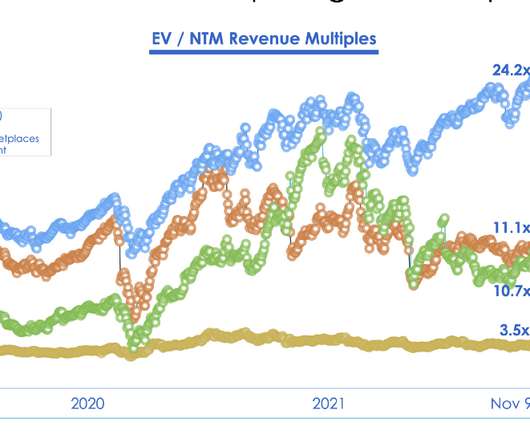

The case for US venture capital outperformance

TechCrunch

SEPTEMBER 24, 2022

She is passionate about leading design, implementation and oversight of actionable strategies unlocking synergies, leveraging untapped efficiencies and fostering collaborations across functional areas. Orchestrating a “soft” landing was a “hopeful” strategy that is proving increasingly elusive.

Let's personalize your content