Many entrepreneurs believe that the size of a VC funding round corresponds with their degree of performance. Unfortunately, this is a false assumption.

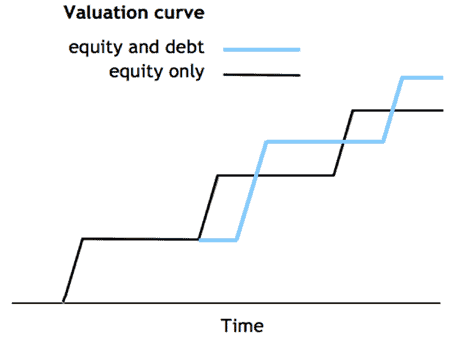

Although equity plays a vital role in helping entrepreneurs achieve their business goals, all equity capital comes at a cost – ownership dilution. So relying solely on equity financing to grow a company has serious consequences.

Thus, to raise capital, a founder must find the right combination of capital sources that allows him to have more control of his company for longer. One such key to achieving this goal is venture debt.

But, what is venture debt? How to raise venture debt? What are its pros and cons?

Let’s demystify this topic.

What Is Venture Debt?

Venture debt, also known as venture lending, refers to debt financing provided to venture capital-backed startups, that doesn’t require any form of collateral but are compensated with the company’s warrants on common equity.

Typically, it is a type of loan given venture capital backed startups that have completed one or two rounds of funding but still need cash to stay afloat or expand.

Startups go for venture debt when they’re not ready for a full-fledged equity round but require money to extend their runway and maximise their value in the next round. They generally seek venture debt financing for various purposes, including performance insurance, financing for acquisitions, capital costs, inventory, and a short-term bridge to the next round of equity. They want to finance an innovative new project that isn’t actually in the startup’s budget but would add significant value. A little extra cash from the debt may be used to finance an optional but high-value project.

Who Provides Venture Debt?

Banks that specialise in venture financing and non-bank lenders like speciality finance firms and industry dynamics provide venture debt to early and growth-stage startups. Besides these, hedge funds, private equity firms, and business development companies also sometimes offer venture debt to promising startups.

Usually, only the entrepreneurial-focused banks or commercial banks with venture lending arms like Silicon Valley Bank or Bridge Bank provide venture debts. These banks typically accept a startup company’s deposits and provide venture debt to complement their overall service offerings. Regular commercial banks usually don’t offer venture debt.

Non-bank lenders handle traditional venture lending and venture leasing. Usually, venture debt firms have higher funding costs, but they offer greater loan amounts and more flexible terms. Companies like Trinity Capital or Lighter Capital are some of the active venture debt providers.

How Does Venture Debt Work?

Unlike traditional loans, venture debt operates differently.

The loan duration is short-to-medium-term in nature, that is, up to 3-4 years, but they often start with a 6-12-month interest-only (I/O) period. The business pays accumulated interest but not principal during the I/O period.

The estimate raised in the most recent round of equity funding is usually used to calculate the principal amount of debt. (loan sizes vary between 25% and 50% raised in the previous round of equity financing)

Interest Payments are dependent on the prime rate or a different interest rate benchmark, such as LIBOR.

As part of the compensation for the high default risk, venture debt lenders receive warrants on the company’s common equity.

Now, what are warrants?

Warrants are security that gives the holder the right (but not the obligation) to buy company stock at a certain price and within a specific time frame. Expiration dates can vary from one to fifteen years. The total value of the warrants distributed ranges from 5% to 20% of the loan’s principal sum.

Also, covenants (additional restrictive terms and conditions) can be used in the debt scheme. Although non-bank lenders are more flexible when it comes to debt and normally include a few covenants in their loan agreements, certain banks may include several covenants to ensure repayment.

Venture Debt vs Venture Capital

Players in the startup community often tend to confuse venture debt with venture capital.

Even though both venture debt and venture capital are funding options available for startups, the significant difference between them is that venture capital lenders (venture capitalists) take a sizable equity stake in the company while venture debt providers don’t.

Repayment

There is an agreed-upon interest period for venture debt during which a startup has to pay the predetermined interest each month. Once that matures, a startup starts to repay the debt, while venture capital doesn’t have to be paid back directly as VCs take a significant stake in the company in exchange for capital.

Returns

Venture debt lenders make money through interest payments, fees, and warrants. VCs profit from the sale of shares during an exit – when a startup goes public or is purchased. While venture debt returns are lower than those of venture capital, individual venture debt investments are less risky because they are more likely to be repaid.

Qualifications

Venture debt financing is considered for fast-growing startups that have already secured venture capital funding. In contrast, venture capital funding is open to businesses regardless of whether they have already received funding or not.

When Do Startups Raise Venture Debt?

