What’s the board’s role in an early-stage startup?

Startup founders frequently ask me about the role of a board of directors. A board can be a crucial asset in an early-stage startup.

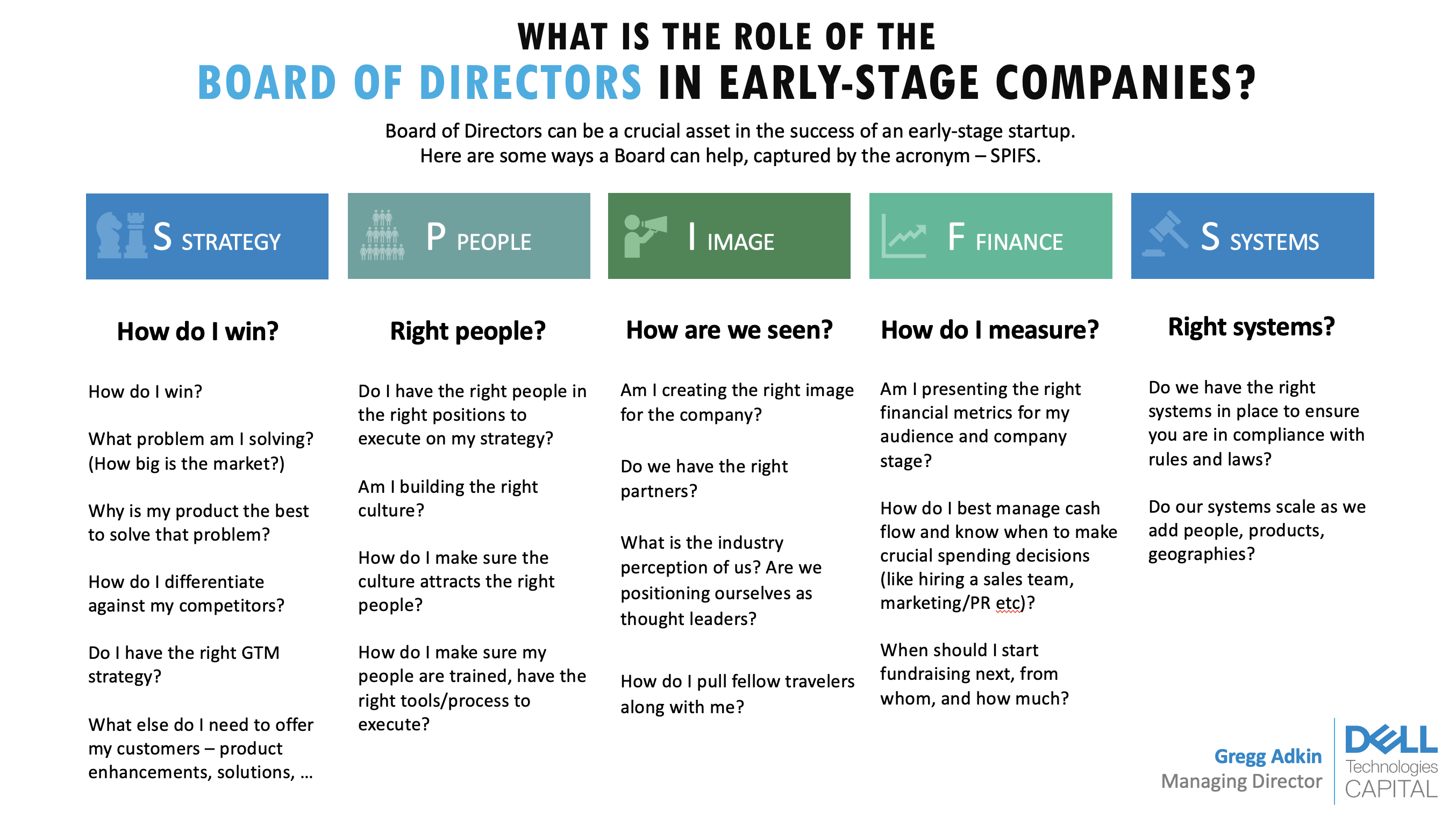

Here’s a framework for how it can help drive success at your company: Strategy, People, Image, Finance and Systems for compliance, or “SPIFS.”

What is a board of directors, anyway?

The board of directors helps with governance of the company. U.S. law requires that any company have one, though does not require how big it should be. By generic definition, the board of directors consists of elected individuals that represent shareholders. It is the governing body that provides company oversight and helps set business policy and strategy.

On a more practical level and in a startup environment, the board can aid in creating a successful business strategy, putting together the right management team, developing branding, building good financial habits, and avoiding legal and compliance issues. The needs and composition of the board will change depending on the startup’s stage, management and financing history (e.g., if there are preferred shareholders, investors that require a board seat and more).

Investors often ask founders about their board: It says a lot about their character, their judgment and their willingness to be challenged.

Investors often ask founders about their board for two reasons. First, it says a lot about their character, their judgment and their willingness to be challenged. The founder can typically choose who is on their board (through careful selection of investors and advisers) and negotiate a board structure they prefer.

Typically, a healthy board will have a good balance between common shareholders, preferred shareholders and independents. It also helps investors and analysts understand who will ask critical questions and give important advice to the company’s executive management, especially when the going gets tough (it inevitably does!).

What exactly can a board help you do?

After 20 years as a venture capitalist and board member, I boiled down the value of a board into five main pieces under the acronym SPIFS: Strategy, People, Image, Finance and Systems for compliance.

Image Credits: Dell Technologies Capital

Strategy

Setting business strategy is one of the main ways that the board helps founders, especially if it’s their first time running a business. It is a valuable sounding board for validating that you have taken a sober account of the market and have the right plan to develop your product and acquire customers.

