60 Top Women-led Venture Capital Firms

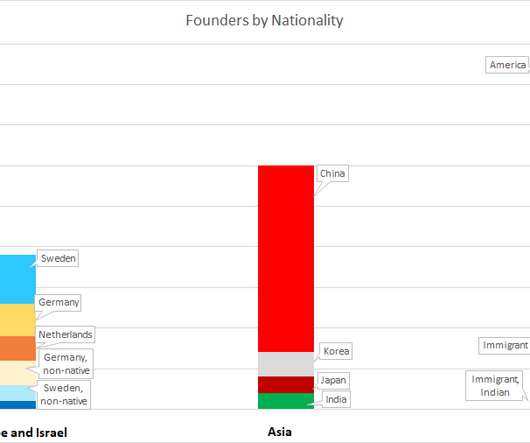

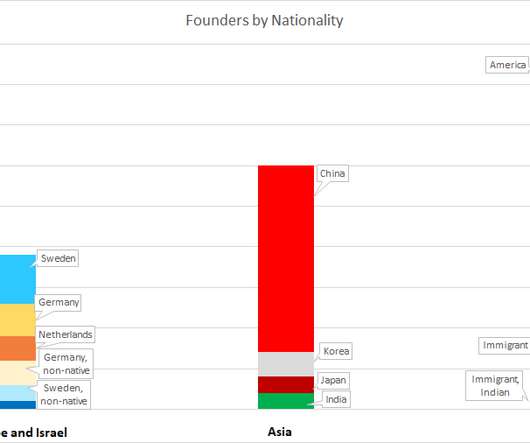

American Entrepreneurship

MARCH 7, 2024

But progress is being made as seen in the rising number of women-led venture funds that focus on funding women entrepreneurs. In addition, Crunchbase reports that w omen-founded venture firms in the U.S. venture firms allocated only 22% of their deals to female-founded startups. billion of total venture capital.

Let's personalize your content