor. For example, the fact that our portfolio company MariaDB raised a Series C round from Alibaba also facilitated their listing on Alibaba’s marketplace for Chinese developers.

When is it time to partner with Chinese investors?

Another aspect you should understand about Chinese funds is that they invest only at later stages. Only 47% of the deals in the EU/U.S. involving Chinese funds were closed at early stages (funding rounds of up to $20 million), which is significantly less than for U.S. funds (75%).

Fig. 6 — Share of deals in the EU/U.S. involving American and Chinese funds, by size of rounds. Source: ITjuzi. Image Credits: Denis Kalinin

However, 47% of early-stage deals still seem to be a pretty big share for Chinese funds, considering that Europe and the United States are new markets for them. We can see that 55% of their deals with funding round sizes of up to $20 million were successes (increased valuation or reached a liquidity event). Some Chinese investors focus on early-stage deals, for example, Zhenfund is an angel fund with an average round size of about $2.5 million.

So it is possible to raise money from Chinese investors at small rounds (up to $20 million), but know that they might be more cautious about such investments unless they are angel or seed investors like Zhenfund.

In conclusion

China is the second largest source of venture capital in the world. Despite political tensions between China and the Western world, deals in the U.S. and EU still accounted for a solid share (~75%) of total Chinese investments abroad in 2020. Chinese funds see Europe as a new strategic area for investment.

Chinese funds also tend to invest outside China only if they are big enough (more than $1 billion in AUM) and they have a strong international background (founder was in the upper echelons of management in a Western company, or the fund has strong connections to Singapore or Hong Kong rather than Mainland China).

Chinese investors can bring value to foreign startups, but you need to study their expertise and how it can be useful for you. For example, cooperation between Chinese funds and Western startups in fintech, deep tech and digital health is more likely to be successful than in B2B SaaS and edtech.

If you want to get a larger valuation or good expertise in fintech or deep tech, look for a financial investor, and if you want to get access to the Chinese market, look for a strategic investor. However, be aware that corporate VC is not always a strategic VC (Tencent and CreditEase are good examples of this).

Chinese funds also prefer to invest at later stages with rounds over $50 million, but rounds up to $20 million are also OK, especially if it is a Chinese angel or seed fund.