The Future of Startup Ecosystems Across the Globe

500

DECEMBER 16, 2019

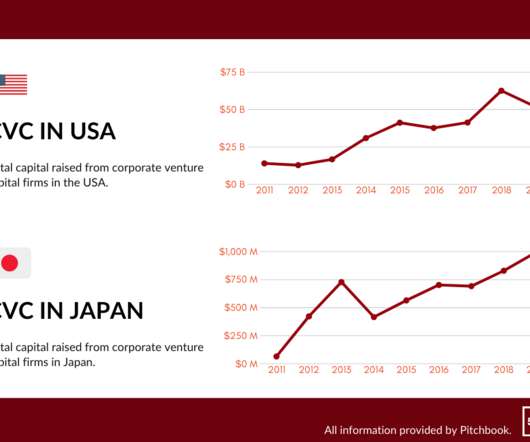

This year we dove headfirst into the rise of corporate venture capital, the changing nature of venture capital education, and the important task of startup ecosystem building. In 2018, we saw this trend reach new heights with more corporate venture capital (CVC) funds than ever.

Let's personalize your content