Alternative VC Tech Stack: Chisos structured finance

David Teten VC

SEPTEMBER 13, 2023

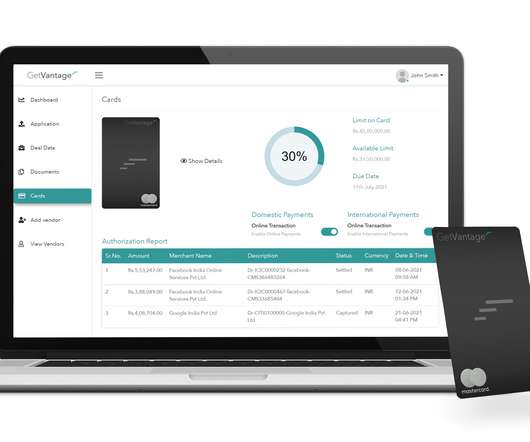

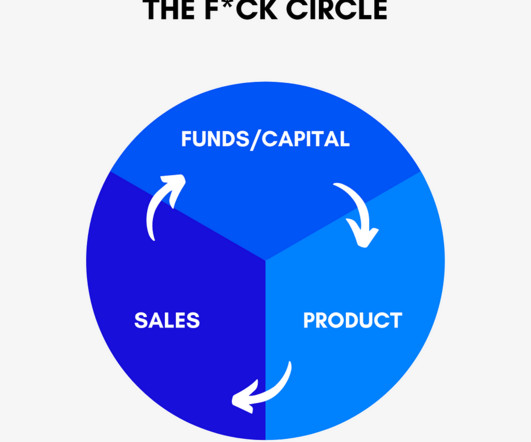

We’re fortunate to interview William Stringer, Founder of Chisos Capital , a structured finance company. Chisos is a structured finance company that provides startup and brand capital to entrepreneurs, athletes and creatives. Q: What is CISA and how does it compare to other alternative VC models?

Let's personalize your content