Is This One For Real?

Crypto has been on a tear in the last week.

Bitcoin is up 18% in the last seven days:

Ethereum is up over 30% in the last week:

But this isn’t the first time we’ve had a bullish run in crypto since the bear market started in early 2018.

If you look at the total market cap of all crypto tokens you can see that this bear market has had several moves up followed by downward price action:

So why will this time be any different? I certainly don’t have a crystal ball, but there are some underlying factors in this run-up that make me think it might be different this time:

1/ There is real fundamental activity in the decentralized finance sector where lending, borrowing, staking, swapping, and yield optimization are all growing significantly in recent months. This chart of the activity on the Uniswap liquidity network is indicative of that:

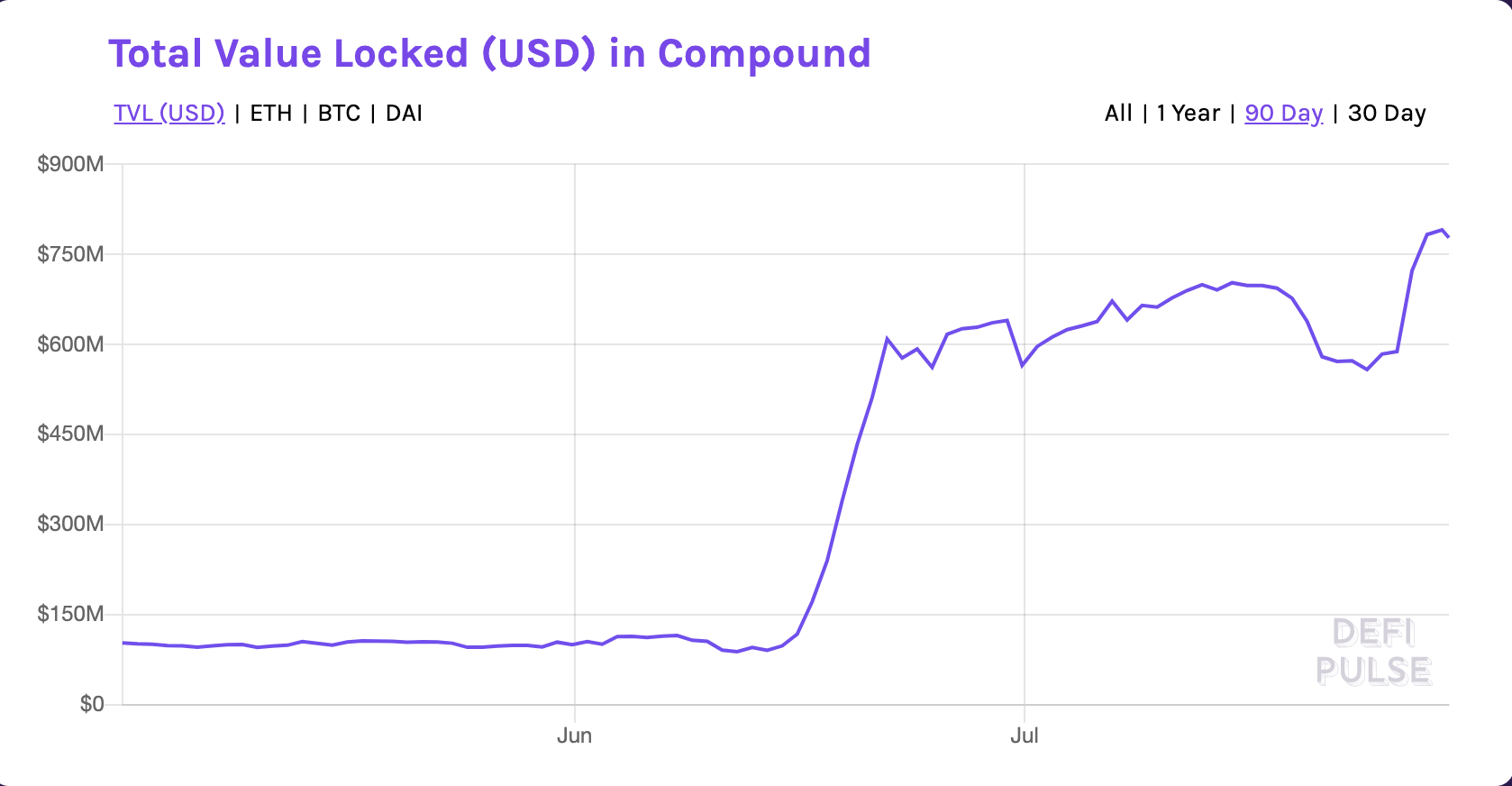

This chart of the total value locked up in the Compound lending/borrowing system is another indication of that:

2/ There are a number of interesting consumer projects launching this summer, many in the gaming and NFT (crypto collectible) sector, that could bring more mainstream users to crypto.

3/ Gold has also been on the move recently. Gold is up 10% in the last month as capital looks for safe havens. I realize that using the words crypto and safe haven in the same sentence is hard for most people to understand, but I believe that one of crypto’s primary use cases is store of wealth and Bitcoin is particularly popular for that.

I don’t believe we have left the bear market behind just yet. But if the total market cap of all crypto assets gets above $450bn, where the first bear market rally stalled out in the spring of 2018, then I think we will be back in a bull market in crypto. And we aren’t far from that. A few more weeks like this past week and we could get there pretty quickly.