The board should ask these questions when guiding founders through setting strategy:

- How do I win?

- What problem am I solving?

- Why is my product the best to solve that problem?

- How do I differentiate against my competitors?

- Do I have the right go-to-market strategy?

- What else do I need to offer my customers (e.g., product enhancements, solutions)?

People

One of the main aspects of running a successful startup is ensuring that the few roles that are available and necessary are filled with the right people. Board members are relevant audiences to provide feedback, discuss personnel issues and reflect on the emerging company culture. Most importantly, since a board can see the strategy and analyze what sorts of people are necessary to successfully execute it, board members can also help founders identify and find the right people.

Key questions:

- Do I have the right people in the right positions to execute on my strategy?

- Am I building the right culture?

- How do I make sure the culture attracts the right people?

- How do I make sure my people are trained and have the right tools and processes to execute?

Image

Having covered the internal aspects of business, the board also helps assess how a company is viewed externally. Taking an external assessment of your business is crucial for understanding not only the brand-building side of things, but also to help create the relevant partner relationships. Moreover, since board members are frequently investors or active market practitioners, they tend to see the latest companies and products in a given market and are able to provide a unique perspective on how competition is evolving and what you need to do to stay ahead.

Key questions:

- Am I creating the right image for the company?

- Do we have the right partners?

- What is the industry perception of us? Are we positioning ourselves as thought leaders?

- How do I pull fellow travelers along with me?

Finance

At the end of the day, a business is a business, and healthy financial performance is vital. So, a good board not only helps set the right expectations for financial reporting, but also assesses the next steps to achieve the right financial milestones as the company matures. An effective board can help you manage large spending strategically and understand when you’ll need to go fundraise again.

Financial metrics

Some of the more typical financial metrics are revenue/ARR, bookings/ACV, gross margins and cash, among others. These metrics help assess the company’s growth, sales, product and operational health.

In addition to having the right metrics, it is vital to measure their significance at the right time in a company’s growth journey. For Series A and Series B companies, below are a few milestones that a board is likely to be focused on to help an early-stage business stay on track:

Series A: Prove out the GTM/revenue model

- Triple revenue from year one to year two.

- Add marquee customers.

- Establish and measure metrics (SaaS has well-defined key metrics) and processes to manage financial metrics.

Series B: Prove the customer engagement/revenue model is repeatable

- Land and expand (as you land the first customers, now you need to expand the business).

- Sales process should start to be well understood, e.g., how long it takes to close a new customer, expand in an existing customer, what support is needed and how much.

- Will need to hire a CFO.

Cash management

Cash is like air to early-stage companies — without it, you die. Managing cash flow is critical, and a good board can help navigate the right timing for major cash expenditures, such as when to hire a sales team, how much money you should spend on marketing/PR, and when it’s necessary to get more cash either via debt or another round of venture financing.

Fundraising

Your board will be essential in helping you plan for your next round of fundraising. Not only can your existing investors make introductions to other potentially interested parties, but they can also provide advice on timing, how long you may need to reserve to fundraise, and how you need to refine your pitch and story. It also can help reflect on what the round structure should look like, from size to number of investors to appropriate valuation.

Key questions:

- Am I providing the right financial metrics for my audience and company stage?

- How do I best manage cash flow and know when to make spending decisions (e.g., hiring a sales team, investing in marketing/PR)?

- When should we go out for our next fundraise, who should we target and how much should we raise?

Systems for compliance

When I originally started this acronym, it was only “SPIF,” but as tech industry compliance and regulations became more complicated the last few years, I felt it important to add a new segment.

Legal issues can arise at any time, and a board can help navigate certain aspects of business that founders (especially first-time founders) may have never dealt with before. Moreover, having seen how certain processes play out in other companies, board members can be a source of valuable advice on how to set up the right internal systems to ensure there are no problems as the company matures.

Particularly for high-growth companies, it is also important to keep track of how scalable these systems are as the company grows. The compliance systems need to be flexible to encompass new products, people and geographies, but also resilient to cover any potential obstacles that arise from fast growth.

Key questions:

- Do you have the right systems in place to ensure you are in compliance with rules and laws?

- Do our systems scale as we add people, products, geographies?

What should a board look like?

The structure of the board can vary greatly, from one person to a complicated structure, such as you might find in public companies. For startups, it is best to keep it simple in the beginning and limit the board membership to only the people who will have the most positive impact for your company’s performance. You don’t even have to like these people. They are there to give you straightforward, candid feedback on your company’s performance and should want the company to succeed as much as you do.

With that said, you do want to give some thought to the actual structure, because these people will have influence over the trajectory of your business. For Series A and Series B startups, a five-person board is typically more than enough to accommodate all the interested parties. Generally, that would consist of:

- Two seats for common shareholders, typically one for the CEO and one for the founder or co-founder.

- Two for preferred shareholders, typically Series A and Series B leads.

- One independent, for objectivity and insight into their expertise.

Avoid an even number of members to avoid voting lockups, and don’t give out too many board seats — board meetings can become unwieldy, unproductive and unhelpful.

Your board should be a great resource

A board can help with setting strategy, discussing management and personnel issues, understanding how you are seen in the market, providing financial discipline and guidance, and ensuring you have the right systems in place to deal with rules and regulations.

At Dell Tech Capital, we typically lead rounds and take board seats. We do this because we want to help build our portfolio companies alongside our founders and help them find answers to some of the most difficult questions en route to success.

The SPIFS framework has helped me add value as a board member for many years and has helped my founders leverage candid feedback from their boards to run more effective businesses. I hope it can do the same for you.