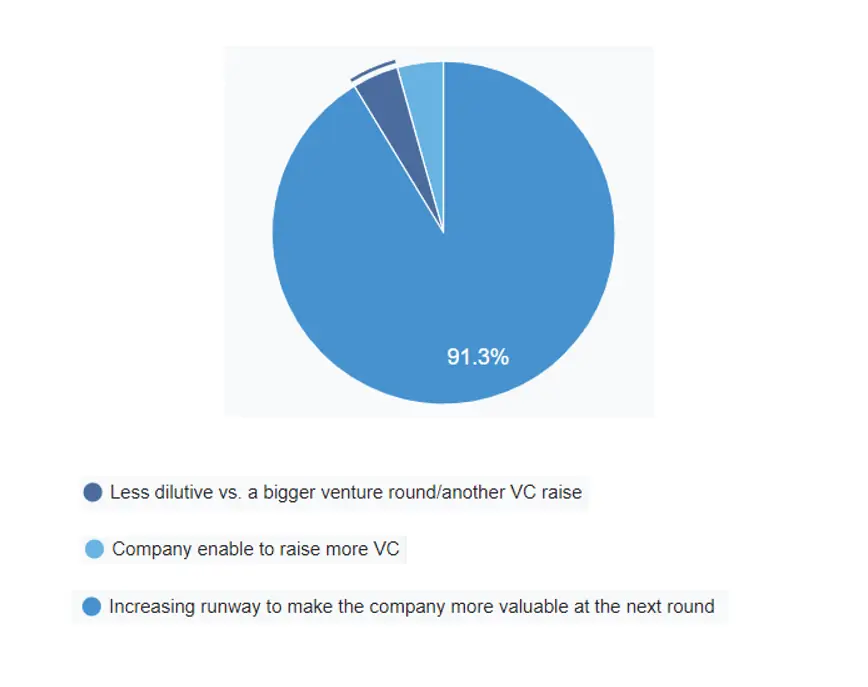

Venture debt is a smart funding choice for entrepreneurs and their venture capital partners as it allows them to retain control and limit the equity dilution of their company.

It can give a startup the extra boost it needs to survive and thrive, provided the company knows when to raise it. Thus, it’s a sensible move to be mindful of when venture debt should be raised.

With Equity raise

There are many advantages of raising debt alongside or soon after an equity raise. After a new equity round, a startup’s creditworthiness and negotiating power are likely to be at their peak. To reduce dilution, companies may reduce their equity round amount and replace it with a venture debt loan.

Post-Revenue

Venture Debt is mostly preferred when the company is generating predictable and recurring revenue. This is significant because businesses need ample cash flow to meet their obligations like interest and principal repayments that are a part of the company’s debt.

Funding Large Capital Expenditures

Each round of equity funding entails a higher level of dilution. If a company’s cash flow is near breaking even or needs to finance a major capital expenditure but doesn’t have the cash on hand, venture debt might be a better option. A company’s net cost of capital would be greatly reduced if they use debt financing.

Fund to Profitability

Using debt to move the business forward during a crucial phase of growth will help the company to avoid the need for a final round of equity funding.

When Not To Raise Venture Debt?

- When the board of directors is not supportive: If management or the board of directors of a startup believes that venture debt should be avoided then the company should not raise venture debt.

- When it cannot be repaid: When a company is on the decline, has a high burn rate, a highly volatile revenue source, and less than six months of cash on hand; venture debt should not be used as a last resort source of funding.

- When the terms or covenants are too stringent: Startups should have someone on their team to model the cost of the debt and consider the effect of any covenants on the business before committing to a venture debt loan.

- When debt payments total more than 20% of a company’s operating expenses: This type of financing may deter potential equity investors at this stage, and it may become a burden for the company.

Advantages of Venture Debt Financing

Venture debt comes with its own set of advantages. These are:

It Accelerates Growth

The most pressing challenge for an early-stage startup is likely to access funding. They don’t want the fruits of their early labors to perish until they reach the market. Venture Debt solves this problem for them. It provides capital growth while preventing or limiting equity dilution.

Venture Debt Is Easier To Acquire Than Bank Debt

Venture debt does not include positive cash flow or substantial assets as collateral. Thus, it is easier to acquire than bank debt, saving management time or meeting unexpected needs (e.g., an acquisition)

It Extends Cash Runway

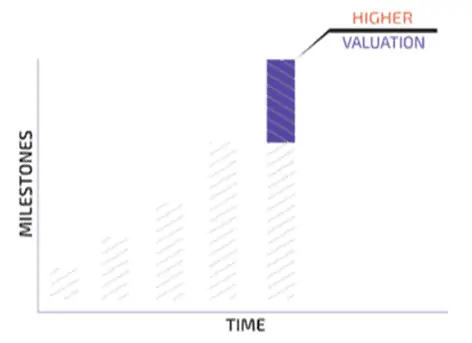

Venture debt comes in handy when the firm is raising equity rounds. This allows a business to reach crucial milestones and a higher valuation in the next equity round by providing a bridge between equity funding rounds.

The Fundraising Process Is Quick

Due to a simpler and quicker due diligence process, it can take as little as 30 days to complete the fundraising process compared to 3-6 months for equity.

