One of the first things I did when I joined the venture asset class as a lowly institutional LP analyst in 2001 was to build the VC fund cashflow model. Just about every analyst who looks at fund investing has built one. You incorporate expected company returns, mortality rates, and fee structures to try to predict how a venture capital fund works from a cash in, cash out, and NAV standpoint.

It's basically the unifying theory behind all your assumptions about 10% of the investments driving most of the returns, needing certain multiples of return, and the basics of how many deals you do a year, with fees layered on.

Let's be clear about this exercise. It's not perfect. There are all sorts of wacky cludges and hacks in it, like the idea that every company performs exactly the same over time, because you don't know *when* the winners and losers happen. You wind up with a Schroedinger's Cat type model where you invest in a company and it partially dies and partially exits over time. This way, you smooth out all the lumpiness of time when multiplied out across 30 or so deals. And no, the numbers don't exactly add up--but they're more than close enough for venture capital.

It's also not the "average fund". You don't want the "average" fund, because average funds don't do well--just like you don't want to model the average startup, because you might as well draw a big flaming hole in the ground. Venture capital is all about finding the extraordinary. It's about building the exceptions.

On the other hand, you can't exactly model out being in Accel Facebook fund, the First Round Uber fund, or the Lowercase Twitter fund. So when you think about returns, what should you expect.

What I tried to model out is "institutional quality" funds--funds that have access to winners--those winners being "normal", however. Not unicorns necessarily, which require the suspension of reality to believe you can consistently pick them.

The average VC-backed exit is somewhere around $250mm... so that's what I said my exits would be as a seed stage fund.

And those exits would be roughly 10% of the portfolio--about 3 out of every 30ish deals.

On top of that, maybe you get another 3 that have good but not so great exits at $50mm.

Perhaps 2-3 more exit for $20mm or so after a Series A.

Toss in a few acqui-hires in the $6-8mm post seed... like 3 or 4, and there you have it. Thirty deals, 13 exits, 17 wipeouts--and roughly a billion dollars of total enterprise value generated. For my fund, an $8mm seed fund, without even following on, you wind up with a 26.67% return and a 2.88x cash on cash return.

If you could return investors nearly triple their money and mid 20's returns consistently, compared to the 8% long term return in the public equities market, they'd more than accept that. Comparatively, if you look at long term private equity results, I think most investors are winding up with high teens returns.

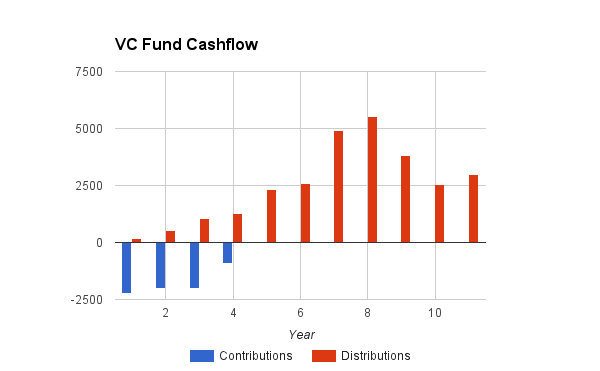

Without complicating the model at first, so what does that actually look like in terms of committing to a VC fund?

It's what you'd expect... You're putting money in over the first 3-4 years, but you're not really seeing most of it back until years 7, 8, and 9, if not longer. Distributions can actually be drawn out over an extended period of time, but for the purposes of this exercise, I just kept the fund to 11 years.

That's if you're not following on. If you're following on, not only do you have a bigger fund, but the requirements to continue putting in money last a lot longer. Obviously, you get more back as well. A fund that follows on would look more like this:

You've probably been sitting there thinking, "What is with this bullshit no follow on strategy you keep talking about? Don't you double down on your winners? Everyone knows that."

Yes, that's conventional wisdom, but my question has always been, "When do you know something is a winner?"

Just because my seed bet raises a Series A, I don't think that automatically think that's a winner. What if we took that as our sole criteria? Then, wouldn't it suggest that Series A funds in general vastly outperform seed funds as a whole? They're only investing in the ones that make it past seed, so isn't that a better bet?

That hasn't been shown to be the case, for a few reasons. First, seed funds tend to be smaller, and smaller funds do generally outperform larger ones. Second, their dollars dollar cost average at cheaper entry prices. Even if you lose a bunch of the seeds, your multiples on the seed exits should more than make up for the ones you lose.

Here's another way to look at it--the cost of capital argument. Do seed investors have Limited Partners with different return expectations than Series A and beyond investors? I'd say no--they're taking money from the same endowments, high net worths and pension funds as everyone else. I've never heard any limited partner ask me if I can generate a better return than their Series A funds. So, if that was the case, and the market was competitive, why wouldn't each VC be bidding up a round up until the point where they could get the return that matches their own cost of capital?

So, whether you're doing Seed, Series A, or Series B, each round would get its net 25% to LPs, no? After factoring in price and mortality rate (risk), every stage's investor would be trying to get a return that satisfies their LPs--and I think that's the same across all early stages.

