60 Top Women-led Venture Capital Firms

American Entrepreneurship

MARCH 7, 2024

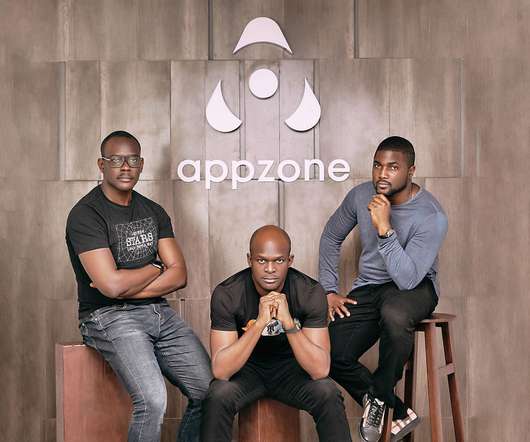

Female-founded venture firms have shown strong support for female-founded startups accounting for 28% of their deal counts from 2016 to October 2021 in startups with at least one female founder. billion of total venture capital. Construct Capital , co-founded by Dayna Grayson previously at NEA and Rachel Holt, a past Uber executive.

Let's personalize your content