Venture Debt Doesn’t Require Startup Valuation

Venture debt is a type of funding that allows startups to look for funds without setting a valuation. It implements growth plans to put a business in a stronger place for valuation in the next equity round.

Venture debt benefits the startup and the investors, who are banking on the company’s potential growth to generate the majority of the profits. The interest rate on venture debt is usually 12-25 %, with warrants included in the offer. Investors can save time and money during the review process by piggybacking on the work that previous investors have already done because venture-funded businesses have gone through due diligence and already have solid boards of directors.

Disadvantages Of Venture Debt

Even though venture debt is an essential part of an entrepreneur’s toolkit, it comes with a few significant potential downsides.

Possibility Of Dangerous Financial Covenants

If a startup doesn’t expand as quickly as it was expected to, it may result in a default, that is, the loan is due and payable. For several startups, this may be a deal-breaker.

Debt Must Be Repaid

If a company cannot repay the loan, the lender will force it into liquidation or bankruptcy. This is not the case when a company takes on venture capital that involves equity dilution.

Estimating The Cost Of Capital Is Difficult

Due to amortisation (the period over which a company pays back principal plus interest) and other features, it can be difficult to estimate the cost of capital.

How To Raise Venture Debt?

The procedure for raising venture debt is easy.

Typically, the lenders request documents such as balance sheets or monthly income statements to demonstrate the company’s financial health. Sometimes, they can ask to submit periodic audits. It ensures that the startup will not defraud them when the time comes to cut the check and repay them. The startups also schedule meetings with potential venture debt lenders and get to know them. Often, startups are asked to present their business model (their unique selling points, customer profile, and future plan), outlining their funding needs and downside scenario planning.

After reviewing the documents and the initial meeting above, the lender issues/negotiates a term sheet.

Following acceptance, a half-day due diligence meeting with the management team, legal documentation, and closing will occur. From term sheet to closing, the entire process usually takes 4-6 weeks.

To negotiate venture debt deals few things should be kept in mind.

- Principal Amount: Loans are often required to meet urgent cash needs, at other times capital is required to provide support. Before consenting to a principal amount, startups should be sure about how much money they’ll need and how much their cash flow would be able to sustain.

- Payment Schedule: Venture debt is a type of term loan, which entails interest payments and principal repayment over a set period. Startups should negotiate an interest-only extension to postpone paying back the principal.

- Cost of Capital: Legal fees, commitment fees, final payment fees, and prepayment fees are examples of additional fees and expenses that lenders can charge. If a startup is tight on cash, it should consider haggling on these figures.

- Covenants: Covenants are a set of rules that lenders impose on startups when they owe them money. Do’s are a set of legal obligations, such as delivering financial data or maintaining insurance coverage. Don’ts are analogous to the veto rights requested by equity holders in terms of reach.

What Happens If A Startup Is Unable To Repay Venture Debt?

If a startup is unable to repay the loan, then it should:

- Use cash on the balance sheet or equity from investors to repay the loan.

- Look for a new investor that will refinance the loan. This entails giving the startup a new loan to pay off their existing one.

- Try to work out a favourable repayment arrangement with the lender. This is crucial because the company would be at risk of failure if they are unable to raise equity or refinance.

Even though venture lenders have the legal right to foreclose and sell the startups’ assets, they try to work it out with the investors to restructure the loan to give the company more flexibility.

Thus, choosing the right lender is crucial as an inexperienced one can saddle the company with hefty debt repayments. A venture lender should be the one who has

- Positive References: Startups should reach out to former portfolio companies to learn how each lender behaves before deciding on a venture debt lender.

- Timely & Dependable Funding: Taking the time to find a lender with a solid track record of financing on time and according to agreed-upon terms will help a startup avoid unnecessary delays in their company’s growth.

- Partner Mentality: When the term sheet is signed, and the contract is closed, the commitment does not end. Hence, startups should choose a lender who will be a reliable financial partner over the loan’s duration.

The importance of choosing the right venture debt lender cannot be overstated. Thus, a startup should look at all of their choices, read the terms and fees carefully, and find a lender who can provide sound advice.

Watch Out For These Mistakes!

Even though venture debt is a viable option for startup growth, one needs to watch out for these mistakes when raising venture debt.

- Raising an excessive amount of money.

- Failure to investigate the lender’s credibility.

- Optimising for cost instead of flexibility.

- Negotiating a term that is too short and an interest-only time.

- Bad post-deal contacts with the lender.

Also, Startups should consider venture debt lenders not only as capital providers but as strategic partners and use them to grow their business.

Thus, “venture debt” is a catch-all word for a range of debt solutions available to Startups and other fast-growing companies. It is a great way for entrepreneurs to raise capital at a low cost, gain more time to develop their company, and balance their capital structure. However, it should be used under the right set of circumstances.

Go On, Tell Us What You Think!

Did we miss something? Come on! Tell us what you think about our article on venture debt in the comments section.

An avid reader and economics enthusiast who is always eager to learn. Prachi is an aspiring leader who believes in what she does. Besides reading , she is fond of baking , dancing and travelling.