Where I don't actually think that's the case is in growth rounds, which seem hyper competitive right now--and where the ability to differentiate yourself as an investor is limited. I honestly don't think the investors who are going into Uber are underwriting that bet to a 25% net return to investors. I think it's closer to 15%, and maybe that's justified because they're very unlikely to go out of business at that point.

But what does the model say?

Well, funny enough, the model pretty much agrees with me, even though I wasn't putting that cost of capital in as an implicit assumption. Things change, however, if you have different mortality timing expectations.

So here goes...

I assumed the following:

Seeds are done as a $1mm round on a pre-money valuation of $5mm.

Series A's are done as a $5mm round on a pre-money valuation of $15mm.

Series B's are done as a $10mm round on a pre-money valuation of $40mm.

Series C's are done as a $25mm round on a pre-money valuation of $100mm.

Exits are $250mm.

Mortality rates dictate that half the seeds don't make it to A, then 30% of those don't make it to B, then 10% of those don't make it to C. Along the way, you've got some early, smaller exits as well... 20% of the Seeds get acqu-hired at the 6 post. 25% of the A's sell for $20mm. 50% of the Bs sell for $50mm.

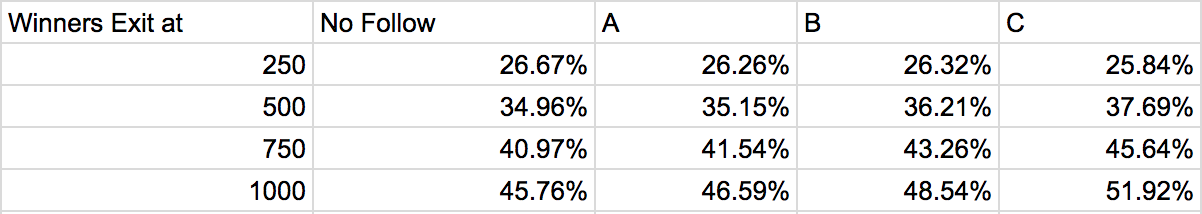

So here's what the charts say for follow on strategies:

If you run down the first column, what it says is that it basically doesn't matter if you follow on from an IRR perspective--a percent won't kill you here or there. You are, however, leaving cash on the table, obviously, b/c you put money to work at the same level of return.

If, however, you assume that companies die later on, here's where you start to lose return. What if most of your seeds are making it to A, but then half of them die between the A and the B round? If you're following on in the A round, then you shed a full 500 basis points on your IRR. You don't really gain it back after that regardless if you follow on in your B's and Cs.

It gets even worse if things just hit a wall at the end--where companies just keep getting funded until they crash, Fab style. If your deaths don't occur until Series C or later, then you're literally talking about a mid teens return--10% less than what you would get if you didn't follow on.

Me personally, I'm happy to keep my fund small, to not have to worry about staying close enough to each company forever to make good follow on decisions, and to not worry about whether the market is artificially propping up companies.

How about price? Does price have an effect on returns?

You bet your tookus it does.

Let's just say that instead of the 5, 15, 40, and 100 pre-money valuations we were paying before, everything was 50% higher. That's going to cut our returns by about 400-500 basis points and much worse if you're following on. This makes sense because you're paying higher and higher prices along the way for the same deals, but your exits aren't getting any better.

If prices are 2x higher, then we're looking at high teens returns for just the seed round's returns, and mid for the whole ball of wax if you follow on.

Seed round returns are particularly sensitive to exit valuation--because what might seem like a million bucks here and there is actually a lot on a percentage basis.

So, if I can get everyone down from $5mm pre-money to $3mm pre-money, now I'm netting my LPs above a 40% return. If I'm forced to pay $7mm pre-money for all the same deals, we're looking at sub 20% returns. Don't even talk to me about paying $9mm pre.

Ok, I know what you're saying. What's with these paltry $250mm exits? Bring on the unicorns!

Fine, fine, what if exits are better than I'm expecting?

Returns obviously get much better in the seed when the outcomes are larger, but it's not really as crazy as you'd think--mostly because exits still take a long time. So, a billion dollars is obviously much better than a quarter billion, but 6-8 years out the effect gets a little muted.

What if you keep following on in your winners AND you get some unicorns. Well, clearly the dollars are much better--which is nice for VCs who get a cut of the dollar profits (as opposed to being paid on IRR). You'd need a bigger fund to maintain your ownership (although in this model, we're still keeping the simplistic A, B, C round approach at the same prices). The fact remains though that the key to getting outsized IRRs is to be in the winners, almost regardless of what you do with them after.

How does time play into this?

Time is the enemy of IRR. No surprises there.

If it normally takes 5-7 years to exit at $250mm, what happens if it takes longer. For every year, you're looking at about a 300 basis point drop in return. Or, to look at it another way, you'd need roughly $75mm in enterprise value gain on exit to keep up with a $25mm net return.... so if you choose not to sell for another two years, you better be exiting at around $400mm.

Obviously, this model isn't perfect, and neither is venture capital--but at least it gives you a ballpark sense of how these funds perform, and what moves the needle on them.

Admittedly, it was fun to pretend that I was a 25 year old analyst again.